The Essential Fintech API Integrations for a Scalable and Compliant Financial Platform

The financial industry is no longer built on legacy systems—it’s powered by fintech APIs. From instant payments and digital banking to AI-driven lending and fraud prevention, seamless API integration is what separates innovators from outdated systems. Want to build a future-proof fintech product?

In this article, we explore the essential fintech API integrations, including:

- Identity & compliance APIs

- Banking & payment APIs

- Cross-border & alternative payments

- Lending & investment APIs

What Is an API in Fintech?

A fintech API is a technology that enables financial applications to communicate and exchange data securely.

Fintech companies can integrate banking, payments, compliance, and lending functionalities without having to construct them from scratch.

APIs have transformed the financial ecosystem by enabling fintech startups to leverage banking infrastructure, automate financial processes, and enhance customer experiences. But how exactly do these APIs function in fintech?

BUILD A SECURE & SCALABLE FINTECH PLATFORM WITH DASHDEVS!

Seamless API integration is the key to faster onboarding, secure transactions, and regulatory compliance in fintech.

How Do Fintech APIs Work?

The image above outlines the three key steps in how APIs facilitate fintech innovation:

- Fintech companies pay for BaaS access: Instead of building banking systems, fintech firms use BaaS APIs to integrate services like account management, lending, and payments quickly.

- Banks provide BaaS APIs to fintechs: Traditional banks offer regulated financial services via APIs, enabling secure fintech collaboration while ensuring compliance.

- APIs power fintech innovation: Fintechs use APIs to build neobanks, wallets, lending platforms, and more—cutting development time, costs, and boosting scalability.

However, not all APIs serve the same purpose. That’s why, to build a scalable and compliant financial platform, businesses must strategically integrate the right combination of APIs.

In the next section, we’ll explore the different types of Fintech APIs, their key functions, and how they empower financial platforms to deliver seamless and innovative services.

#1 Identity Verification & Compliance Integrations

In the financial industry, trust is everything. When fintech companies bring on new customers, check out business partners, or make sure they follow anti-money laundering laws, they need to make sure they have strong identity verification and compliance APIs in place to lower risks, stop fraud, and meet regulatory requirements.

Without custom fintech integrations, financial platforms face high fraud risks, regulatory penalties, and operational inefficiencies—all of which can hinder growth and customer trust. That’s why compliance-driven APIs are the first layer of defense in any scalable fintech platform.

KYC (Know Your Customer) APIs: Automating Identity Verification

KYC (Know Your Customer) is a regulatory requirement that mandates financial institutions to verify the identity of their users before granting access to financial services. The goal is to prevent identity fraud, money laundering, and terrorist financing.

Traditionally, KYC was a manual process requiring users to submit physical documents, leading to slow onboarding, human errors, and high operational expenses. Today, KYC APIs automate this process, enabling real-time identity verification with minimal friction.

Key features of KYC APIs:

- Biometric verification: Face and fingerprint recognition to match users with official documents.

- Document scanning: AI-driven OCR (Optical Character Recognition) extracts data from passports, driver’s licenses, and IDs.

- Database cross-checks: Matches customer details against government databases, watchlists, and credit bureaus.

Our use case: Veriff integration for our project

One of DashDevs’ projects, integrated Veriff’s KYC API to streamline customer onboarding while reducing fraud risks. By leveraging AI-powered document verification and biometric checks, the client achieved:

- 90% reduction in onboarding time (from 24 hours to just a few minutes).

- 50% decrease in fraudulent account registrations, significantly enhancing platform security.

- Fully automated KYC workflow, cutting operational costs and increasing compliance efficiency.

Selecting the appropriate KYC API can significantly impact fintech startups. The faster and smoother the onboarding experience, the higher the customer conversion rate. But security should never be compromised for speed.

Read more about KYC and fraud detection in fintech apps in another blog post by DashDevs.

KYB (Know Your Business) APIs: Verifying Business Entities

While KYC services focus on individual customers, Know Your Business (KYB) ensures that businesses using financial services are legitimate and compliant with regulations. This is critical for B2B fintechs, neobanks, and marketplaces that deal with business transactions, corporate accounts, and supplier payments.

A KYB API automates business verification, eliminating manual paperwork while ensuring real-time risk assessment.

Key functions of KYB APIs:

- Business registration checks: Verifies company registration details across global corporate registries.

- UBO (Ultimate Beneficial Owner) identification: Identifies the true owners behind a business to prevent fraud.

- Compliance screening: Screens businesses against global sanctions lists and adverse media reports.

Use case:

- Neobanks: Need KYB APIs to verify corporate clients before issuing business accounts.

- B2B payment platforms: Ensure suppliers and vendors are legitimate before processing high-value transactions.

- Crypto exchanges: Must verify institutional investors to comply with financial regulations.

And here is a comparison of KYC and KYB in detail:

KYB is not just a regulatory requirement—it’s a business necessity. A single fraudulent business transaction can cause irreversible financial and reputational damage.

AML (Anti-Money Laundering) Screening APIs: Stopping Financial Crimes Before They Happen

AML (Anti-Money Laundering) regulations require fintechs to monitor, detect, and report suspicious financial activities. AML APIs integrate real-time transaction monitoring and risk scoring to identify illicit money flows before they reach criminal organizations.

Key features of AML APIs:

- Real-time transaction monitoring: Analyzes financial transactions and flags anomalies.

- Risk-based scoring: Assigns risk levels based on transaction patterns and customer behavior.

- Global watchlist screening: Checks users and businesses against sanction lists (FATF, OFAC, Interpol).

Now, let’s consider the difference between KYC and AML APIs:

Our use case: Dozens’ AML integration

DashDevs implemented an AML screening API for Dozens, which automated fraud detection and regulatory reporting. This resulted in:

- 30% decrease in fraudulent transactions through AI-driven risk analysis.

- Automated compliance reporting, reducing manual workload for compliance teams.

- Real-time alerts for suspicious activity, enabling proactive fraud prevention.

A strong AML strategy isn’t just about compliance—it’s about protecting your fintech platform from being exploited for financial crimes.

Fraud Prevention APIs: The Last Line of Defense Against Financial Fraud

Fintech platforms handling high transaction volumes or cross-border payments are prime targets for fraud, account takeovers, and identity theft. A fraud prevention API adds an extra layer of security by detecting and blocking fraudulent transactions before they occur.

Key features of fraud prevention APIs

- AI-driven anomaly detection: Identifies unusual spending patterns using machine learning.

- Behavioral biometrics: Analyzes how users type, swipe, or navigate an app to detect fraud.

- Geolocation tracking: Flags transactions from suspicious or high-risk locations.

Use cases:

- Neobanks & digital wallets: To prevent identity theft and unauthorized account access.

- E-commerce & payments: To stop payment fraud and chargeback abuse.

- Crypto & Forex platforms: To detect suspicious trading activity and protect against cyberattacks.

Fraud is constantly evolving—so should your security measures. A fintech without a real-time fraud detection API is an easy target for criminals.

#2 Banking & Payment Infrastructure Integrations

A strong banking and payment infrastructure is the foundation of any successful fintech platform, ensuring secure, compliant, and seamless financial transactions. From managing customer accounts to processing payments and issuing cards, Banking as a Service (BaaS) and payment APIs empower fintechs to offer fully functional banking solutions without the need for extensive in-house development.

Core Banking / BaaS (Banking as a Service) APIs

Building a fully functional banking system from scratch is expensive, time-consuming, and requires regulatory approval. Core Banking APIs, often provided through Banking as a Service (BaaS) platforms like ClearBank, Solarisbank, and Railsr, allow fintechs to integrate essential banking functionalities without becoming a licensed bank. These APIs power account creation, transaction processing, interest calculations, and regulatory compliance, helping fintechs scale efficiently.

Traditional banking infrastructure is rigid and slow to adapt, but BaaS APIs offer fintech companies agility, allowing them to launch banking services in weeks instead of years.

Key features of core banking/BaaS APIs:

- Account creation: Enables instant digital account opening and management.

- Ledger management: Tracks balances, transactions, and interest calculations in real-time.

- Regulatory reporting: Automates compliance reporting to meet financial regulations.

- Multi-currency support: Manages transactions across different currencies for global scalability.

Our use case:

One of DashDevs’ projects, MuchBetter, integrated ClearBank’s BaaS API to power its digital wallet and neobanking services. The result was a highly scalable, real-time banking infrastructure that provided:

- Instant transactions with real-time account funding and transfers.

- Seamless multi-currency support for global transactions.

- Full regulatory compliance without requiring a banking license.

BaaS APIs are a transformative tool for fintechs seeking to expand. They remove the barriers to entry in banking, allowing companies to focus on customer experience instead of infrastructure.

Learn more about the top 10 core banking software providers.

Card Issuing & Management APIs

The demand for virtual and physical payment cards has skyrocketed, driven by neobanks, digital wallets, and corporate expense solutions. Card issuing APIs allow fintechs to generate and manage payment cards in real time, offering custom spending controls, security features, and transaction insights.

Key features of card issuing & management APIs:

- Custom spending limits: Enables predefined limits for personal, business, or employee use.

- Dynamic CVV: Generates a new CVV for each transaction, enhancing security.

- Real-time transaction insights: Provides instant notifications and spending analytics.

- Virtual & physical card issuance: Supports one-time-use virtual cards and physical contactless payments.

Card issuing APIs are the backbone of modern payments. They offer fintechs complete control over card programs, allowing them to customize security and spending features in ways traditional banks cannot.

Payment Processing APIs

Fintech platforms rely on frictionless, fast, and secure payment processing to ensure smooth user experiences and high conversion rates. Payment processing APIs support card transactions, bank transfers, and alternative payment methods (APMs) while offering security features like tokenization, instant settlements, and fraud detection.

Without reliable payment APIs, fintechs risk slow transaction speeds, high chargeback rates, and compliance issues that can hurt business growth and customer trust.

Key features of payment processing APIs:

- Tokenization: Secures card details by replacing them with encrypted tokens.

- Instant settlements: Enables real-time payment confirmation and fund availability.

- Cross-border processing: Supports multiple currencies and international payments.

- Multi-payment method support: Accepts credit/debit cards, bank transfers, and digital wallets.

Our use case:

MuchBetter partnered with IOL Pay to integrate a high-speed payment processing API for global transactions. The fintech integration delivered:

- 99.9% transaction success rate, minimizing failed payments.

- Cross-border payment support, enabling international expansion.

- Faster settlements, reducing fund processing times from days to minutes.

A great payment processing API doesn’t just move money—it ensures security, compliance, and a seamless user experience. For fintechs, this can mean the difference between success and failure.

Open Banking & Embedded Finance APIs

The open banking revolution has changed the way fintechs interact with financial data. Open banking APIs allow fintech companies to access user banking information securely, enabling services like account aggregation, financial insights, and instant account-to-account payments.

At the same time, Embedded Finance APIs allow non-financial companies to integrate banking features into their platforms, enabling services like in-app lending, payments, and insurance.

Key features of open banking & embedded finance APIs:

- Secure data sharing: Provides read/write access to user bank accounts with consent.

- Instant payments: Enables direct bank-to-bank payments without card fees.

- Enhanced user insights: Aggregates transaction data for better financial recommendations.

- Embedded financial services: Allows e-commerce, travel, and SaaS companies to integrate financial solutions into their platforms.

Our use case:

DashDevs worked with Vlorish and Tarabut to integrate Open Banking APIs, enabling fintechs to leverage real-time financial data and automate secure bank-to-bank transactions. The outcome:

- Seamless banking data aggregation, giving users full visibility of multiple accounts.

- Instant account-to-account payments, eliminating card processing fees.

- Enhanced financial analytics, allowing fintech apps to offer personalized budgeting insights.

Open Banking isn’t just about access—it’s about creating smarter, more intuitive financial experiences. Fintechs that leverage open banking APIs can build more engaging, customer-centric products.

To get deeper insights on open banking integration, read our guide.

#3 Cross-Border Finance & Alternative Payment Integrations

Expanding into international markets requires seamless foreign exchange, cross-border payments, and remittance solutions. Fintech platforms that support multi-currency transactions, real-time FX conversions, and efficient international money transfers provide a better experience for global users while reducing operational costs.

Without cross-border finance APIs, fintechs risk high foreign exchange fees, slow settlement times, and complex compliance hurdles. The right fintech integration enable businesses to offer borderless financial services, expand their customer base, and comply with international regulations effortlessly.

Foreign Exchange (FX) & Multi-Currency APIs

For fintechs operating in multiple markets, real-time foreign exchange (FX) and multi-currency support are essential to managing global transactions. FX APIs provide seamless currency conversion, competitive exchange rates, and compliance automation, allowing businesses to offer borderless financial services while reducing foreign transaction costs.

Without FX and multi-currency APIs, fintechs struggle with slow settlement times, high currency conversion fees, and inconsistent exchange rates, negatively impacting cross-border transactions.

Key features of FX & multi-currency APIs:

- Hedging tools: Protect against currency fluctuations with automated risk management.

- Compliance automation: Ensure adherence to anti-money laundering (AML) and financial regulations.

- Multi-currency accounts: Enable users to hold, send, and receive money in different currencies.

Cross-Border Payments & Remittances APIs

Traditional cross-border payments and remittance services are slow and costly due to multiple intermediaries, high transaction fees, and regulatory complexities. Cross-border payment APIs solve these challenges by connecting fintechs to local clearing networks, automating compliance, and offering flexible payout options.

Key features of cross-border payments APIs:

- Local clearing networks: Connects to banking systems worldwide for faster settlements.

- Automated compliance: Ensures adherence to cross-border payment regulations.

- Flexible payout options: Supports transfers via bank accounts, digital wallets, and cash pickup.

Cross-border payments must be instant, secure, and low-cost. The right API integration ensures customers can send and receive money globally with minimal friction.

#4 Lending, Investment & Financial Insights Integrations

Digital finance is evolving, making lending, investing, and financial management more accessible through APIs. Lending-as-a-Service, WealthTech, and Income Verification APIs help fintech streamline loans, expand investment access, and enhance decision-making. Without them, fintech risks slow processes, limited options, and higher fraud risks.

Lending as a Service APIs: Enabling Digital Credit & BNPL

The rise of Buy Now, Pay Later (BNPL) and digital lending has transformed the way consumers access credit. Lending APIs provide automated credit scoring, risk assessment, and instant approvals, helping fintechs offer personalized, real-time financing solutions.

Key features of lending APIs:

- AI-powered credit scoring: Assesses risk based on alternative financial data.

- Instant loan approvals: Enables real-time lending decisions.

- BNPL functionality: Supports flexible installment payments for e-commerce and fintech platforms.

Embedded lending is the future. BNPL and alternative credit models allow fintechs to serve customers who would otherwise be excluded from traditional banking services.

Brokerage & WealthTech APIs: Democratizing Investments

Robo-advisory platforms and fractional investing have made wealth management more accessible than ever. WealthTech APIs enable fintechs to offer trading, portfolio management, and automated investment solutions without developing proprietary trading infrastructure.

Key features of brokerage & wealthTech APIs:

- Fractional trading: Allows users to buy partial shares of stocks or ETFs.

- Automated portfolio rebalancing: Adjusts investment portfolios based on market conditions.

- Real-time market data: Provides access to live stock prices and trading insights.

Use case:

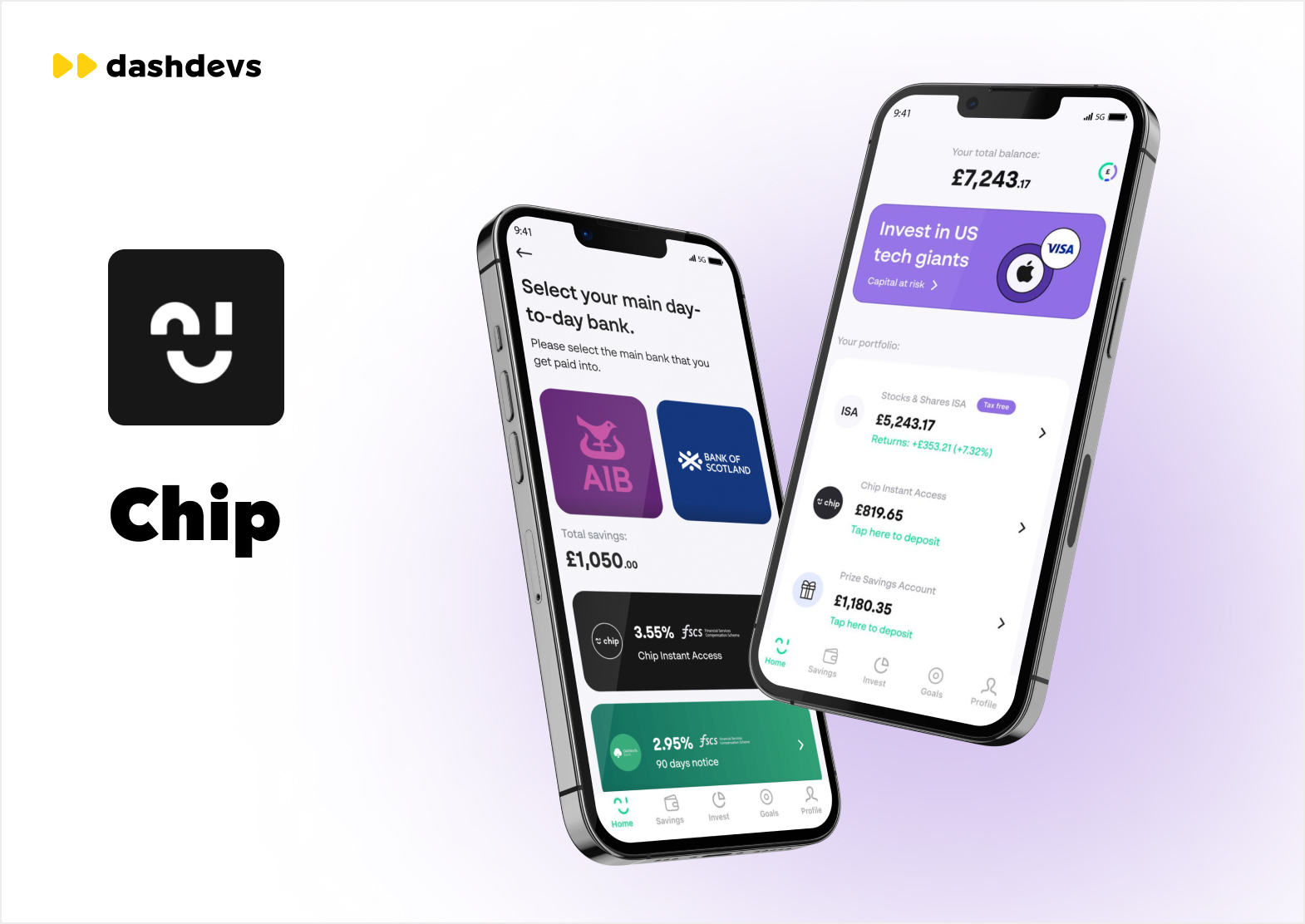

DashDevs developed investment APIs for Inablr and Chip, providing users with:

- Fractional stock trading, allowing investments in high-value assets.

- AI-driven portfolio management, automating wealth-building strategies.

- Real-time market data feeds, improving trade execution and analytics.

The future of investing is API-driven. Fractional shares, robo-advisory, and embedded finance will make wealth management accessible to everyone.

Income Verification APIs: Real-Time Financial Assessment

For lenders and BNPL providers, verifying income and employment status is essential for making informed credit decisions. Income verification APIs aggregate financial data from bank accounts, payroll systems, and tax records, providing a more accurate view of a user’s financial stability.

- Role: Assessing user income for credit decisions and affordability checks.

- Features: Bank account aggregation, payroll data access, AI-driven income assessment.

- Use Cases: Crucial for BNPL providers, lenders, and gig economy platforms.

Fintech APIs simplify the process for businesses to expand, innovate, and maintain compliance, eliminating the need for extensive development. By integrating the right APIs for payments, banking, lending, and security, fintechs can improve user experience, cut costs, and grow faster while ensuring safety and compliance.

How to Integrate Fintech APIs into Your Product

Fintech APIs are the building blocks of modern financial platforms. They let businesses offer safe, scalable, and legal financial services without having to do much development. Whether it’s payments, lending, identity verification, or wealth management, API integration allows fintech to innovate faster while staying cost-efficient and regulatory-compliant.

However, successful fintech integration requires careful planning, from choosing the right providers to ensuring seamless connectivity and security. Below is an infographic guide outlining the key steps to integrating fintech APIs into your product.

Final Thought

Fintech APIs are transforming the financial industry, enabling businesses to build scalable, secure, and compliant fintech API platform with ease. From identity verification and payments to lending, investments, and cross-border transactions, these integrations allow fintechs to offer seamless financial services without heavy infrastructure costs. By choosing the right APIs, companies can enhance user experience, improve security, and accelerate growth in a competitive market.

At DashDevs, we have over 12 years of experience delivering cutting-edge fintech solutions, integrating hundreds of APIs for global startups, banks, and financial platforms. Our expertise spans payments, banking, lending, compliance, and more, ensuring smooth, secure, and regulatory-compliant integrations. Whether you’re launching a new fintech product or optimizing an existing one, our team is here to help.