AUGUST 21, 2024

12 min read

How do payments work in your business? Your customers find what they prefer among your products and services. However, will they find a preferred payment method among your company’s supported methods?

Studies show that businesses that offer multiple payment options increase revenue by nearly 30 percent. In turn, companies that accept four or more payment options increase their revenues several times! More than a third of small business customers left without a purchase just because the store did not accept payments in the forms they are used to.

It’s worth looking at how you can expand the range of available payments in your business. The financial sector rediscovered direct payments from bank accounts.

Pay by bank payment method is quickly gaining the favor of consumers and arousing general interest. Not all payment options have a potential user audience in 94% of American households, but pay by bank does.

In this article, I will talk about the features of pay by bank and how you can use the opportunities associated with it in your business.

What is Pay by Bank?

Pay by bank is a streamlined payment solution that allows customers to make purchases or service payments directly from their bank accounts. This method bypasses traditional credit or debit card systems, transferring funds securely and immediately from the customer’s bank account to the business account.

With the pay by bank payment option, the customer purchases or pays for servicing directly from the bank account. This way, the amount goes directly from your bank account into the bank account of the business without the need to use a credit or debit card.

Whether it is product payment, bill payment, subscription services, or loan repayment, you only need a bank account to use the pay by bank method. Your customers may use the pay through account option in their bank’s mobile app, which they are used to.

With this payment method, your company can receive funds from buyers and clients in its bank account. At the same time, to ensure seamless payment receipt and a great customer experience, it is appropriate to integrate pay by bank into your business software solutions.

Such availability determines the immense potential of spreading this payment method. I cited the statistic at the beginning of the article that 94 percent of households in the United States use at least one bank account. Hence, with pay by bank, the vast majority of your new customers will always already have a ready way to pay for your products or services.

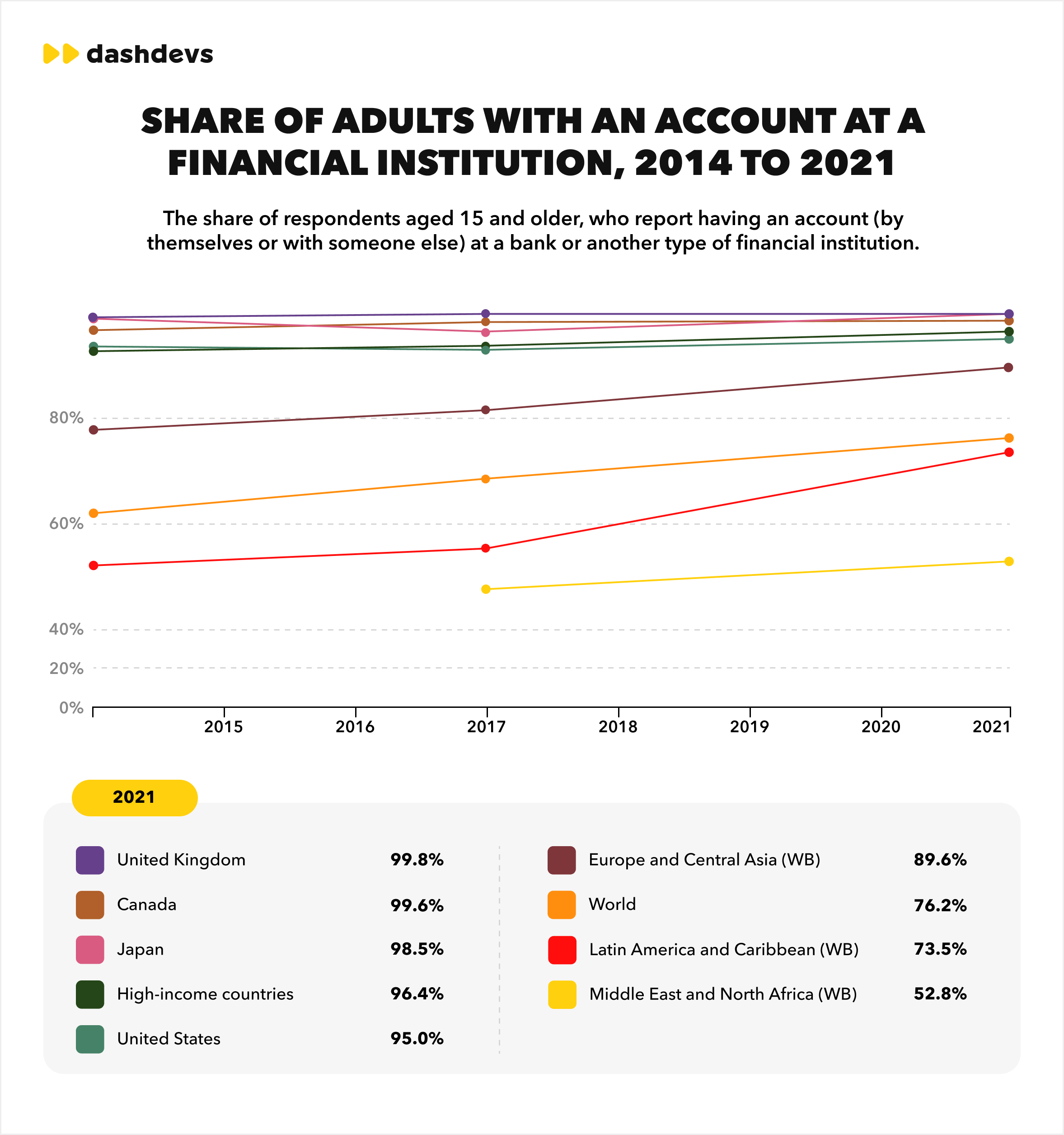

Here’s the World Bank’s data on the proportion of adults who have an account at a bank or similar financial institution.

Pay Through Bank Meaning for Future of Payments

By making an effort to introduce a pay through account in your company, you have every reason to expect that this payment method will continue to be relevant. Analyzing the evolving banking, fintech, e-commerce, and user preferences, you can identify at least three factors that guarantee pay by bank a place in the future of payments:

Pay by bank complies with generally accepted regulations and practices.

Pay by bank aligns with Open Banking and related legislation, particularly the Payment Services Directive of the European Union 2015/2366 (PSD2). Sharing customer data of their choice between banks and other financial institutions through APIs provides a solid legal and technological basis for pay by bank.

Pay by bank meets current payment trends.

Here, for example, we can note the growing popularity of embedded payments, which enable users to make payments without leaving their preferred mobile or web app or website. 44% of surveyed businesses consider embedded payments critical to them in 2024.

Influential user groups drive the popularity of pay by bank.

For example, in the US, almost three-quarters of individuals aged 15 to 24 reported preferring to use mobile banking. According to research, 54% of consumers and 64% of mobile banking users in the UK are ready to make bank payments through open banking solutions.

How Pay by Bank Works

Pay by bank expands your customers’ choice of payment methods, increasing the appeal of your online or brick-and-mortar store. Such customer experience improvement enhances the attraction and retention of clients who prefer to pay by bank account.

The Mechanism of Pay via Bank Transactions

Remarkable authority of pay by bank method is that it relies on widespread existing technological solutions.

Pay by bank payments work with different platforms and technologies, first and foremost:

- Open Banking solutions

- Bank application programming interfaces (APIs)

- Payment gateways capable of supporting direct bank transfers.

Regarding security measures in pay by bank, you don’t have to reinvent the wheel to protect these transactions because the banking sector’s security measures apply to pay via bank payments. At the same time, the participants in operations are obliged to comply with the rules generally accepted in the banking sphere, in particular, Anti-Money Laundering (AML) policies and practices, Know Your Customer (KYC) standards, and others.

Pay by bank payments work in this way:

- Payment request: A customer wants to initiate payment for any product or service he wishes to purchase; he opts for making a payment through “Pay by bank” or “bank transfer.” This option can be available on your e-commerce site, a bill payment portal, or any other kind of online platform.

- Select a bank: The payer can usually select one of the banks supporting this service from a list via a dropdown or search option.

- Customer Authentication: The customer shall be redirected to a secure online environment of his or her bank or asked to log in through a third-party interface. Further verification may be required, including entering the code sent to their mobile, security token, or biometric authentication, such as facial recognition.

- Payment confirmation: The payer checks and confirms the payment details before execution.

- Transfer of funds: Once confirmation takes place, the bank transfers the stipulated amount from the customer’s account to the business account.

- Notification and execution: The payment is completed, and both the customer and the business will be informed. This could be in the form of an email, SMS, or on-screen message.

- Settlement: The bank executes this deal by updating accounts involved in this specific deal.

Paying by Bank: Why It’s Right for Your Business

The pay by bank method is gaining a place in monetary settlements and even claims to be considered the future of payments. Therefore, it’s crucial to comprehend how such payments work and their impact on all parties involved in the process.

Let’s explore the advantages that pay by bank offers to stakeholders in direct settlements—consumers, financial institutions, and merchants—when compared to traditional payment methods like debit or credit cards or digital wallets.

Advantages of pay through the account option for individuals:

- Lower Transaction Costs: Paying directly from a bank account often incurs lower transaction fees than credit card payments, which benefits both the customer and the business. Fewer third-party intermediaries lead to lower overall processing fees and the absence of interchange fees.

- Enhanced Security: Customers authenticate directly with their bank, lowering the risk of phishing and unauthorized access. Since transactions are conducted within the bank’s secure portal, the chances of stolen payment information are significantly reduced.

- Faster Transactions: Some bank-based payment methods can process transactions instantly, unlike credit cards, which may take several days to settle.

- Increased Control: Customers can pay directly from their bank accounts, eliminating concerns over credit limits or interest rates on unpaid balances.

- Lower Risk of Transaction Failure: Direct bank payments usually have lower chargeback risks due to secure authentication, minimizing unauthorized transactions.

- Accessibility: Many bank-based payment systems facilitate more manageable international payments, avoiding the limitations and fees often associated with credit cards. The pay-by-bank method provides access to payment options for individuals without credit cards but with bank accounts.

Advantages of pay by checking account for financial institutions:

- Increased Transaction Volume: Encourages using existing bank accounts for more transactions, boosting overall activity.

- Enhanced Customer Retention and Loyalty: Customers may prefer to use their existing bank accounts rather than opening new ones, fostering loyalty.

- Reduced Operating Costs: Streamlined Process eliminates the need for third-party payment processors, reducing operational expenses.

- Opportunities for Innovation: The rise of pay by bank fosters innovation, with financial institutions developing new features to enhance the customer experience.

- Increased Security Focus: As pay by bank grows, financial institutions efficiently protect customer data and prevent fraud.

Advantages of pay via bank for merchants:

- Lower Fees: Merchants benefit from lower fees associated with direct bank transfers, potentially saving millions annually compared to credit card fees. Card payment processing fees can vary by country, industry, and card type, but rates of up to 3.0% in the US and Canada and up to 3.5% in the UK encourage merchants to seriously consider the benefits of pay by bank.

- Durable Recurring Payments: Bank accounts don’t expire like credit cards, reducing churn for recurring payments like subscriptions and bills.

- Insights and Flexibility: Merchants can customize payment processes more freely with direct bank payments, gaining insights into declined transactions. Pay by bank is a digital alternative to cash, useful in scenarios where card payments may not be practical enough.

At the same time, you should consider that the pay-by-checking account method has disadvantages like any other method. Individuals may need more rewards programs, such as cashback or points, which are typical for payment card systems.

Financial institutions may face additional administrative workload due to increased payments through accounts. Merchants may incur extra costs for integrations and upgrades of their software systems, and they should be aware that it will take some time for some customers to get used to pay by bank.

Setting Up Pay by Bank for Your Business: Step-by-step Guide

To implement the pay through account method in your business, I have prepared a step-by-step guide that will help you make this process as smooth as possible:

Steps to Enable Pay by Bank Payments

- Choose the right technological solution: Whether open banking solutions, bank APIs, or a dedicated payment gateway, decide what will work for you. This shall be based on your technical capabilities and required features such as real-time processing or multi-currency features.

- Integrate with your website or app: You will need to integrate the pay by bank option, for instance, into your web platform or mobile app. Make sure the user interface is intuitive and the payment is seamless. Payment integrations have many subtleties, and it is generally advisable to involve teams of software engineers with experience in such projects to help you bypass the pitfalls and achieve the desired result.

- Set up customer authentication: Add secure authentication protocols to verify customers’ identities. This step is critical in reducing fraud and ensuring transaction security. At the same time, you should aim to make the authentication process convenient and understandable for payers. Following the best practices of KYC services will help balance security requirements and user-friendliness of pay via bank solutions.

- Configure payment settings: Configure your payment settings to add the pay by bank option next to other payment methods. Make the checkout process smooth and easy by instructing the user to proceed with a pay-by-bank transaction. Set up notifications for you and your customer after a successful or failed transaction.

- Test the payment process: Test rigorously to ensure the pay by bank method works as expected across all devices and platforms. Testing must include failed payments and successful transactions to ensure a smooth customer experience flow.

- Train your staff: Train your customer service and technical support team members about how the pay by bank process works. Be prepared to answer a flurry of customer queries.

- Update your terms and conditions: Update your terms of service and policies to include pay by bank. This should explain the payment method and how this may affect a customer.

- Share it with your customers: Let them know that you will now offer this new payment option, whether through email newsletters, social media, or your website. Emphasize the reduced fees and enhanced security features that it can use.

- Monitor and optimize: Monitor very carefully the transaction data and customer feedback immediately after the implementation. Use this information to further optimize the process, correct any issues that may appear, and ensure that the pay by bank option works to satisfy all your business needs and all of your customers.

Taking the steps I recommend will help you not only implement the functionality of pay by the bank for your business but also overcome users’ prejudices and lack of awareness about this payment method, as shown in surveys.

Expert Tips for Effortless Pay by Bank Integration

Like any digital business solution, pay by bank requires a thorough study of the needs of your client audience. Here is what is of primary importance for service users to pay through bank:

Following these proven tips will help you meet the demands of your customers when you offer them the option to pay via bank:

Managing transaction reversibility and chargebacks

Establish clear dispute resolution protocols and provide robust customer support. Ensure that processes for refunds or adjustments are in place to address errors or customer dissatisfaction effectively.

Tighten security measures

Users must be conversant with good security practices and the risks of phishing. Implement multi-factor authentication and biometric verification for added security, with safe communication protocols. Enforce regular security audits of the payment platforms to detect and resolve any possible vulnerabilities.

Ensuring cross-border compatibility

One of the attractive features of paying through a bank is the ability to provide financial settlements across borders. However, the differences in regulatory norms in different countries and regions must be taken into account.

Work closely with banks and financial institutions and engage the technical experts that help you comply with regulatory and licensing requirements in the areas where your business operates.

Providing seamless and uninterrupted payments

When introducing a pay by bank option, your business needs to have smooth interaction with banks and settlement systems. Implement reliable payment gateways, take care of updating your legacy systems, and integrating the pay by bank payment method with your internal corporate software.

At the same time, payers should not consider how many links money passes between their and your accounts while they watch on their devices how quickly it happens. You can involve developers that will take care of payment gateways, software system integrations, and other things you need under the hood of user-friendly pay by bank solutions for your business.

Enhancing user experience

Simplify the payment process by leveraging open banking and API integration to streamline the user interface, reducing the steps needed to complete transactions.

Remember that, for example, in 2023, two-thirds of the U.S. population used online banking, and this number is estimated to exceed 79 percent in 2029. In the United States, 43.5% of households use mobile banking as their main way to access bank accounts.

Consider updating or launching a user-friendly app for your bank or business to ease the customer journey further. An experienced engineering team can tailor pay by bank software solutions to your business’s unique specifics and goals.

Keep in mind a possible cooperation for introducing the pay through account option

The prospect of pay-by-bank settlements creates the ground for partnerships and collaborations in this area, among which, most likely, the following are possible:

- E-commerce platform integration: E-commerce platforms are progressively incorporating pay by bank as a payment option, offering customers a streamlined and secure way to pay.

- Fintech and Bank Partnerships: Fintech, retail and services companies can collaborate with traditional banks to develop cutting-edge pay by bank platforms, blending technology and financial expertise.

Pave Your Business’s Path into the Future of Payments with DashDevs

Engaging with an expert fintech team is crucial for successfully launching new payment solutions. DashDevs offers the specialized knowledge and state-of-the-art technology to bring your business vision to life.

Contact us today, and let’s create a financial software product that surpasses your customers` expectations.