How to Create a Trading Platform?

Trading platforms as a business endeavor can become a way for a fintech business to ride the wave of trends. It is possible to integrate trading elements into fintech applications or even create a fully functional stock trading app as a standalone platform. Developing a custom trading platform that goes beyond basic functionality can provide significant competitive advantages. I can say with confidence, however, that the market is consistent in favorable conditions for trading today.

The current projectile of market size growth for 2024 for the trading platform market is overstepping 10.15 USD billion and is projected to grow steadily to 16.71 USD billion by 2032. The CAGR demonstrated with such a forecast is reaching 6.4%.

In this article, I will focus more on how you can ride the wave rather than how tall the wave is. I will walk you through what a trading platform is, which types you should look at, and, finally, how to build a trading platform as a business owner.

What is a Trading Platform

A trading platform is software that acts as an intermediary connection between individuals and financial markets, enabling investors to sell and acquire assets such as stocks, bonds, or currencies.

Its main function is to monitor live prices and assist the user in finding the best deals among the presented. Overall, it’s a digital interface for managing investment portfolios and accessing market data.

Currently, the vast market is rich with different online trading platforms, such as trading services and other solutions that can assist banks and individual traders by evaluating the fintech market. The workflow of such a platform is relatively simple. But to know how to build a trading platform, you need to know how it works.

Due to complex security regulations, the trading platform requires a specific development approach. With our extensive practical experience with fintech software, DashDevs can enable your clients to trade with the utmost security.

How Does a Trading Platform Work?

The process starts with the user making an account on the trading platform. Then, they make a request or simply follow the presented data in the application to see how the trading platform evaluates the market with the data analytics algorithms it’s equipped with. Usually, the analytics is based on real-time data analysis.

Next are the two most crucial steps: order placement and order execution. These signify the customer’s intent to acquire the asset, send the request to the brokerage office, and inevitably enable trade. Usually, the customer would receive a confirmation after the trade is completed.

Essentially, a stock trading platform acts as an intermediary between the trader and the broker’s firm via a certain configuration of APIs. If you want to know how to build a trading platform, this is something to consider throughout the development process. The image below illustrates how online trading works if executed via a software trading platform.

Types of Trading Platforms

There are several different types of trading platforms available on the global market, and each is usually aimed at different assets or goals. I personally distinguish between the two following types of trading platform software, as they seem to be the most popular as of date. When considering how to build a trading platform, the types of stock trading apps are definitely among the first things to look at.

#1 Traditional stock trading platform

I would call this a golden classic that is most prevalent on the market today. Most trading platforms ultimately follow the classical way of how a stock trading platform functions. These applications, as I’ve pointed out above, connect the user to stock exchanges, allowing them to place orders using the app’s interface.

Among the most popular stock trading apps are: Robinhood and TD Ameritrade.

#2 Cryptocurrency-oriented trading platform

This is an emerging trend among traders and brokers that surely marks the vector of growth for trading platforms. Even Robinhood recently expanded its crypto services towards the European Union, enabling the trade of over 25 currencies in the region. As can be concluded, cryptocurrency trading platforms enable the exchange and acquisition of cryptocurrencies, with some of them also offering storage.

Among the most popular stock trading apps are: Coinbase, Binance, and Kraken.

Regardless of the type you choose, there is a unified process to follow if you want to get a successful custom trading software development. So, let’s take a look at how you can build a trading platform to wow even the most sophisticated users.

How to Build a Stock Trading App

The process of creating a trading platform is similar to some fintech software development processes, although it has its own differences. In this segment, I will delve deeper into the processes, explaining each step based on my own hands-on experience with trading platforms.

#1 Planning and Researching

Defining the target audience for custom trading software should be a little less complicated. You would just need to narrow down the general public of traders. To do so, think about the people who are most likely to use your application.

For example, will they be retail investors or institutional traders? This will greatly help you steer the development of your application by adding niche-specific features.

#2 Defining the Scope of Work

At this stage, I advise you to consider the features of your trading platform. Some of them would be mandatory, such as registration and user profiles, and some might be specific to your niche. I will discuss this in detail later in this article.

You should also pay attention to KPIs and the desired results you want to achieve by the end of the stock trading app development. Whether you want to have a functioning MVP or fully-fledged software, regardless of your goal, you should create a project roadmap and focus on achieving the desired milestones.

#3 Choosing a Tech Stack

Choosing a tech stack for a trading platform can be a bit tricky, and it is generally a better idea to consult with your development partner instead of trying to pick all the technologies remotely without their help. However, if you have a technical background, you can narrow down your search to developers by determining the stack you’ll use.

In my practice, we usually the following technologies are typically used for custom trading software development:

- Front-end: React

- Back-end: Node.js or Python

- Database: PostgreSQL or MySQL

- Cloud Infrastructure: AWS

If you feel like you need professional help when choosing a tech stack, don’t hesitate to connect with your potential partner for fintech consulting.

#4 Choosing an Approach

Software development approach can be crucial, and you should base it on several different factors, such as the team’s experience and project complexity. Choosing between, for example, Agile, a framework focusing on breaking a project into phases, and Waterfall, a framework featuring a linear way of structuring processes, can influence development, affecting both quality and time to market. My colleague recently wrote an article on choosing a software development methodology, a parameter especially useful if you want to know how to build a trading platform.

#5 Forming and Onboarding a Team

First, you need to understand the team composition after you’ve determined the core features and the scope of work in general. It’s impossible to assess the needed roles without specifics of the project, but based on my experience, this is how an average team composed for trading platform development would look like:

- Developers, both frontend and backend.

- UI/UX designer.

- Project manager.

- Business analyst.

- Quality assurance engineer.

- Software architect.

This team configuration can include from 2 to 4 developers and change depending on the projects’ and business needs.

The team would also usually require an onboarding. This process can take anywhere from a week to a month and would usually include establishing communication channels, assessing the team’s skills, and training if required.

#6 Prototyping

Prototyping the trading platform involves creating a wireframe of how your software would look and function. This is usually done by a UI/UX designer. A high-quality useful prototype would typically be a high-fidelity mockup representing the final visual design, and in some cases, the prototype would also undergo some user testing.

You can explore the difference between a prototype and an MVP in another blog post by DashDevs.

#7 System Security

There are several ways to ensure security in your stock trading app, but this step requires precision and extreme attention to detail, as it can determine the overall success of your app and the preservation of your users’ data. I recommend data encryption combined with multi-factor authentication. It is also important to follow the guidelines and implement KYC/AML mechanisms.

To ensure that your trading platform’s security is unmatched, I recommend performing penetration testing. This method of QA would enable you to see how the application would perform in stressful conditions and whether the data is truly protected.

#8 MVP Development

If you decide to start with MVP development rather than going for a full-fledged product from the get-go, you should focus on core features and only implement them. The primary goal of MVP development is to achieve the viability of your product and see the users’ response to it. However, MVP as a software solution would be fully functional and could bring profits to your business until you decide to upgrade.

#9 Testing and Validation

There are several testing methods (aside from the pen testing I mentioned before) that you can perform to ensure not only security but also high performance of your application. Among them are:

- Unit testing.

- Integration testing.

- Functional testing.

- Security testing.

- Compatibility testing.

- API testing.

- End-to-end testing and other types.

When an MVP hits the market, it can function as a hypothesis-testing device to see which features would be best reciprocated by your customers. Treat your customers for trading platform software as the main stakeholders, and always take feedback into account.

#10 Scale from an MVP

If you created an MVP before developing a full-fledged software trading platform, you will need to scale with time. Remember that an MVP gives you an advantage, as you already know what your users want from the app.

Scaling might involve changing some of the features, adding new ones, or even slightly pivoting. Always consider received feedback and try not to overcomplicate your software. Keep your hand on the pulse and step ahead with every new version, carefully considering both your clients and your competitors in software trading platform development.

#11 Launch

After the testing is complete and you are satisfied with the results, the meticulous process of launch starts. It’s the ultimate completion of the trading platform software development process and involves great attention to detail. For example, you need to carefully think through your customer support system and launch a marketing campaign to target potential customers.

#12 Maintenance

In the ultimate question of how to build a trading platform, there is always a question of what to do after your software trading platform is launched. Although the trading platform software development process is officially complete with the launch of your trading platform, it might still need some support in the future.

New version releases, updates, and additional features will require full support from a tech team. From hot fixes to updates and new patches, post-release maintenance is essential and is the responsibility of trading software development companies.

What Functionalities Should a Stock Trading App Have?

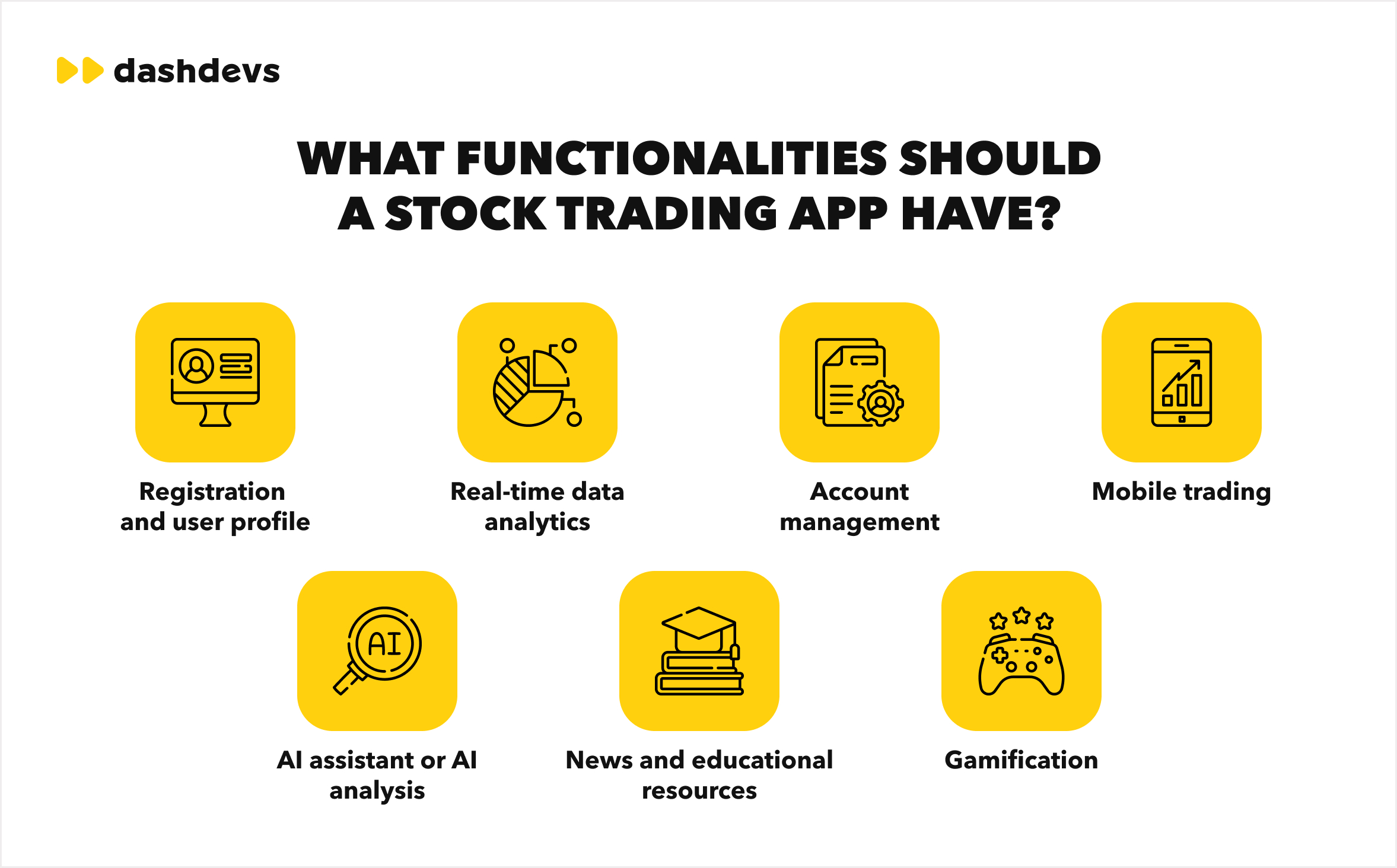

Speaking about an MVP and scaling, it’s important to discuss features a trading platform would have. Several features would be absolutely crucial, while others would be more of a competitive advantage.

- Registration and user profile. Since a trading platform is essentially a management tool and can help users manage their investment profile, it needs to have a personal user page and all that comes with it.

- Real-time data analytics. Trading platforms typically need to analyze the market in real-time, which makes data analytics crucial to them.

- Account and portfolio management. Akin to the user profile, this feature in a trading platform would enable your users to manage their deposits and withdrawals. It would also enable them to view their history and portfolio performance.

- Mobile trading. Given the current trend of mobile applications, making a mobile version of a trading app is a very good idea. This would enable trading on the go and might have several additional features, such as push notifications.

- Order types. A trader can place an order to buy or sell an asset in different ways. Common types include market orders, limit orders, and stop orders.

- Trading dashboard. This feature is a simple user interface that provides real-time market data, portfolio performance, and trading tools.

- AI assistant or AI analysis. Artificial intelligence is a trend everywhere, especially in finance. Some fintech applications offer AI assistance or AI analysis of investing profiles. It can also help users find the most beneficial time for order placement.

- News and educational resources. You can add news on the market’s updates or educational resources to help your users navigate the app or specifics of the modern trading domain.

- Fund withdrawals and deposits. These are the mechanisms for transferring funds into and out of a trading account.

- Gamification. Adding gamified features, such as ratings or mini-games, might encourage your customers to spend more time in the app.

Based on my experience with trading platforms (and with developing them), this list should be comprehensive enough to help you create much more than a viable trading platform. It should enable you to withstand the competition.

Practical Tips for Creating a Trading Platform

DashDevs team has previously worked with both standalone trading platforms and trading functionalities as a part of bigger-scale fintech applications. I’ve compiled all the practical experience we have combined to bring you some high-value professional tips we wish we had known when first dealing with trading platforms.

#1 KYC Should be a Starting Point

Adherence to compliance with regulations should be a priority at the start; otherwise, compliance issues might hinder time-to-market. It’s also crucial to know which region the software is planning to scale to.

For example, Inablr — an investment platform, we started by building a deeper understanding of the regulations of the Islamic capital market and helped them scale and license the product. Now, this platform has segregated bank accounts, which helps them prioritize the protection of the investors’ funds.

#2 Consider Custom APIs Development

To enable trading, you can create a custom API if none of the others fit your requirements. Sometimes, it even would work faster as you don’t have to think about how to fiddle with existing APIs that don’t quite work with your needs.

For Chip — an AI-based mobile investment application, we’ve created an API to enable an easy integration of the customers’ accounts from different banking institutions into the app. The application helps users track their spending and savings and choose the investment initiative that would fit their financial goals.

#3 Make Scalability a Priority

Scalability is an important point during architecture creation and connects to both the number of customers and markets trading platform software services. Consider scalability the foundation of your software, and think about the architecture as soon as you start building the platform.

This is what we did with Downing — an investment management platform currently with over 25,000 investors. Their growth was exponential and vastly disproportionate to the capabilities of the current architecture, so we decided to build an application on a software architecture scalable enough to withstand the growth.

#4 Think About the Geography of Your Market

When scaling, consider more than the general milestone for a number of customers and exponential growth. Keep in mind geography and globalization, the markets you work in, and those you would like to expand to. They would have different regulation requirements and will need significant intervention in integrations between different bank accounts.

I hope these bits of advice will help you create an application that will rock your customers’ worlds. As always, if any questions arise, you can always contact me directly to discuss anything you find confusing or interesting.

Final Thoughts

Developing a trading platform can be a great way to build profits in a modern world of investments and financial achievements. However, creating such a software solution requires precision and robust security, accompanied by high-quality QA and, of course, top-notch development. As with any fintech app, stock trading app development is complex but exciting, and it needs a combination of business and technical outlooks, which a trusted fintech development agency can offer.

DashDevs has been in the market for over 14 years, and we’ve completed 500+ projects, of which over 25 were in the fintech niche. Our experience would allow us to guide you through the trading platform development process and help you skyrocket your business.