The Go-To Guide to Navigating DORA Regulation in EU

Maintaining system security and resilience becomes even more crucial as technology propels the financial sector ahead. That’s where the recently approved Digital Operational Resilience Act (DORA) finds application. Starting in January, DORA imposes rigorous guidelines to guarantee that financial institutions all throughout the EU can resist digital disruptions and cyberattacks.

What does this mean, though, for your company? Whether your field of expertise is leadership, compliance, or fintech, keeping ahead depends on knowing DORA process. This control will change the way financial services handle their digital infrastructure; hence, strong security and resilience are needed.

In this article, we’ll clarify the new DORA framework, explain how it differs from similar rules outside the EU, and describe how our team handles producing DORA compliant software.

What Is DORA Regulation and Why It Matters

So, what is DORA? To understand the relevance of the Digital Operational Resilience Act, we must take a step back and look at the escalating cyber threats that the banking sector faces. Security breaches in finance increased by 72% in 2023, surpassing the previous all-time high set in 2021.

Financial institutions—whether huge banks, insurance businesses, or fintech startups—are prime targets because of the sensitive nature of the data they manage and their importance to the economy. A single breach in one institution might have far-reaching consequences for the whole financial system, creating a systemic risk.

EU DORA solves that vacuum by establishing a set of regulations to ensure the resilience of digital operations, not just for banks but also for third-party providers such as cloud services and payment platforms.

Key Differentiators of DORA Regulation

DORA offers a few distinct components to the table, especially for financial institutions:

- Cyber threats: DORA act goes beyond baseline cybersecurity precautions to prevent cyberattacks that could directly impact financial activities. This includes more stringent data and system security requirements.

- Third-party risks: Unlike traditional laws, DORA regulation considers third-party IT risks. It clearly includes cloud service providers, data centers, and other external technology partners under its regulatory purview, ensuring that their systems and operations are as resilient as the institutions they serve.

- Incident management: Traditional regulations typically lacked consistent methods for dealing with IT incidents. DORA compliance specifies incident management plans, requiring institutions to have clear and quick response mechanisms in place for any digital interruptions, ensuring minimal impact on operations and timely communication with regulators.

What Is the NIS2 Directive?

The NIS2 Directive (Network and Information Security Directive 2) is a European Union regulatory framework designed to strengthen cybersecurity across member states. Replacing the original NIS Directive, NIS2 expands the scope of cybersecurity requirements to include a broader range of sectors critical to the economy and society, such as energy, healthcare, digital infrastructure, and public administration.

The NIS2 Directive is structured around key pillars to enhance cybersecurity resilience and cooperation across the EU. These include:

- Expanded scope and sector inclusion: NIS2 now covers additional sectors, including digital infrastructure, supply chains, healthcare, and energy, making more entities subject to cybersecurity regulations.

- Incident reporting and response: Organizations must report significant cybersecurity incidents within 24 hours, improving response times and transparency.

- Enhanced risk management requirements: Entities are required to implement risk management measures covering areas like access control, data security, and incident handling.

- Improved cross-border collaboration: NIS2 fosters increased cooperation between EU states through streamlined frameworks for information-sharing and coordinated responses to cyber threats.

By focusing on these areas, the directive aims to create a more secure and resilient digital landscape across Europe, addressing evolving cyber threats through proactive regulation and collaboration.

Read also about PSD3 vs. PSD2 Regulations and what they mean for the payment sector.

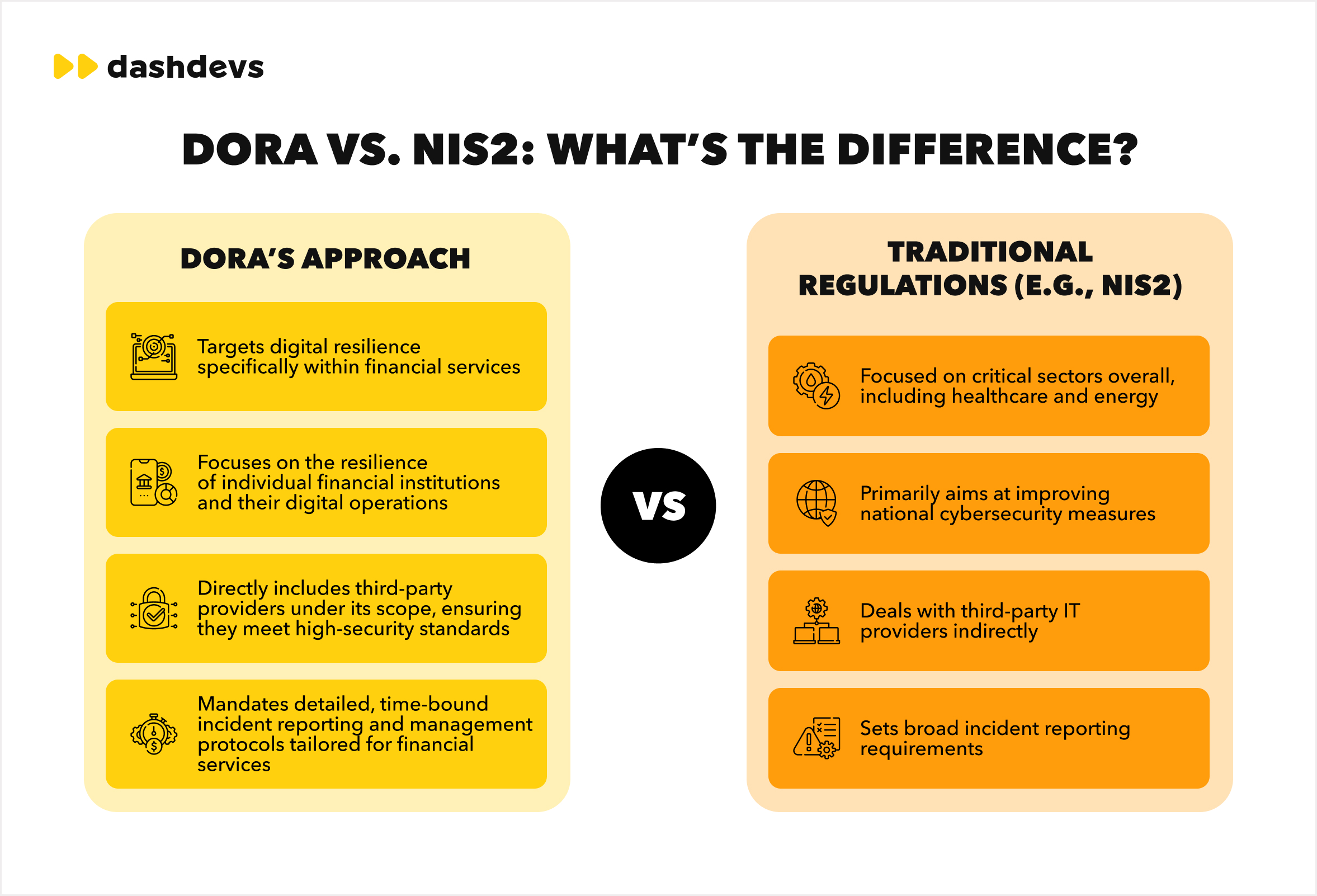

DORA vs. NIS2: A Close Comparison

Both DORA European act and NIS2 are critical to increasing cybersecurity; however, they cater to various scopes and industries.

Key Objectives of DORA Regulation

DORA aims to create a robust framework that strengthens the operational resilience of financial institutions in an increasingly digital environment. Here’s a breakdown of its core objectives and what they mean for businesses:

#1. Strengthening ICT Risk Management

ICT systems are central to financial services, but they also pose substantial risks. The DORA regulation summary requires financial institutions to adopt comprehensive risk management strategies that address ICT risks, ensuring that firms are prepared to identify, assess, and mitigate any vulnerabilities in their digital infrastructure.

Policies must include:

- Identifying and evaluating ICT risks regularly.

- Implementing measures to mitigate risks, such as cybersecurity protocols.

- Monitoring risk exposure continuously to adapt to emerging threats.

This means firms will need to incorporate technology risk into their overall risk management frameworks, which may require updates to current practices.

#2. Incident Reporting

DORA regulation establishes strict requirements for the reporting of serious ICT-related incidents. Financial institutions must report these incidents within predefined timeframes, ensuring regulatory authorities have real-time awareness of cyber threats and disruptions.

Incident reporting requirements:

- Report significant ICT disruptions within hours or days, depending on severity.

- Document and explain the root cause, impact, and steps taken to resolve the issue.

- Share information with authorities to help prevent systemic risks.

This reporting standard promotes transparency and enables regulatory bodies to respond to potential widespread threats.

#3. Digital Operational Resilience Testing

Under DORA regulation, continuous testing of ICT systems is mandatory. Financial institutions will be required to simulate different scenarios to assess their ability to withstand disruptions, including cyberattacks and large-scale system failures.

Testing includes:

- Penetration testing to simulate real-world cyberattacks.

- Stress testing to evaluate how systems handle extreme operational stress.

- Regular review and updating of testing protocols to align with evolving threats.

These resilience tests ensure that firms are continuously prepared for emerging digital risks.

| Test Type | Objective |

| Penetration Testing (TLPT) | Simulate attacks to identify and fix vulnerabilities. |

| Stress Testing | Assess resilience to large-scale disruptions and extreme events. |

| Incident Simulation | Test response protocols for handling critical incidents. |

#4. Third-Party Risk Management

As financial institutions become more reliant on third-party technology providers (cloud services, data management systems, payment processors), DORA regulation focuses heavily on managing these external risks. Institutions are required to have strict oversight over third-party providers to ensure they meet operational resilience standards.

Requirements for third-party risk management:

- Conduct regular risk assessments of all critical third-party providers.

- Establish detailed contracts that define resilience responsibilities.

- Perform audits and ongoing monitoring of third-party services.

This means financial firms must ensure their external partners comply with the same resilience standards as the financial institution itself.

I suggest reading an article on regulations in the MENA region for insight into how fintech regulations can vary depending on different authorities and countries.

#5. Coordinated Oversight

The DORA regulation summary introduces coordinated supervision of important outside service providers, therefore improving the function of regulatory bodies. Direct supervision of these providers will be under the authority of regulatory agencies, therefore ensuring that their offerings fit the strict criteria of the financial industry.

Important features of supervision:

- Critical ICT service providers will be immediately under supervision by authorities.

- By means of audits, inspections, and evaluations, authorities will guarantee compliance.

- Constant observation will help to avoid systematic hazards connected to outside vendors.

To prevent fines or disruptions, financial institutions have to keep close contact with their service suppliers and guarantee that they satisfy all legal criteria.

By concentrating on these five goals, DORA requirements offer a complete structure to improve the digital resilience of the financial industry, thereby assuring that institutions are more suited to manage the complicated risks connected with digital operations.

DORA regulatory act covers a broad spectrum of financial organizations and associated services. It is meant to establish a consistent operational resilience level all over the financial system. Although the DORA regulation summary affects different sized and varied enterprises, all will have fresh obligations to satisfy digital resilience criteria. Let us investigate the affected parties and how the control will influence their activities.

Financial Entities Covered by DORA: Who and How

DORA certification guarantees you are acting in every conceivable way to protect your operations from vulnerabilities. This table provides a picture of how various areas of the financial sector are affected and indicates who needs to do what.

| Sector | Examples | How They Are Impacted |

| Banks and Credit Institutions | Retail banks, investment banks, savings institutions | Must adopt rigorous ICT risk management strategies. |

| Insurance Companies | Life insurance, health insurance, property & casualty insurers | Required to improve digital operational resilience. |

| Investment Firms | Asset managers, broker-dealers, investment advisors | Must ensure robust protection against cyber threats. |

| Payment Service Providers | Payment processors, electronic money institutions | Required to secure their digital transaction infrastructure. |

| Crypto Asset Service Providers | Cryptocurrency exchanges, custodians, wallet providers | Subject to rigorous security standards for protecting assets. |

| ICT Third-Party Providers | Cloud service providers, data centers, software companies | Must meet stringent security standards. |

How External Fintech Partners Can Assist With DORA Regulation Compliance

External providers specialize in developing software solutions that meet DORA requirements by implementing best practices in risk management, incident reporting, testing, and third-party oversight. Here’s how providers like our company typically approach this process:

#1 Review Your ICT Risk Management

Fintech software development companies begin by conducting a comprehensive review of your existing ICT risk management policies. This step is crucial to identifying any weaknesses in your security protocols. By leveraging their expertise, they can uncover vulnerabilities that may not be evident to your in-house team. For example, when working with a mid-sized investment firm, DashDevs identified significant flaws in their third-party service provider management.

To effectively evaluate ICT risk management, software development companies:

- Conduct thorough assessments of your current systems and procedures.

- Utilize cybersecurity expertise to pinpoint vulnerabilities.

- Document any identified bottlenecks and collaborate on strategies to address them proactively.

You might also be interested in how regtech solutions for banks are connected with financial regulations.

#2 Set Incident Reporting Channels

Establishing effective incident reporting channels is vital for compliance. Software development providers help organizations create streamlined reporting systems that comply with DORA European regulation. They focus on automating reporting processes to ensure timely communication of incidents.

For instance, we at DashDevs transformed the incident detection and reporting system for a growing fintech client by implementing automated alerts, enabling quick responses that support DORA compliance.

To establish incident reporting channels, providers usually:

- Configure automated reporting systems to promptly identify and notify relevant events.

- Ensure protocols are in place for both internal responses and external notifications to regulatory authorities.

- Regularly review and update these systems to remain aligned with changing regulatory requirements.

#3 Outfit Auditing and Frequent Testing

Waiting for a problem to surface can be dangerous, particularly in relation to digital resilience. At DashDevs, we counsel every customer to make consistent ICT system test investments. This proactive strategy can help you find and fix vulnerabilities before they become major causes of concern.

Staying ahead of possible failures through consistent audits and tests is the secret, not waiting for a tragedy to hit.

Providers typically implement:

- Scheduled system audits and penetration tests to identify weaknesses.

- Engagement with external cybersecurity firms for diverse perspectives on vulnerabilities.

- Timely remediation of identified flaws to prevent more significant issues.

#4 Track and Oversee Third-Party Service Providers

Controlling outside risk is a fundamental component of Digital Operational Resilience Act compliance. Although many financial institutions depend on outside service providers, this might create vulnerabilities if those providers fail to meet strict security and resilience criteria.

At DashDevs, we collaborated with a bank that encountered challenges with their cloud provider. This situation highlighted the risks of insufficient third-party monitoring, which can lead to significant security vulnerabilities. To address this, we implemented a comprehensive monitoring and auditing plan for their suppliers, ensuring that all services complied with essential security and resilience standards, thereby enhancing overall operational compliance.

Recommended key actions to monitor external vendors include:

- Continuous assessment of the security and performance of third-party providers.

- Clearly defined resilience and risk management expectations in vendor contracts.

- Regular reviews to ensure compliance and transparency.

When you partner with DashDevs, compliance is built into every step of our development process. We integrate DORA Europe standards from the outset, ensuring your software meets today’s regulations and can adapt to future changes. Here’s how we support your compliance needs:

- Embedded compliance standards: DORA and other regulations are woven into our development approach from day one.

- Expert regulatory insight: Our team stays informed on the latest standards, helping you stay ahead.

- Resilient, scalable systems: We design adaptable, secure architectures ready for evolving compliance.

DashDevs is dedicated to creating software that’s not only compliant but resilient, supporting your business as it grows confidently in a regulated digital world.

Discover how our consulting services can support you in building robust DORA compliant fintech software.

Final Take

DORA is a game-changer for Europe’s financial sector, setting a higher bar for resilience, transparency, and cybersecurity. For fintech, banks, and financial service providers, DORA EU isn’t just about ticking boxes—it’s about future-proofing your business against the unexpected.

DashDevs is here to help you navigate these regulations with ease. Our team is well-versed in DORA and other compliance frameworks, ensuring your systems are not only secure but also fully compliant. Secure your future with DashDevs and face regulatory demands confidently.