AI Opportunities in Banking and Payments

Today’s banking and payments industry is being rapidly reshaped by artificial intelligence, as advanced algorithms and machine learning allow businesses to achieve better results. Financial institutions can enhance customer experiences and mitigate risks faster and more efficiently. The integration of AI is transforming how banks and payment processors function, promising to revolutionize the industry.

According to the CITY GPS report, the technology can upscale global banking profits up to $2 trillion by 2028, driving the industry to a 9% increase. This growth is fueled by the increasing volumes of data generated by financial transactions, which AI can analyze to extract valuable insights.

And the opportunities the AI gives to businesses are what I will be talking about in this new article.

The Current State of AI in Banking and Payments

Artificial intelligence in banking and payments is one of the solutions that can drive immense success to the business, but also be a liability if not managed properly. More and more SMEs are turning to AI because of how facts speak for the technology. Such, for example, is the business value that is projected to grow to 99 billion USD just in the Asia Pacific region.

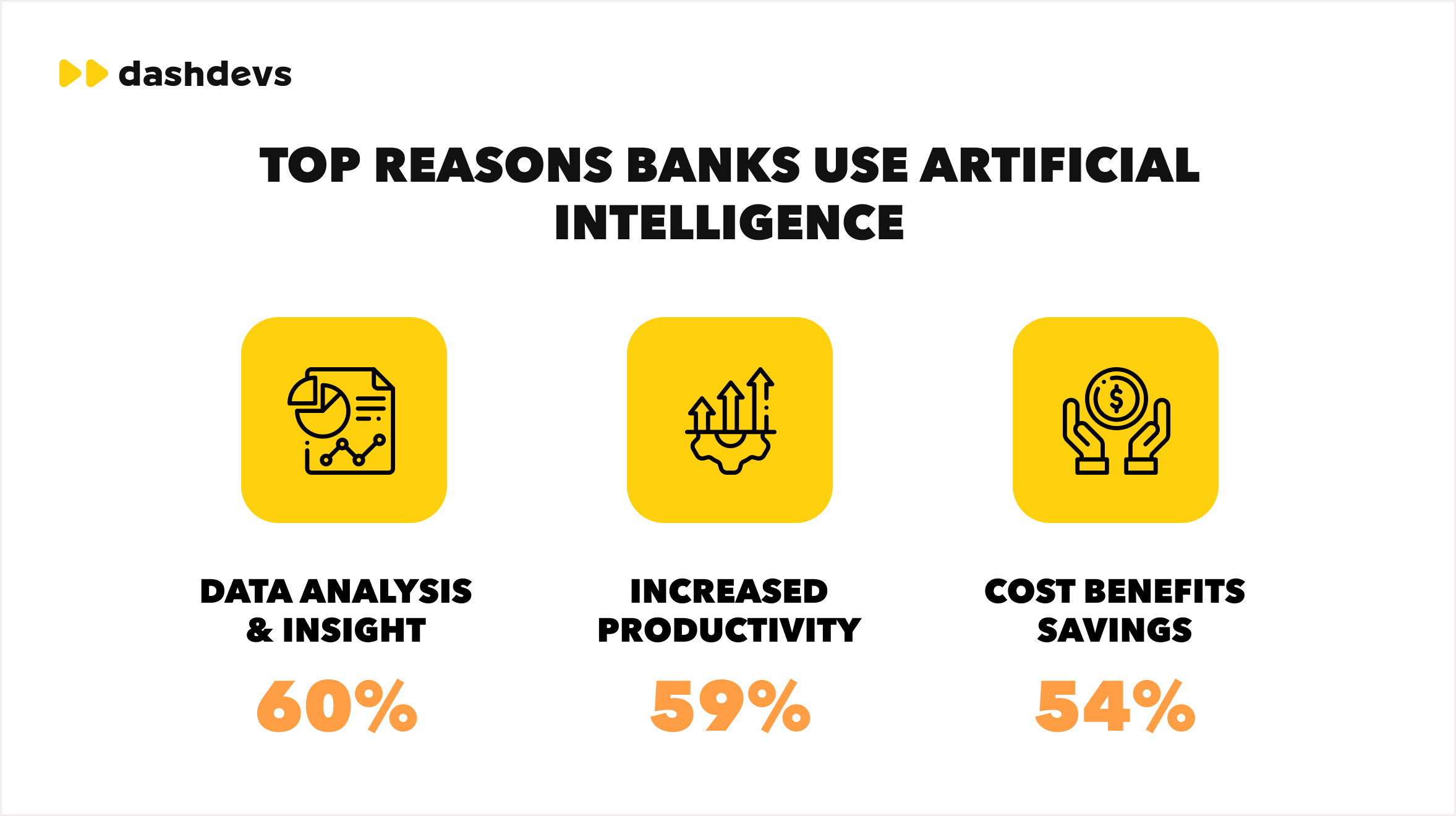

Using AI has become more than a trend. Users expect chatbots to have ready-made answers to their questions and algorithms, being able to find out what is required before the user needs to openly state it. Nowadays, over 75% of users use AI for navigation, 70% use AI virtual assistance, and over 250 million users have used AI tools in 2023. They used it for multiple reasons, and some of them – the use cases particularly relevant for finance, banking, and payments – I will review next.

Use Cases

- Fraud detection: AI can identify patterns in vast datasets, making it a powerful tool for fraud prevention. It can detect anomalies indicative of fraudulent activity by analyzing transaction data in real time. Given that ML models learn and adapt to developing fraud techniques, it becomes a very efficient solution for sensitive and demanding fields such as payments. An example of AI for fraud detection is Onfido. This KYC solution uses artificial intelligence for identity verification. Such a method helps them ensure customer trust, enabling seamless onboarding.

- Customer service chatbots: Virtual assistants have become people’s favorite because of the wide range of services available. Modern users can ask the chatbot to provide them with account balances, transaction histories, and even loan applications. This allows businesses to free up resources for more complex issues. This is being used by Credit Karma. Their AI advisor, Intuit Assist, can help users optimize their spending and cash flow through chat with an assistant and personalized advice.

- Personalized recommendations: When we think about AI, this is the first thing that comes to mind. Personalization in payments and banking can be offered via an AI analysis of users spending behaviors, financial goals, and other parameters that can impact the offers, products, and services offered to the customers. Kasisto, a conversational financial AI, allows businesses to implement this solution into their platform to empower personalized recommendations for their customers. The platform offers personalized responses and process automation through a language model built for banking.

- Credit scoring and lending: AI-powered crediting always relies on data-driven decision-making. It considers a broad range of facts, including behavioral patterns, location, and other information, that would help many financial institutions and banks expand access to credit for underserved populations. One of the best examples of AI used to power up fintech solutions is Ant Financial. A branch of Alibaba Group, the company utilizes AI to power the credit scoring system. It enables them to provide funds for various customers and businesses covering the risk mitigation and making data-driven decisions.

- Risk assessment: With all the data stored, collected and analyzed, AI becomes irreplaceable at risk assessment. It can assess credit risk, market risk, and operational risk in seconds by performing a fast analysis of the data it gathers. Appello uses predictive analytics to help customers who integrate with it make data-informed decisions. Within the platform, customers have successfully implemented credit scoring and churn modeling with the help of an AI tool.

- AML or anti-money laundering: among the biggest and most popular uses of AI, AML is one of the first in the list. It always needs analysis or large data volumes, and AI is what suits such a task the best. It can identify suspicious patterns and flag potential money laundering activities for further investigation. One of the companies that uses AI for anti-money laundering is Eastnets. The platform has a human-first interface, which, with intuitively understandable features, enables customers to implement data and behavioral analytics for AML.

- Robo-advisors: Nothing can be better than well-timed advice, and robo-advisors are exactly the tools that can offer automated investment advice and portfolio management. They also can provide personalized investment recommendations faster and cheaper compared to traditional methods. Companies such as Intellectia. AI are using the tool to provide users with personalized advice based on their intel and market data. Intellectia.AI, for example, uses robo-advisor technology for stock selection, technical analysis, crypto trend rating, and other data insights.

Trends in AI in Banking and Payments

The use cases are one thing, but AI is not just machine learning. It has trending sectors and tools, some more useful than others. It is changing the banking industry and in more than one way.

In this section of the article, I want to cover those that I see as the most effective for payments and banking.

- Natural language processing (NLP) can empower chatbots to understand and respond to customer queries in natural language. Its main goal is to provide efficient and personalized support. In my experience, we implemented NLP to analyze customer feedback. Businesses I worked with report that this solution enabled them to find areas for improvement and enhanced customer satisfaction.

- While not strictly AI, robotic process automation (RPA) often works in conjunction with AI. Its goal is to automate repetitive tasks. In banking, RPA can handle rule-based processes like data entry, reconciliation, and report generation. It frees human employees to work on more crucial tasks, reducing operational costs.

- Last but not least, machine learning (ML). I mentioned it before, and can confidently say that ML is the backbone of many AI applications in banking. As we’ve covered previously, it enables predictive analytics, fraud detection, credit scoring, and risk assessment.

With all this in mind, banking AI can be a game changer for businesses, startups, and customers, too. The trends are constantly changing, adding more new ones to the list, but even with the most prominent ones, the potential is visible. And it is no doubt interesting what opportunities AI has in store for both the banking and payment industries.

Key AI Opportunities in Banking

AI in banking is a rapidly growing niche. The CAGR, according to Grand View Research, will reach 31.8% during the 2024-2030 period. This astounding progress has already been shown by AI in the banking industry size of 19.87 billion USD in 2023. The opportunities are plentiful, but they all are different.

#1 Personalized Banking

As discussed, personalization with AI is normally achieved by advanced analytics of customer behavior, preferences, choices, and goals. This enables banks to create customized offerings, which, in turn, leads customers to use the services more efficiently and—most importantly—often. JPMorgan Chase uses AI to analyze customers’ spending patterns, which allows them to create customized offers for loans. Overall, this tactic increases customer satisfaction, loyalty, and retention.

#2 Chatbots and Assistants

Chatbots and AI assistants are available 24/7 and can help users solve problems of small and medium complexity. It drastically increases the work speed, automates mundane tasks, reduces HR costs, frees up human resources, and creates a more engaging and smooth customer experience. Some companies I mentioned above use AI for chatbots capable of giving personalized recommendations. Several AI solutions are developing full-fledged NLP models for human-like chatting experiences and utilize machine learning and predictive analytics capabilities to help users build investment portfolios, improve their spending, enhance saving habits, and even track subscriptions to entertainment services.

#3 Sentiment Analysis

Customer sentiment is important for any business and crucial for banking, as it is the best way to both improve services and reach the highest level of customer retention. With AI on board, businesses can utilize the tools to process customer feedback from different channels at once. One of the most famous examples of sentiment analysis AI is HSBC, which analyzes unstructured data to recognize different identify negative news.

#4 Automation

Automation is always great for a digital business. Banking automation with the use of AI means streamlined operations, reduced costs, and improved efficiency. Wells Fargo, for example, has implemented AI-powered robotic process automation (RPA) to automate tasks such as data entry and report generation. Process automation can also greatly impact customer onboarding, with ML being utilized for anti-money laundering and KYC. Generally, any repeated process can be automized with AI, even feedback analysis and customer support through robust and customer-friendly chatbots.

#5 Data-Driven Decision Making

With AI, banks can use the data they store to make informed decisions. Machine learning and artificial intelligence algorithms are usually used to optimize marketing campaigns. But this is not everything they can do. On top of it, ML can help introduce new services and products, and allow businesses to use information to gain competitive advantage. Bank of America is using AI to analyze customer data and identify cross-selling opportunities.

AI Opportunities in Payments

Artificial intelligence for payments is not that much different from artificial intelligence for banking. It still provides grand benefits and is so widely used that it reached over a 20% CAGR in the Asia Pacific region alone. What is different, however, is the opportunities that payment businesses get from AI.

#1 Real-Time Security Measures

AI is famous for analyzing vast amounts of transaction data in real time. Thus, AI algorithms can identify suspicious patterns and flag potential fraudulent activities. A prominent example is Mastercard’s Decision Intelligence platform. It uses AI to detect anomalies and approve or decline transactions in milliseconds, reducing fraud losses.

#2 Payment Processing

This feature is arguably the backbone of payment software. So, if you would like to use machine learning for it, you should note that the algorithms can do wonders for payment routing. If real-time payments are important to your business, this is the way to improve it. And, of course, AI can automate invoice processing and issuing as well.

#3 Payment Authorization

Security is the vital element of payment software, so fraud detection and AML are the pinnacle of what you, as a business owner, need to tackle first. Artificial intelligence, in this case, would allow you to analyze customer behavior, transaction history, and suspicious activity to determine the likelihood of fraud. It would also reduce false declines and authorize legitimate transactions much quicker, as AI algorithms would work faster than traditional methods.

Challenges and Considerations

While promising, implementing AI in banking and payments is not without its challenges. One of the most significant concerns currently is the potential for AI bias. This raises concerns in businesses, with over half of business owners expressing apprehension about losing customer trust (56%) and 50% being uneasy about potential reputation compromises. However, it can be fixed. For this, payments and banking businesses need to ensure that the data AI uses to learn is diverse and high-quality and put the system through rigorous testing.

It’s also not easy to find specialists with extensive experience with AI implementation and integration. Our team works with AI-powered API integration, and I have personally been involved in some such projects.

A lot of people I know, however, struggled with looking for an AI engineer. To avoid this hardship, my advice is to research. Look up specialists and companies, find those who fit your needs, and contact them. Sometimes, the best solution is integration and not custom development of just one feature.

And there is also a problem of compliance. The AI field is developing very quickly, and new trends or solutions sometimes can hit the market even before it’s properly regulated. In such situations, there might always be a risk that your idea would be limited by the changed made in the regulations after it hits the market.

The only option here is keeping your hand on the pulse. No other way would help you understand the industry better than being an active part of it.

Conclusions

Artificial intelligence is still a very trending topic, and is likely to continue holding top charts of every discussion. The technology appears in every domain, any market, every niche, and sometimes even party talks. It has its complications and ethical concerns, but so many benefits and opportunities to go with it. Apart from profit growth and customer retention, artificial intelligence for banking and payments promises better resource allocation, sentiment analysis, automation, and security. All this combined is a great and detailed explanation of why AI is so popular in financial markets.

Should you implement it? The decision is yours. But it would definitely be beneficial for your business to have a conversation with the trusted technical partner before making a hard yes or no decision. If you need any advice or answers – you’re welcome to contact me.