From Banking Infrastructure to Business Advantage: The Role of Banking APIs

APIs aren’t just backend plumbing anymore. In modern fintech, they are the product. Every instant payment, balance update, compliance check, or embedded lending flow depends on how well banking systems communicate—and that communication happens through APIs.

A banking API connects third-party products to core banking infrastructure, enabling secure, real-time data exchange. Whether you’re launching a digital wallet, automating payouts, or building a full digital bank, bank API integration is what makes the product actually work.

This is now table stakes. Fintech is API-native by default, and open plus custom banking APIs power the speed, scale, and compliance users expect today. This guide takes a practical, product-first view—showing how API banking works in real products, under real regulatory and operational pressure.

Throughout the article, we’ll reference our real cases, including:

- Dozens, a multi-license digital bank built on a modular, API-first architecture

- Fintech Core, where banking APIs are not features, but core building blocks for regulated fintech products

Key Takeaways

- Banking APIs are the foundation of modern fintech products, enabling real-time payments, compliance, and embedded finance.

- API-first architecture drives speed, scalability, and flexibility, allowing teams to launch and expand without rebuilding core systems.

- Successful fintech is built on architecture, not UI—well-designed bank API integration determines resilience, compliance, and growth.

What Is Banking API?

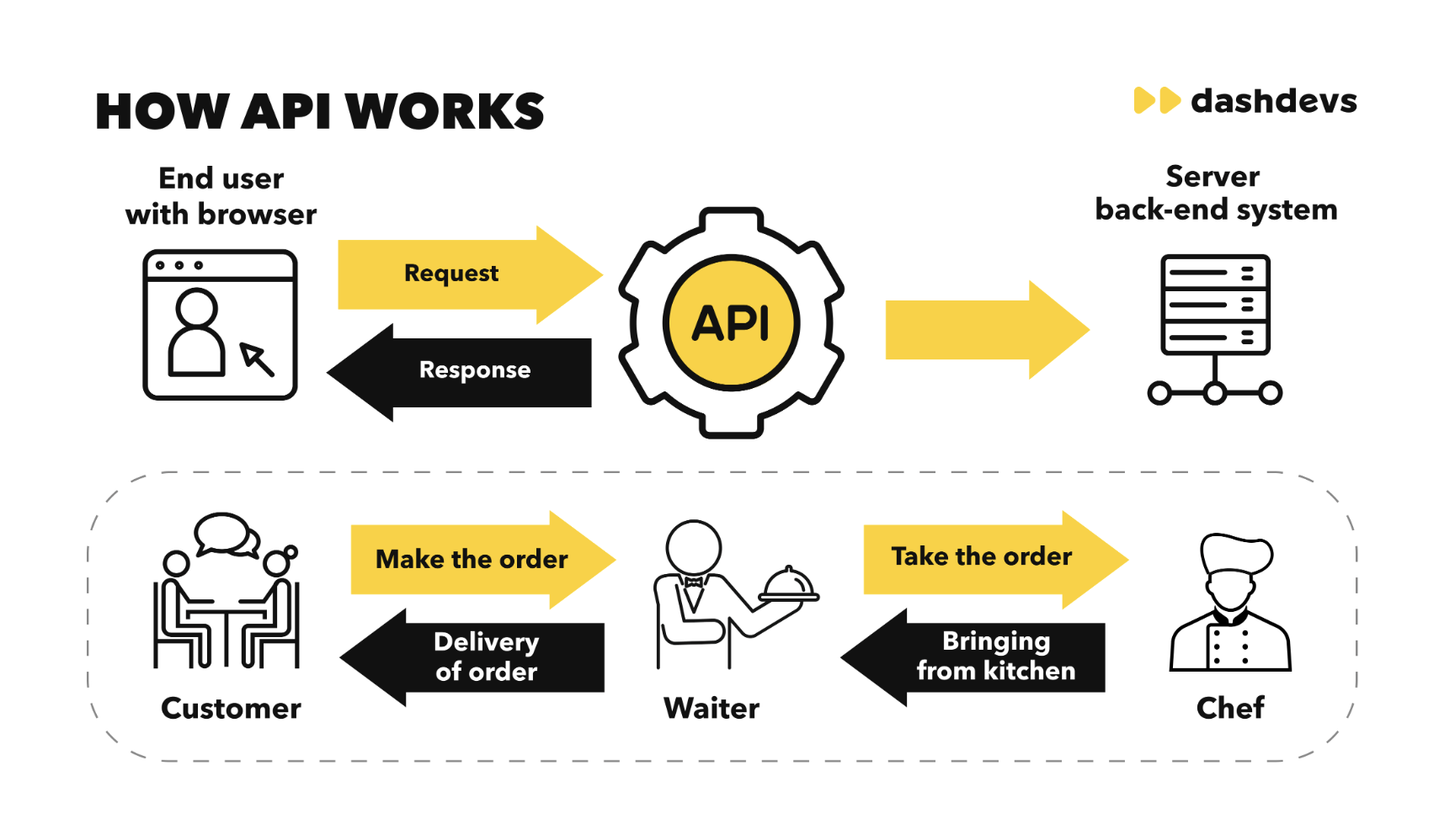

At a basic level, an API integration is a bridge between the client-facing product (web or mobile app) and the backend systems where logic, data, and transactions actually live. In banking, that bridge connects products people see and use with regulated banking infrastructure they never see.

In fintech, almost every modern web or mobile product operates through APIs. Payments, onboarding, balances, cards, lending, and compliance checks don’t happen inside the app—they’re triggered through API calls to banking systems.

Put simply:

A banking API is a set of rules and protocols that allows software applications to access banking services and execute financial operations securely.

Why Bank APIs Matter in Modern Digital Banking

In real fintech products, APIs are not single actions like “get balance” or “send payment.” They form end-to-end workflows:

- onboarding → identity verification → account creation

- payment initiation → fraud checks → ledger updates → settlement

- lending request → scoring → decisioning → disbursement

Modern platforms rely on API orchestration layers that coordinate multiple providers and services behind the scenes. This abstraction allows product teams to swap vendors, scale across markets, and meet regulatory requirements without rewriting the entire product.

How Banking APIs Work in Practice

A classic example is when a non-banking company offers financial services without holding a banking license.

Take Samsung and its digital wallet. Samsung itself isn’t a bank. Yet users can open accounts and access financial services because the wallet integrates with a licensed banking provider such as Solaris via banking APIs.

Here’s what happens under the hood:

- The user submits a request in the app (for example, to open an account).

- The app sends that request through a secure banking API using an API key.

- The licensed bank processes the request according to its regulatory and operational rules.

- The API returns a success or failure response, which the app displays to the user.

All regulated actions—account creation, payments, transfers—are executed on the bank’s side. The product simply orchestrates the experience.

A Practical Definition

A banking API enables non-banking and fintech products to access regulated financial services and embed them directly into their applications—without owning the banking infrastructure themselves.

That’s why APIs are the glue of modern fintech ecosystems. They allow products, platforms, and providers to work together as one system—securely, at scale, and under regulation.

If you’re building or scaling a fintech product, banking APIs aren’t an integration detail. They’re the operating system your product runs on.

The API Landscape in Banking

If you look at successful fintech products from the outside, they often feel simple: open an account, send money, get a card, track spending. Behind that simplicity sits a carefully layered API landscape. Modern fintech isn’t built on one banking API—it’s built on coordinated systems of APIs working together as workflows.

Let’s break down the key API categories used in real fintech products and how they show up in practice.

Identity & Verification APIs

Identity APIs power everything that happens before a user ever touches money. This includes KYC, KYB, document checks, biometric verification, AML screening, and sanctions monitoring.

In real products, identity verification is rarely handled by a single provider. High-performing fintech platforms use multiple identity vendors with fallback logic. If one service fails, produces low confidence results, or slows down onboarding, another takes over automatically. The user experiences a smooth flow, while the platform quietly balances risk, cost, and speed.

This orchestration approach reduces drop-off during onboarding without lowering compliance standards—one of the biggest conversion wins in fintech.

Core Banking APIs

Core banking APIs are the engine room of any financial product. They manage accounts, balances, ledgers, transaction posting, and the lifecycle of money inside the system.

But in real fintech products, these APIs are never exposed directly to the app. They’re wrapped in business logic layers that apply product rules, limits, and regulatory checks. A “simple” transaction often triggers multiple steps: balance validation, compliance checks, ledger updates, and reporting—before the user ever sees a confirmation screen.

Fintech Core takes this approach by design, integrating core banking APIs with compliance and product logic so teams can launch regulated products without hardcoding bank-specific behavior into every feature.

Payment APIs

Payment APIs move money—but production payment flows are far more than a single API call.

In real systems, payments include retries, idempotency controls, fraud checks, asynchronous confirmations, and reconciliation. A payment might be “sent” from the user’s perspective, while the platform continues processing, validating, and settling the transaction in the background.

Importantly, payment APIs are embedded into user journeys, not exposed as standalone features. They’re triggered by actions like checkout, subscription renewal, payroll runs, or invoice approval—turning payments into a natural part of the product experience rather than a separate step.

Card Issuing APIs

Card issuing APIs enable fintech products to create and manage virtual and physical cards linked to user accounts.

What makes modern card products powerful is orchestration. APIs allow teams to define card behavior at the product level: spend limits, merchant restrictions, virtual cards for subscriptions, instant freeze and unfreeze, and real-time controls inside the app.

The result is a shift in how users perceive cards. They’re no longer static payment tools—they’re programmable features that adapt to user needs and reduce fraud at the same time.

Open Banking & Data APIs

Open Banking and data APIs give users secure, consent-based access to their financial data across institutions.

A common use case is account aggregation in budgeting or financial management apps, where users connect multiple banks to see everything in one place. But the most effective products go further.

They combine data APIs (to read balances and transactions) with push and payment APIs (to initiate transfers, repayments, or savings actions). This turns insights into action—moving from “here’s your data” to “here’s what you can do with it.”

Fintech products don’t succeed because they integrate more APIs. They succeed because they design coordinated API ecosystems—with orchestration layers, provider abstraction, and product logic built for change.

That’s the difference between a fintech demo and a fintech business that scales.

Why APIs Matter in Banking (From Theory to Product)

Consumer behavior has already shifted decisively toward digital. The Onbe survey shows that 74% of consumers prefer digital payment methods over traditional ones. At the same time, FDIC data highlights how physical access is becoming less central: in 2021, 14.9% of unbanked households relied on bank teller machines to access their accounts—a figure that continues to decline as more users manage finances online or via mobile apps.

But the real shift happens when APIs stop being integrations—and start becoming a competitive advantage.

APIs as a Competitive Advantage

API-first platforms launch faster because they don’t rebuild what already exists. They rely on orchestration layers that connect identity, banking, payments, cards, and compliance into coherent product flows.

That speed-to-market compounds:

- fewer operational dependencies on single vendors

- faster rollout of new features

- easier expansion into new regions

- safer experimentation without breaking production

APIs also enable product-level differentiation. Real-time notifications, dynamic spending controls, personalized limits, and automated compliance checks aren’t “features”—they’re outcomes of how APIs are orchestrated behind the scenes.

Why APIs Matter for Banks

Customer behavior has already moved digital. Branch visits and teller interactions continue to decline, while mobile and online banking dominate everyday financial activity. APIs allow banks to meet customers where they already are—inside apps, platforms, and ecosystems.

By exposing services through APIs, banks can:

- deliver seamless digital experiences without expanding branch networks

- aggregate multiple services into a single customer journey

- reduce friction and touchpoints across financial flows

- partner with fintechs and platforms instead of competing head-on

- accelerate time-to-market for new products

Open banking providers and bank API integration also create new revenue streams. By enabling third parties to build on top of regulated infrastructure, banks increase transaction volumes, grow deposits, and extend their reach far beyond their own channels.

Why APIs Matter for Fintechs

Fintech companies move fast—but most don’t hold banking licenses. APIs are how they bridge that gap.

Instead of becoming banks, fintechs integrate with licensed institutions via banking APIs to offer payments, wallets, lending, and account services directly inside their products. Building this infrastructure from scratch would be slow, expensive, and risky—APIs make it viable.

In practice, APIs allow fintechs to:

- launch regulated financial services without owning a bank

- stay compliant while focusing on product and UX

- embed finance directly into non-financial user journeys

- cross-sell financial features alongside core products

- build trust through secure, bank-backed services

Data aggregation is a good example. Providers like Plaid expose APIs that let apps securely access user financial data across institutions—powering budgeting, lending, and personal finance tools without direct bank integrations.

From Infrastructure to Product Differentiation

The most successful fintech products don’t win because they have APIs. They win because they use APIs to build better experiences:

- proactive notifications instead of static statements

- automated compliance instead of manual reviews

- personalized financial controls instead of one-size-fits-all rules

That’s the real evolution—from APIs as plumbing to APIs as product strategy.

In modern banking, APIs don’t just connect systems. They define how fast you can move, how safely you can scale, and how distinct your product can become.

How DashDevs Uses APIs in Production

APIs only create value when they are designed as part of real product flows—not as isolated technical integrations. In production fintech systems, API calls rarely stand alone. They are orchestrated into end-to-end journeys that must handle provider failures, regulatory checks, retries, and unpredictable user behavior.

That’s why at DashDevs we don’t “connect APIs.” We design production-ready banking workflows.

In practice, this means every integration is built with the assumption that something will fail—and the product must continue working anyway.

We apply several core patterns across our fintech builds:

- Provider abstraction layers: Business logic is decoupled from specific vendors, allowing payment, KYC, or card providers to be swapped without rewriting the product.

- Fallback and retry logic: If a primary provider becomes unavailable or slow, requests are routed to alternatives automatically.

- Stateful orchestration: User journeys—onboarding, verification, funding—are tracked and resumable if interrupted.

- Observability by default: API latency, failures, reconciliation mismatches, and SLA breaches are monitored continuously in production.

In products like Dozens, this approach ensures onboarding doesn’t depend on a single identity provider, payments are always aligned with compliance checks, and card actions reflect real-time balances and risk rules.

The result is not just integration—but resilient fintech products that survive provider outages, traffic spikes, and regulatory change.

Fintech Core — An API-First Fintech Foundation

Fintech Core is the natural outcome of DashDevs’ experience building and operating API-driven fintech systems under real-world conditions.

Instead of rebuilding the same integration logic for every new product, Fintech Core provides a modular, API-first foundation shaped by years of production experience—not theoretical architecture diagrams.

In practice, Fintech Core acts as:

- An integration operating layer between your product and external providers

- A system of record for accounts, balances, and ledger logic

- An orchestration engine for onboarding, compliance, payments, and cards

- A provider abstraction layer for KYC, banking rails, and payment networks

- A user state and notification layer powering real-time product flows

What teams get out of the box is equally practical:

- Multi-provider setups with no hard vendor lock-in

- Built-in retries and fallback logic for unstable APIs

- Compliance checks embedded directly into product flows

- Production-grade monitoring and observability

For product teams, this translates into faster launches, lower delivery risk, and long-term architectural control. Provider strategies can change, markets can expand, and commercial terms can be renegotiated—without re-architecting the platform.

Simply put, Fintech Core turns API complexity into a reusable product asset, not a recurring engineering cost.

Mini Case Study: Dozens

Dozens is a clear example of how API-driven architecture becomes a product enabler, not a technical dependency.

The Challenge

The product required multiple third-party integrations across identity verification, payments, and financial operations. But the real challenge wasn’t connecting APIs—it was orchestrating them into reliable user journeys.

Key risks included:

- onboarding dependent on external verification providers

- payment flows tied to provider availability

- operational reporting dependent on consistent transaction data

Any failure in an external system could not be allowed to block critical user actions.

The Solution

DashDevs designed an API orchestration framework that:

- abstracted all third-party providers behind unified interfaces

- implemented fallback logic for high-risk dependencies

- synchronized compliance checks with money movement flows

- introduced monitoring and alerting across all API integrations

Instead of embedding provider logic into business features, all external APIs were treated as interchangeable infrastructure components—connected through controlled, observable workflows.

The Outcome

This approach allowed the product to:

- launch faster without locking into a single vendor

- maintain reliability during provider outages

- scale operational processes without rewriting core logic

- introduce new integrations without breaking existing functionality

Project Imagine demonstrates a practical fintech principle: APIs should be orchestrated as part of product logic—not embedded inside it.

Conclusion

Bank APIs are no longer a technical layer hidden behind the product—they are the foundation that determines how quickly a fintech can launch, how reliably it operates, and how safely it scales. The real advantage doesn’t come from having more integrations, but from orchestrating APIs into resilient workflows that handle compliance, failure, and real user behavior without breaking the experience.

As examples like Dozens show, API design is a strategic decision, not just an engineering one. Platforms built on API-first foundations such as Fintech Core turn hard-earned production experience into reusable infrastructure, reducing risk and accelerating innovation. In modern fintech, APIs are where product ambition meets operational reality—and how well that connection is designed defines whether a product simply launches or truly lasts.