Building a Website that Can Accept Online Payments in 6 Steps

The value of distributing goods and services digitally, with an opportunity to receive payments online, is immense. For instance, retail e-commerce revenue globally alone has exceeded $4.1 trillion as of 2024. And there are still other industries where businesses widely utilize websites that can accept online payments.

In this post, you’ll discover what a website payment system actually is, what businesses must prioritize adding it to their web resource, and how to accept online payments as a merchant. Besides, you’ll review six basic steps present in every website development project and explore the fees for sending and accepting payments online.

What Is a Website Payment System

A website payment system is an own or a third-party service that enables businesses to accept payments online and transfer funds to their accounts.

Without such a website payment system in place, offering payment options to customers is technically impossible. So, any business that intends to distribute its services and products online should consider adopting a website payment functionality.

You can explore how a website payment system works in the infographics below:

While particular website payment system’s features may require a separate discussion, it’s worth mentioning that third-party payment services already come with vital components, including:

- Compliance management: Third-party services ensure adherence to stringent regulations that guide the process of accepting online payments. As such, PCI DSS compliance is necessary for handling and storing users’ payment card information. This compliance is challenging for businesses to obtain independently. Luckily, it’s typically covered by a service provider.

- User card data storage: While it is possible for businesses to store card data, it requires meeting complex security standards. Payment systems simplify this by securely storing card details and allowing businesses to reuse card IDs for subsequent transactions.

- Integrated interfaces: These systems provide pre-built interfaces, for each payment method its own. In this payment interface, customers can enter their billing details and, for repeated transactions, choose to enter billing details automatically.

So, when acquiring a third-party integration, a business obtains a quite comprehensive solution. However, the integration itself is just a part of a more complex process of creating a website capable of accepting payments online.

What Businesses Need a Website with Payment Options

In the modern world, most businesses, predominantly those that provide Business-to-Customer (B2C) services and distribute products online, have already adopted websites that accept online payments. From my experience, common examples of such companies include:

- Online marketplaces

- Subscription-based service providers

- Event ticketing platforms

- Nonprofit businesses receiving donations

- Online educational platforms

- Platforms that distribute digital content

- Hospitality businesses with booking opportunities

- Health and wellness providers

- Food delivery and ordering services

- Travel agencies and tour operators

- Crowdfunding platforms

- B2B platforms with online invoice payments

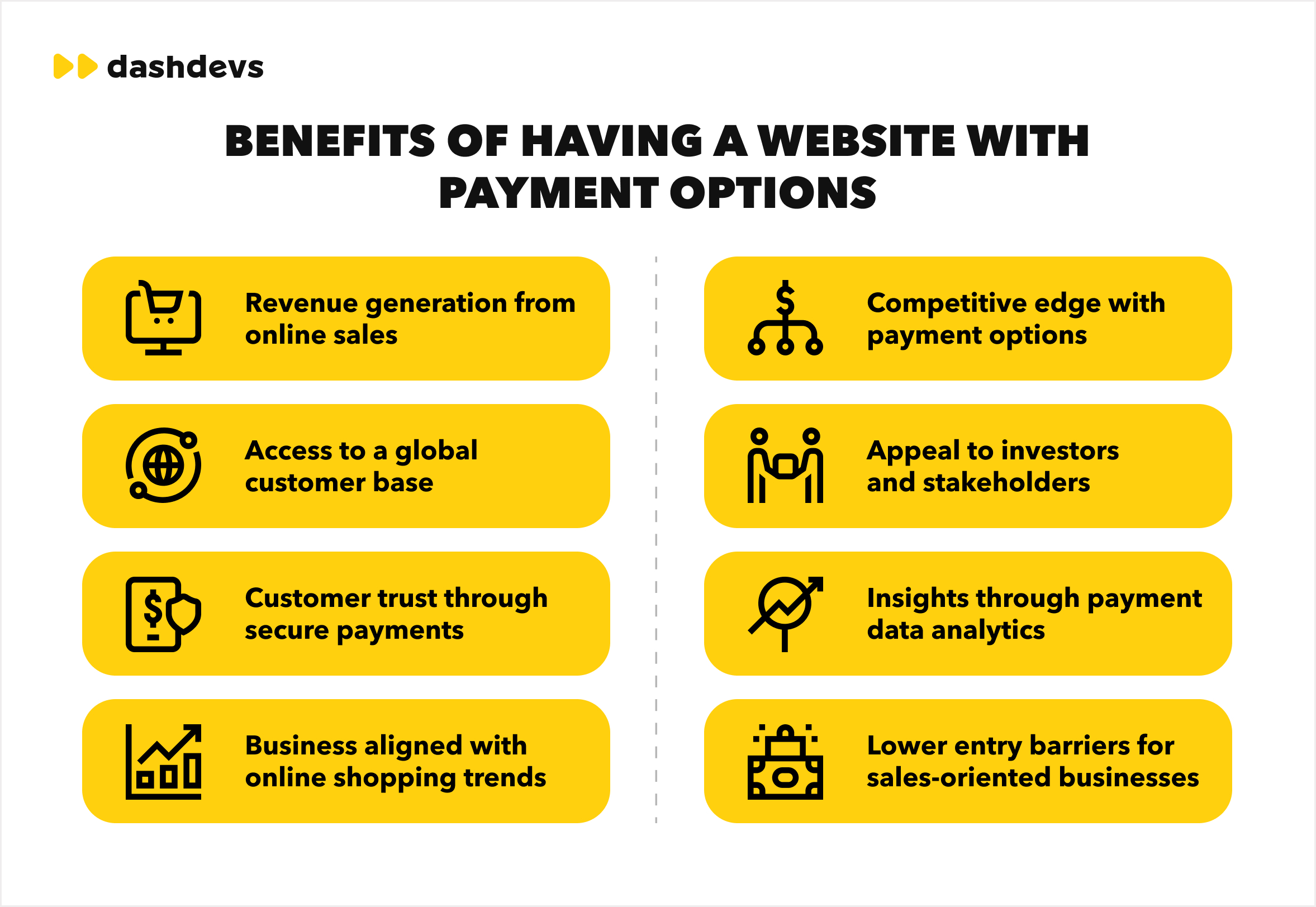

As for the benefits the mentioned businesses reap from having a website that can accept online payments, they encompass revenue generation, competitive edge, access to a global c customer base, and others. See all of them provided in the image below:

It’s hard to imagine a marketplace or a booking platform without the functionality to accept online payments or argue against the usefulness of such software. The actual nuances to delve into are mainly online payment methods and steps to get started, which I provide further in the post.

Looking for reliable web development services? Contact DashDevs and let us contribute to your best project.

Website Options for Accepting Online Payments

Let’s get through all the main options for how to accept payments online for a merchant:

- Credit and debit card payments: Payments that are conducted directly through widely-used Visa, Mastercard, or other card networks.

- Digital wallets (E-wallets): Options to pay seamlessly by using platforms like PayPal, Apple Pay, or Google Pay.

- Buy Now, Pay Later (BNPL): Flexible installment options for customers at checkout.

- Cryptocurrency payments: Decentralized payments with Bitcoin, Ethereum, or other digital currencies.

- Prepaid cards and gift cards: An option to redeem payments using preloaded or gift cards.

- Subscription payments: Automated, scheduled online payments for ongoing products or services.

- Electronic Checks (E-checks): Direct bank account transfers with digital check processing.

Important note. There are also recurring payments, which are often confused with subscription payments. In fact, recurring payments are not a website option for accepting payments online but rather a modification of other online payment methods. They allow for repeated payments, whether automated or semi-automated and are assisted with automated billing details entry functionality. For example, credit card payments can be recurring. Yet, BNPL or digital wallet transactions can be recurring as well. As for subscription payments, they are recurring by their nature.

The integration of a website functionality is conducted through an Application Programming Interface (API). Discover how APIs work in the related DashDevs publication.

6 Steps to Create a Website that Can Accept Payments Online

Now, let’s proceed with reviewing high-level business steps on how to establish a website with payment options that can receive transactions online:

#1 Discovery Phase and Business Requirements Testing

The discovery phase is the initial stage where the groundwork for a new project is conducted. Omitting regular discovery phase steps like market and competitor research or creating user personal, let’s delve into specific nuances of creating a website with payment options.

You can discover how DashDevs approaches the discovery phase in our projects from the corresponding blog post and our discovery services page.

So, aside from regular considerations in the discovery phase, it’s necessary to define the following:

- What currencies must be supported?

- What payment methods must be supported?

- What countries must the website legally operate in?

- What are the deadlines?

- What third-party payment integrations to include?

As you can observe, the first several considerations guide toward the last one, as payment integrations are chosen primarily based on specific website needs and requirements.

#2 Registration as a merchant

To be eligible to accept payments and do it successfully, you must be a registered merchant approved by your chosen payment service provider. This step necessitates taking the following actions:

- Registering as a merchant

- Creating subscriptions

- Obtaining access tokens, and

- Exploring payment provider’s documentation

- Exploring merchant’s monitoring options.

It’s also worth mentioning that many providers of third-party integrations for websites that accept online payments already offer external systems, such as a back office or accounting tools, to streamline operations.

Note. DashDevs software development agency assists, among others, with merchant registration, documentation, and monitoring. However, it’s important that a merchant also obtains a proper insight into how the system operates and can manage it themselves or delegate these operational processes to a dedicated person.

#3 Development

The development phase is split into back-end, design, and front-end development. The design stage typically starts before the development stage and then often runs in parallel with it. As for front-end development, where the user interface and its functionality are implemented, this stage always follows the back-end development.

Let’s get through several back-end development actions that are unique to accepting online payments via websites:

- Creating databases and tables for storing user tokens

- Creating databases and tables for storing transaction IDs

- Creating a payment ledger and consolidating all payment systems integrated into this since ledger

As mentioned above, payment integration providers offer their own payment infrastructure for conducting payments. Or, from another perspective, they simply conduct the transaction instead of the merchant themselves. Since the merchant doesn’t handle back-end aspects of the online payment, they should not access and store customers’ billing data. Instead, only user tokens encrypt billing data and are stored to enable auto-filling of billing data for recurring payments and transaction IDs for verifying successful payments.

Explore DashDevs development service offerings on our corresponding website page.

#4 Integration of a payment provider

Let’s explore how to enable transactions on your website with payment options based on the example of how DashDevs integrates a payment provider like Stripe.

- Create a payment provider account. First, we create and configure an account on Stripe. Then, we define the currencies you’ll accept and the payment methods (e.g., credit cards, Apple Pay, Google Pay). After that, it’s necessary to link a bank account for fund withdrawals and retrieve the API keys to interact with Stripe’s API.

- Connect Stripe to a website. On the next step, we add an online payment form where customers can securely input their details to a website. The card details entered by the customer are encrypted with Stripe’s public key before being sent to the server. Stripe’s official library is used to implement this functionality.

- Set up server payment processing. Then, it’s necessary to create a server route to handle payments, which may include custom logic. We utilize the Stripe SDK for this integration. DashDevs ensures that all secret API keys for Stripe are stored securely on the server side.

- Configure webhooks. On the backend, we set up webhooks to receive notifications about payment statuses, such as successful payments or refunds. This allows your system to stay updated in real-time.

- Monitor payments. Then, a website’s owner can use Stripe’s tools to track payments, refunds, and potential issues. This helps to monitor sales and manage any problems effectively.

You can see the visualization of this process in the infographics below:

In the workflow, payment gateway implementation is what causes the most concern, so I believe sharing additional details here might be useful.

Each payment gateway requires custom integration using API endpoints provided by the service documentation. As a rule, for every payment service, we develop a dedicated gateway that communicates using the merchant’s credentials. The number of gateways matches the number of payment services integrated.

As for the customer-facing environment, i.e., user interface, it adapts depending on the payment methods offered. For example, a credit card payment interface differs from that of a digital wallet. That’s why payment interfaces that are tailored to different payment options may differ even if they both are provided by the same integration partner. That’s the case, for example. With PayPal.

#5 Testing

Testing is integrated into the development process, following the Agile methodology. It means, as an option, that the development process is divided into two-week sprints, and every feature or component developed during the sprint it to be tested separately, ensuring that no code is written on the top of a malfunctioning component.

You can discover more about software development methodologies from another blog post by DashDevs.

Here at DashDevs, when development is complete, we perform regression testing, which evaluates all website functionalities holistically. This rigorous testing process ensures that the website performs under various scenarios and meets user expectations.

#6 Launch

The last step involves transitioning the website from the development environment to staging and finally to production.

There must be a well-prepared infrastructure, including servers, a hosting environment, a database, and network components that are ready to handle the website. Here at DashDevs, we dedicate DevOps specialists to support this transition to ensure a secure and efficient launch.

After the site goes live, developers typically conduct a series of real payments to confirm that everything functions correctly in a live environment. After that, the website is fully ready to accept online payments from actual customers.

How Much Does It Cost to Accept Payments On a Website

The cost of accepting payments on a website varies depending on the payment processor, the volume of transactions, and any additional services needed. Let’s take a look at the breakdown of typical fees you might encounter while enabling online payments:

- Payment processing fees. These are the basic fees most payment processors charge for each transaction. It’s typically a small percentage of the transaction amount plus a fixed fee. For example, as per standard pricing policy, Stripe charges 2.9% + 0.3$ per successful charge.

- Monthly fees. These are typically fixed fees that some providers charge for access to their advanced features, such as subscription billing and enhanced fraud protection to value-adding services like VIP programs. For example, PayPal offers a “Payments Pro” plan that includes features like a customizable checkout experience and virtual terminal access at a monthly fee of $30.

Payment processing fees are often paid by your customers in full, of which you should inform them. However, sometimes transaction fees are paid both by a merchant with a website accepting online payments and their customers. Besides, you will likely bear monthly fees associated with access to advanced merchant programs and services.

Important note: There are a couple of other types of fees. For example, setup fees are charged when a website owner is assisted with integration by the integration provider itself rather than by a dedicated provider of integration services. As for chargeback fees, i.e., transaction expenses that a website owner bears in case of a canceled transaction or a refund, in the modern days, popular payment providers nearly never charge them.

Success Stories of Developing Websites With Payment Options

Here’re a couple of cases by DashDevs where we created websites with payment options through a payment provider integration.

iOL Pay Global Hospitality Platform

Challenge: iOL Pay needed a customizable payment platform built in just three months, replacing external services with a native solution to cut costs. The platform required three SDKs for seamless B2C integrations, advanced payment features like Apple Pay, Google Pay, deposit options, and support for Alternative Payment Methods (APMs).

Solution: DashDevs developed a robust platform with payment options supporting 26 languages, 140 currencies, and over 250 payment methods. The solution included backend architecture, a web app, SDKs, and Stripe integrations.

Result: Launched in three months, iOL Pay expanded to 37 international markets and integrated with over 23,000 hotels, including brands like Marriott. The platform streamlined payments, reduced costs, and partnered with Visa and Mastercard for enhanced reliability.

Vidby Call Translator Platform

Challenge: Vidby required the development of an AI-driven call translation tool capable of seamless integration with platforms like Google Meet and Zoom. Frequent updates from these platforms demanded rapid adjustments to maintain compatibility. Additionally, integrating third-party APIs for real-time transcription and translation in 70+ languages was required.

Solution: DashDevs developed Vidby from the ground up, creating a multilevel AI-powered solution with real-time transcription, translation, and voiceover capabilities. The product integrates seamlessly with Google Meet and Zoom, functioning like a virtual participant. To enable our customers to receive payments via their Vidby platform, we integrated Stripe as a payment vendor in a way described in the sections above.

Result: The MVP was delivered in just three months. Later on, Vidby became an unmatched solution in the communication industry. The product’s unique AI capabilities and real-time updates ensure it remains ahead of competitors. The partnership between DashDevs and Vidby continues to foster innovation and growth.

Explore Vidby Call Translator success story

Final Take

Building a website capable of accepting online payments is a game-changer for established benefits and startups. Among the many value-adding benefits this initiative brings are expanded customer reach, faster transactions, and improved user convenience. By following these six steps —discovery, merchant registration, development, gateway integration, testing, and launch, you can ensure a seamless, secure online payment experience for your customers.

Should you need a website that can accept online payments, don’t hesitate to apply for expert development help. Here at DashDevs, we have substantial experience conducting payment integrations enabling access to digital transactions. With more than 14 years of experience and over 500 successful projects under our belt, we are ready, willing, and able to contribute to your best website.