From Digital Onboarding to Daily Banking: Maximizing Customer Success Every Step of the Way

Digital customer onboarding has become the gateway to lasting customer relationships in banking. It’s no longer just about opening an account—it’s about creating a seamless experience that sets the stage for daily engagement, loyalty, and long-term customer success.

As Denys Trush, Digital Finance Lead at DashDevs, puts it:

“Onboarding isn’t the finish line of client acquisition—it’s the first real test of trust. How you design this moment determines whether your customers become long-term advocates or walk away before they even start.”

In this article, we’ll explore how banks can transform digital onboarding in banking into a journey that reduces friction, builds trust, and drives measurable business outcomes. We’ll also break down tools, strategies, and best practices that connect the first login to everyday banking success.

Why Digital Customer Onboarding Matters in Banking

The banking industry is under intense pressure. Customers compare their first interaction with a bank not against other banks, but against the digital experiences of Netflix, Uber, or Apple. If onboarding feels outdated or slow, they simply abandon the process.

1. First Impressions Define Loyalty

Customer onboarding in banking is more than a compliance requirement. It’s the first real experience of the bank’s brand promise. A complicated form, a request to visit a branch, or long waiting times can instantly destroy trust.

According to the report, 63% of users abandon onboarding journeys because the process is too complicated or time-consuming. This is a staggering loss of potential revenue, especially considering the cost of acquiring a single customer in banking often ranges from $200 to $500.

“Banks spend huge amounts on marketing to attract leads, but lose them at the very first step. Every abandoned onboarding flow is not just lost revenue—it’s wasted acquisition spend.”

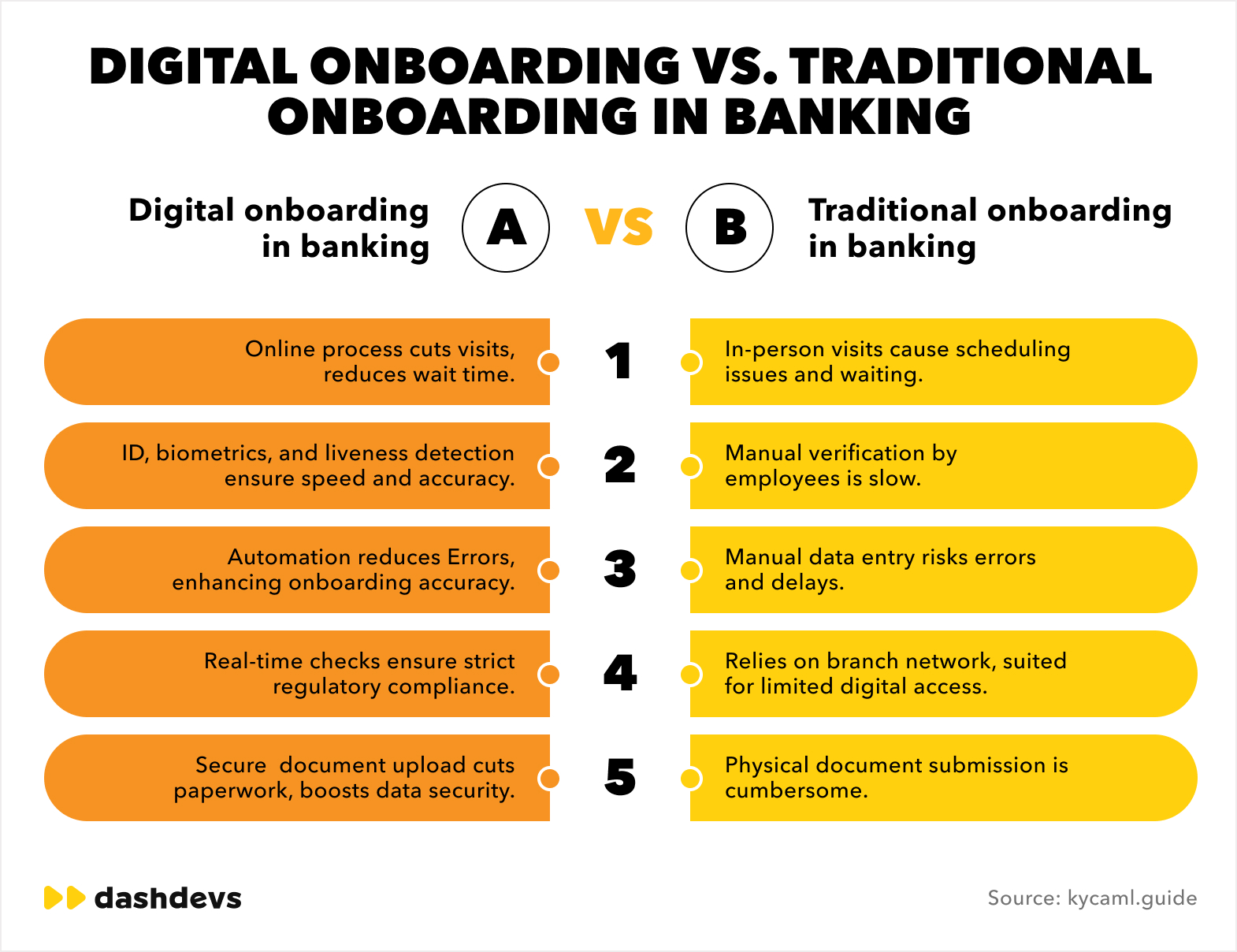

2. Compliance + Customer Experience, Not Compliance vs. Experience

Traditionally, banks viewed onboarding primarily as a regulatory hurdle. KYC checks, AML compliance, and risk scoring dominated the design. But digital-native customers expect speed and convenience as well.

The challenge for modern banks is balancing both:

- Compliance ensures trust and prevents financial crime.

- Experience ensures customers complete the journey and engage further.

McKinsey notes that digital onboarding can cut KYC costs by up to 50% and reduce onboarding time from weeks to minutes, proving that compliance and UX can work together when supported by the right technology.

3. Reduced Drop-Offs = Higher ROI

High abandonment rates aren’t just inconvenient—they directly hit profitability. If 10,000 prospects begin a bank onboarding journey and 60% abandon it, only 4,000 accounts get opened. With optimized digital customer onboarding banking flows, conversion can rise by 20–30%, meaning thousands of additional active accounts without raising marketing spend.

This is why banking digital onboarding is considered a revenue enabler. By reducing friction, banks convert more of the leads they already have, drastically improving ROI.

4. Building Trust Through Security

Fraud and identity theft remain major concerns in financial services. Customers want reassurance that their data is handled securely. Advanced onboarding solutions that integrate biometric checks, liveness detection, and AML screenings build confidence.

As Denys Trush puts it:

“A seamless digital experience is important, but customers must also feel safe. The trick is embedding strong security without making the process heavy. The best onboarding solutions are invisible to the customer but ironclad for the bank.”

5. Gateway to Daily Banking Success

A customer who smoothly signs up, deposits funds, and makes a first payment is far more likely to explore additional services. Conversely, if the first journey is frustrating, the likelihood of churn within 30 days skyrockets.

Visa research shows that 80% of customers who have a positive onboarding experience remain loyal in the first year, while those with a poor experience are three times more likely to close their account within 90 days.

This demonstrates why digital customer onboarding is the foundation of long-term customer success in banking.

Key takeaway for banks: So, digital onboarding is about trust, cost efficiency, and long-term revenue growth. By rethinking onboarding as the first milestone of customer success, banks can transform a compliance-driven obligation into a powerful competitive advantage.

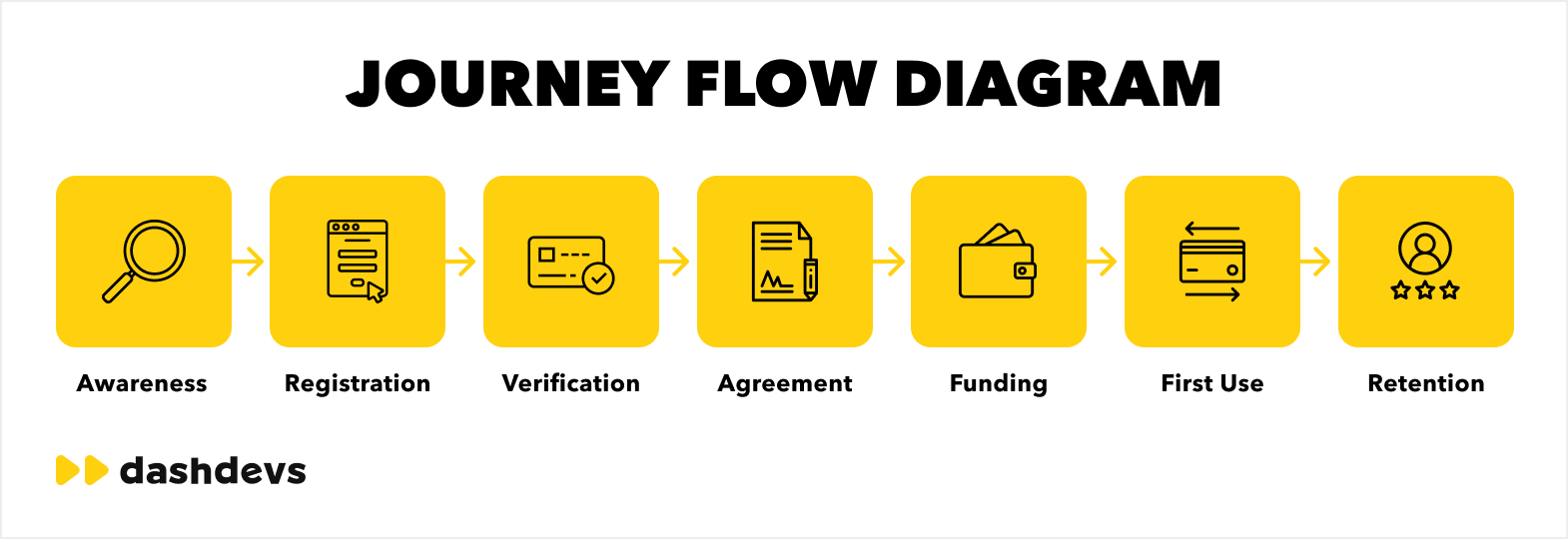

Mapping the Customer Onboarding Journey

A customer onboarding journey is more than a process. It is a series of steps that guide a person from first interest to active use of banking services. Each stage matters. If one step is slow or confusing, the customer may drop off. A clear, simple, and value-driven journey ensures higher conversion and long-term loyalty. Let’s walk through each stage.

1. Awareness

This is the first moment of contact. The customer sees an option to open an account and considers whether it is worth the effort. At this stage, motivation is fragile, and many people leave if they don’t see immediate value.

- Customer action: Clicks on “Open Account”

- Risk point: Motivation is weak. If the benefit is unclear, the person leaves

- Best practice: Use clear calls-to-action and highlight benefits like speed, no fees, or welcome bonuses

A strong awareness step creates interest and encourages the customer to move into registration.

2. Registration

The next step is registration. Here, the person provides basic information. This stage often creates friction if the form is too long or complicated.

- Customer action: Provides name, email, and phone number

- Risk point: Long forms increase drop-off rates

- Best practice: Ask only for essential details, use autofill, and collect extra data later

A simple registration process keeps customers engaged and makes them more willing to proceed with verification.

3. Verification (KYC)

Verification is critical for compliance and security. It is also the point where many people abandon the journey.

- Customer action: Uploads identity documents and takes a selfie

- Risk point: Errors, delays, or manual reviews frustrate users

- Best practice: Use real-time biometric checks, liveness detection, and automated reviews

Smooth and reliable verification builds trust. Customers feel secure and confident in the bank while moving forward quickly.

Learn more about our KYC service here.

4. Agreement

After verification, the customer must accept the terms and conditions. This step should feel modern and efficient.

- Customer action: Reviews and accepts terms

- Risk point: Paper-based or manual signatures slow the process

- Best practice: Offer e-signature solutions that work instantly within the app or browser

Digital agreements make the process simple and professional. Customers can finalize this stage without leaving the digital channel.

5. Funding and Activation

The account is open but not active until the customer adds funds. This is the moment of commitment.

- Customer action: Makes the first deposit or links a payment method

- Risk point: Delays in deposits or limited payment options cause abandonment

- Best practice: Provide instant funding options and support multiple methods such as cards, transfers, or wallets

Quick activation reassures customers. Once they see money in the account, the relationship feels real and valuable.

6. First Use

The first real action defines future engagement. If customers stop here, they often churn within weeks.

- Customer action: Makes a payment, transfer, or card transaction

- Risk point: Without clear guidance, many customers do not take the first step

- Best practice: Offer welcome tours, in-app prompts, or nudges that encourage first activity

When customers complete their first action, they see the benefit immediately. This creates momentum for continued use.

7. Retention

Retention turns one-time users into long-term clients. It depends on continued engagement and perceived value.

- Customer action: Explores and uses more services

- Risk point: If no extra value is shown, the activity drops

- Best practice: Provide personalized offers, loyalty rewards, and relevant recommendations

Retention is the stage where banks create habits. When customers return regularly, the onboarding journey evolves into customer success.

A complete onboarding journey is a chain of experiences. Each step leads naturally to the next, from awareness to retention. If one stage fails, the chain breaks. But when all stages are designed to be fast, simple, and valuable, the customer not only opens an account but also stays active, engaged, and loyal.

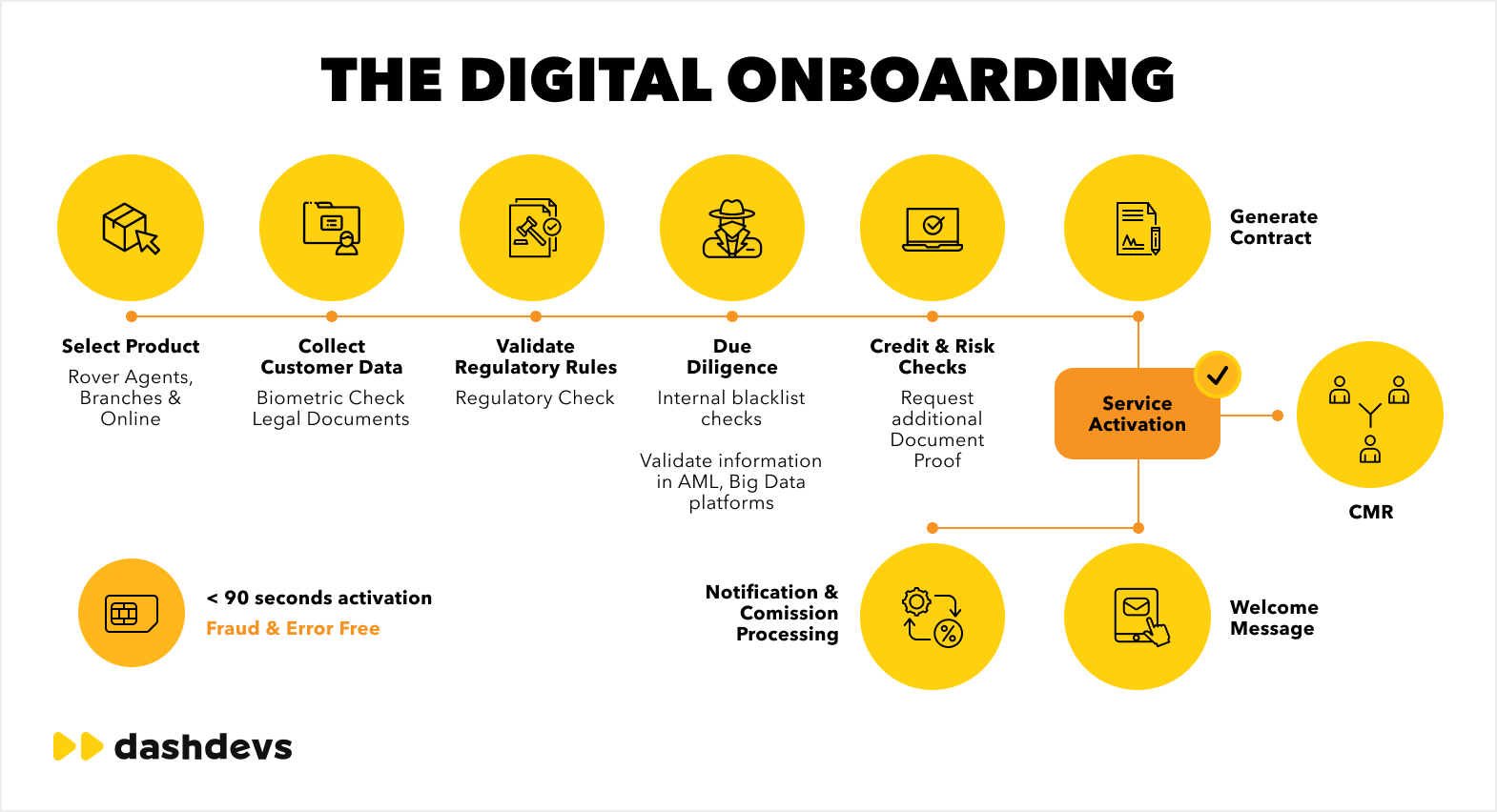

Tools and Solutions That Enable Smooth Onboarding

Many banks think of onboarding as a form with a few fields. In reality, it is a complex journey that requires the right technology behind the scenes. Customers don’t see most of it, but they feel the difference when everything works seamlessly.

Imagine two scenarios. In the first, a customer downloads a banking app, fills in a form, and then waits three days for approval. Frustrated, they uninstall the app. In the second, they scan their ID, confirm their face, sign digitally, and fund their account—all within 10 minutes. The difference is not just convenience; it’s a customer gained versus a customer lost.

That’s why the following tools are critical for banks that want to win and retain clients.

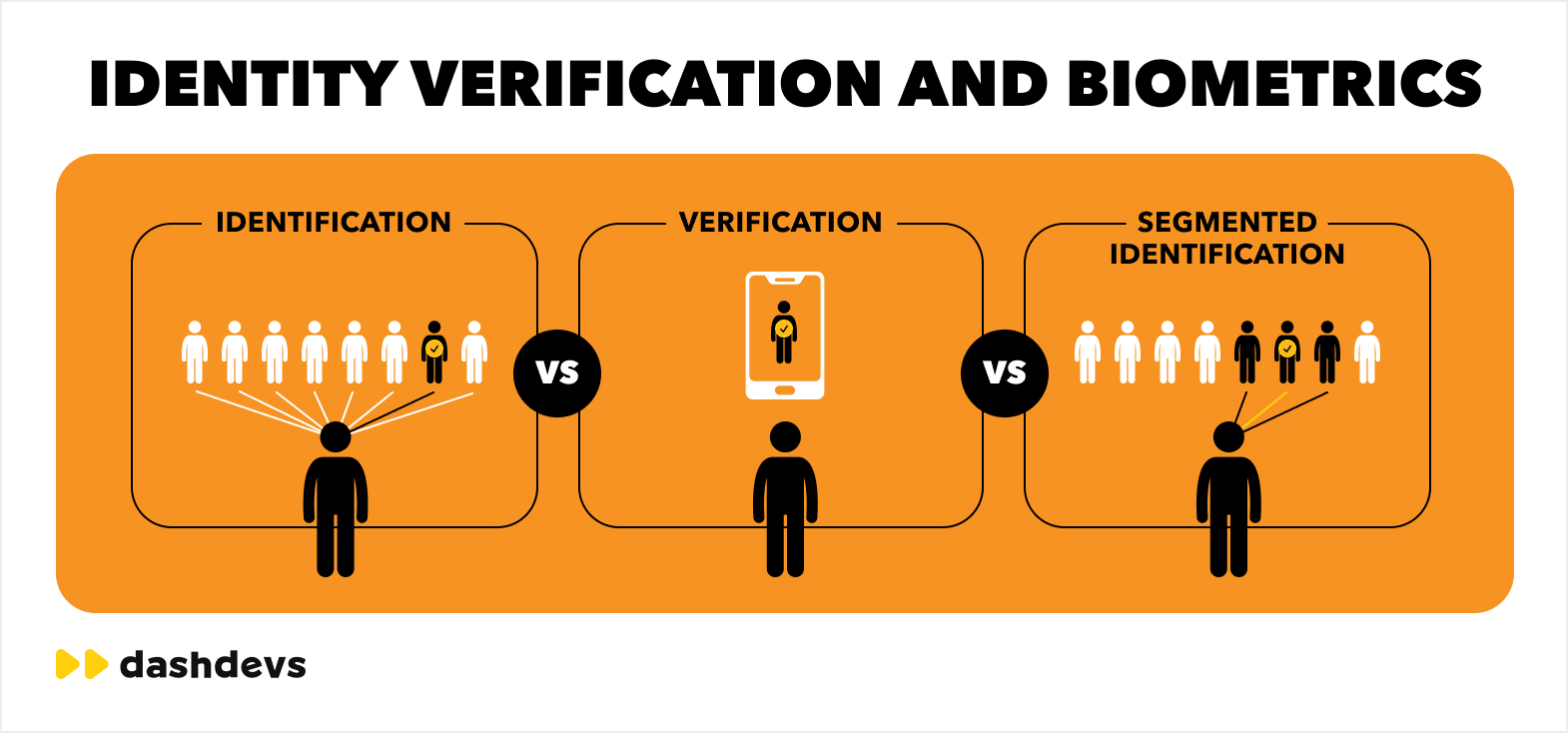

Identity verification and biometrics

- Scan passports, ID cards, and driver’s licenses with OCR and advanced security checks

- Match the document photo with a live selfie using facial recognition

- Apply liveness detection to prevent spoofing and deepfake attempts

- Ensure global coverage so international clients enjoy the same smooth process

Banks that invest here cut account-opening times dramatically. Customers see the institution as modern, secure, and easy to deal with.

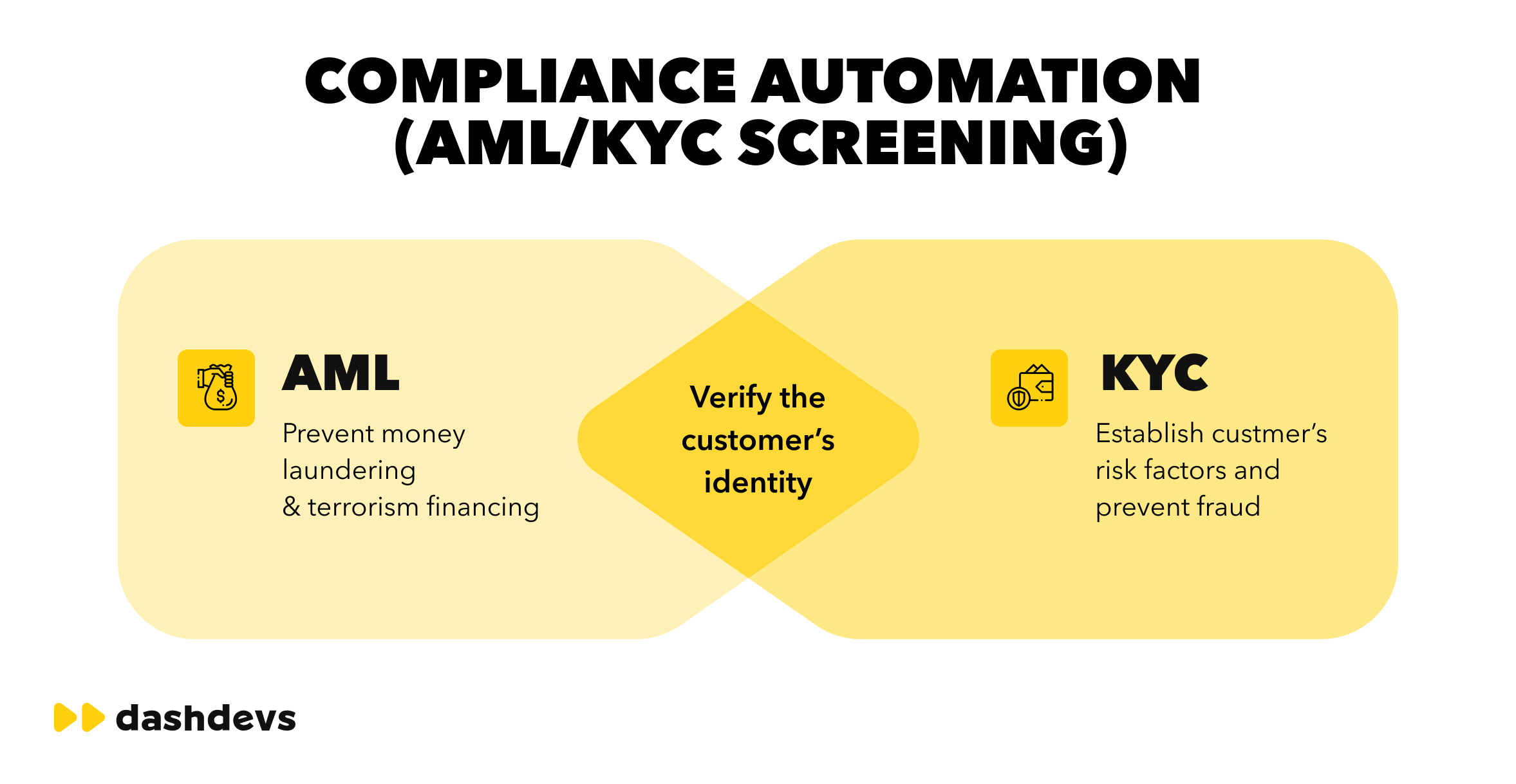

Compliance automation (AML/KYC screening)

- Connect instantly to global sanctions, PEP, and adverse media databases

- Apply dynamic risk scoring: low-risk profiles pass quickly; high-risk ones trigger enhanced checks

- Enable continuous monitoring beyond onboarding

- Reduce manual workload for compliance teams by up to 70%

Automated compliance changes the economics of banking. Instead of long delays, approvals happen in minutes, while regulators see a strong, traceable process.

E-signature platforms

- Allow customers to sign agreements in the app or browser, no paper required

- Comply with global standards like eIDAS, ESIGN, and UETA

- Add multi-factor authentication for sensitive cases

- Integrate with CRM and core systems to remove manual steps

E-signatures don’t just speed up processes—they also modernize the brand image. Customers feel the bank respects their time, and employees no longer waste hours on paperwork.

Fraud prevention tools

- Monitor devices, IP addresses, and unusual login patterns with AI

- Use behavioral biometrics to detect bots or scripted attacks

- Block fake accounts at the entry point

- Continuously adapt through machine learning as fraud tactics evolve

Fraud prevention is often invisible to customers. But when it fails, it damages trust permanently. Modern systems keep good clients flowing through while quietly stopping bad actors.

Analytics and optimization engines

- Track where customers abandon onboarding and how long each step takes

- Run A/B tests to refine flows and messaging

- Use cohort analysis to link onboarding experience with customer lifetime value

- Measure “time-to-first-value”—the moment customers complete their first meaningful action

Analytics provide proof. Banks can see the ROI of onboarding improvements in hard numbers, from higher conversion rates to longer customer lifetimes.

Bringing it together

Onboarding is not one tool but an ecosystem. Identity checks, compliance, signatures, fraud prevention, and analytics all work together. When banks get this mix right, they turn a risky and costly process into a growth engine. Customers feel welcomed and secure, while banks reduce costs and scale faster.

Compliance as a Driver of Trust, Not a Barrier

Compliance has long been treated as a legal checkbox. Today, it’s a strategic lever. A smooth KYC/AML process reassures customers, lowers operational risk, and builds credibility in markets where trust is everything.

| Challenge | Traditional Way | Automated Way | Business Value |

| KYC checks | Manual reviews, days of waiting | OCR + biometrics verify ID in under 60 seconds | Shorter onboarding, less drop-off |

| AML screening | Staff search multiple databases manually | Real-time scanning of sanctions, PEP, and adverse media | Higher accuracy, lower regulatory risk |

| Fraud detection | Reactive checks after fraud occurs | AI flags high-risk accounts instantly | Prevents fraud losses, protects reputation |

| Customer experience | Feels bureaucratic, intrusive | Runs silently in the background | Trust grows, users feel respected |

- Speed meets safety: Automation enables both. Instead of making customers wait days for approval, banks can finish checks in minutes while still meeting the highest regulatory standards.

- Scalability: Automated systems handle thousands of checks per day, supporting growth without hiring large compliance teams.

- Customer trust: Modern customers want visible security. When onboarding feels structured but quick, it communicates reliability.

As Denys Trush, Digital Finance Lead at DashDevs, explains,

“A seamless digital experience is important, but customers must also feel safe. The trick is embedding strong security without making the process heavy. The best onboarding solutions are invisible to the customer but ironclad for the bank.”

Key takeaway: Compliance is no longer just about avoiding fines. It’s about creating confidence. When banks automate compliance, they show customers they are both safe and modern, turning a regulatory task into a competitive advantage.

How Digital Customer Onboarding Shapes the Journey and Drives Customer Success

When banks analyze why customers stay loyal or leave, the first 30 minutes with the institution often explain the outcome. Onboarding is where trust is either built or broken. Customers judge not only the product but also how much the bank values their time, safety, and convenience. That judgment carries forward into every later interaction.

Impact on the Customer Onboarding Journey

- Simplifies early steps: A traditional retail bank may ask a customer to fill out 10 pages of forms and visit a branch to verify identity. Many abandon halfway. By contrast, a European neobank allows the same customer to scan an ID, take a selfie, and confirm details in under 8 minutes. Completion rates jumped from 40% to over 70% after the switch to digital.

- Creates confidence in the process: In the Middle East, regulators require strict KYC checks. One bank introduced biometric verification and liveness detection during onboarding. Clients saw their account approved in minutes instead of waiting three days. The faster process built immediate trust, especially among younger, mobile-first users.

- Encourages first actions: A North American fintech integrated instant funding at the final step of onboarding. Instead of waiting for ACH transfers to clear, customers could use their account instantly with a card load or Apple Pay. This change increased first-week transaction volume by 25%.

- Builds momentum: A UK digital bank tested onboarding flows with and without in-app guidance. Customers who received tooltips and nudges were twice as likely to complete their first transfer in the first 48 hours. Early activity became a predictor of higher retention over 6 months.

Impact on Long-Term Customer Success

- Higher engagement: In one case, a bank that streamlined onboarding saw customers adopt at least two additional products within the first year — such as savings accounts and personal loans. Digital onboarding made upselling easier because clients already trusted the platform.

- Lower churn: Research shows that 80% of clients who have a positive onboarding experience remain active in the first year, while those with a poor experience are three times more likely to churn. This was confirmed by a Southeast Asian bank, which reduced 90-day churn by 30% after redesigning onboarding with biometric KYC and e-signatures.

- Improved customer lifetime value: A US-based challenger bank calculated that each completed onboarding generated $280 more annual revenue than incomplete ones. Faster, smoother onboarding wasn’t just a CX win — it directly improved lifetime value.

Why It Matters for Banks

Marketing budgets are wasted if leads never turn into customers. For example, if a bank spends $500,000 on acquisition but loses 60% of prospects at onboarding, most of that spend delivers no return. By adopting digital onboarding, the same budget produces more active accounts, higher retention, and stronger ROI.

As Denys Trush, Digital Finance Lead at DashDevs, explains, “Onboarding* defines how customers will interact with your bank in the future. If you give them a fast, secure, and simple start, you build the foundation for long-term loyalty and growth.”*

Takeaway

Digital onboarding shapes the journey at every stage: it shortens signup, speeds up verification, encourages first actions, and sustains long-term engagement. Real-world examples show the difference: from three days to three minutes, from abandoned forms to active clients, from churn risk to higher lifetime value. For banks, onboarding is not a formality—it’s the moment that decides customer success.

DashDevs’ Approach: Turning Onboarding Into Long-Term Success

At DashDevs, we treat digital onboarding as the start of customer success, not just a technical requirement. Our approach combines a proven white-label foundation with deep expertise from global fintech projects. This allows banks to launch faster, reduce risk, and deliver onboarding flows that lead to real engagement.

What sets our approach apart

- Compliance-first, experience-driven: Every flow balances strict KYC/AML requirements with simple user journeys.

- Flexible and modular: With Fintech Core, banks can switch KYC providers or adapt to new regulations without rebuilding.

- Global expertise: We’ve delivered onboarding in highly regulated markets across Europe, the UK, and the Middle East.

- Scalable by design: Our solutions serve startups growing to millions of users without rework.

Projects that prove our expertise

Fintech Core (White-label platform)

Modular onboarding engine with vendor-agnostic KYC integrations, e-signature support, and analytics dashboards. Banks use it to launch compliant digital products in months, not years.

Tarabut Gateway (MENA, Open Banking)

We helped build the region’s first open banking platform, integrating 24+ banks across Bahrain, Saudi Arabia, and the UAE. Our role included designing compliant onboarding flows that passed regulatory checks and provided smooth connections for end users.

We created onboarding flows that passed FCA scrutiny while scaling to millions of users. The flows included biometric checks and AI-driven fraud prevention, ensuring both security and adoption.

Why banks choose DashDevs

- Faster launches thanks to reusable frameworks

- Lower regulatory risk through embedded compliance expertise

- Higher ROI as more prospects complete onboarding and move to daily use

- A trusted partner with 20+ years in fintech delivery

As Denys Trush puts it,

“We don’t build onboarding just to open accounts. We build onboarding to set the stage for long-term customer success.”

Conclusion

Digital customer onboarding is more than the first step of account opening. It sets the pace for the entire customer journey, shaping trust, engagement, and long-term success. Banks that redesign this stage with modern tools and automation reduce drop-offs, improve compliance, and create stronger relationships from day one.

In a competitive market, those who view onboarding not as a regulatory hurdle but as a growth opportunity will gain the real advantage.

Ready to rethink how onboarding shapes your customer journey? Discover how smarter onboarding can turn first impressions into lasting relationships.