How To Start A Small Localized Bank In The UK

How To Start A Small Localized Bank In The UK

Starting a bank used to mean marble buildings, vaults, and hundreds of millions in capital.

In 2026, it means something very different.

If you’re researching how to start a bank, the real question isn’t just regulatory. It’s strategic. You’re not just building a financial institution — you’re designing a regulatory model, capital structure, and product strategy that can survive modern compliance and customer acquisition realities.

The truth is: you don’t always start with a bank. You start with the right model.

Let’s break it down.

Key Takeaways

- Starting a bank in the UK requires choosing the right entry model first — full license, EMI, BaaS, or a staged hybrid path.

- Niche and localized banks are often more viable than mass-market challengers in 2026, especially under rising compliance and CAC pressure.

- Modular architecture and orchestration layers matter more than vendor selection, helping avoid lock-in and future migrations.

- Distribution and unit economics determine survival — without embedded channels and sustainable LTV, even well-built banks struggle to scale.

Why Small, Localised Banks Still Make Sense in the UK

The mass-market challenger era is no longer wide open.

In 2026:

- Regulatory overhead is heavier

- Capital requirements are stricter

- Customer acquisition costs (CAC) are rising

- Digital retail banking is crowded

This is exactly why small, focused banking propositions are often more viable than large retail challengers.

You don’t need to be Monzo to win. You need a defined audience and a defensible niche.

Why Niche Beats Mass-Market in 2026

| Mass Market Strategy | Niche / Localised Strategy |

| Competes on features | Competes on specialization |

| High CAC | Built-in community distribution |

| Broad compliance exposure | Targeted risk model |

| Heavy marketing spend | Trust via focus |

Examples of viable 2026 banking niches:

- Regional SME banking

- Industry-specific financial services

- Diaspora and cross-border communities

- Private banking for defined wealth segments

- Embedded financial services inside platforms

In 2026, small, focused banking propositions are often more viable than mass-market challengers. Regulatory overhead, capital requirements, and CAC reward teams that start narrow and scale deliberately.

If you’re asking, how do I start my own bank? — The first answer is focus.

Choosing the Right Market Entry Model

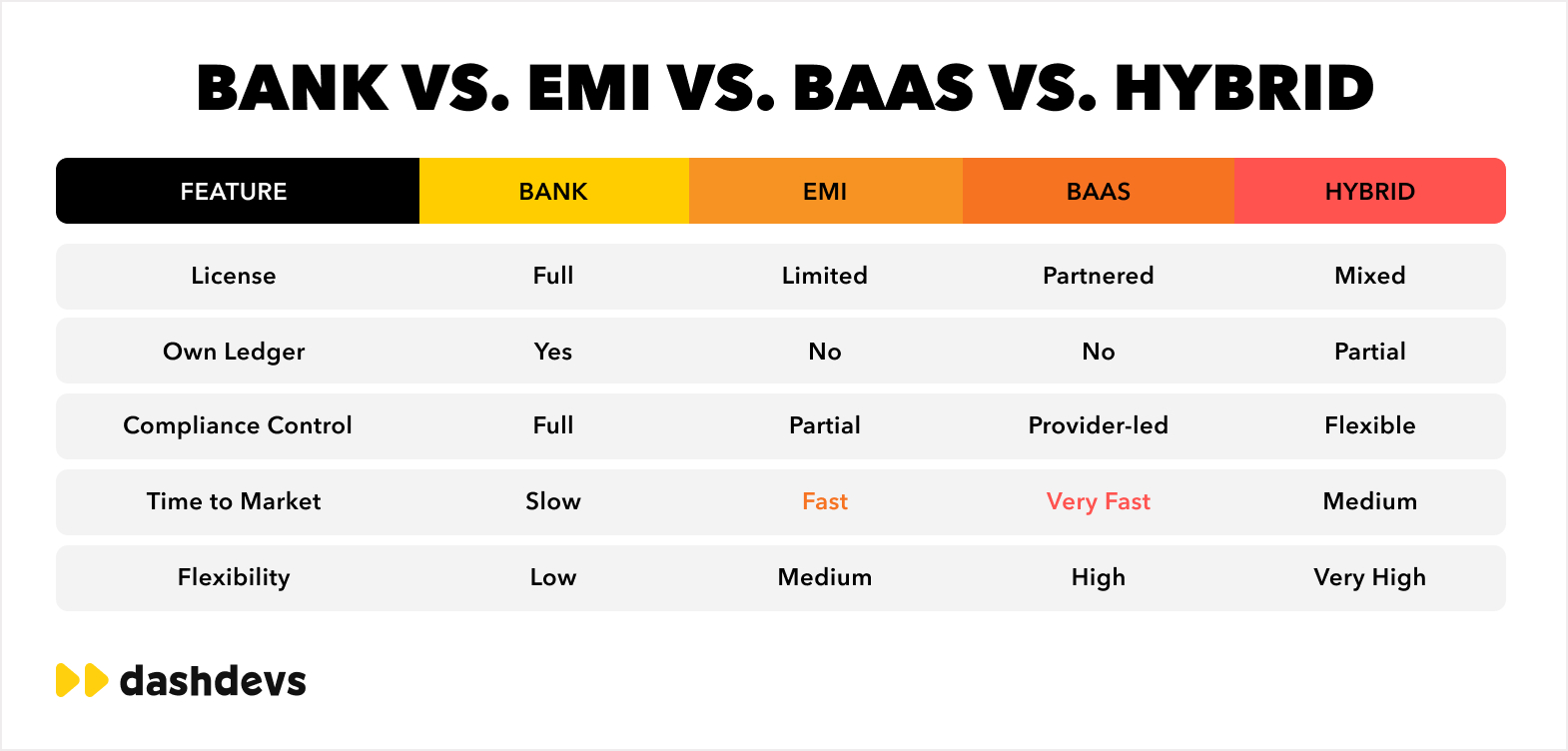

Most founders researching how to start a bank UK assume they must immediately apply for a full banking license. That’s rarely the optimal path. Today, there are four realistic market entry models.

Full Banking License (PRA + FCA)

If you’re asking how do you own a bank in the traditional sense, this is it.

With a full license, you:

- Hold deposits

- Lend from your own balance sheet

- Operate under PRA and FCA supervision

- Control your regulatory destiny

But the commercial reality is significant:

- High regulatory capital requirements

- 2–4 year approval timelines

- Heavy compliance infrastructure

- Large operational teams

This route is best suited for well-capitalised, long-term retail banking ambitions.

If you’re asking how much money do you need to start a bank? — for a UK full license, think in the tens of millions in capital plus multi-year runway.

For first-time founders, this is rarely step one.

EMI (Electronic Money Institution)

An EMI license is often the practical answer to how to start an online bank.

Under an EMI model:

- You can issue e-money

- Offer accounts and cards

- Operate payment services

- Launch within 6–12 months

But:

- You cannot lend from deposits

- You are regulated by the FCA only

- Customer funds must be safeguarded

An EMI allows you to validate your proposition without full banking capital intensity. For many founders asking how to create a bank, this is the first operational version.

BaaS / Sponsorship Model

Banking-as-a-Service is often the fastest route to market. Instead of becoming a bank immediately, you partner with a licensed institution and build on top of their infrastructure.

What this means in practice:

- Launch in 3–6 months

- Lower upfront capital

- Revenue sharing with sponsor bank

- Reduced regulatory burden

This model is especially effective for:

- SME-focused banks

- Localized or community banking

- Embedded finance propositions

- Distribution-first strategies

If you’re researching starting a bank but want speed and capital efficiency, BaaS is often the most realistic starting point.

Hybrid Path (EMI/BaaS → Full License)

This is increasingly common in the UK in 2026. Many challengers now:

- Launch via EMI or BaaS

- Validate demand

- Prove unit economics

- Build compliance track record

- Apply for full license later

This staged approach dramatically reduces early capital burn and regulatory risk.

Regulation & Compliance: What Gets Underestimated

When founders research how to start a bank in the UK, they usually focus on capital requirements and license timelines.

That’s the visible part.

What’s harder — and often underestimated — is operating under regulation every single day.

Whether you apply for a full banking license (PRA + FCA), launch as an EMI, or partner through BaaS, compliance shapes your product, architecture, and growth model from day one.

Here’s where most teams get surprised:

The Hidden Complexity

| Area | What Founders Expect | What Happens in Reality |

| BaaS / Sponsor Bank | Fast launch, shared compliance | Product limits tied to sponsor’s risk appetite |

| EMI Safeguarding | “Light banking” model | No lending from deposits, strict fund segregation |

| AML/KYC Vendors | Plug-and-play onboarding | Throughput limits, false positives, regional constraints |

| Operational Resilience | Basic uptime requirements | Formal third-party risk management, outage documentation, auditability |

For example, under a BaaS model, your sponsor bank may influence transaction caps, onboarding flows, and even certain product features. You move faster — but you don’t move alone.

Under an EMI model, safeguarding changes your balance sheet strategy entirely. You cannot use customer funds the way a licensed bank can. That affects margins, lending strategy, and investor expectations.

And in 2026, regulators expect strong operational resilience — clear monitoring, fallback procedures, and visibility into third-party risk.

Compliance isn’t a box to tick. It’s a structural design decision.

The Tech Stack You Actually Need (and How to Avoid Lock-In)

After licensing, founders usually ask: “Which core banking provider should we choose?”

In 2026, that’s only part of the equation.

You will need a standard fintech stack:

| Layer | Purpose |

| Core Banking | Accounts, ledger, transaction posting |

| Payments | Faster Payments, internal transfers, reconciliation |

| Card Issuing | Physical & virtual cards, tokenization |

| KYC / AML | Identity verification, screening, monitoring |

| Front-End Apps | Mobile & web customer experience |

| Back Office | Case management, reporting, audit logs |

But here’s the key shift:

Differentiation no longer comes from which core you pick. It comes from how you orchestrate everything around it.

Where Lock-In Happens

Many new banks hard-code provider logic directly into product flows. It works early — until:

- You renegotiate commercial terms

- A provider changes API behavior

- You expand into a new jurisdiction

- A vendor outage blocks critical journeys

Then migrations become painful and expensive. Read more on how to avoid vendor lock in traps here.

The Real Differentiator: Orchestration

In 2026, strong banking platforms separate:

- Infrastructure (providers)

- Product logic (what your bank does)

- Compliance logic (risk & regulatory checks)

An orchestration layer sits in between.

| Without Orchestration | With Orchestration |

| Vendor-dependent product flows | Provider abstraction |

| Risk of hard lock-in | Swappable integrations |

| Fragile payment journeys | Stateful, resilient workflows |

| Compliance as add-on | Compliance embedded into flows |

That control layer is what gives you long-term flexibility. Without it, you’re integrating APIs. With it, you’re building a bank that can evolve.

Here you can read more about top banking software providers.

Fintech Core: A Practical Shortcut for Early-Stage Banks

Once founders understand licensing and compliance, the next question usually becomes operational: How do we actually assemble all of this without spending three years rebuilding infrastructure?

Early-stage banks typically struggle in the same places.

Not with branding. Not with product vision. But with operational plumbing.

Back-office systems often lag behind customer-facing apps. Onboarding flows break when identity providers fail. Compliance tooling becomes fragmented. Payment orchestration turns fragile under scale. Reconciliation logic ends up scattered across systems.

None of these problems are visible on launch day. They appear six to twelve months later — when growth begins.

Some teams choose to assemble their own modular banking stack from scratch. Others accelerate early delivery by starting with pre-built banking components and adapting them to their regulatory model and distribution strategy.

A modular banking foundation typically includes:

- Account and ledger management

- Payments orchestration

- Card issuing integration

- Compliance and safeguarding logic

- Back-office tooling Monitoring and resilience layers

When these components are already designed to work together, early-stage banks avoid the most common integration traps.

You can learn more about building white-label bank with modular system.

Where Modular Components Help Most

| Area | Typical Early-Stage Problem | Modular Approach Benefit |

| Onboarding | Vendor bottlenecks | Orchestrated multi-provider logic |

| Back Office | Manual compliance work | Embedded compliance workflows |

| Payments | Fragile API chains | Controlled orchestration layer |

| Partner Integration | Hard-coded dependencies | Abstraction + swap flexibility |

| Regulatory Readiness | Reactive adjustments | Built-in structural compliance |

Time-to-market improves. Regulatory documentation becomes easier to prepare. Partner integrations become predictable rather than painful.

Fintech Core was shaped by exactly these recurring patterns — not as a shortcut around regulation, but as infrastructure logic informed by real delivery constraints.

For early-stage banks, the question isn’t whether to build modularly. It’s whether to build those modules once — or rebuild them repeatedly.

Case Example: Dozens

If you want to understand what assembling a modular banking stack looks like in practice, Dozens provides a strong reference point.

As a UK challenger bank, the product required coordinated integration across:

- Payments infrastructure

- Card issuing programs

- Account management and ledger logic

- Identity verification

- Compliance monitoring

The complexity wasn’t in connecting APIs. It was in orchestrating them under regulatory constraints while maintaining speed to market.

Building a digital bank in the UK means operating within PRA/FCA expectations from day one. That affects how payments are structured, how cards are issued, how customer onboarding is controlled, and how monitoring is implemented.

In Dozens’ case, architectural decisions had to balance:

- Modularity vs speed

- Control vs external dependency

- Compliance depth vs user experience friction

Payments, cards, accounts, and onboarding were not isolated systems. They were coordinated flows.

That orchestration layer became critical.

It allowed the product to:

- Integrate multiple third-party providers

- Maintain regulatory alignment

- Avoid hard vendor lock-in

- Evolve infrastructure without rewriting core product logic

Dozens demonstrates what it actually takes to assemble and operate a modular banking stack for a UK challenger — and the trade-offs teams face when moving fast under regulatory pressure.

It’s not just about building a bank. It’s about building one that can adapt.

Go-To-Market for Localised Banks (Where Most Teams Struggle)

Most founders spend 80% of their energy on product and licensing.

But when starting a bank in 2026 — especially a localized or niche bank — the real differentiator isn’t product quality.

It’s distribution.

You can build the most compliant, beautifully architected digital bank in the UK. If you don’t control distribution, CAC will crush you.

Localized banks win because they start with:

- A defined audience

- A pre-existing community

- A clear reason to exist

Not because they have better UX animations.

Why Distribution > Product

In mass-market retail banking, customer acquisition is expensive and brand-driven.

In localized banking, distribution is embedded.

That can come through:

- Partnerships with local business networks

- Industry associations

- Diaspora communities

- Professional groups (landlords, healthcare providers, logistics firms)

- Digital platforms serving niche sectors

Instead of fighting for generic retail customers, localized banks attach themselves to ecosystems.

The Winning Pattern

| Generic Neobank | Localised Bank |

| Broad target market | Narrow ICP |

| Paid acquisition | Embedded distribution |

| Competes on features | Competes on relevance |

| High CAC | Community-driven growth |

The strongest localized banks in 2026 don’t market like banks. They behave like infrastructure partners inside ecosystems.

If you’re asking how to start your own private bank or how to create a community bank, your GTM model matters more than your feature list.

Commercial Model & Unit Economics

Another common misconception when researching how to start a bank is that interchange revenue will carry the business.

It won’t.

Interchange is thin-margin. It scales with transaction volume, but it rarely builds a sustainable standalone banking model — especially in the UK.

Successful localized banks diversify revenue from day one.

Where Revenue Actually Comes From

| Revenue Stream | Why It Matters |

| Lending partnerships | Higher margin than payments |

| SaaS + banking bundles | Platform monetization |

| Premium features | Tiered pricing strategy |

| B2B financial services | Stronger LTV per client |

| Embedded financial tools | Deep integration into workflows |

If your entire commercial model depends on card spend, your economics will be fragile.

Why Many Localized Banks Fail

Not because of compliance. Not because of architecture.

But because:

- CAC exceeds LTV

- Distribution assumptions were wrong

- Margins were thinner than projected

- Lending strategy was unclear

- GTM execution was weak

In 2026, starting a bank is technically possible. Building a profitable one requires disciplined unit economics. Before asking how much money do you need to start a bank, ask: How will this bank make money sustainably?

What Will Change by 2027–2028

Banking models are evolving quickly. If you’re building now, you need to anticipate what the landscape will look like in two years.

As discussed in Fintech Garden Episode 122, “The Great Unbundling — When Fintech Banks Start Looking Like Banks Again,” Igor Tomych and Dumitru Condrea highlighted a shift already underway:

“Fintechs spent a decade trying to look different from banks. Now the strongest ones are rebuilding the discipline banks always had — balance sheets, compliance depth, and infrastructure control.”

That shift explains much of what we’re seeing in 2026.

Here’s what we expect:

1. Most New Banks Will Launch via BaaS

Full licenses will remain capital-intensive and slow. The majority of new entrants will validate demand via EMI or BaaS before pursuing full authorization.

2. Vertical Banks Will Outperform General Neobanks

Banks built for specific groups — SMEs, landlords, creators, logistics companies — will outperform general neobanks. Focus beats breadth.

3. Embedded Finance Will Beat Standalone Apps

Banking features integrated inside platforms will capture more value than standalone banking apps competing for generic retail users.

Distribution will continue to dominate.

4. AI-Driven Onboarding & Compliance Will Become Baseline

Manual compliance workflows will shrink. AI-assisted onboarding, monitoring, and fraud detection will move from “innovation” to operational standard.

5. Banks Without Orchestration Layers Will Struggle

As providers change, regulations evolve, and commercial terms shift, banks that hard-coded vendor dependencies will face painful migrations.

Modular, orchestrated infrastructure will become a structural advantage.

Bottom Line

Starting a bank in the UK in 2026 is absolutely possible — but it’s no longer about simply securing a license or launching an app.

The real challenge lies in choosing the right entry model, designing modular infrastructure that won’t lock you in, embedding compliance from day one, and building a distribution strategy that keeps CAC under control. Most successful new banks won’t begin with a full license. They’ll start focused, validate demand through BaaS or EMI structures, and scale deliberately with strong unit economics.

In the end, the question isn’t just how to start a bank. It’s whether you can build one that adapts, survives regulatory pressure, and grows sustainably in a market where infrastructure, orchestration, and distribution matter more than ever.