Embedded Finance Vs. Traditional Distribution of Financial Services

According to multiple industry reports, embedded finance is no longer a niche innovation. The global embedded finance market is projected to exceed $7 trillion in transaction value by 2030, with adoption accelerating across e-commerce, SaaS, and B2B platforms. More than 60% of digital-native companies already embed at least one financial service—payments, lending, or accounts—directly into their products, and that number continues to rise.

DashDevs has supported large-scale embedded finance platforms across this evolution—from regulated open banking infrastructure such as Tarabut Gateway to embedded lending platforms like Twisto—helping product companies operationalize payments, accounts, and credit at scale.

Today, digital products don’t just integrate with financial services—they become the point of financial interaction. Payments, lending, and credit now live directly inside e-commerce platforms, SaaS tools, and marketplaces, delivered exactly where users need them. This shift—known as embedded finance—has moved decisively from experimentation to core infrastructure.

Embedded finance isn’t replacing banks. Instead, it’s redefining how financial products are distributed, monetized, and experienced. For businesses, it unlocks new revenue streams, higher conversion, and deeper customer engagement. For financial institutions, it reshapes the role of distribution, partnerships, and technology ownership—shifting value from channels to platforms.

This article explores how embedded finance compares to traditional financial distribution—and what this structural shift means for both fintech and non-fintech businesses building products in a finance-native digital world.

Key Takeaways

- Embedded finance has become a core capability, not an optional add-on for digital platforms

- Distribution is shifting from banks to products, with financial services delivered in context

- Technology platforms are emerging as financial gateways, powered by APIs and AI-driven decisioning

- Banks are evolving into infrastructure and risk partners, rather than primary customer interfaces

- The right embedded strategy balances growth, compliance, and control

The Role of Embedded Finance Adoption

It’s safe to claim that the world is becoming increasingly digitalized. Respectively, businesses have to keep up with the tempo by adopting innovations that are not in the last place.

We can define embedded finance technology’s role in fintech and non-fintech sectors as follows:

- Embedded finance in fintech: A natural modification of traditional finance processes and an opportunity to ensure cross-collaboration with industries that used not to get involved with finance at all.

- Embedded finance in non-fintech: A simplification of finance-related processes, such as receiving payments for goods. Besides, it’s an additional opportunity to provide an extra service and ensure a higher-tier user experience for customers.

Embedded finance redefines how industries interact with and benefit from financial services. It provides individuals with a seamless buyer or user experience that cannot be interfered with by the constraints of traditional financial services. Embedded finance is one of the major trends of the year 2024 in the fintech industry. It represents a future where finance is not just a standalone sector of the economy but an integrated component of diverse digital ecosystems.

If you are curious about other key trends in banking to follow, check out another blog post by DashDevs.

What Is Embedded Finance and How It Differs from Traditional Distribution?

Embedded Finance vs Traditional Distribution

| Dimension | Traditional Financial Distribution | Embedded Finance |

| Customer entry point | Bank branches, banking apps, lender websites | Non-financial platforms (e-commerce, SaaS, marketplaces) |

| User journey | Separate, multi-step onboarding | Seamless, in-context experience |

| Credit decisioning | Manual or semi-automated, slow | Real-time, AI-driven credit decisioning |

| Data sources | Credit bureaus, internal history | Transactional, behavioral, alternative data |

| Approval speed | Hours to days | Seconds to minutes |

| Customer acquisition cost | High | Lower (built into existing platforms) |

| Access to thin-file users | Limited | Significantly higher |

| Risk assessment | Static scorecards | Adaptive AI credit scoring |

| Personalization | Minimal | High (contextual, behavior-based) |

| Revenue model | Interest, fees | Embedded fees, revenue sharing, lifecycle value |

| Scalability | Slow, license-heavy | High, API-driven |

| Role of AI | Optional, often experimental | Core to credit risk management and approval |

| Competitive advantage | Brand & branch network | Data, speed, and user experience |

Embedded finance is the integration of financial services into non-financial products, platforms, and business ecosystems.

Embedded finance offers financial products outside of traditional financial service providers like banks or credit unions. It brings an exciting opportunity for customers to exploit all the financial capabilities, even when they request services from non-fintech firms.

On the contrary, traditional financial service distribution is the provision of financial services under the supervision of a license holder, i.e., a conventional financial institution.

Without further ado, you can discover more about how traditional banking and embedded finance approaches correlate and what are the roles involved from the infographics below:

Source: PwC

Embedded finance vs. banking as a service is not exactly the rivalry. After all, 70% of executives in fintech claim that embedded capabilities are either core or complementary to their businesses.

How Do Embedded Financial Services Work?

At its core, embedded finance means delivering financial services directly inside a non-financial product—without forcing users to leave the platform or switch contexts. While the experience feels seamless to the end user, behind the scenes it relies on a carefully orchestrated technical and operational flow.

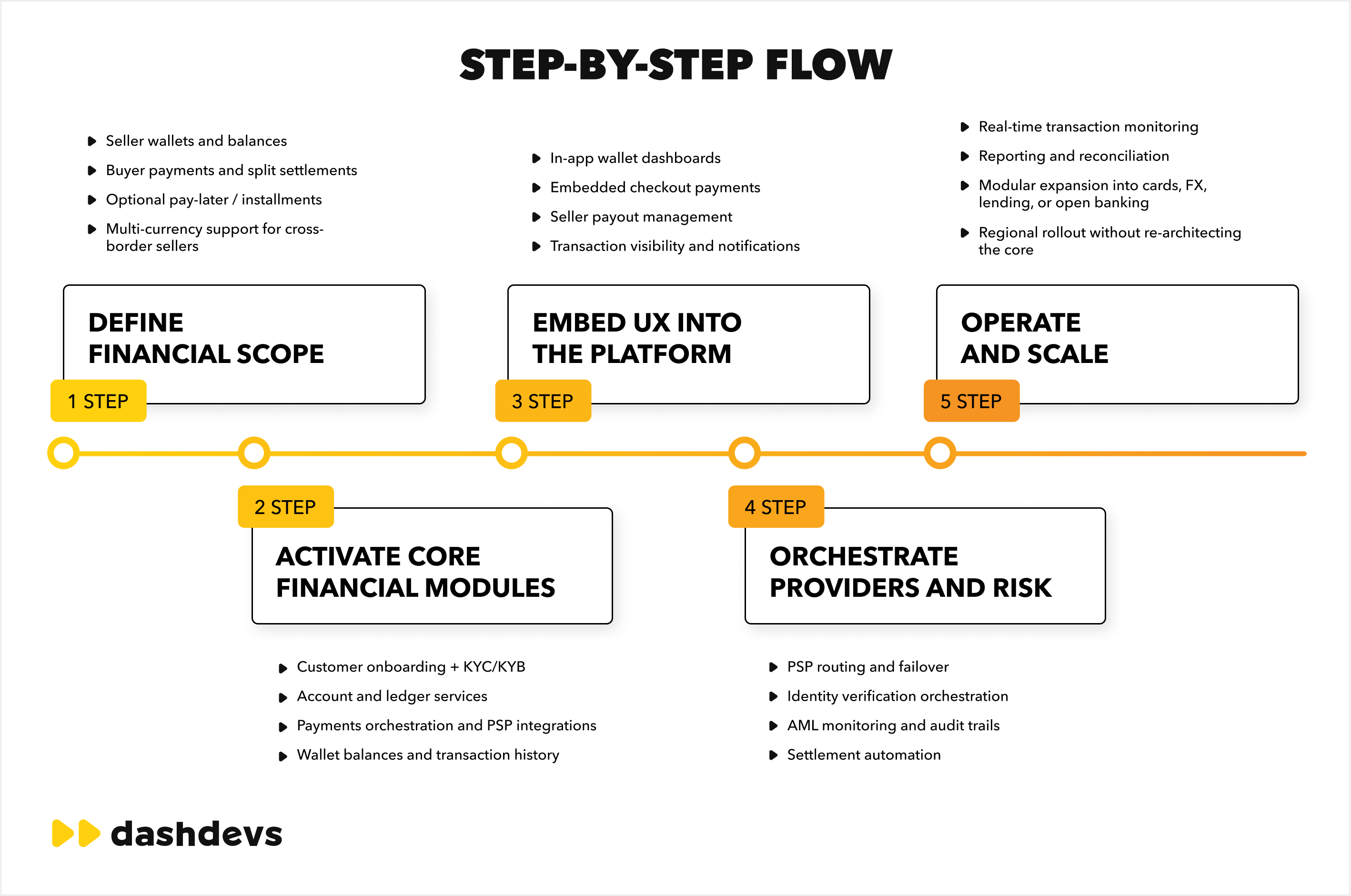

In practice, implementing embedded financial services usually follows several interconnected steps.

1. API integration as the foundation

Everything starts with APIs. A licensed financial provider exposes APIs for payments, accounts, lending, or compliance services. These APIs are integrated into the host platform, enabling it to trigger financial actions programmatically.

This stage includes authentication, secure API calls, webhooks, and error handling. The quality of this integration largely determines how scalable, resilient, and future-proof the embedded finance solution will be.

In real-world projects we’ve worked on, this layer often evolves into an orchestration component that connects multiple providers at once—payments, lending, identity, and risk—rather than relying on a single API endpoint.

2. User experience built around the core product

Embedded finance succeeds or fails at the UX level. Even when financial providers offer ready-made UI components, platforms usually need to adapt or redesign them to match their own product logic.

This may include:

- Embedded payment widgets

- Credit or installment selection inside checkout

- In-app wallets or balances

- Financing flows that feel like part of the product, not a separate financial process

In large-scale embedded lending implementations, we’ve seen platforms move away from “plug-and-play” widgets toward fully custom flows—because conversion, trust, and compliance all depend on how naturally financial actions fit into the user journey.

3. Data flow, risk logic, and compliance alignment

Once financial services are embedded, the platform becomes part of the data chain. Transaction data, user behavior, and financial signals need to flow securely between systems while remaining compliant with regulatory requirements.

This includes:

- Secure data transmission and storage

- Clear separation of responsibilities between platform and licensed provider

- Consent management and audit trails

- Alignment with AML, KYC, and data protection rules

In complex embedded finance setups, platforms often introduce an internal risk or decisioning layer. This allows them to control how data is used for credit, limits, or eligibility—while still operating within the boundaries of the licensed partner’s framework.

4. Transaction handling and lifecycle management

Embedded finance is not just about initiating transactions—it’s about managing their full lifecycle.

Payments, loans, or payouts can move through multiple states: initiated, pending, completed, failed, and reversed. Each state needs to be handled correctly, with retries, fallbacks, and clear user feedback.

In mature embedded finance systems, this logic becomes critical during peak loads or edge cases. We’ve seen platforms processing thousands of concurrent financial operations per second, where stability and orchestration matter far more than basic integration. Similar high-load transaction orchestration challenges were addressed in the Digital Assets Trading Platform, where wallet balances, asset settlement, and trading flows required resilient event-driven processing and real-time monitoring.

5. Monitoring, reporting, and continuous optimization

Finally, embedded finance requires constant visibility. Platforms need real-time monitoring of transaction health, error rates, and provider performance, as well as reporting for finance, compliance, and analytics teams.

This typically includes:

- Transaction and settlement monitoring

- Risk and performance dashboards

- Financial and regulatory reporting

- Alerts for failures or anomalies

Over time, this data is used not only for compliance but also to optimize pricing, limits, approval logic, and user experience—turning embedded finance into a strategic growth lever rather than a static feature.

In large embedded lending and payments projects we’ve supported under NDA, success depended not on a single provider or API, but on orchestration—connecting multiple financial services, managing risk centrally, and keeping the user experience consistent even as complexity grew.

This is where many platforms struggle when they try to handle everything in-house. Embedded finance looks simple on the surface, but scaling it reliably requires profound experience across APIs, compliance, risk, and high-load financial systems.

For companies that prefer to focus on their core product, partnering with an experienced fintech engineering team can significantly reduce time to market and long-term operational risk.

As embedded finance matures from isolated integrations into full product capabilities, many platforms face a new challenge: how to move beyond stitching together APIs toward building a scalable, compliant financial foundation without reinventing core infrastructure. While embedded finance promises speed and distribution advantages, delivery complexity often grows rapidly once platforms introduce regulated workflows, multi-provider orchestration, reporting, and lifecycle management.

This is where white-label and modular fintech platforms play an increasingly important role. Instead of assembling every financial capability from scratch, teams can leverage pre-built financial building blocks — accounts, payments, onboarding, compliance, orchestration — and embed them directly into their product experience.

Building an Embedded Finance Layer for a Marketplace with an Embedded Financial Product

Consider a marketplace platform that wants to embed financial services directly into its seller and buyer experience — enabling instant payments, split payouts, seller wallets, optional pay-later financing, and automated reconciliation, all without redirecting users to external financial providers.

Using an embedded finance backbone, the platform can progressively activate financial capabilities while keeping control over UX, data flows, and provider selection.

Fintech Core: A Modular Platform for Embedded Financial Products

Fintech Core extends embedded finance beyond individual features into a composable platform approach. Rather than embedding isolated payment flows or lending widgets, product teams can embed complete financial capabilities — including customer onboarding, KYC/KYB, account management, ledger-based balances, card issuing, payment orchestration, FX and treasury logic, open banking connectivity, and operational tooling — as modular services. Each module is API-first and can be selectively activated based on product scope, regulatory requirements, and market expansion strategy. This allows platforms to accelerate time-to-market while avoiding tight coupling to single vendors or rigid banking cores.

From an embedded finance perspective, Fintech Core functions as the orchestration layer between licensed providers, infrastructure partners, and user-facing products. It centralizes financial logic, compliance workflows, transaction lifecycle management, and reporting — enabling platforms to embed financial services consistently across user journeys while maintaining operational control and observability. As platforms scale into higher transaction volumes, multi-region expansion, or more complex regulatory environments, this modular foundation reduces integration risk, simplifies change management, and supports continuous product evolution without disruptive replatforming.

4 Examples of Embedded Finance Products

Understanding the essence of embedded finance is important. Yet, having an appropriate insight into its real-life implementation is even more significant. Let’s review four major examples of embedded finance services and products, so it’s clear how you, as a C-level executive, can apply the technology:

#1 Embedded Banking

Embedded banking implies providing a non-financial institution with a branded checking bank account, enabling it to hold funds, make payments, track expenses, and withdraw earnings seamlessly. The concept that powers up the embedded capabilities here is called open banking. The best thing about it for businesses is that all the functionalities are accessible via their primary platforms and their work interfaces.

Use case: Shopify’s “Shopify Balance” for merchants. Shopify, a predominant e-commerce platform, offers a dedicated business account directly within the Shopify ecosystem, streamlining cash flow tracking and expense management. This embedded financial solution eliminates the barriers of traditional banking.

You can familiarize yourself with the general overview of how embedded banking works from the below infographics:

#2 Embedded Payments

Embedded payments are transaction functionalities natively integrated into applications, eliminating the need for third-party payment gateways or external processes. This means that end users of business platforms can make payments, preload funds, and manage their finances without leaving the primary platform or app they’re using.

Use case: Stripe company provides financial infrastructure for businesses worldwide and empowers them to process transactions within non-financial platforms. While embedded banking as one of the embedded finance examples, is about accessing core banking services, like loans or savings, embedded payments are just about enabling one to send and receive money or pay for something.

One of Stripe’s prominent clients is the global e-commerce company Shopify.

#3 Embedded Lending

Embedded lending is the integration of lending services within platforms not traditionally associated with loans or credit. Users can send a request for financial credit seamlessly as they shop, engage with services, or manage their activities on these platforms.

Use case: Klarna’s “buy now, pay later” embedded lending proposition. When integrated into online storefronts, Klarna presents shoppers with instant, flexible payment options at checkout. Customers can opt to pay for their items immediately, defer the payment for a short period, or break down their payments into smaller installments over time.

#4 Embedded Insurance

Embedded insurance is the integration of insurance services within platforms that are associated with activities or purchases that carry risks. In this case, embedded insurance can offer tailored insurance policies based on the specific details of the product or service, by a customer’s request.

Use case: Tesla’s car insurance for vehicle owners. Tesla’s embedded insurance product leverages the vast amount of data cars generate and provides competitive rates, especially for drivers who utilize Tesla’s autopilot and safety features. Tesla’s knowledge of its vehicles, combined with real-time data, can result in better risk assessment and, subsequently, more accurate insurance pricing.

For additional insight into the role of merchants in fintech and how they revolutionize traditional services, read another our blog post.

The Benefits of Adopting Embedded Finance

Naturally, the first thing to look out for is what advantages a technology can bring to your business. Here’s the list of major benefits the adoption of embedded financing has to offer:

- Enhanced customer experience: The best thing about embedded finance is that it streamlines financial processes, offering intuitive, one-stop solutions that increase user satisfaction and retention.

- New revenue streams: The technology diversifies business models. It enables the monetization of financial services, driving additional income for financial and non-financial companies.

- Increased engagement: Incorporating the vast embedded finance capabilities keeps users within the platform longer, increasing customer retention and boosting interaction and transaction frequency.

- Operational efficiency: Integrating embedded finance solutions reduces the need for traditional intermediaries, which minimizes added costs and expedites transactions.

- Data insights: Embedded analytics, as one of the offered embedded finance capabilities, helps to gather user spending and behavior data. It drives business strategies and fosters personalized offerings.

Even though embedded finance is regarded as a nice-to-have feature by many, we can assume that it will become a must-have functionality for any non-fintech platform shortly.

The Limitations and Challenges of Adopting Embedded Finance

As with any technology, there are some pitfalls you should be aware of when considering the adoption of embedded fintech capabilities:

- Security concerns: Handling financial transactions on your side implies that you will need to reflect upon security measures to prevent fraud and breaches.

- Integration complexity: Embedding finance might demand tech restructuring, which can be both time and resource-consuming in some cases, depending on the complexity of the intended functionality.

- Steep learning curve: Non-finance companies may face challenges in understanding and navigating the financial landscape effectively. It may include challenges with the lack of financial literacy, building customer trust, integrating new operational processes, and more.

- Compliance & Legal Challenges: Adopting embedded finance may bring about additional costs related to ensuring data privacy, adhering to stringent financial regulations, and obtaining the necessary licenses. Achieving compliance can be complex, and it often requires expert knowledge, potentially leading to increased operational expenses.

However, you shouldn’t be frustrated about embedded finance opportunities since businesses can only evolve when facing and overcoming challenges. Besides, providers of fintech software development services can always give you a helping hand at your request.

You may discover more about the integration of Tap to Pay, i.e., technology for easy payment processing into non-banking digital products from another or blog post.

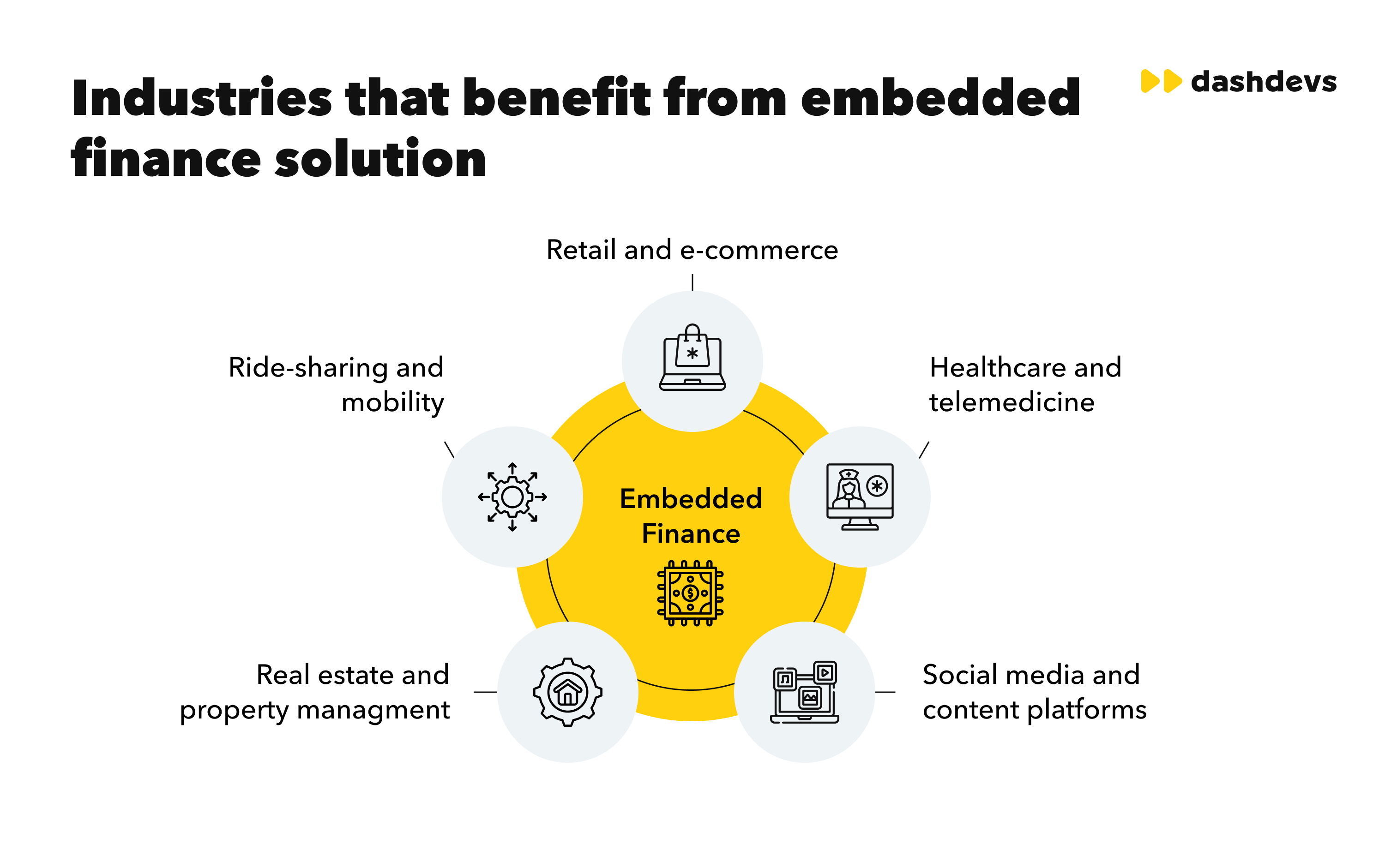

5 Industries That Benefit from Embedded Finance the Most

While some business domains may not be impacted by embedded finance, others can reap the most advantage of adopting this technology. Examples include the following industries:

Retail and E-commerce

In the vast landscape of retail and e-commerce, having a smooth flow of financial transactions is absolutely critical for business growth. Embedded finance facilitates this by providing:

- Integrated payments: Allowing for quicker and more flexible payment methods directly on the platform.

- Point-of-Sale lending: Offering instant loans at checkout can enhance customers’ purchasing power.

- Tailored marketing: Leveraging financial data for personalized marketing strategies.

As a result, e-commerce platforms can provide a seamless shopping experience, leading to higher customer satisfaction and increased sales.

Ride-Sharing and Mobility

The mobility sector thrives on convenience and instant solutions. Embedded finance adds to this by:

- Immediate earnings access: Drivers can instantly withdraw their earnings, boosting their liquidity.

- Integrated payments: Riders have various embedded payment options, enhancing their ride experience.

- Customer loyalty programs: Directly integrating rewards to promote frequent usage.

These integrations ensure both drivers and riders enjoy smoother, more efficient transactions and financial benefits.

Real Estate and Property Management

For even a non-financial industry as vast as real estate, making it easy to handle financial aspects can matter a lot. In this domain, embedded finance drives:

- Easy rent transfers: Tenants can pay rent or charges through integrated platforms, ensuring timely payments.

- Property investment: Potential buyers can access instant loans or mortgage options right from property listing sites.

- Operational efficiency: Embedded technologies can automate invoicing and reconciliation tasks.

By integrating these solutions, property management becomes more efficient and user-friendly for both landlords and tenants.

Healthcare and Telemedicine

The healthcare industry is increasingly moving towards digital platforms. Embedded finance aid providers and patents by offering:

- Seamless payments: Patients can make direct payments after a teleconsultation, simplifying the billing process.

- Flexible financing: Providing patients with payment plans or instant loans for treatments.

- Insurance integration: Direct processing of insurance claims and approved payments.

Through these integrations, patients experience a hassle-free healthcare journey, and healthcare providers see improved revenue cycle management.

Social Media and Content Platforms

As the digital content world expands, so does the need for integrated financial solutions. Here is the embedded finance offering for social media:

- Direct monetization: Content creators can receive payments or tips directly on the platform.

- Subscription management: Users can easily manage and renew subscriptions or access premium content.

- Ad revenue: Streamlined processes for advertisers to fund campaigns or pay for ad slots.

By weaving financial processes directly into the platform, content creators, advertisers, and users all experience enhanced financial convenience and growth opportunities.

Since embedded finance is spreading across various domains, it’s likely that we’ll see its inclusion in business environments in many other industries.

When Embedded Finance Is Not the Right Choice

Embedded finance is powerful—but it’s not universal. While many platforms benefit from embedding financial services, there are scenarios where it can introduce more complexity, risk, or cost than value. Understanding these limits is essential before committing to an embedded finance strategy.

1. When financial services are not core to the user journey

If payments, credit, or wallets are not tightly connected to how users interact with your product, embedding finance can feel forced. In these cases, financial features may see low adoption while still adding operational and regulatory overhead.

2. When regulatory ownership is underestimated

Even when working with embedded finance providers or BaaS platforms, responsibility does not fully disappear. Compliance, customer communication, and reputational risk often remain shared. Businesses without internal compliance readiness may struggle to scale safely.

3. When margins don’t justify complexity

Embedded finance works best at scale. For low-volume platforms, the cost of integration, licensing, monitoring, and ongoing maintenance can outweigh potential revenue gains—especially for lending or embedded banking use cases.

4. When speed-to-market matters more than differentiation

In early-stage products, using external payment links or third-party checkout flows may be faster and safer. Embedded financial services are most effective once a platform has proven traction and clear monetization pathways.

5. When control over data and UX is critical

Some embedded finance platforms limit customization, data ownership, or pricing flexibility. For businesses that require full control over financial logic or customer experience, a deeper infrastructure approach may be more appropriate.

Bottom line:

Embedded finance is a strategic decision—not a default one. The strongest implementations align tightly with user value, platform scale, and long-term business goals.

Embedded Finance’s Impact on FinTech

At the end of the day, it’s vital not to have either an extremely negative or overly positive attitude towards embedded finance for fintech businesses. Here are the four main challenges and opportunities to keep in mind when considering to develop your fintech software:

- Modified relationships with consumers: Adoption of embedded finance capabilities deepens trust, fosters convenience, and personalizes the experience of end users of financial services.

- New revenue streams: The technology can help diversify income sources by integrating profitable financial services into non-financial platforms. Revenue options that can be explored here include transaction-based and subscription-based models, as well as forming partnerships with financial service providers.

- More partnerships: Embedded finance, by its nature, focuses on fostering collaborations between fintech, non-fintech, tech firms, and traditional banks. It should result in the emergence of comprehensive offerings.

- Greater competition: As with most game-changing technologies, embedded finance intensifies rivalry, pushing firms to innovate, adapt, and offer unique value propositions.

Anyway, embedded finance has already played a role in reshaping the fintech domain, and its influence definitely won’t wear out in the near future.

Final Take

Embedded finance is no longer a differentiator—it’s becoming a baseline expectation. For non-financial platforms, it unlocks new revenue, higher engagement, and stronger customer retention. For traditional financial providers, it reshapes distribution and opens new partnership models. The real advantage lies not in offering embedded finance, but in implementing it strategically and responsibly.

DashDevs helps businesses design and scale embedded finance platforms—from open banking infrastructure to embedded lending platforms and high-load wallet ecosystems in digital asset platforms.