JUNE 26, 2023

9 min read

The financial industry has changed a lot as a result of the behavioral economics and fintech blend. Thanks to knowledge of how people act and make decisions, businesses now can build solutions of any kind to satisfy the demands and preferences of very different clients.

In this in-depth guide, I will cover some of the main points on how fintech businesses may utilize behavioral economics data. By exploring how these technologies facilitate the elimination of barriers to adoption and the creation of customer-centric solutions that align with individuals’ inherent biases and preferences, you can gain a deeper understanding of how to enhance predictive capabilities of your fintech business and make more informed decisions about customer transactions.

Understanding What is Behavioral Economics

Behavioral economics is the study of making decisions. It has been extensively embraced by marketing, commercial, and talent teams, and even governments since it has been shown to be effective in market tests and in real-world circumstances.

To apply behavioral economics to product design, you should first understand the mechanisms behind human acts. This process includes controlled research and hypotheses about human behavior.

Behavioral Economics Definition in Fintech

Behavioral economics is particularly useful in the banking industry because of the strong emotional responses people have to money and finances. Even when clients believe they are acting logically, emotions are always there.

To assist banks in making informed decisions about customer transactions and enhance their predictive capabilities, businesses should consider their clients’ moods. Instead of attempting to alter human nature, fintech businesses may study it and design digital banking solutions that affect decisions and steer users toward better ones.

Examples of Businesses Using Behavioral Economics

In my experience, the implementation of behavioral economics has been most prevalent in the fintech, healthcare, and UI/UX industries. Among some notable examples are:

- Qapital: A mobile app that uses behavioral economics to help users save money for specific goals. The app allows users to set savings goals and then uses “nudge”, behavioral economics term that encourages people to save more. For example, the app might suggest that a user set up a “guilty pleasure” rule where a small amount of money is automatically transferred to their savings account every time they spend money on something they consider to be a guilty pleasure.

- Merill Lynch: An investment bank, employed a unique approach to encourage retirement planning by allowing users to upload photos of themselves and see how they would age over time. This feature led to users taking more responsibility for their financial future and subsequently changing their behavior.

- Robinhood: Robinhood is a commission-free trading app that aims to make investing more accessible to the general public. One of the ways the app does this is by using behavioral economics to reduce the barriers to entry for new investors. For example, the app uses a “gamified” interface that makes investing feel more like a game, which can appeal to younger, less experienced investors.

Although it is evident that many startups are utilizing behavioral economics, larger financial institutions have yet to take full advantage of its benefits. With access to data on millions of customers, these institutions could greatly benefit from testing and implementing insights gained from behavioral economics.

The potential for creating innovative products and finding new revenue streams is enormous, and I firmly believe that if all banks and financial institutions could recognize the potential of behavioral economics, the entire banking industry would be transformed.

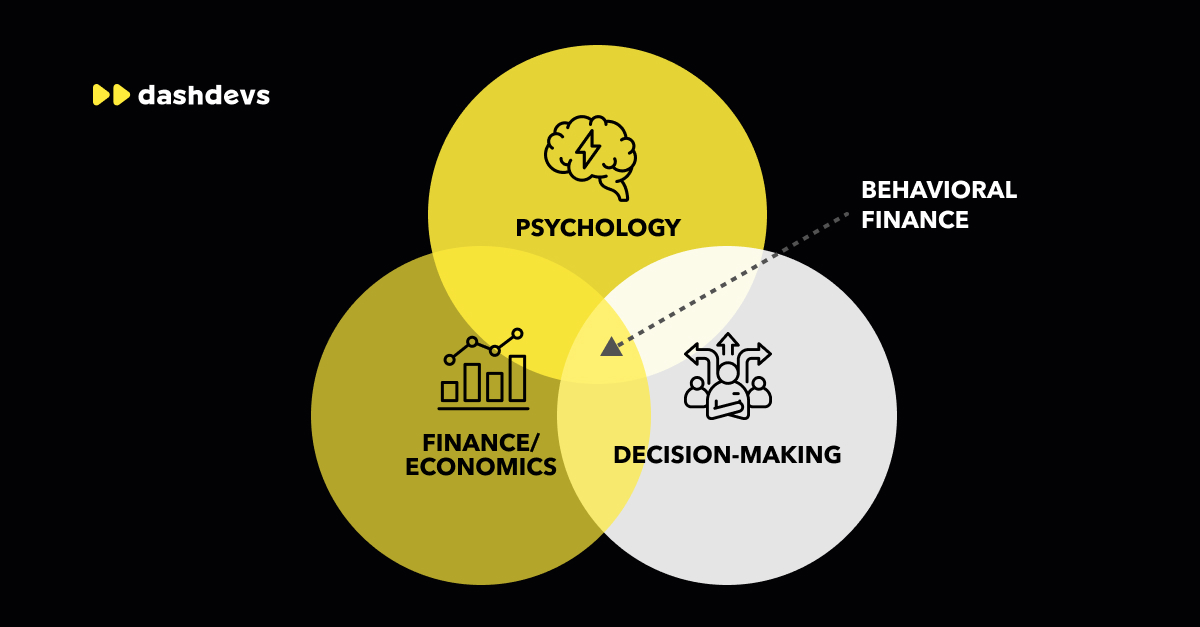

What Behavioral Finance Is

Behavioral finance assumes that financial participants are not always rational and self-controlled but rather influenced by psychological factors and tendencies. The decision-making of people often depends on their mental and physical health, as their overall well-being can impact their rationality towards financial issues. In the field of behavioral finance, one of the main areas of study is bias.

Bias occurs when an individual makes a decision that may not be well-informed, driven by their past preferences and deeply ingrained beliefs.

Cognitive bias takes us away from rational choices as we become influenced by non-economic factors such as emotions, prejudgements, fears and fantasies. In other words, our decisions can be clouded by subjective factors rather than purely objective reasoning. Understanding these biases is crucial for designing effective fintech products that account for human behavior and enhance user experiences.

Let’s move on to the concepts of behavioral finance so you can better understand these biases. They arise from various factors and are typically classified into five different types.

5 Concepts of Behavioral Finance

Within the field of behavioral finance, there are five main concepts that are studied:

- Mental accounting: People tend to allocate money for specific purposes, even if it may not be the most rational choice.

- Herd behavior: People often mimic the financial behaviors of the majority, which can lead to dramatic rallies or sell-offs in the stock market.

- Emotional gap: Decision-making can be influenced by extreme emotions such as anxiety, fear, or excitement, which can lead to irrational choices.

- Anchoring: Spending can be attached to a certain reference, such as a budget level or satisfaction utility, leading to consistent or rationalized spending.

- Self-attribution: Individuals can make choices based on overconfidence in their own knowledge or skill, even when objectively falling short. This often stems from an inborn talent in a particular area, leading to ranking one’s knowledge higher than others.

Leveraging Behavioral Biases

Let’s move on to six behavioral biases that fintech companies leverage to improve the user experience and boost their offerings. If you get how important these biases are and capitalize on them, your fintech business will attract users, establish credibility, simplify complex concepts, deliver instant gratification, and create a sense of exclusivity with greater efficiency.

Attractiveness of Free

People love getting free items when making decisions. Fintech companies capitalize on this by offering free features to lure users into hitting the “Download” or “Sign up” button.

Example:

- Robinhood offers commission-free trading and the first stock for free to new customers.

- Mint Banking has the word “free” mentioned seven times on its homepage to encourage visitors to sign up for an account.

- Coinbase offers up to $32 worth of crypto when a new user starts earning with them.

- Revolut previously sent out debit cards to new users for free.

TAKEAWAY: budget for the freebies.

Social Proof

People tend to want a product or a service when they know that others are already using it. Fintechs take advantage of this psychological bias if they ensure that customers see how many people use certain features or items.

Example:

- Revolut’s “send money to friends” feature is a convenient way to pay without the hassle of entering bank account details because all your friends’ phone numbers are already on your phone.

- Lemonade fuels new user sign-ups with raving testimonials, all verifiable on Twitter.

- Venmo takes social proof to a whole new level with its social network feature.

TAKEAWAY: paint a vivid picture of the popularity of your service.

Authority

In decision-making, people tend to trust influencers and outsource some of their efforts to field experts. Fintechs work hard to be featured in relevant media outlets and get endorsed by established professionals, as this builds business’ legitimacy.

Example:

- Mint is known for being backed by heavy-hitting media outlets like the New York Times and Business Insider.

- Coinbase boasted a list of investors on their homepage to showcase their legitimacy.

- Lemonade goes all-in with Dan Ariely as their chief behavioral officer, which builds authority.

- Stripe partnered with Elon Musk and Jack Dorsey to promote their services. These influential figures’ endorsement helped to solidify Stripe’s authority and attract a wider audience.

- Revolut collaborated with financial experts such as Warren Buffett and Mark Cuban to endorse their innovative products. The association with these respected individuals has significantly boosted Revolut’s credibility and positioned them as a trusted player in the fintech industry.

TAKEAWAY: promoting the product through well known and respected individuals to endorse your business.

Category Heuristics

**Heuristics **are mental shortcuts that our brains use to solve problems and make judgments. People prefer simple categories over complex intertwined concepts from financial math. That’s why fintechs write in simple English, easy to understand for anyone.

Example:

- Robinhood explains stock markets in simple terms.

- Wise’s money-sending calculator has two headlines: “You send” and “Recipient gets”.

- Venmo uses everyday speech terminology like “getting money to you”.

TAKEAWAY: test your messaging with customers and aim for a 7th grade level in English.

The Power of Now

Immediate gratification is preferred over delayed satisfaction. Fintech companies excel at delivering instant results by utilizing the speed of digital transactions.

Example:

- Revolut provides users with a virtual card as soon as they sign up, enabling immediate online shopping before the physical card arrives. Their in-app ID verification process streamlines account opening, contrasting with the lengthy procedures of traditional banks.

- Venmo’s one-tap checkout button at webshops saves users time and enhances transaction convenience.

- Robinhood provides users with near-real-time information on market trends, filling their locked phone screens with notifications.

TAKEAWAY: identify and emphasize aspects of your product or service that deliver instant gratification.

Scarcity

While fintech companies aim for scalability, they also understand the value of scarcity in driving demand. Limited availability or time-sensitive offers can increase interest in a product or service.

Example:

- Robinhood previously employed an email signup waiting list to grant early access to investing in fractional shares, creating a sense of exclusivity.

- Similarly, in its early days, Revolut operated as a closed community accessible only to members who joined via email, generating a feeling of limited access.

- Venmo regularly introduces time-limited cashback offers at selected merchants, constantly changing them to provide surprises and novelty.

TAKEAWAY: incorporate variability and impose quantity or time limitations.

Key factors When Incorporating or Expanding Behavioral Economics

#1 Engage Top Management

Gaining support and commitment from top management is essential for successfully implementing behavioral economics initiatives. The leadership team should prioritize the development of impactful projects, training programs, and targeted initiatives across various areas. They must establish clear direction, define objectives, specify the number of employees to be trained, and set expectations for the application of the methodology.

#2 Gradual Implementation

Transformation in banking takes time, and initial behavioral economics projects need not aim for an overnight revolution. Striking a balance between generating significant impact and managing resources is crucial during the early stages. This phase is an opportunity to build internal credibility. EY-Parthenon’s experience shows that projects lasting between two and three months can achieve substantial outcomes.

#3 Not Everyone Needs to Be an Expert

While it is important for the organization to have a basic understanding of behavioral economics, not every individual needs to be an expert. The practical application varies across business areas, such as accounting and risk. Consequently, designing training courses at different levels, including online options, can cater to diverse needs. Additionally, certain teams may be more involved in behavioral economics projects than others, as discussed in the next point.

#4 Establish a Structured Framework

With the agile restructuring prevalent in banks, expanding behavioral economics to different teams becomes more feasible. It’s vital to establish a knowledge center and assign expert personnel to lead projects within multidisciplinary teams. Banks should determine how these experts collaborate with other team members, such as product owners or user experience (UX) specialists, fostering an effective working environment.

#5 Engage Key Teams

While not everyone needs to be an expert, involving key individuals who drive significant projects is essential. Identifying influential personnel, such as the digital transformation or marketing director, is crucial to gaining their active participation. Likewise, engaging the human resources department, particularly the training coordinator, can play a pivotal role in the implementation process.

Tap into BE Power for Improving User Experience

Understanding how people engage with your product or service provides valuable information and helps you read their motivations. This knowledge empowers you to create effective strategies that can inspire significant changes in behavior. In the world of advanced financial tools, people can easily plan their financial futures, making smart decisions with the resources they have. That’s why it’s important to pay attention to behavioral economics and stay updated on current trends.

By linking spending and saving across different accounts, these innovative leaders help people see the bigger picture, making it easier to avoid harmful financial choices. Hence, I am very excited to witness the advancements Neobanks will introduce, revolutionizing the financial landscape in ways we’ve never seen before.

If you need more information on behavioral economics or a consultation for your business, don’t hesitate to book a call! It’s always a pleasure for DashDevs experts to speak with great minds.