How to Build a Digital Bank?

For more than a decade, “digital banking” meant putting old banking processes behind a mobile interface. Fewer branches. Fewer people. Less paper.

That phase is over.

What’s emerging now is something fundamentally different: banking as a software platform, designed to operate in real time, adapt continuously to regulation, and scale through ecosystems rather than branches.

Early digital banks optimized for cost and distribution. The next generation must optimize for trust, adaptability, and long-term economics.

If you’re asking how to build a digital bank in 2026 — or how to start an online bank that can survive growth, regulation, and competition — the real challenge isn’t features or UX.

It’s architecture.

This article breaks down what a digital bank really is today, how it differs from neobanks and fintech apps, and how platform decisions determine whether your bank becomes an ecosystem — or hits a ceiling.

Key Takeaways

- Digital banks are regulated platforms, not apps with accounts

- Most failures come from mixing product experimentation with regulated infrastructure

- Orchestration and modularity now matter more than feature speed

- Build vs white-label is a strategic decision, not a technical one

- Early architecture choices compound into cost, compliance, and growth limits

What Is a Digital Bank?

It is a regulated financial platform that delivers banking services entirely through digital channels and carries full responsibility for money, risk, and compliance.

When founders explore how to build a digital bank or how to start a bank, they usually begin with features: onboarding, cards, transfers, and savings. That’s understandable — features are visible. What actually defines a digital bank is invisible.

A digital bank is responsible for:

- safeguarding customer funds

- meeting regulatory and reporting obligations

- managing risk, treasury, and operational resilience

That responsibility changes how everything is designed. It forces teams to think beyond UX and into architecture, governance, and long-term control.

This is why early digital banking often disappointed customers. As David M. Brear, CEO at 11FS, explains in Fintech Garden Episode 130 (Banking Transformation, and Human-Centered Service):

Digital banking didn’t start because it was better for customers. It started because it removed people, paper, and buildings from the equation.

The first wave of digital banking focused on efficiency, not service. It reduced cost, but it rarely redesigned how banking should work in a digital world.

That historical context matters because it explains the confusion we still see today between fintech apps, neobanks, and real digital banks.

Digital Bank vs. Neobank vs. Fintech App

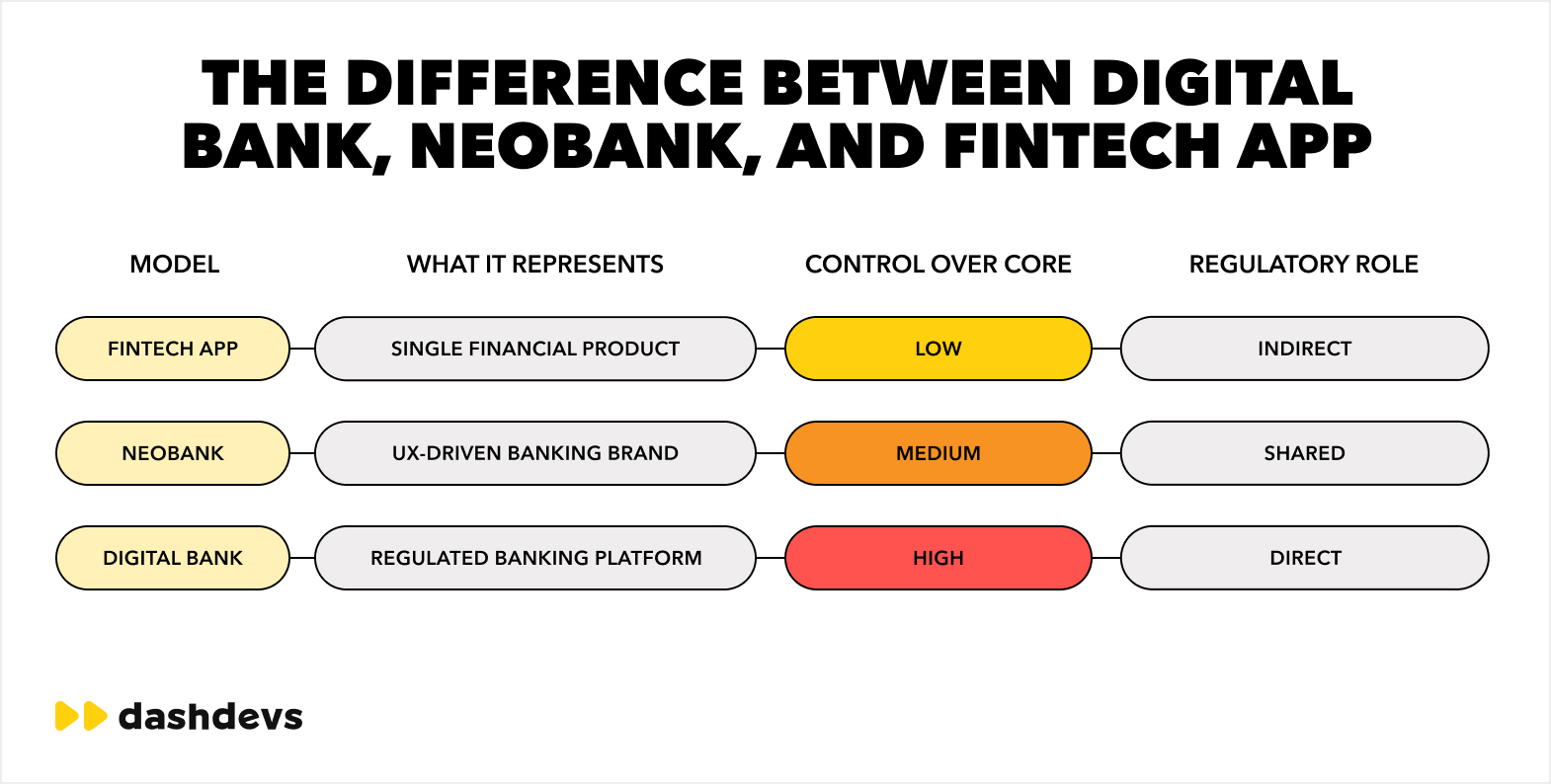

At a glance, these models can look similar. Structurally, they are very different.

| Model | What it represents | Control over core | Regulatory role |

| Fintech app | Single financial product | Low | Indirect |

| Neobank | UX-driven banking brand | Medium | Shared |

| Digital bank | Regulated banking platform | High | Direct |

A fintech app solves one job extremely well. Payments, FX, lending, and budgeting. It relies heavily on third-party providers and avoids direct regulatory responsibility.

A neobank improves the banking experience but usually operates under a sponsor bank or BaaS model. Core infrastructure, treasury, and risk are often shared or outsourced.

A digital bank controls or governs the regulated core. This may be through a full banking license, an EMI model, or a tightly managed sponsor-bank structure. What matters is not branding, but who owns risk and compliance.

As I explained in Fintech Garden Episode 122 (The Great Unbundling of Fintech Banks): Regulators are right to insist that EMI institutions don’t call themselves banks, even though customers instinctively treat them like one.

From the customer’s point of view, trust defines a bank. From the operator’s point of view, treasury, risk, and compliance define it.

This leads directly to the next challenge teams face when trying to build a digital bank: mindset.

Platform Thinking and Why It Matters

Most teams still approach digital banking as a product problem. Products are built to ship fast. Banks must be built to be trusted.

A digital bank has to support rapid product iteration without destabilizing regulated infrastructure. That is not a feature challenge. It is a platform challenge.

Modern digital banks integrate many moving parts:

- core banking systems

- payment rails and card schemes

- KYC, AML, and fraud engines

- analytics and regulatory reporting

Without orchestration and modularity, these systems become fragile dependencies. Every change becomes risky. Vendor lock-in increases. Scaling into new markets slows down. Compliance debt accumulates silently.

This is also why digital banks are evolving into financial operating systems. They expose regulated capabilities into partner platforms, embedded finance ecosystems, and marketplaces through APIs — while keeping governance and control centralized.

A digital bank that cannot orchestrate systems, manage compliance continuously, and scale through infrastructure will eventually hit hard limits, no matter how good the UX looks.

What Do You Need to Know Before Building a Digital Bank?

Once teams move past what a digital bank is, the real complexity begins. Whether you’re exploring how to start a bank, how to form a bank, or how to establish a bank in a digital-first way, the challenge is never just product development.

Building a digital bank is a sequence of structural decisions that define speed, cost, risk, and long-term growth. The earlier these decisions are made, the more they compound.

Before choosing technology or vendors, there are several fundamentals every team must understand when deciding how to start your own bank or how to start an online bank business.

Regulatory Model, Time-to-Market, and Cost Reality

The first critical decision in how to build a digital bank from scratch is the regulatory model. It determines how quickly you can launch, how much control you retain, and how much operational responsibility you carry.

| Regulatory model | Time to launch | Control level | Typical use case |

| Full banking license | 18–36 months | Very high | Long-term, multi-market digital banks |

| EMI / payment institution | 6–12 months | Medium | Payments-led digital banking products |

| Sponsor bank / BaaS | 3–6 months | Lower | Fast launch, market validation |

There is no universally “right” choice. Teams deciding how to start a bank must trade speed against control. A faster launch usually means more dependency. More control usually means more time, capital, and regulatory effort.

Cost expectations also need to be realistic.

When teams ask how to create a digital bank, they often focus on development cost. In reality, development is only one part of the equation.

Ongoing cost drivers typically include:

- regulatory capital and audits

- compliance operations and reporting

- transaction, scheme, and processing fees

- fraud monitoring and dispute handling

- customer support and operational tooling

For many founders, the real surprise is not building the bank, but running a regulated digital banking platform at scale.

Vendor Dependency, Scalability, and Architecture Debt

Vendor decisions made early in developing banking infrastructure have long-term consequences.

Heavy reliance on a single provider may simplify how to start a digital bank, but it also introduces structural risk:

- limited control over roadmap and pricing

- slower expansion into new markets

- reduced ability to differentiate the product

Scalability challenges rarely appear during MVP. They surface later — during audits, market expansion, or rapid growth.

This is where architecture debt appears.

Architecture debt shows up when:

- compliance teams struggle to explain system behavior

- product teams avoid changes because they feel risky

- audits become slower and more expensive

- entering new markets requires workarounds instead of extensions

This is why teams serious about building a digital banking product must think beyond launch.

The core takeaway is simple: early architecture decisions compound.

Teams that separate regulated infrastructure from product innovation retain flexibility. Teams that mix them create friction that slows growth over time. Understanding these fundamentals early is what separates teams that successfully build a digital bank from those that stall after launch.

Building a Digital Bank With Custom Development Services

Custom development is not the default path for every digital bank. It becomes the right choice when differentiation, control, and long-term scalability are central to the business model.

Teams usually arrive here after asking hard questions:

- How do we avoid vendor lock-in?

- How do we scale across markets?

- How do we keep compliance under control while still moving fast?

For banks operating in one market with a narrow product scope, white-label solutions may be enough. For banks with multi-license ambitions, complex products, or ecosystem strategies, custom development becomes a strategic necessity.

Custom development means owning the orchestration layer, the data layer, and the rules that govern how systems interact. It gives teams control over how compliance, risk, and product logic evolve together — not in isolation.

When Custom Development Makes Sense

Custom development is justified when banking is not just an enabler, but the core of the business.

Typical signals include:

- operating across multiple countries or regulatory regimes

- supporting more than one license model (e.g., EMI + banking license)

- building differentiated products beyond standard cards and payments

- needing deep analytics, custom risk logic, or advanced treasury flows

- planning long-term platform evolution, not just fast launch

In these cases, speed alone is not the goal. Sustainable control is.

| Dimension | Custom development impact |

| Orchestration | Full control over system interactions |

| Data ownership | Centralized, analytics-ready |

| Vendor dependency | Reduced, abstracted |

| Regulatory adaptability | Built into architecture |

| Long-term cost | Lower marginal cost at scale |

This approach allows teams to treat vendors as components, not constraints.

Mini Case: Dozens — Custom Platform Justified by Complexity

Dozens is a strong example of when custom development becomes the correct decision.

The platform operates as a multi-license digital bank, supporting different regulatory models across markets. This introduced complexity that could not be handled reliably through off-the-shelf solutions alone.

Instead of stitching together siloed systems, the platform was built around:

- heavy orchestration logic to manage compliance and payments

- modular services that could evolve independently

- centralized governance over data, risk, and reporting

This architecture allowed Dozens to:

- support regulatory variation without duplicating systems

- introduce new products without destabilizing the core

- scale operations while keeping compliance auditable and explainable

In this context, custom development was not about building everything from scratch. It was about designing a platform that could grow without rewriting itself.

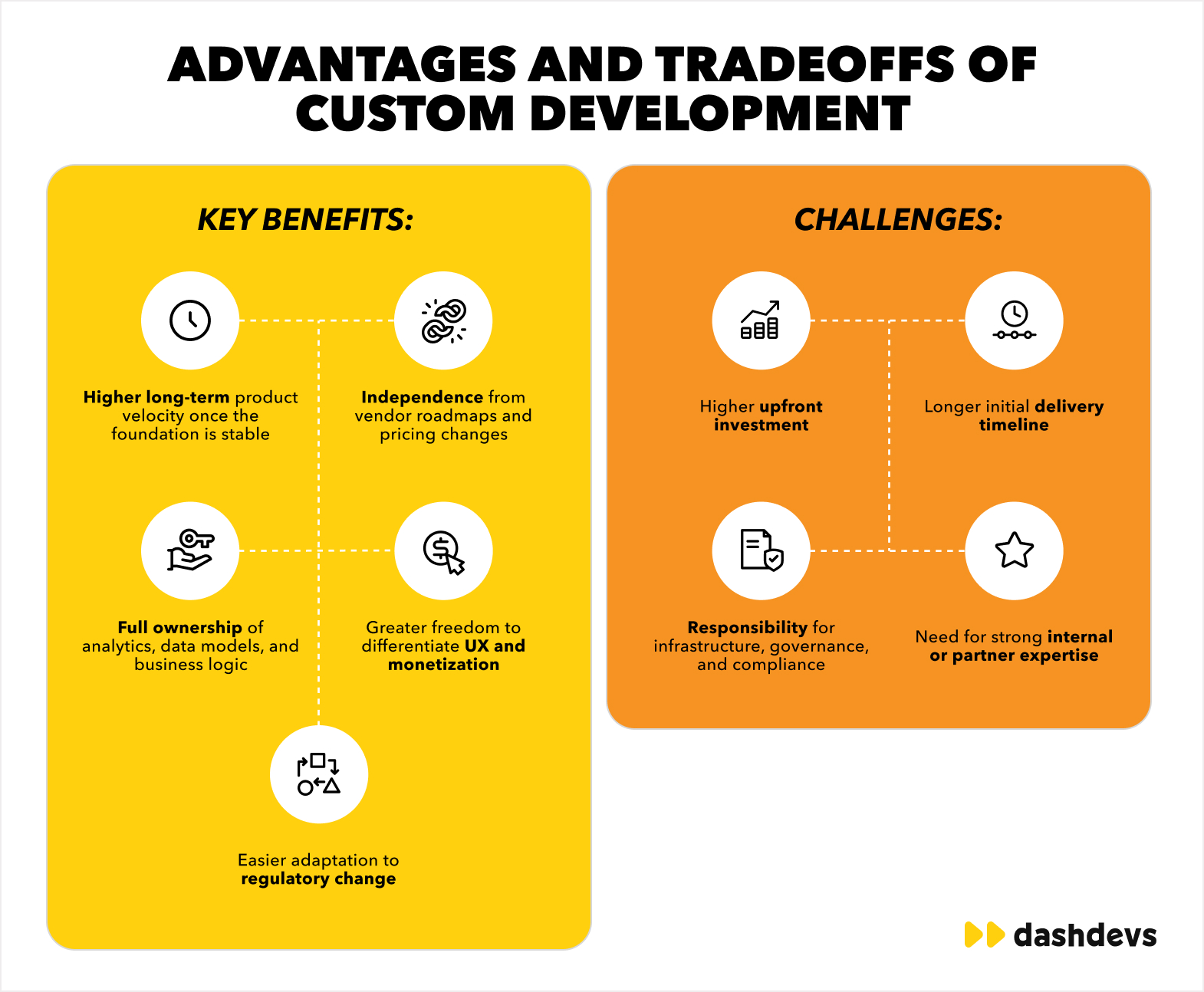

Advantages and Tradeoffs of Custom Development

Custom development brings clear advantages, especially over time.

This is why custom development works best when paired with experienced fintech engineering teams who understand regulation, not just software.

For banks with real growth ambition, custom development is not about speed today. It is about not being blocked tomorrow.

Building a Digital Bank With White-Label Solutions

White-label banking is the fastest way to answer the question how to start an online bank without taking on full licensing, infrastructure, and compliance ownership from day one. For many teams, especially those validating a market or launching a focused proposition, it is the most pragmatic path to building a digital banking product.

Instead of assembling dozens of vendors independently, white-label platforms provide a pre-integrated banking stack: core ledger, payments, cards, compliance tooling, and operational workflows — all delivered under a single contract.

This approach dramatically shortens time-to-market and reduces early risk, especially for teams asking how to start a digital bank business without building everything from scratch.

Why Teams Choose White-Label Banking First

White-label solutions work best when speed, capital efficiency, and regulatory certainty matter more than deep differentiation at launch.

Typical drivers include:

- launching an MVP to test demand or distribution

- operating under EMI or sponsor-bank models

- entering a regulated market for the first time

- limited in-house banking or compliance expertise

In practice, this means teams can focus on customer experience and growth, while the platform absorbs much of the regulatory and operational complexity.

| Dimension | White-label approach |

| Time to market | 3–6 months |

| Upfront cost | Lower |

| Compliance readiness | Pre-certified |

| Engineering load | Reduced |

| Differentiation | Moderate |

Mini Case: Pi-1 — A Modular White-Label Banking Platform at Scale

Pi-1 is a strong example of how white-label banking development can scale beyond MVP when done correctly.

DashDevs delivered Pi-1 as a modular, cloud-based white-label banking platform, designed to support both consumer and B2B2C use cases. The platform combined EMI and MiFID II capabilities while remaining flexible enough to onboard multiple banks and fintechs.

Key platform realities:

- 30+ third-party integrations (KYC, AML, document recognition, payments)

- unified API for end-to-end digital banking services

- built-in analytics and lifecycle visibility

- white-label UX configurable per client

This was not a “skin on top of a core.” It was a banking platform designed for reuse and extension.

What White-Label Gets Right — and Where It Stops

White-label platforms like Pi-1 excel at removing early friction.

They allow teams to:

- launch faster without waiting for full licensing

- rely on pre-approved compliance workflows

- reduce integration and certification risk

- avoid early operational overload

At the same time, there are natural limits.

Over time, teams may face:

- constraints on roadmap flexibility

- dependence on vendor release cycles

- limited ability to re-architect core flows

- challenges introducing non-standard products

This is why white-label works best as a phase, not a forever decision.

The strongest teams treat white-label banking as:

- a launch accelerator

- a controlled environment to learn

- a foundation that can later be extended or replaced

Pi-1 demonstrates that when white-label is built with modularity and orchestration in mind, it can support real scale — not just fast launches.

When White-Label Is the Right Answer

White-label banking is the right choice when:

- speed outweighs full customization

- regulatory risk must be minimized early

- capital efficiency matters more than control

- differentiation sits mostly in UX, brand, or distribution

For many founders asking how to start a bank or how to create a digital bank, this is the most realistic entry point into regulated finance.

The key is knowing when white-label accelerates you — and when it starts to limit you.

What Is the Process of Building a Digital Bank With a White-Label Solution?

Building a digital bank with a white-label platform is less about “setup” and more about controlled orchestration. Each stage reduces uncertainty — regulatory, technical, or operational — while preparing the product for scale.

Stage 1: Choosing a White-Label Provider

Everything downstream depends on this choice.

Teams evaluating how to start a digital bank should look beyond feature lists and focus on structural fit and KYC:

- regulatory coverage across target markets

- API maturity proven in live environments

- extensibility without breaking certifications

- an ecosystem of vetted KYC, payments, and compliance vendors

A provider that looks flexible in demos but rigid in production becomes a growth constraint later.

Stage 2: Product Configuration & UX

Once the platform is selected, attention shifts to shaping the product.

White-label platforms allow teams to compose:

- which banking features go live first

- how branding is applied across onboarding and daily use

- how customer journeys handle identity, payments, and support

This is where the bank stops looking like “a platform” and starts looking like a product.

Stage 3: Third-Party Integrations & Compliance (Where Most Complexity Lives)

This stage defines whether the bank can operate efficiently under real regulatory pressure.

Core integrations usually include:

- identity verification and onboarding

- payment processing and transaction monitoring

- AML controls and regulatory reporting

- internal support and case management tools

This is also where automation becomes critical.

Digital Identity development case

DashDevs designed an automated digital identity and onboarding flow as part of a regulated white-label banking setup. The goal was not just faster onboarding, but scalable compliance.

The solution:

- automated identity verification and risk checks

- reduced manual review across high-volume onboarding

- produced audit-ready data trails for regulators

- allowed compliance teams to scale without linear headcount growth

This approach turned onboarding from a bottleneck into a controlled, repeatable operation — a pattern that becomes essential once user volumes increase.

Stage 4: Testing & Certification

Before launch, the platform must demonstrate reliability:

- regulatory and scheme approvals

- load and stress testing under peak scenarios

- failover readiness and incident handling

Certification is where assumptions are tested under real scrutiny.

Stage 5: Launch & Market Entry

Launch readiness extends beyond deployment:

- trained support teams and escalation paths

- live fraud and transaction monitoring

- operational dashboards for real-time oversight

Strong operational readiness prevents early failures from becoming reputational damage.

Stage 6: Post-Launch Scaling

After launch, the focus shifts from stability to growth:

- enabling additional products

- expanding into new markets

- layering monetization on top of existing flows

At this stage, the value of earlier integration and compliance decisions becomes obvious — either enabling scale or slowing it down.

Advantages of Fintech Core White-Label Solution

Fintech Core is designed for teams that want the speed of white-label banking without sacrificing future control. Its modular architecture allows banks to launch fast, then evolve without re-platforming.

| Advantage | What it enables in practice |

| Modular expansion | Add or replace features without disrupting live operations |

| Vendor orchestration | Manage KYC, payments, AML, and cards through a unified control layer |

| Faster experimentation | Test new products and flows without breaking compliance |

| Lower integration risk | Pre-integrated, production-tested fintech providers |

Using Fintech Core’s modular white-label approach, Pi-1 launched with 30+ integrations, supported multiple regulated use cases, and scaled into a reusable banking platform — without locking product teams into rigid vendor dependencies.

How Do Digital Banks Make Money?

Digital banks rarely rely on a single revenue stream. The strongest models combine infrastructure-driven income with product-led monetization, allowing margins to grow as user engagement deepens.

| Revenue stream | How it works in practice |

| Interchange | Earned on every card transaction, scales with active users |

| Lending margin | Interest spread on consumer or SME lending products |

| Deposits | Net interest margin on customer balances |

| FX spreads | Revenue from cross-border payments and currency exchange |

| Premium services | Subscriptions for advanced features or benefits |

| Embedded monetization | Financial services integrated into daily user flows |

The key shift is that monetization is no longer separate from the product. Revenue is increasingly embedded into user behavior, not added as fees.

Mini Case: Sustainable Finance Platform — Brand-Led Monetization

This US-based digital banking platform shows how values-driven differentiation can unlock multiple revenue streams without relying on aggressive fees.

The product combines:

- cash management and card accounts

- high-yield, fossil fuel–free savings

- sustainable investing and retirement products

- carbon footprint tracking and offset programs

Rather than monetizing through friction, the platform monetizes through alignment with user values.

What this enables commercially:

- premium account tiers tied to sustainability benefits

- higher deposit retention through purpose-led savings

- value-added services layered on top of core banking

- strong brand trust driving long-term engagement

Delivery highlights:

- secure identity and access (Face ID, Touch ID, 2FA, 256-bit encryption)

- advanced analytics for personalized insights and recommendations

- loyalty and rewards systems integrated into daily spend

- scalable mobile architecture (iOS, Android, backend, QA, PM)

Results:

- 5M+ users worldwide

- 4.5+ rating across app platforms

- Webby Award for Best User Experience in Finance

This case demonstrates that modern digital banks don’t just monetize money flows — they monetize trust, engagement, and relevance.

How Much Does Digital Bank Development Cost?

When teams ask how much it costs to build a digital bank, they usually expect a single figure. In reality, cost depends far more on architecture and regulatory choices than on development hours.

An MVP can be launched with a controlled scope: one market, one license model, limited features. That keeps early investment manageable. The real cost challenge starts after launch.

What actually drives cost over time

| Cost driver | Why it matters |

| MVP vs scale | Volume increases compliance, fraud, and operational costs |

| Licensing model | EMI, sponsor bank, or full license change cost structure |

| Architecture choice | Vendor fees vs long-term platform ownership |

| Compliance operations | Audits, reporting, controls scale with activity |

| Support & operations | Disputes and customer service grow faster than features |

Licensing and architecture decisions are especially critical. White-label and BaaS reduce upfront cost but introduce recurring fees tied to transactions and users. Custom platforms cost more initially but reduce marginal cost as volume grows.

The real question isn’t how cheap you can launch, but how expensive you’ll be at scale.

Typical cost expectations (indicative)

| Stage | What teams often underestimate |

| MVP launch | Compliance tooling and reporting effort |

| Year 1 scaling | Vendor fees and fraud operations |

| Multi-market expansion | Licensing, localization, and audit costs |

| Long-term operations | Support, monitoring, and incident response |

Building a digital bank is not a project — it’s a regulated operating business with compounding costs.

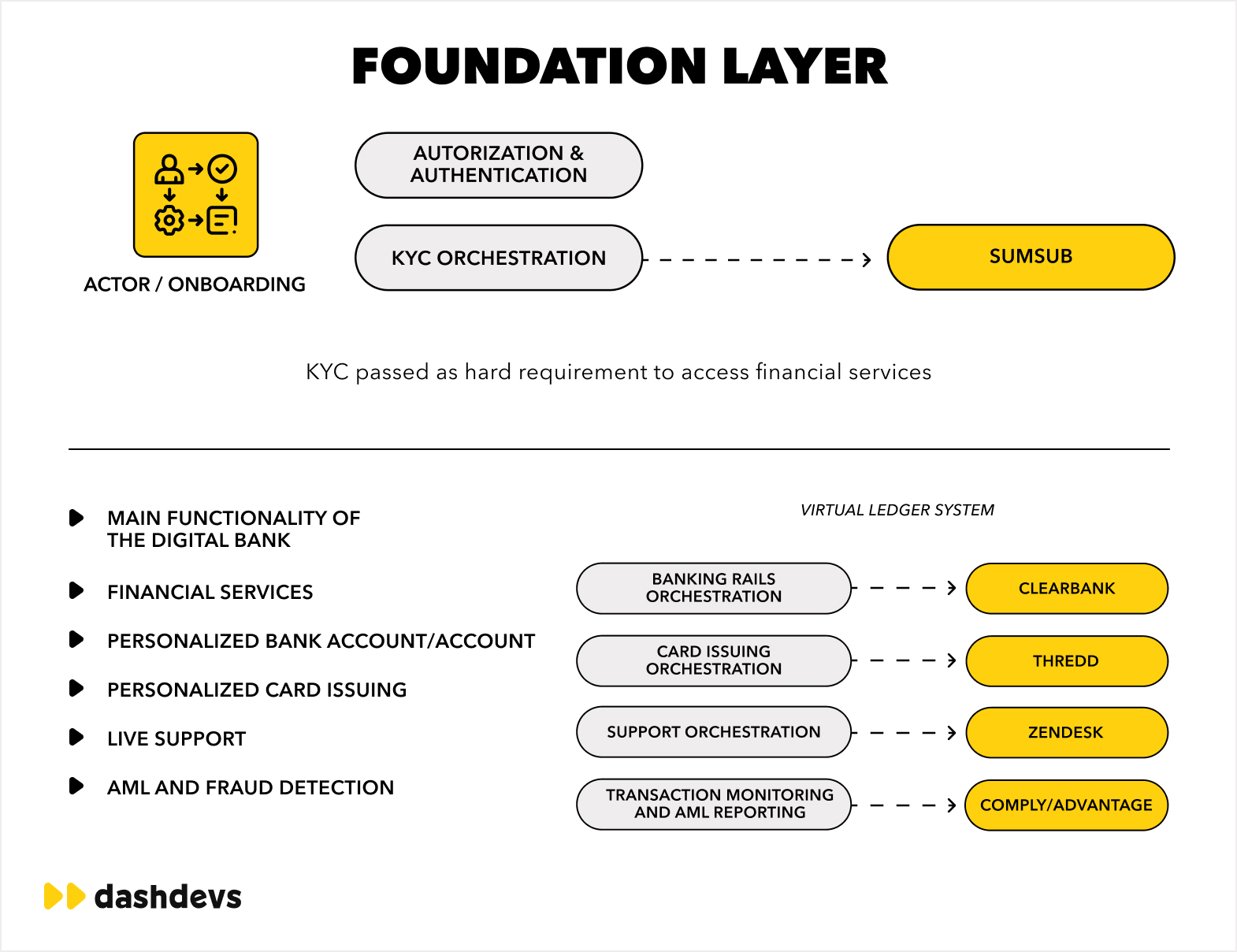

Designing a Digital Bank: Foundation Layer vs Differentiation Layer

Most digital banking failures don’t come from bad ideas. They come from mixing compliance infrastructure with product experimentation.

Successful digital banks separate their platforms into two layers.

Foundation Layer — what must never break

This layer exists to create trust with regulators and customers.

| Foundation components |

| Identity & onboarding |

| Core ledger |

| Payments rails |

| Card issuing |

| AML & fraud |

| Customer support |

Characteristics: regulated, stable, risk-driven, slow to change, non-differentiating.

This is where platforms like Dozens’ multi-license architecture and digital identity infrastructure live. The goal here is correctness, auditability, and resilience — not innovation speed.

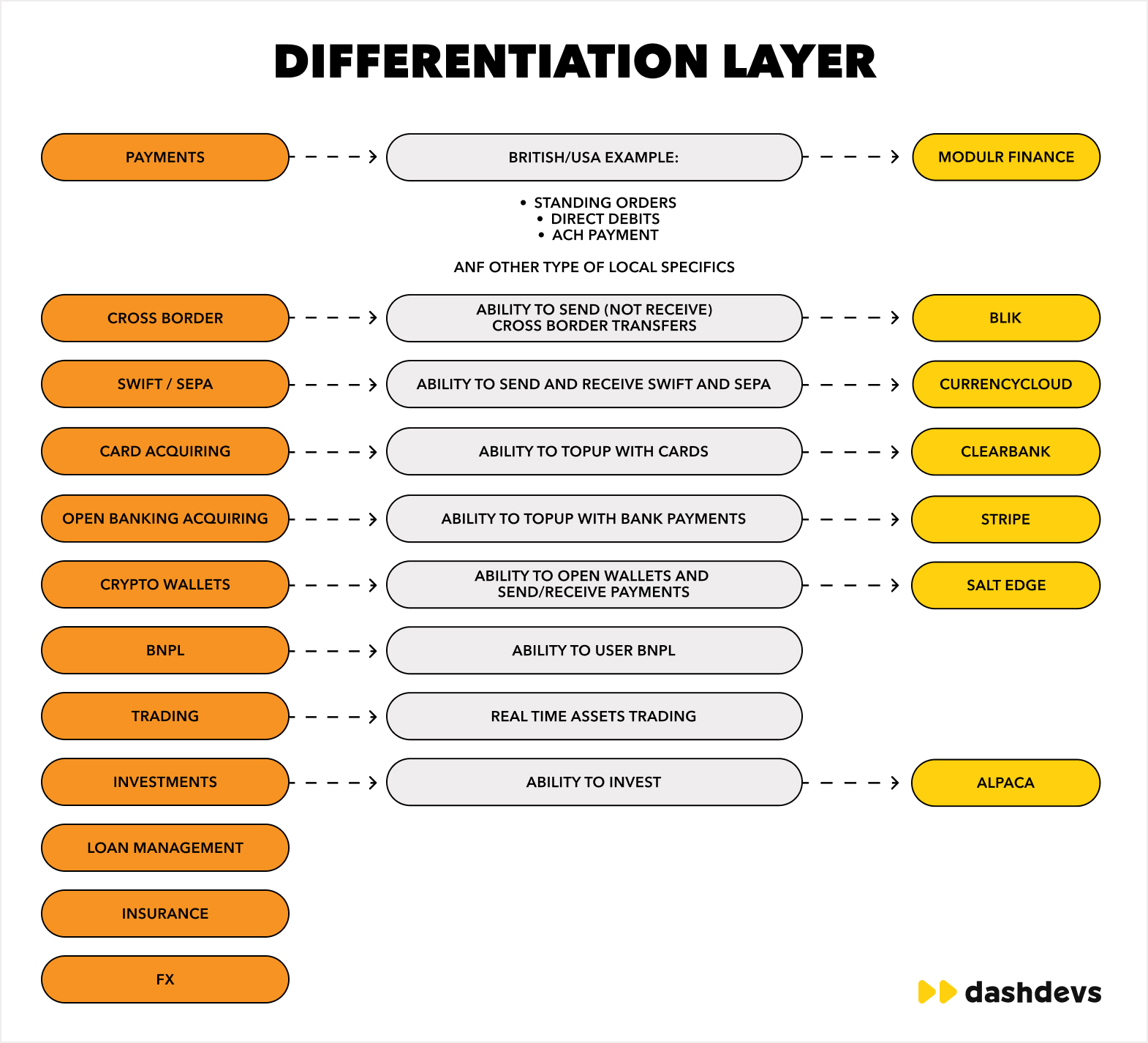

Differentiation Layer — where growth happens

This layer creates market advantage and revenue.

| Differentiation capabilities |

| Payments innovation |

| FX & cross-border |

| Crypto & digital assets |

| BNPL & lending UX |

| Investing & insurance |

| Embedded finance ecosystems |

Characteristics: fast iteration, revenue-driven, UX-focused, competitive moat.

The Sustainable Finance platform demonstrates this approach: a stable core paired with values-driven UX, premium services, and data-powered insights.

How Teams Should Architect for Both

The strongest teams don’t choose between speed and safety. They design for both.

| Architectural principle | Why it matters |

| Modular orchestration | Change features without touching the core |

| API-first integration | Add partners without rewrites |

| Vendor abstraction | Avoid long-term lock-in |

| Data ownership | Power analytics and compliance |

| Observability | Connect product behavior with risk |

This structure allows teams to innovate without destabilizing regulated infrastructure.

Wrapping up

Digital banking is no longer about launching fast or copying what worked for early neobanks. In today’s market, success is determined by how well a platform is designed to operate under real regulatory pressure, scale without friction, and evolve as products, markets, and customer expectations change. Teams that struggle are rarely missing features — they are constrained by early decisions around architecture, licensing models, vendor dependency, and compliance, all of which compound over time.

The digital banks that win treat banking as a platform, not an app. They separate foundation systems built for trust and resilience from differentiation layers built for growth and experimentation. Whether you’re figuring out how to start a digital bank, how to build a digital bank from scratch, or how to evolve a fintech into a regulated institution, the lesson is the same: architecture is strategy. Build it right, and everything else becomes possible.