The Future of Digital Wallet Innovations, Tokenization & Adoption Trends

A decade ago, digital wallets were simple. Tap, pay, done.

Today, they’re evolving into full-fledged financial ecosystems—integrating payments, identity, loyalty, credit, and even tokenized assets. From Apple Pay to MuchBetter, the modern wallet is no longer just a utility—it’s becoming the front door to financial services.

At DashDevs, we’ve seen this shift firsthand through projects like MuchBetter, where we helped build an award-winning e-wallet with seamless payments, loyalty features, and smart risk monitoring—all designed for global scale and daily use.

In this article, we’ll explore:

- The market growth and adoption are shaping wallet innovation

- How tokenization improves security and enables new use cases

- The role of regulation (EMI, PSD2, open banking) in wallet design

- What’s next: from super apps to CBDCs and digital identity

Let’s dive into the future of wallets—and why it matters now more than ever.

Why the Digital Wallet Market Is Booming

At DashDevs, we’ve worked with fintechs across the globe that are no longer asking, “Should we launch a wallet? but rather, “How fast can we scale one?” This shift is being driven by real market signals, and they’re impossible to ignore.

Here’s what’s fueling this growth:

- Mobile-first user behavior: People want frictionless, app-based experiences that centralize how they pay, save, and engage with financial services.

- The rise of e-commerce: By 2025, digital wallets are expected to handle over half of all online transactions globally.

- A global user base: Wallets enable instant, cross-border payments, and users are adopting them in both mature and emerging markets.

- Multifunctionality wins: Loyalty, subscriptions, credit, insurance, peer-to-peer—it’s all converging into one wallet experience.

Market Growth Snapshot

| Metric | 2024 | 2030–2033 Forecast |

| Digital Wallet Market Size | $195.6 billion | $701 billion by 2033 (CAGR 15%+) |

| Transaction Volume via Digital Wallets | ~$9 trillion | $19.7+ trillion by 2030 |

| Share of Global E-commerce Payments | ~40% | 50%+ by 2025 |

| Digital Wallet Users Worldwide | 3.5 billion | 5.2 billion by 2026 |

Source: GlobeNewswire

But numbers alone don’t tell the full story. Behind the explosive market growth lies a deeper shift in user expectations. As digital wallet innovations accelerate, consumers are demanding more than speed—they want value, personalization, and flexibility. That’s where adoption trends come into play.

Let’s take a closer look at how users are engaging with digital wallets today and what that means for the future of the ecosystem.

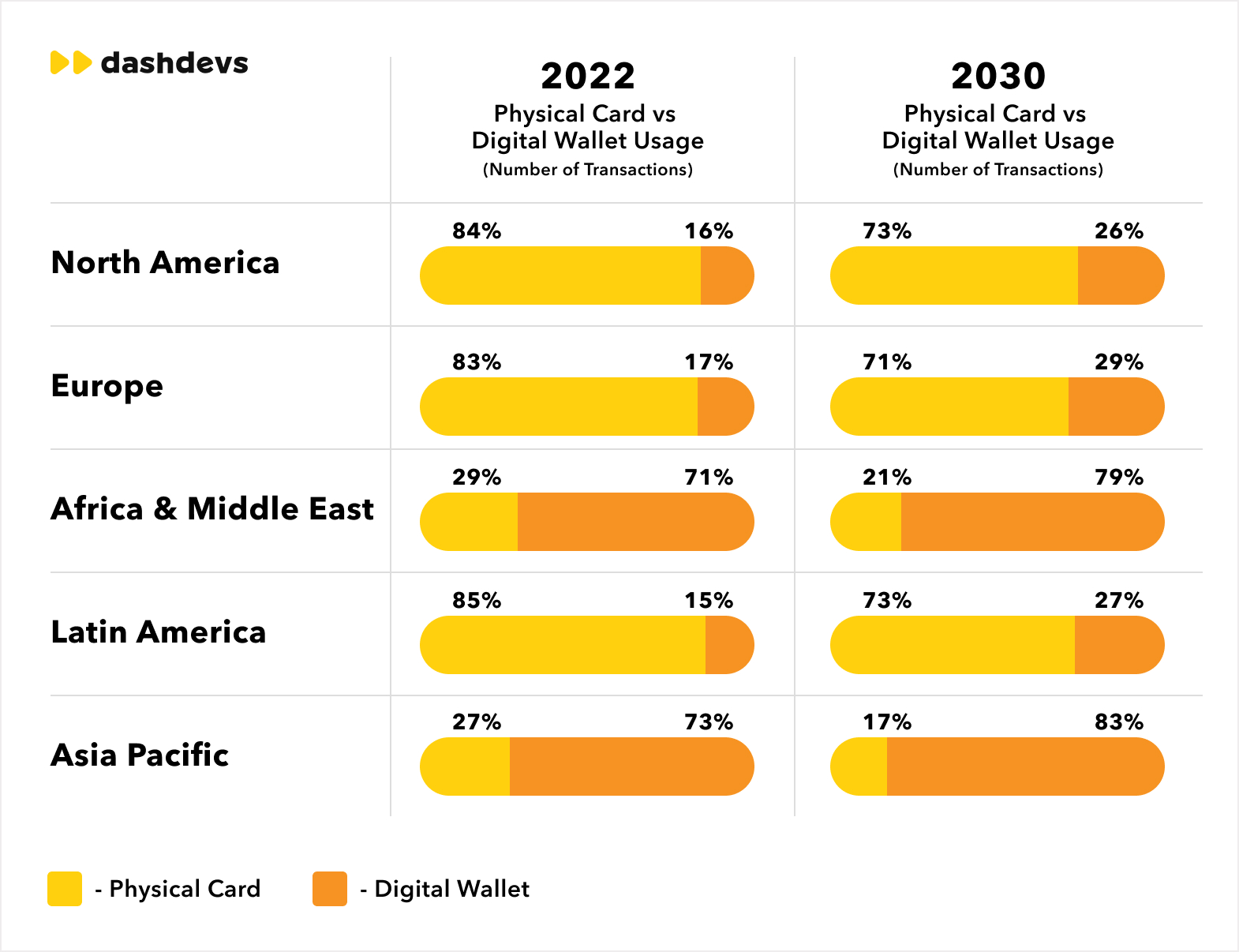

Digital Wallet Adoption: What’s Driving Mass Usage?

The evolution of digital wallets from basic cardholders to full-fledged financial ecosystems isn’t just a technology story—it’s a user behavior story.

Today’s consumers expect more than just payment convenience. They want wallet technology that integrates into daily life, works across borders, adapts to multiple use cases, and offers value beyond transactions. This shift is fueling massive digital wallet adoption around the world—and shaping the future of digital wallets as engagement platforms, not just payment tools.

Who’s Using Digital Wallets?

The growth is staggering. According to a recent report, over two-thirds of the global population will use digital wallets by 2029.

Young users, particularly Millennials and Gen Z, are driving the trend, but older demographics are rapidly catching up. People aren’t just using wallets to pay; they’re using them to save loyalty points, split bills, manage subscriptions, and access credit. These use cases are turning standard apps into super wallet apps—multifunctional, high-frequency platforms at the center of users’ financial lives.

From Single-Purpose to Super Wallets

Let’s be clear: this is not just about the evolution of digital wallets; it’s about the redefinition of financial access. Today’s leading digital wallet examples—like Apple Pay, Revolut, Alipay, and DashDevs-built MuchBetter—all share one trait: they go far beyond payment.

They incorporate:

- Digital assets and crypto rails

- Tokenized security infrastructure

- Embedded financial products like insurance or lending

- Seamless digital wallet integration with loyalty, ID, and biometric authentication

- Smart UX for speed and repeat usage

This is what the future of e-wallet platforms looks like: context-aware, intelligent, and open. No more siloed financial apps. Just one interface that does it all.

As adoption accelerates, so do expectations for trust and safety. A wallet might win users with convenience, but it keeps them through security. This is where digital wallet tokenization steps in—transforming not just how transactions are processed, but how risk is managed. And it’s not happening in isolation: regulations like PSD2, EMI licensing, and VASP rules are shaping the way wallet technology is designed, integrated, and deployed.

Let’s explore how tokenization, security frameworks, and regulation are driving the next wave of digital wallet innovations.

Take a look at the webinar of DashDevs CEO — Igor Tomych, on the topic of how to build digital wallets.

Tokenization, Security Use Cases & Regulatory Landscape

Two powerful forces are shaping the evolution of digital wallets.

- Digital wallet tokenization—transforming how transactions are secured.

- Regulatory frameworks—defining how wallets are designed, integrated, and scaled.

Both are central to the future of digital wallets, and both determine how fintech e-wallet providers compete in a rapidly growing market.

Reducing Fraud with Tokenization

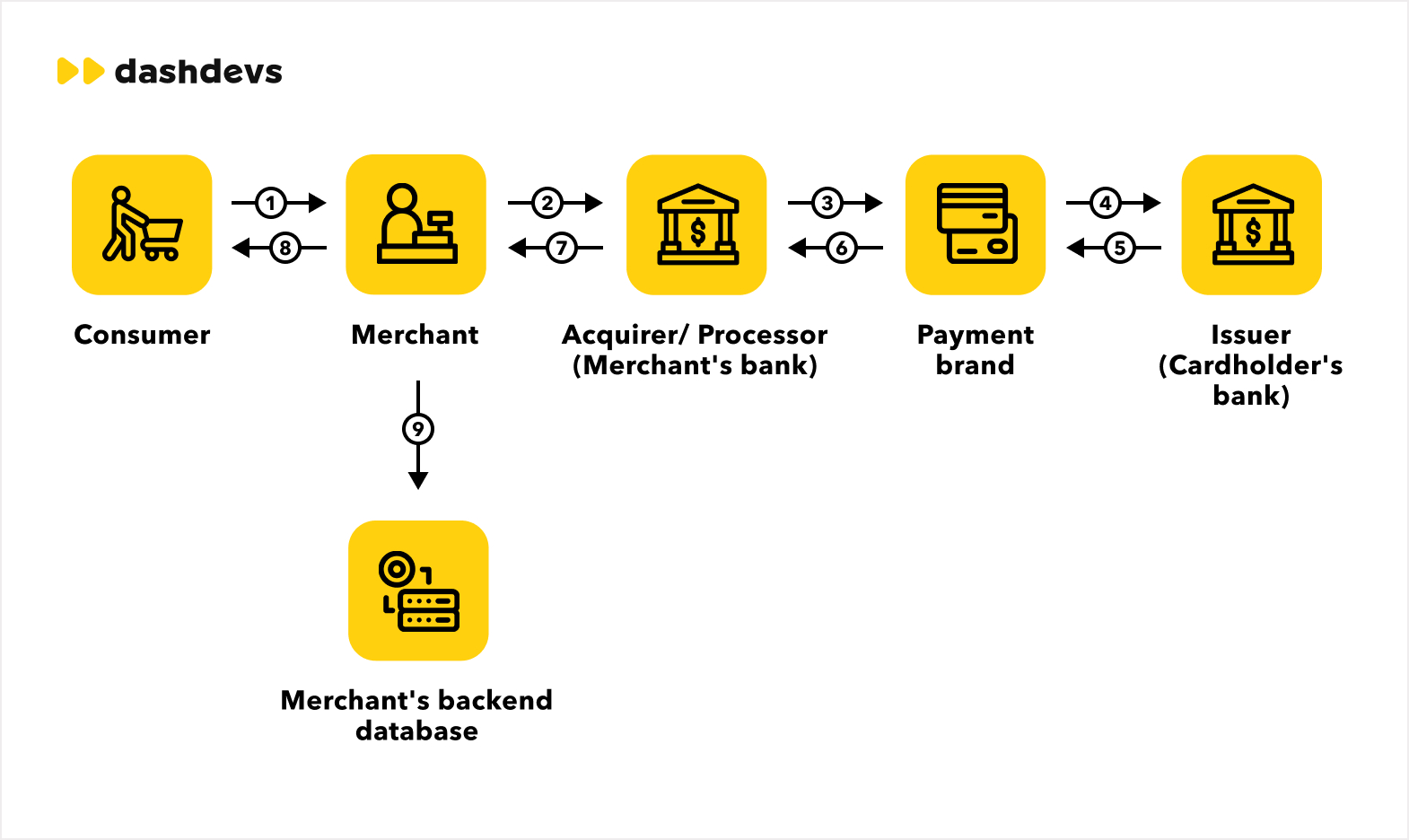

At its core, tokenization replaces sensitive payment details with unique, random tokens. The real card or account data never appears in a transaction, which means even if a breach occurs, the stolen data is useless.

For wallet providers and merchants, the benefits are clear:

- Fraud rates can drop by up to 50% in tokenized payment networks.

- Approval rates improve as issuers trust tokenized transactions more.

- Chargebacks and operational costs decrease.

- User trust grows, driving higher digital wallet adoption.

In short, tokenization turns a wallet from a payment tool into a secure, everyday financial platform for digital asset payments.

How Leading Wallet Platforms Use Tokenization

The biggest digital wallet examples have built tokenization into their core wallet technology:

| Provider | How Tokenization Works in Their Wallet |

| Apple Pay | Stores credentials in Secure Enclave, uses biometrics, generates dynamic tokens |

| Google Pay | Uses network tokenization with encryption at the device and transaction level |

| Samsung Pay | Tokenized card storage backed by Knox security platform |

| Revolut | Tokenizes card data for recurring billing, cross-border transfers |

| MuchBetter | Combines tokenized transactions with loyalty and risk monitoring |

This approach is now a baseline for any serious digital wallet platform—and a must-have for secure digital wallet integration.

Tokenization Beyond Payments

Tokenization is no longer limited to card payments. It’s becoming a backbone for:

- Cross-border transfers: Tokenized identity and payment data speed up settlement and reduce fraud risk.

- Crypto transactions: Securely stores and moves tokenized assets, including stablecoins.

- CBDC use cases: Supports regulated, programmable central bank digital currency payments.

- Tokenized securities: Enables fractional ownership and compliant peer-to-peer transfers inside wallets.

This expansion pushes the evolution of digital wallets from simple payment tools to multi-asset, multi-function platforms.

Regulations Shaping Wallet Design

While tokenization improves security, regulations ensure that wallet technology operates within trusted, standardized frameworks. Key rules include:

- PSD2 & Open Banking: Require Electronic Money Institutions (EMIs) and payment providers to open secure APIs to third parties, enforce strong customer authentication, and ensure interoperability.

- EMI Licensing: Essential for issuing electronic money in compliant digital wallet platforms.

- MiCA Regulation: Sets operational, capital, and custody requirements for Virtual Asset Service Providers (VASPs) and Electronic Money Token issuers.

- National Guidance (EBA, FCA, etc.): Allows phased integration of crypto-assets into fintech e-wallet ecosystems under controlled conditions.

At DashDevs, we design digital wallet projects with these regulations in mind from the start—so compliance isn’t a hurdle; it’s a launchpad for trust and scalability.

Security and compliance might be the foundation, but they’re not the endgame. Once a wallet is trusted and interoperable, the real question becomes: what else can it do for the user? This is where the future of digital wallets takes shape—through innovation, integration, and the evolution into super wallet apps that handle far more than just payments.

Should you need fintech consulting* assistance with choosing a tech stack, defining best-suited features, and more, don’t hesitate to reach out to DashDevs.*

Emerging Innovations & Future Trends in Digital Wallets

The next wave of digital wallet innovations is about transforming wallets into primary financial interfaces—platforms that users interact with daily, not just when they pay for something. From digital wallet integration with identity and loyalty systems to handling tokenized assets and programmable money, the opportunities are expanding quickly.

Super Wallet Apps: Beyond Payments

The line between a digital wallet platform and a lifestyle app is disappearing. The most competitive solutions already include:

- Loyalty and rewards tied to spending

- Embedded lending and BNPL options

- Insurance access and claims processing

- Peer-to-peer transfers in multiple currencies

- Storage and use of digital assets like stablecoins

In markets like China, WeChat Pay and Alipay have proven this evolution of digital wallets works—turning them into indispensable daily tools. The same model is now gaining traction in Europe, the US, and the Middle East.

Digital Identity Integration

One of the biggest trends wallet providers are preparing for is the unification of payment and identity.

- The EU’s Digital Identity Wallet aims to store IDs, driving licenses, health data, and payment credentials in one secure app.

- National initiatives in Asia and the Middle East are exploring similar wallet technology models.

For providers, this means digital wallet development must focus not just on transactions but on secure, tokenized identity management.

Tokenized Assets and Programmable Money

Digital wallet tokenization is evolving from a fraud-prevention measure to a way of delivering new asset classes.

- Users could soon manage tokenized real estate, stocks, or commodities directly within their fintech e-wallet.

- CBDCs will integrate with wallets for programmable, regulated payments—like automated tax collection or instant loan repayments.

This is the future of e-wallet functionality: multi-asset, programmable, and compliant.

Interoperability & Open Finance

Winning wallets will be those that integrate seamlessly with other financial and non-financial platforms:

- Open banking APIs enable smooth connections between wallets, banks, and merchants.

- Standardized token protocols allow cross-border, cross-industry payments without friction.

In this model, a digital wallet vs. payment gateway isn’t even a debate—the wallet is the gateway, and much more.

Looking for expert e-wallet app development services? Reach out to DashDevs with your project idea, and let’s discuss it.

AI-Driven Personalization

Advanced wallet technology will use AI to:

- Predict cash flow and spending patterns

- Offer tailored financial products and rewards

- Flag suspicious activity in real time

This creates a stickier, more valuable digital wallet platform, boosting both user retention and digital wallet adoption.

The future of digital wallets is platform-based, identity-first, tokenized, AI-enhanced, and globally interoperable. Providers that start building for this future now will be the ones setting the pace—not trying to catch up.

A Real-World Example of Digital Wallet Innovation Done Right

One of our standout digital wallet development projects is MuchBetter, an award-winning fintech e-wallet designed for the UK market. Entering a competitive space dominated by Neteller, Skrill, Entropay, and Ecopayz, the goal was clear: create a digital wallet platform that could match (and surpass) established players in functionality, security, and user engagement.

We delivered the fully operational solution in 4 months, covering the entire product lifecycle:

- Architecture & development of a scalable, regulation-ready wallet

- Implementation of digital wallet tokenization to secure payments and personal data

- Cross-border transaction support with multi-currency capabilities

- Integration of loyalty rewards to drive digital wallet adoption

- Real-time risk monitoring and anti-fraud systems for user trust

The result was not just a payment tool but a super wallet app—a daily-use financial interface built for both speed and compliance. Today, MuchBetter stands as a clear example of how the right digital wallet innovations can break into mature markets and win loyal users fast.

Final Thought

The future of digital wallets is shaped by more than just technology—it’s defined by trust, security, and the ability to adapt to user needs. Tokenization, regulatory frameworks, and the shift toward super wallet apps are setting the stage for platforms that are secure, compliant, and deeply integrated into everyday life.

As the market continues to grow and mature, the opportunities for digital wallet innovation will only expand. The businesses that succeed will be those that combine robust security with seamless user experiences—building wallets that people not only use, but rely on.

If you’d like to discuss ideas or challenges around digital wallet development and integration, feel free to contact us.