Developing a Custom Payment Gateway: Key Steps and Considerations

Developing a Custom Payment Gateway: Key Steps and Considerations

Summary

TL;DR

- Digital payments are growing rapidly, creating strong demand for scalable gateway infrastructure.

- A custom payment gateway gives full control over fees, routing logic, security, and user experience.

- Development requires deep focus on compliance (PCI DSS), fraud prevention, and system resilience.

- The right architecture turns payments from a processing tool into a strategic business asset.

Payment gateways are an integral component of the digital payment processing flow that ensures secure, efficient, and convenient online transactions. Notably, businesses across diverse industries can benefit from both custom payment gateways and seamless payment gateway integrations, enhancing their operations and customer experiences.

According to Statista, the total transaction value in the US is expected to show a CAGR of 15.24%, resulting in a projected total amount of €3,381.00bn by 2027. It clearly shows that the number and the amount of finance transferred digitally is rising. So, there is still room for businesses aiming to become owners of payment gateway products.

In this post, I’ll delve you into how to create a payment gateway and what its components are. You’ll also explore the benefits and challenges of owning custom payment solutions.

Payment Ecosystem & Key Players

If you are researching how to create a payment gateway, you will quickly encounter confusion around payment gateway vs processor, acquirers, issuers, and card networks. These are not interchangeable terms. Each plays a specific role in how payments flow — and misunderstanding them leads to flawed architecture decisions during payment gateway development.

Let’s walk through it in plain language.

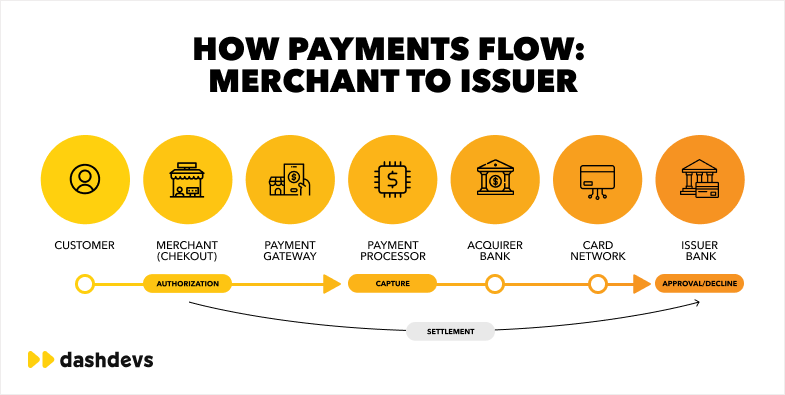

When a customer enters their card details at checkout, the transaction moves through a structured chain:

Customer → Merchant → Payment Gateway → Payment Processor → Acquirer → Card Network → Issuer → Response back

Here is what happens behind the scenes:

- The payment gateway securely encrypts and transmits card data.

- The payment processor handles the technical communication with financial institutions.

- The acquirer (merchant’s bank) receives funds on behalf of the merchant.

- The issuer (customer’s bank) approves or declines the transaction.

The lifecycle of a transaction includes three critical stages:

Authorization – The issuer verifies funds and fraud signals and reserves the amount. Capture – The merchant confirms the transaction and initiates collection. Settlement – Funds move from the issuer through the acquirer into the merchant account.

Many founders ask about payment gateway vs processor. The difference is structural:

| Component | Core Role | What It Controls |

| Payment Gateway | Secure transmission of payment data | APIs, encryption, tokenization |

| Payment Processor | Execution and routing of transactions | Connectivity to acquirers and networks |

Now let’s clarify the banking layer.

An acquirer explained simply: it is the financial institution that processes card payments for merchants and settles funds into their accounts. Major global acquirers include Adyen, Worldpay, Fiserv, Chase Merchant Services, and Global Payments.

An issuer is the customer’s bank — such as JPMorgan, Barclays, HSBC, or Capital One — responsible for approving transactions and releasing funds.

Understanding how payments flow — and who controls each step — is foundational when planning to build gateway infrastructure or invest in custom payment gateway software development. If the architecture does not clearly separate gateway logic from processing and acquiring responsibilities, compliance and scaling problems will follow.

Why Build a Custom Payment Gateway

Once you understand the ecosystem, the next strategic question becomes clear: should you build your own payment gateway or rely on a managed provider?

For CTOs, product leaders, and founders, the decision revolves around control, cost optimization, and regulatory exposure.

The Business Case

Building a custom payment gateway gives you:

- Full control over PCI compliance and fraud logic: You define tokenization flows, authentication mechanisms, and risk rules instead of relying on vendor defaults.

- Custom routing and smart decline handling: You can route transactions dynamically across multiple acquirers to improve approval rates and reduce failed payments.

- Interchange and fee optimization: At scale, small improvements in routing and transaction structuring can significantly reduce processing costs.

For high-volume platforms, owning the gateway layer allows margin control and operational flexibility that off-the-shelf solutions may not provide.

If you are comparing your options against managed providers, reviewing Stripe competitors can help frame what you gain — and what you give up — when choosing control over convenience.

The Risks

However, building a payment gateway is not just a technical exercise.

You assume:

- Responsibility for PCI DSS compliance and audits

- Ongoing fraud monitoring and encryption management

- Infrastructure scalability under peak load

- Continuous regulatory updates (PSD2, data residency, GDPR)

- Long-term maintenance costs

Time to market also increases compared to using prebuilt providers.

When It Makes Strategic Sense

Building your own gateway is typically justified when:

- You operate B2B enterprise payments at scale

- You manage global, multi-currency transaction flows

- You work in regulated industries such as banking, healthcare, or crypto

- You require advanced routing logic across multiple acquirers

If your platform processes significant volume or operates under strict compliance frameworks, learning how to build a payment gateway becomes a strategic investment rather than a technical experiment.

The decision to create a payment gateway should be based on transaction scale, regulatory requirements, and long-term margin strategy — not just engineering ambition.

If you’re starting from the basics and need to understand how to enable online transactions end-to-end, explore our guide on 6 Steps to Create a Website that Can Accept Online Payments.

Who Needs a Custom Payment System and Why?

I believe that the decision between custom and ready-made solutions should be based on a thorough analysis of a business’s current needs, future growth prospects, available resources, and industry-specific requirements. Businesses that most often need to know how to make payment gateway payment gateway solution fall within these four categories:

- Large corporations. Such businesses often deal with a diverse range of financial transactions, both domestically and internationally. A custom payment system can facilitate seamless interdepartmental transfers, handle multiple currencies, integrate with other enterprise software, and ensure compliance with varying regional financial regulations.It’s the primary reason why such companies consider to build gateway.

- Large e-commerce and retail companies. These businesses thrive on customer transactions, often in high volumes, especially during peak seasons. A custom payment system ensures a smooth checkout experience for customers, offers multiple payment options, integrates with inventory and supply chain solutions, and can potentially reduce transaction fees. That’s why strategizing for a custom payment gateway is absolutely worth it when you build an e-commerce business.

- IT companies. Such organizations, especially those dealing in B2B services or software-as-a-service (SaaS) platforms, may have unique billing models like subscription-based or milestone-based billing. In such scenario, it’s worth to create payment gateway to automate recurring digital payments, handle international transactions, and integrate with project management tools.

- Banks, credit unions, and other financial institutions. Being at the core of the financial world, these institutions have intricate and often unique transactional needs. A custom payment system can streamline internal financial processes, offer innovative services to their customers, integrate with other banking systems, and adhere to strict financial regulations and security standards.

At the same time, I can also define a range of other companies that potentially can also benefit from owning custom payment processing systems:

- Government and public sector agencies. Custom payment systems can help manage large-scale transactions like tax collections, fine payments, and public fund disbursements, ensuring accuracy and regulatory compliance.

- Healthcare providers. Tailored systems in healthcare can help handle patient billing, integrate with health records, and manage insurance claims, ensuring both efficiency and data protection compliance.

- Educational institutions. In this case, custom systems enable to cater to tuition fees, donations, and other charges, integrating with student databases for a seamless financial experience.

- Non-profit organizations. They may require specialized systems for handling donations, memberships, and fundraisers, ensuring transparency and donor trust.

- Real estate and property management companies. Custom solutions can streamline rent collections, property sales, and lease payments, integrating with property databases.

- Subscription-based businesses. Tailored systems can manage recurring billing cycles and payments, enhancing the user experience.

- Hospitality and travel industry. Customized solutions can help cater to bookings, ticketing, and reservations, integrating with booking databases and managing multiple currencies.

- B2B businesses. Their unique invoicing and bulk transaction needs can be managed efficiently with custom systems that also handle international digital payments.

- Crowdfunding platforms. With an integrated payment gateway, specialized systems can cater to campaign-specific fund collections and disbursements, ensuring transparency and security.

You may think, why do any businesses even care to get involved with payment gateway software development? After all, some of them may stick with conventional bank-provided solutions, while others, such as e-commerce businesses, can exploit the built-in payment processing provided by platforms like Shopify or WooCommerce. Well, depending on the number of transactions, location of the business, and other factors, companies may opt to implement payment gateway solution for the following reasons:

- Tailoring to specific needs

- Cost efficiency in the long run

- Flexibility and scalability

- Competitive advantage

- Integration with your own software solutions

- Enhanced security options

- Better ownership and control

- Avoiding third-party limitations

- Branding

- Better User Experience

- Regulatory compliance

Typically, larger businesses looking for tailored solutions to align with their unique operational, security, regulatory, or scalability needs can find payment gateway development as a promising investment opportunity.

If you’re comparing custom payment gateway development against managed solutions, review our breakdown of Top 5 Stripe Superior Competitors for Businesses to understand how hosted providers differ from owning your infrastructure.

Core Payment Gateway Architecture

If you are serious about payment gateway development, architecture is where strategy meets engineering. A payment gateway is not just an API endpoint that sends transactions to a processor. It is a layered system that must handle traffic spikes, fraud attempts, regulatory audits, and cross-border complexity — all in real time.

Below is a structured view of a modern custom payment gateway architecture that works both as a developer reference and a decision framework for product leaders.

Technical Components

At its core, a payment gateway consists of three primary layers.

API Layer (REST / Webhooks) This is the external interface of your gateway. It allows merchants or internal products to:

- Create payment intents

- Submit card or wallet transactions

- Receive authorization results

- Listen for asynchronous events via webhooks

A well-designed API layer supports versioning, idempotency, rate limiting, and multi-merchant isolation. For companies building a custom payment gateway development platform, API design directly affects scalability and partner integrations.

Frontend Payment UI This includes hosted payment pages, embedded checkout components, SDKs, or tokenized payment fields.

The UI layer must:

- Minimize PCI scope exposure

- Support SCA / 3D Secure flows

- Enable tokenization for returning customers

- Handle multi-currency and localization

In regulated environments, UX decisions directly impact compliance obligations.

For financial institutions planning broader infrastructure modernization, including regulatory reporting updates, our guide to ISO 20022 Migration: A Guide for Banks and FIs provides additional strategic context.

Backend Orchestrator

This is the brain of the gateway.

It controls:

- Routing logic (which acquirer to use)

- Retry mechanisms

- Smart decline handling

- Fraud rule triggers

- Logging and monitoring

For businesses that want to build a payment gateway, the orchestrator is where competitive differentiation lives. It determines approval rates, latency, and cost optimization.

Security & Fraud Layer

Security is not an add-on in gateway architecture. It is foundational.

Tokenization Sensitive card data is replaced with secure tokens. This reduces PCI exposure and enables recurring billing without storing raw PAN data.

End-to-End Encryption Card data must be encrypted in transit and often at rest. Transport Layer Security (TLS) and strong cryptographic key management are mandatory.

3D Secure / SCA (Strong Customer Authentication) Under PSD2 and similar frameworks, SCA is required for many European transactions. Your gateway must support dynamic authentication flows and exemption logic to reduce friction while staying compliant.

Fraud systems often include:

- Velocity checks

- Device fingerprinting

- Behavioral scoring

- Rule-based and ML-based risk analysis

If you plan on building a payment gateway, understand that fraud logic is an ongoing operational function — not just a technical module.

Compliance Modules

Compliance defines whether your payment gateway can legally operate.

PCI DSS Levels & Requirements Your PCI scope depends on transaction volume and data handling model. If you directly process or store cardholder data, you may fall under higher PCI DSS levels, requiring annual audits and penetration testing.

Reducing PCI scope through tokenization and hosted fields can significantly decrease operational burden.

PSD2 (2025 Implications) In the EU, PSD2 requires SCA enforcement, transaction monitoring, and open banking readiness. Future updates emphasize fraud reporting transparency and liability controls.

Data Residency & GDPR If you operate across regions, you must define where payment data is stored and processed. Data residency rules and GDPR compliance influence infrastructure location and logging policies.

For CTOs evaluating how to build a payment gateway, compliance design must happen before infrastructure deployment.

Integration Interfaces

A payment gateway rarely operates in isolation. It connects to a broader ecosystem.

Acquirer APIs Your gateway must integrate with one or multiple merchant acquirers. Multi-acquirer setups allow smart routing and redundancy.

Wallets & Alternative Payments Apple Pay, Google Pay, PayPal, regional wallets, and alternative methods must be supported through modular connectors.

Reconciliation Engines Transaction reconciliation ensures that authorization, capture, and settlement records match across gateway logs, acquirer reports, and merchant systems.

Poor reconciliation logic leads to financial discrepancies and audit issues.

Architecture Summary Table

| Layer | Purpose | Strategic Impact |

| API Layer | Merchant-facing interface | Partner scalability |

| Frontend UI | Secure checkout experience | PCI scope & UX |

| Backend Orchestrator | Routing & logic control | Approval rates & cost optimization |

| Security & Fraud | Data protection & risk management | Loss prevention |

| Compliance Modules | Regulatory alignment | Legal operation |

| Integration Interfaces | External connectivity | Global scalability |

If you plan to create a payment gateway that competes beyond basic functionality, the architecture decisions you make today will determine your approval rates, compliance exposure, and long-term margins.

How to Build a Payment Gateway From Scratch

For starters, let’s get an insight into the entire gateway payment processing flow:

As we can observe, the online payment gateway system is a fintech solution that is tightly coupled with other participants of the processing flow. Now, let’s review how to build a payment gateway from scratch:

#1 Research & Planning

Before diving into payment gateway implementation, conduct comprehensive market, user, and product research. Take into consideration the following:

- Target audience

- Regional regulations

- Type of transactions

- Types of currencies

- Prevalent payment methods

- Potential user requirements.

Besides, you need to set a clear project scope and budget in this step. The preliminary phase establishes a strong foundation, guiding the subsequent steps and ensuring that your payment gateway aligns with user expectations and industry standards.

#2 Create Your Payment Gateway Infrastructure

Design a robust and scalable architecture. The main elements of an online payment gateway system are:

- Backend architecture. Build a strong fintech server architecture that can handle large traffic levels while maintaining excellent uptime. Consider cloud-based solutions because of their scalability and redundancy.

- Database. Create a safe database system to hold transaction records, user data, and other important information.

- API. Develop or request ready-made APIs that allow your payment gateway to be easily integrated into merchant systems.

You will also need to choose a reliable hosting solution that guarantees uptime and quick response rates. Besides, factor in redundancy mechanisms to handle failures and maintain seamless operations.

#3 Choose a Payment Processor

As I mentioned previously, you don’t need to create a payment processor yourself, as you can choose among ready-made and freely available options on the market. When selecting one, consider their transaction fees, settlement times, supported payment methods, and regions of operation. Ensure the chosen processor aligns with your business needs and can integrate seamlessly with your infrastructure.

#4 Select a Processing Method

Here you can choose between direct processing or using hosted payment gateways:

- Direct processing. When using direct processing, businesses handle transactions right on their website or platform. This means they have full control over the user experience, allowing them to maintain consistent branding throughout the payment process. While this method offers greater flexibility, it comes with the responsibility of handling sensitive customer data.

- Hosted payment gateways. Opting for hosted payment gateways means businesses entrust the payment process to third parties. When customers are ready to pay, they’re redirected to a secure page managed by the payment service provider. Once the transaction is complete, they’re then directed back to the original site. This method alleviates much of the security and compliance burdens of the business.

Guide the choosing between these two options based on the business’s requirements, capabilities, and priorities.

#5 Ensure Security

For a payment gateway, it’s essential to implement end-to-end encryption to safeguard sensitive data. Implementing security protocols like Secure Socket Layer (SSL) certificates ensures encrypted links between servers and browsers. Compliance with standards such as the Payment Card Industry Data Security Standard (PCI DSS) is also crucial, protecting both your business and your customers from potential breaches.

#6 Integration with Banks and Card Networks

To accept digital payments, your custom gateway must seamlessly connect with banks and major card networks like Visa, Mastercard, and American Express. Probably you are not obligated to partner with all the mentioned, but you have to have at least one institution backing you up.

Establishing secure and efficient communication channels with financial entities ensures smooth transactions. Integration may involve API integrations, partnerships, or contracts with banking institutions and card networks.

#7 Interface Development

After all, a payment gateway is a customer-facing software. The user interface (UI) has a significant impact on the experience of a user using your customer payment gateway, for example, to purchase an item from an e-commerce store. An intuitive, well-thought-out interface can help reduce cart abandonment rates and improve customer satisfaction.

Interface development involves creating:

- The merchant dashboard, where businesses can view and manage transactions

- The customer payment interface, which is responsive and accessible across devices

An intuitive, well-thought-out interface can help reduce cart abandonment rates and improve customer satisfaction. At the same time, a good dashboard makes it easier for businesses to work with your system and ensures that they stick with it for a prolonged time.

#8 Testing

Before going live, thorough testing is essential. This involves checking for any vulnerabilities, ensuring integrations work as expected, and simulating transactions to guarantee the system processes payments correctly.

Regularly conducting both manual and automated tests, including stress and load testing, ensures that the custom gateway works reliably and all emerging cyber threats are adverted.

#9 Launch

After exhaustive testing, it’s time to launch the payment gateway. Roll out the system, preferably in phases, to monitor and address any unexpected issues. Inform your stakeholders, especially potential clients and users, about the new gateway and its features.

#10 Ongoing Maintenance and Updates

The modern business environment evolves rapidly. Regularly updating your payment gateway ensures it remains compatible with changing technology, maintains high-security levels, and incorporates any necessary improvements or new features. This involves periodic code reviews, updating software components, and ensuring compliance with any new regulations.

#11 Customer Support

Offering stellar customer support is vital for any service, but especially so for custom gateways where issues can directly impact a business’s revenue. Establish a dedicated team to:

- Assist users

- Troubleshoot issues

- Address emerging concerns.

Providing round-the-clock support, creating comprehensive FAQs, and offering resources like tutorials can significantly enhance user trust and satisfaction.

Payment Orchestration — Powering the Gateway

As payment ecosystems mature, a single PSP or acquirer is rarely enough. Approval rates differ by region, fraud patterns shift, and costs vary depending on routing paths. This is where payment orchestration becomes the next evolution of gateway strategy.

If a payment gateway secures and transmits transactions, orchestration decides where and how those transactions should be processed.

Payment orchestration is a centralized control layer that connects multiple PSPs, acquirers, fraud engines, and routing rules. It enables businesses to dynamically optimize performance, cost, and resilience without rebuilding the gateway itself.

It is important to clarify what orchestration is not. It is not simply retry logic or a backup integration. It is not a basic routing table. True orchestration means making real-time decisions based on BIN data, issuer response trends, transaction type, geography, and historical approval performance.

When implemented properly, orchestration enhances gateway efficiency in three major ways:

Smart routing directs transactions to the PSP or acquirer most likely to approve them. This increases conversion rates.

Automatic fallback ensures continuity. If one processor experiences downtime or declines due to technical reasons, traffic is redirected without user friction.

Cost optimization allows routing based on interchange, cross-border fees, or regional pricing — improving margins at scale.

A practical example is the Eleven Crypto Digital Wallet case. In this project, DashDevs engineered a multi-PSP orchestration layer that handled crypto-fiat transactions across jurisdictions. The system balanced fraud control, cost efficiency, and approval optimization — demonstrating how orchestration aligns architecture with business strategy.

For a deeper breakdown of orchestration mechanics, see our guide.

Tech Stack & Tools Matrix

When founders search for “payment gateway software development” or “how to build a payment gateway,” they are often evaluating technical feasibility. Stack decisions influence scalability, compliance readiness, and operational overhead.

A modern custom payment gateway typically includes:

- REST-based API frameworks (Node.js, Java Spring Boot, .NET Core)

- OLTP databases (PostgreSQL, MySQL) for transactional integrity

- Event-driven messaging systems (Kafka, AWS SQS, RabbitMQ)

- Fraud scoring engines (custom ML or third-party APIs)

- Logging and observability tools (ELK stack, Datadog, Prometheus)

Below is a simplified technical matrix:

| Component | Recommended Tools | Primary Use Case |

| API Layer | Node.js / Spring Boot | High-throughput transaction handling |

| Database | PostgreSQL | Transaction storage & reconciliation |

| Messaging | Kafka / SQS | Event-driven retries & routing |

| Fraud Engine | ML models + risk APIs | Real-time risk scoring |

| Observability | ELK / Datadog | Monitoring & compliance logging |

Choosing tools depends on transaction volume, compliance requirements, and cloud strategy. Cloud-native and event-driven architectures are increasingly preferred for scalability and resilience.

Real Business Examples: Payment Gateways Built by DashDevs

Theory matters — but payment infrastructure proves itself in production.

Below are real-world projects where DashDevs engineered custom payment gateways and orchestration layers tailored to specific industries, regulatory environments, and scalability demands. Each case demonstrates how architecture decisions directly influence performance, compliance, and long-term flexibility.

Digital Assets Trading Platform — Hybrid Fiat & Crypto Infrastructure

A high-performance crypto exchange approached DashDevs with a complex requirement: integrate traditional banking rails with crypto on-ramps while maintaining compliance across multiple jurisdictions.

Business challenge The client needed a payment gateway capable of handling multi-currency authorization, instant settlement, and strict regulatory controls — something off-the-shelf providers could not support due to hybrid fiat/crypto routing.

Solution built DashDevs engineered a custom payment gateway integrated with multiple PSPs, crypto custody systems, and banking APIs. The architecture supported dynamic routing and secure asset handling while maintaining low latency.

Technical approach

- Modular microservices

- Multi-PSP orchestration

- Secure tokenization and encryption

- Event-driven transaction processing

Result High throughput transaction processing, improved approval rates, and stable cross-border compliance operations.

This case highlights when building a custom payment gateway becomes strategically necessary — especially in hybrid financial ecosystems.

Payment App — Consumer Payments Engine with Mobile-First UX

In this project, the goal was to create a secure and scalable consumer payments ecosystem supporting peer-to-peer transfers, wallet top-ups, and merchant checkout.

Business challenge The client needed a payments engine that combined backend reliability with intuitive mobile interfaces and API flexibility.

Solution built DashDevs developed a custom gateway layer responsible for tokenization, 3D Secure flows, real-time balance management, and merchant integrations.

Technical approach

- REST-based API framework

- Mobile SDK integration

- Real-time messaging architecture

- Embedded fraud controls

Result A scalable consumer payment platform with seamless mobile UX and strong PCI-aligned security.

This case shows how gateway development must consider both backend orchestration and frontend API design for broad adoption.

Eleven Crypto Digital Wallet — Payment Orchestration in Action

The Eleven Crypto Digital Wallet required more than transaction processing. It needed orchestration across multiple PSPs to optimize approval rates and settlement costs for crypto-fiat flows.

Business challenge Balance regulatory compliance, fraud detection, and cost optimization across jurisdictions.

Solution built DashDevs designed a bespoke orchestration layer connecting wallet infrastructure, multiple PSPs, and fraud engines into a unified routing system.

Technical approach

- Multi-PSP smart routing

- Automatic fallback mechanisms

- Fraud scoring integration

- Event-driven architecture

Result Improved authorization rates and reduced cross-border processing fees.

This project illustrates how payment orchestration enhances gateway efficiency beyond basic routing.

IOL Pay Hospitality Payment Solution — Industry-Specific Gateway Logic

IOL Pay introduce unique operational challenges — split billing, contactless payments, loyalty integrations, and POS connectivity.

Business challenge Develop a payment gateway capable of handling industry-specific workflows while maintaining PCI compliance and seamless integrations with property management systems.

Solution built DashDevs engineered a specialized gateway integrating POS systems, loyalty programs, and compliance modules.

Technical approach

- Industry-specific workflow logic

- Secure tokenization

- Real-time reconciliation

- Integration with property management software

Result Smooth hotel payment operations with improved risk management and regulatory alignment.

This case demonstrates how payment gateway architecture must adapt to vertical-specific requirements rather than relying on generic models.

If your platform requires multi-PSP routing, advanced fraud logic, or industry-specific workflows, these cases illustrate how a tailored gateway architecture can support growth without compromising compliance or performance.

Cost & Time Benchmarks

If you’re evaluating how to create a payment gateway, budgeting should reflect more than feature count. Costs are driven by compliance scope, transaction volume, orchestration complexity, and long-term operational requirements.

Below is a practical breakdown by development stage.

MVP Payment Gateway

An MVP focuses on validating the core transaction lifecycle:

- REST API for payment creation and authorization

- Tokenization to reduce PCI scope

- Single acquirer or PSP integration

- Basic 3D Secure / SCA support

- Logging and basic reconciliation

Timeline: 3–6 months Team: Backend engineers + DevOps + QA Purpose: Prove end-to-end payment flow and merchant integration

This stage is common for startups or platforms testing a custom payment layer before investing in orchestration or multi-region scaling.

Full-Featured Enterprise Gateway

An enterprise-grade gateway introduces optimization and resilience:

- Multi-PSP and multi-acquirer routing

- Smart decline handling and retry logic

- Advanced fraud scoring and rule engines

- Multi-currency support

- Real-time reconciliation systems

- High-availability infrastructure with failover

Timeline: 6–12+ months Team: Backend + DevOps + Security + Compliance specialists Purpose: Production-ready infrastructure with routing intelligence and cost optimization

At this level, the gateway becomes a strategic revenue optimization engine — not just a transaction processor.

Security & Compliance Work

Security and compliance are major cost drivers and often underestimated.

Includes:

- PCI DSS certification (depending on level)

- Encryption and key management systems

- Penetration testing

- PSD2 / SCA compliance (for EU markets)

- GDPR and data residency alignment

This work runs in parallel with development and continues post-launch.

SLA & Operational Overhead

After launch, maintaining uptime and performance adds ongoing cost:

- Cloud hosting and redundancy

- Monitoring and observability tools

- Incident response and DevOps coverage

- Fraud tuning and chargeback management

- Compliance audits and updates

High SLA targets (99.9%+ uptime) increase infrastructure and staffing requirements.

Example Cost Overview

| Stage | Timeline | Investment Level | Primary Cost Drivers |

| MVP Gateway | 3–6 months | Moderate | Core API, single PSP integration |

| Enterprise Gateway | 6–12+ months | High | Orchestration, routing logic, multi-region |

| Security & Compliance | Parallel & ongoing | High | PCI audits, encryption, regulatory alignment |

| SLA & Operations | Continuous | Recurring | Hosting, monitoring, DevOps support |

The biggest cost increases come from multi-region expansion, orchestration complexity, and compliance requirements — not just adding more payment methods.

Final Take

A payment gateway is a complex, multi-component software that serves as one of the participants in the digital transaction processing workflow. The development of such a custom solution gives businesses and their customers more flexibility in handling transactions online, as well as grants additional business opportunities.

Partnering with a provider of fintech services, including custom payment gateway development and integration, is how you can ensure the success of your project. Let DashDevs, a company with more than 16 years of experience in the market, assist you in this matter. You can reach out to us to discuss the development of a custom payment gateway for your business.