From Compliance to Opportunity: Building Value with SEPA Instant Payments

For years, Europe’s payment rails have been fast, but not instant. That changed in 2025 with the Instant Payments Regulation (IPR).

From January 9, 2025, FIs in the eurozone must be able to credit a payee’s account within 10 seconds, any time, any day, without charging extra fees. From October 2025, the same applies to dispatching instant payments.

Non-eurozone payment institutions and those operating under an e-money license get a brief reprieve—until 2027 and 2028, respectively.

This shift isn’t trivial. To conjure instant payments, FIs need to comply with a stack of new regulatory, operational, and technical requirements.

“For many financial companies, IPR means rethinking everything from core banking architecture to liquidity management to enable 24/7/365 availability, zero downtime, real-time fraud checks, name verification, and daily sanctions screening. Often, that’s about as easy as knitting a sweater with spaghetti”, says company spokesperson.

So why should you go instant with payments—and, more importantly, how do you do that? Get the answers to these questions (and more!) from this briefing.

TL:DR – Key Insights

- SEPA instant payments are euro transfers that arrive in ten seconds or less, any time of day, including weekends and holidays, with no additional fees compared to standard SEPA transfers.

- SEPA instant payment implementation deadlines were January and October 2025 for eurozone-based institutions. Non-eurozone payment firms and e-money institutions have deadlines pushed to 2027 and 2028.

- SEPA Instant payments require continuous system availability, ISO 20022 messaging, Confirmation of Payee, daily sanctions screening, and automated fraud detection.

- The key benefits of instant payments include better SME cash flow, faster supplier payments, instant consumer disbursements, and improved treasury visibility.

- PSPs and fintechs can integrate instant payments by upgrading existing systems, adding a parallel instant payments layer, or adopting a cloud-native instant payments platform.

The Business Case for SEPA Instant Payments Adoption

Consumers are already conditioned to expect everything—from groceries to gig work payouts—immediately. Businesses are catching up, too, especially SMEs.

Among EU-based SMEs, 44% believe that instant payment regulation will save them money, and 27% think it will improve their cash flow. For SMEs, that expectation translates directly into operational efficiency. With money becoming visible and usable in real time, the treasury stops lagging behind transactions. Businesses can pay suppliers instantly and return funds to customers without delay.

Likewise, consumers are swayed by the prospects of instant payouts from employers, lenders, online marketplaces, and government bodies. Three-quarters of those who rely on disbursements for their core income would love to receive those payments instantly. This consumer appetite is creating a strong pull for providers — employers, fintechs, and marketplaces — to offer instant payouts.

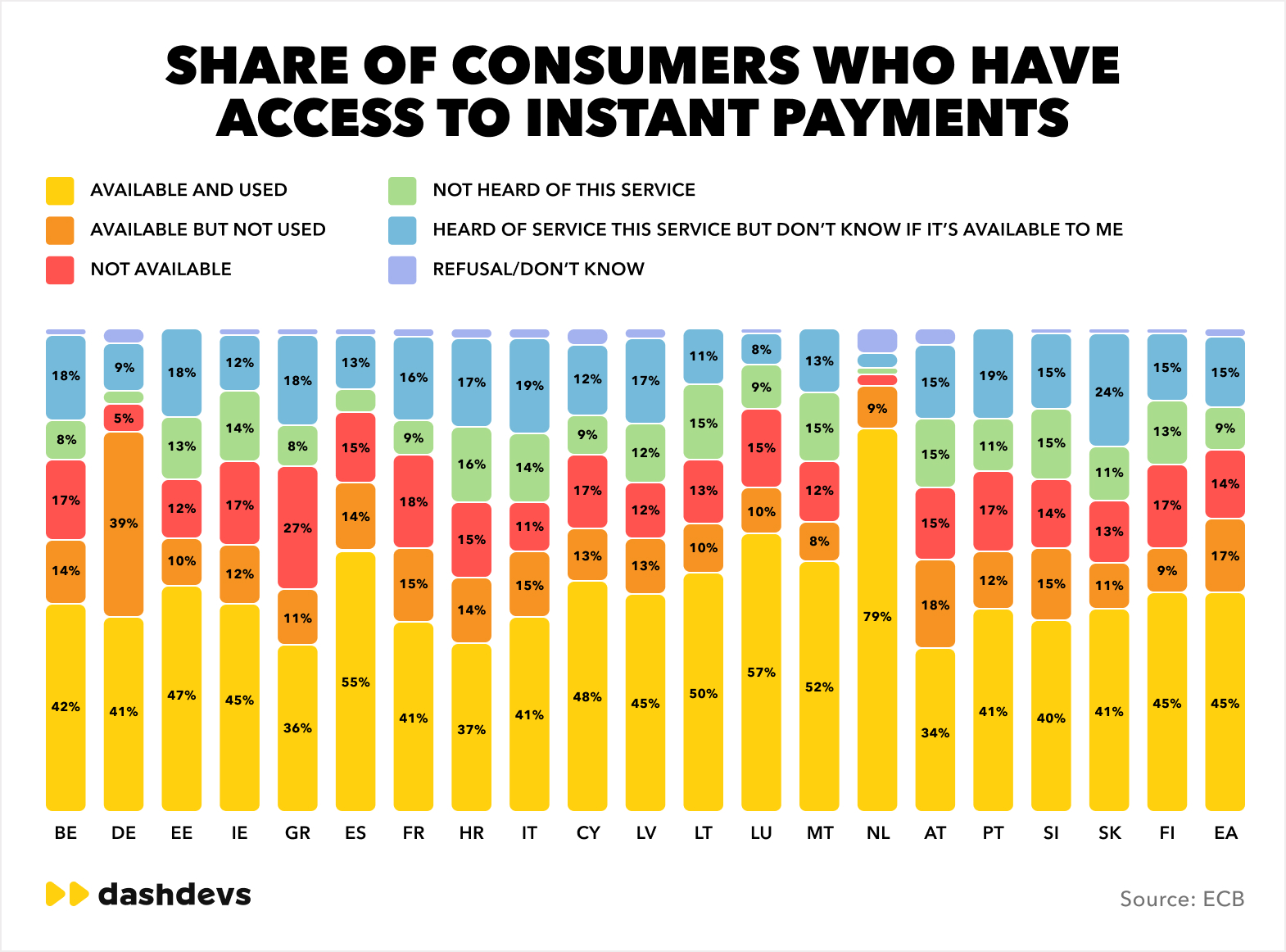

Yet, only a fraction of Europeans have access to or use instant payments.

To date, SEPA instant payments have been implemented mostly by major institutional banks in the eurozone. Digital banks, payment services providers, and other fintechs, especially outside of the eurozone, have yet to catch up.

For most adopters, the priority has been clear: re-architect the core banking systems to support instant payment processing. Few looked beyond that, into launching new financial software, built on top of instant payment functionality.

But that’s where the upside is. Instant payments are becoming Europe’s next financial rail — one that links markets, simplifies settlement, and opens fresh profit lines.

Untapped instant payment use cases

Instant refunds for e-commerce

Real-time treasury management for corporates

Optimized payroll processing

Streamlined public-sector disbursements

Faster B2B supplier payments

Real-time bill payments

Accelerated claim settlements

Real-time point-of-sale reconciliation

Each of these use cases represents a new monetizable rail. For PSPs, EMIs, and other fintech builders, the next two years are about getting their systems, compliance, and liquidity ready for this new era.

How instant payments in the EU work

The EU Instant Payment Regulation (EU) 2024/886 provides a single playbook for implementing instant payments.

The process relies on three key elements:

- SEPA Instant Credit Transfer (SCT Inst) scheme

- TARGET Instant Payment Settlement (TIPS)

- Integrations with national clearing systems

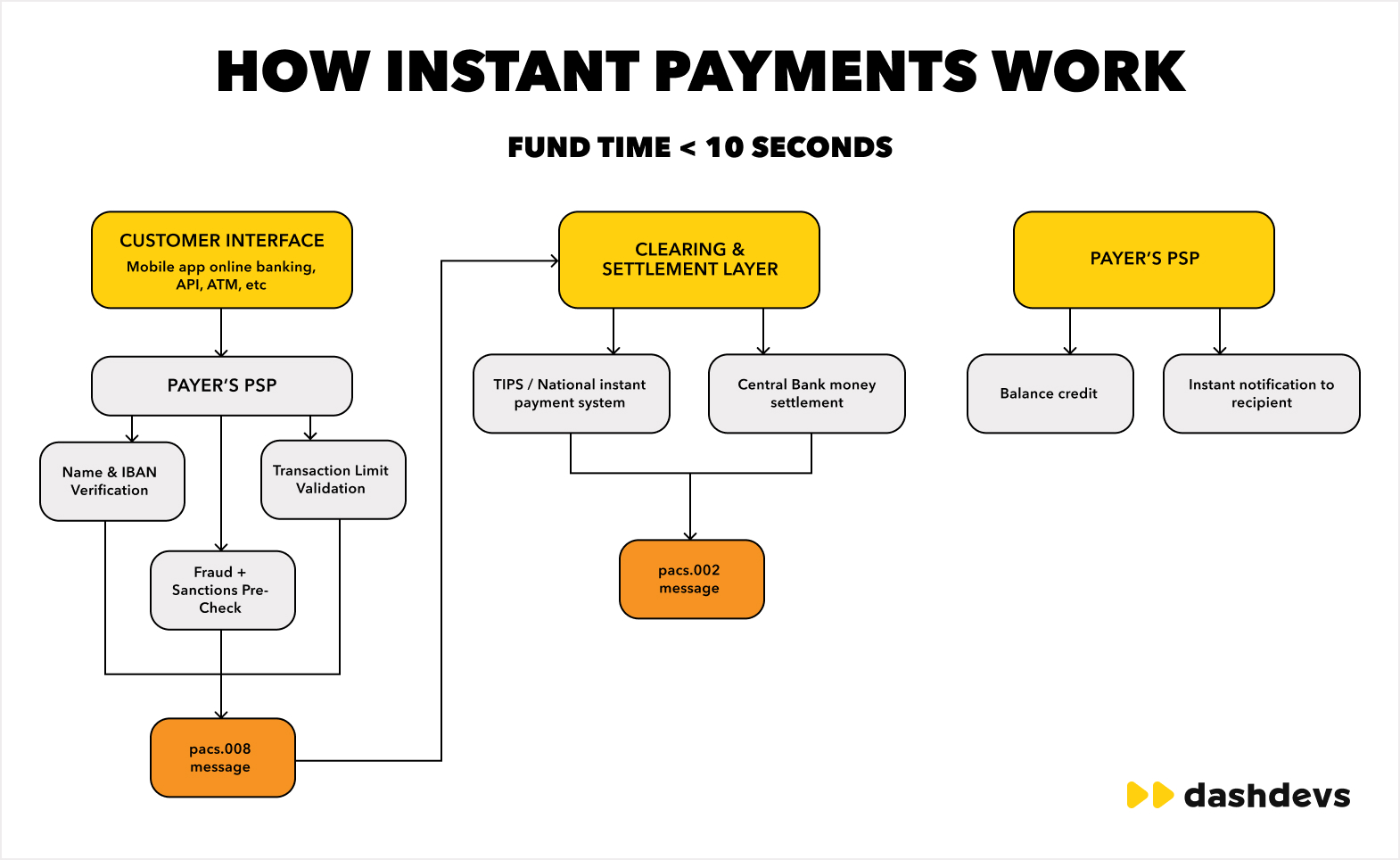

Here’s how an instant payment flow looks:

The payer can initiate an instant SEPA transfer via any available channel — mobile or web app, ATM, or any third-party product with an embedded API connection.

The payer’s PSP runs the name/IBAN match (Confirmation of Payee), screens for sanctions and fraud red flags, and checks customer-set SEPA transfer limits. If all’s good, the PSP sends a pacs.008 message to the clearing and settlement layer (typically TIPS or a national instant payments system) for processing.

The settlement engine validates and settles the transaction instantly in central bank money, crediting the payee’s PSP within seconds.

The payee’s PSP then confirms receipt with a pacs.002 acknowledgment message, updating the recipient’s account balance in real time. If no confirmation arrives within 10 seconds, the transaction automatically reverses — as if it never happened.

What Do You Need to Implement SEPA Instant Payments?

Unlike traditional SEPA payments that batch and settle in cycles, instant payments are continuous. You can’t mandate service cut-off times, business-hour limits, or premium fees for the service. The system must also remain operational 24/7/365, with only minimal planned maintenance windows allowed.

Under the new rules, any financial institution — chartered bank, e-Money, or payment company — can plug into the designated settlement systems directly, provided they meet safeguarding, governance, and IT continuity requirements.

Key Instant Payment Implementation Requirements

- 24/7/365 availability. Systems must operate continuously with no cut-off times. Planned downtime is only allowed for brief maintenance and must be minimized.

- 10-second settlement. The payee’s account must be credited within 10 seconds. If confirmation isn’t received, the transaction must be automatically reversed.

- Equal pricing. Instant payments must cost the same as regular SEPA transfers. No premium fees are allowed.

- Multi-channel interoperability. Instant payments must be available through every channel customers use for standard SEPA transfers — mobile app, online banking, ATM, or branch.

- Batch and file support. If a PSP supports batch or file-based transfers, it must also support the same for instant payments under identical conditions.

- Customer-set transaction limits. Users must be able to set and adjust maximum transfer limits (per transaction or per day) at any time, with a max transaction cap of €100,000.

- Confirmation of Payee (CoP). PSPs must verify the match between a payee’s name and IBAN before executing an instant SEPA credit transfer and warn users of discrepancies.

- Sanctions screening. All customers must be screened once per day against EU sanctions lists, but real-time checks during transactions are not allowed to delay execution.

- Real-time fraud monitoring. PSPs must use automated tools to detect anomalies, behavioral patterns, or device irregularities that signal fraud within milliseconds.

- Structured address enforcement. By November 2026, all payment messages must use structured address fields compliant with the ISO 20022 standard.

- Strong governance and safeguarding. PSPs and EMIs must demonstrate sound risk management, IT continuity (aligned with DORA), and a credible wind-down plan to participate in the scheme.

- Interoperability with clearing systems. Systems must fully comply with ISO 20022 formats and the SLEV (shared charges) model to integrate with TIPS or national instant networks.

- Liquidity readiness. Participants from non-Euro countries must maintain Euro liquidity buffers through pre-funding or credit lines and apply approved caps for off-hour payments.

How to Integrate SEPA Instant Payments in Financial and Fintech Products

There’s no one-size-fits-all route to adopting SEPA instant payments. Implementation depends on how modern (or rigid) your core stack is. Broadly, you have three paths forward:

- Upgrade existing SEPA or core systems to support instant SEPA bank transfers. You gain operational consistency but face downtime and high development costs.

- Add a separate instant payments layer alongside your current setup to test and scale gradually. Though managing two systems doubles maintenance over time.

- Replace legacy infrastructure with a cloud-native, API-first instant payments platform, gaining built-in compliance and lower operational overhead at the cost of vendor dependency and deeper integration work.

Each route has trade-offs — but all lead to the same goal: delivering real-time, compliant euro payments.

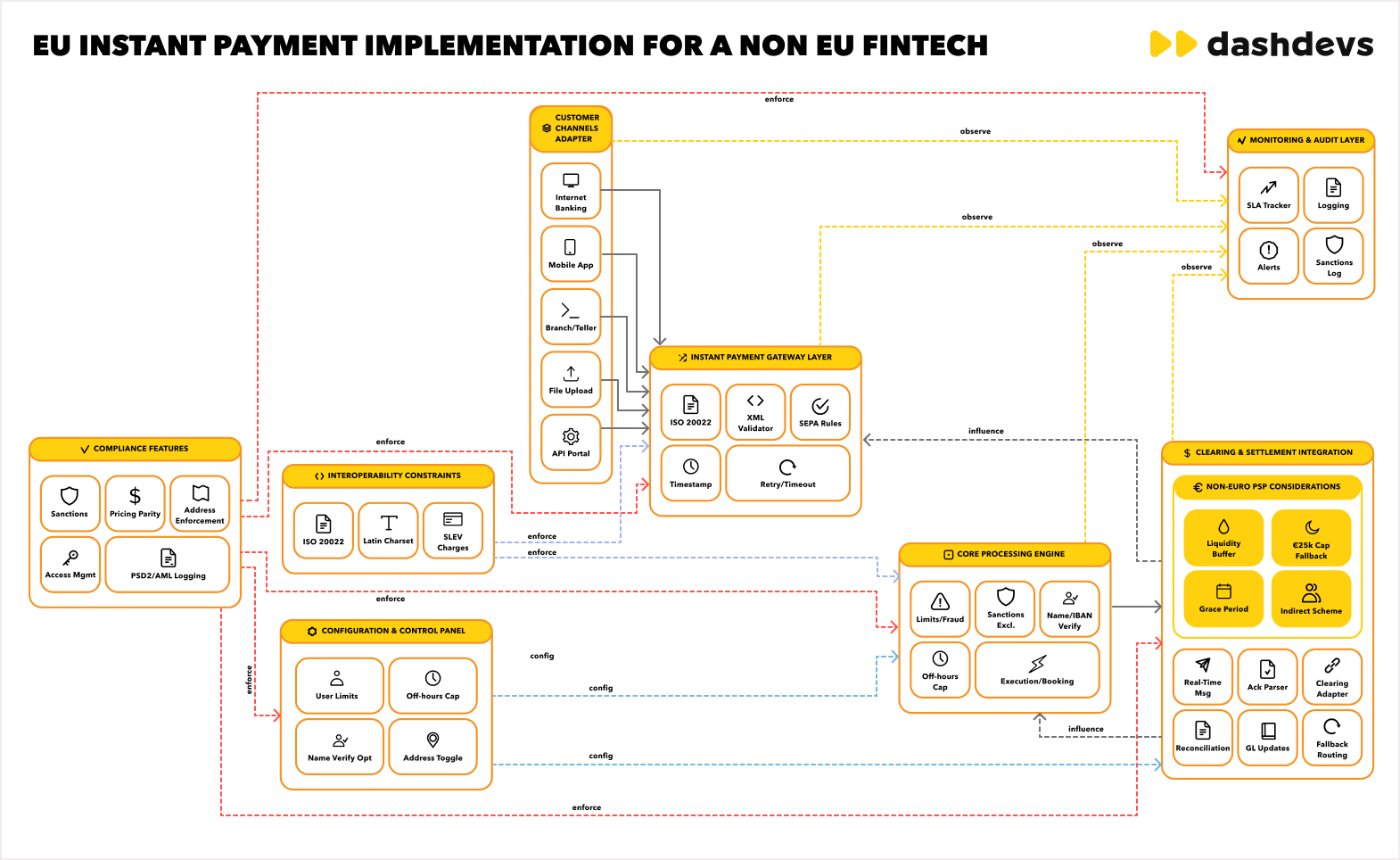

Here’s a reference diagram of EU instant payment implementation for a non-eurozone fintech

More specifically, we recommend paying special attention to the following capabilities:

24/7/365 Availability

Instant payments never pause, and neither can your infrastructure. Under the new EU instant payment regulation, PSPs must keep systems continuously available — every second, every day. That means rethinking how your core operates.

No more batch jobs or end-of-day closures. Your core banking system should be based on event-driven architecture (like our white-label FinTech Core platform). All transactions, reconciliations, screens, and reports must be triggered automatically the moment they happen.

For extra system redundancy, build an active-active setup across multiple regional data centers. Replace full system maintenance shutdowns with rolling updates by using blue-green deployments or canary releases to avoid disruption to payment flows.

For extra resilience, run DORA-recommended continuity tests that simulate incidents, vendor outages, or liquidity shortages. Ensure your liquidity dashboards update live, giving treasury teams constant awareness of prefunded accounts and settlement queues.

Comprehensive System Observability

Instant payments require real-time visibility and sharp reaction into your core systems. That level of visibility starts with building observability directly into your payment stack.

Your goal: no blind spots. Every layer of your architecture — from payment gateway to clearing integration — should generate and surface metrics that can be tracked, correlated, and acted upon in real time. Here are a few tips from our team:

- Implement SLA tracking in real time. Capture timestamps from initiation to credit confirmation for every transaction. Set up dashboards that display average processing times, queue depth, and response latency. Use this data to verify compliance with the 10-second credit rule and flag any outliers.

- Proactive alerting and auto-remediation. Configure alerts for failed or delayed settlements, duplicate messages, or schema validation errors. Integrate monitoring tools like Grafana or Elastic Stack with Slack or Opsgenie to notify teams instantly. Where possible, enable automatic retries or fallback routing to minimize downtime.

- Message flow logging and validation. Add a unique transaction ID to all ISO 20022 messages (e.g., pacs.008, pacs.002, camt.056, camt.029, pacs.004). Collect schema validation results, routing path, and retry attempts. With this data, you can later reconstruct any transaction path within seconds for audits or dispute resolution.

- Centralize audit trails. Store every interaction — user-facing or interbank — in an immutable audit log with timestamped entries and role-based access controls. This ensures full traceability across customer actions, PSP responses, and settlement acknowledgements.

Lastly, aggregate data from application logs, infrastructure metrics, and business events into a single observability dashboard. Use correlation IDs to tie logs, metrics, and traces together, providing context-rich insights during incident analysis and resolution.

With a robust IT monitoring setup, you can detect bottlenecks before customers do, flag compliance breaches before regulators do, and provide the forensic clarity auditors expect.

Verification of Payee

Trust is the currency of instant payments. When money moves in under ten seconds, there’s no time for second-guessing whether funds are going to the right person.

That’s why Verification of Payee (VoP) is now mandatory across the euro area — a simple step that prevents costly mistakes and blocks billions in potential fraud every year.

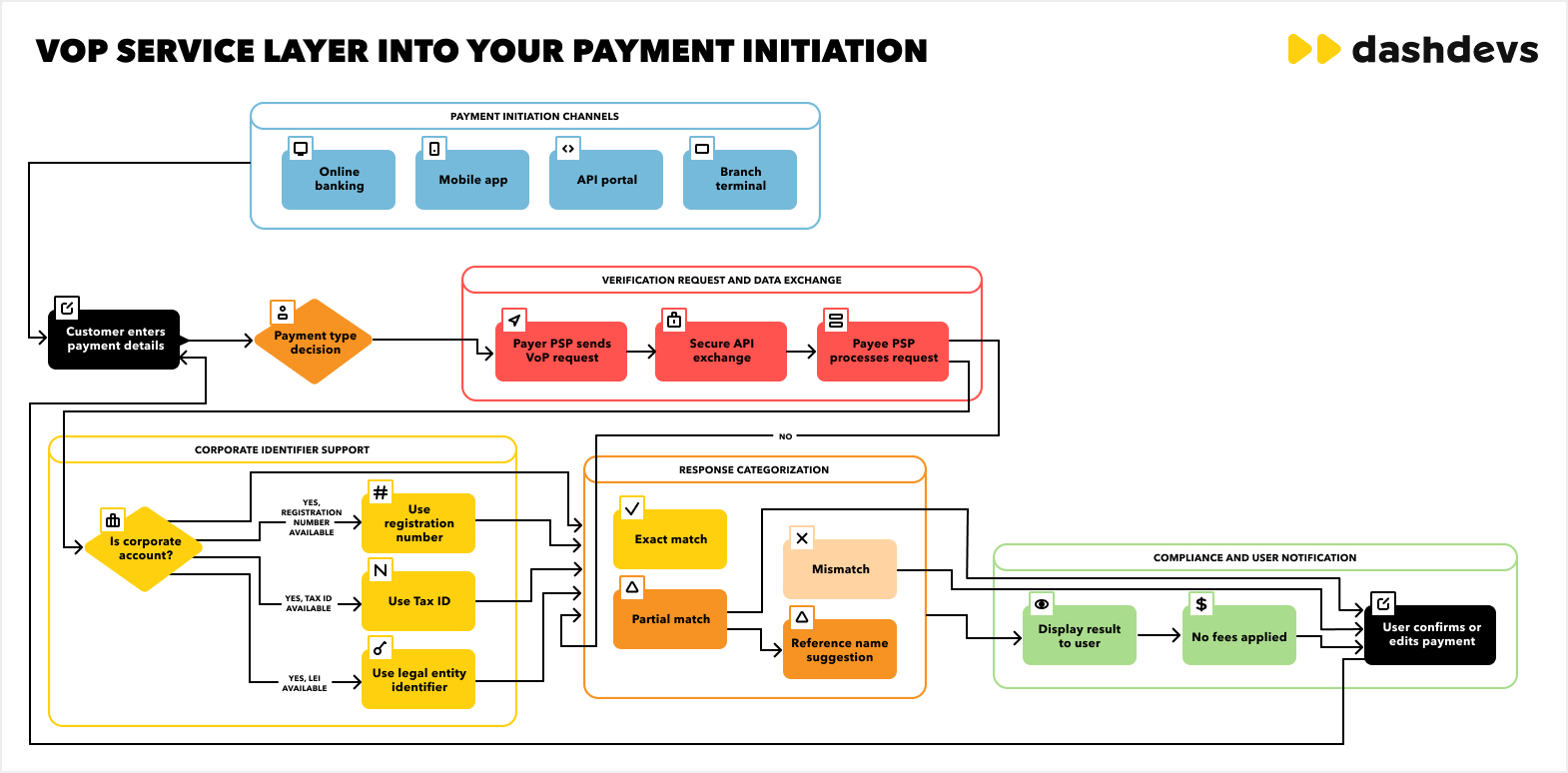

**From October 9, 2025, every PSP must verify that the name of the payee matches the IBAN before executing an instant SEPA transfer. **

VoP check happens the moment the payer enters the recipient’s details. The results must be shown instantly. If there’s no match in the system, the customer must be warned before confirming the payment. If it’s a close match, the system should display the registered account name as a hint.

To comply with this requirement, you’ll need to integrate a VoP service layer into your payment initiation flow. Here’s what it may look like:

VoP builds confidence in every transaction. 86% of SMEs say upfront beneficiary checks are important to them as they help avoid blunders, which may feel especially painful for higher-value transactions.

AML/CFT Screening

Execution speed doesn’t excuse weak security controls. But the ten-second settlement rule for instant payments removes the buffer that traditional compliance teams relied on.

What emerges instead is a new approach of continuous AML/CFT intelligence, with customers screened before, during, and after every payment without slowing the flow.

Per regulations, instant payment participants must run daily sanctions screening across their entire customer base. Any matches automatically restrict future payments until cleared, while verified accounts are added to a pre-cleared directory of safe payers and beneficiaries. This directory is what your instant payment engine checks in real time, not the raw sanctions lists.

At execution, your risk engines should be able to assess the transaction context within milliseconds. We recommend using ML/DL models to analyze:

- Transaction velocity, suggestive of mule activity

- Device fingerprints to gain richer data

- Behavioural patterns to build suspicious clusters

If anything stands out, the system generates an automated case with full audit data and routes it to analysts within minutes.

A good approach is to set up dedicated microservices for sanctions, PEP, and adverse-media checks to power your screens. Implement message queues to ensure screening results are persisted even if a downstream service fails. Also, apply consistent correlation IDs across instant payment and AML systems for traceability. Lastly, retain transaction data and screening outcomes for at least five years in line with AMLD6.

Real-Time Fraud Monitoring

Fraud prevention has to move at the same speed as the instant payment itself. Once funds leave an account, recovery is hardly easy. By the time a refund arrives, the damage to customer trust is already done.

To stay ahead, most FIs will need to invest in better fraud detection and prediction systems.

Modern AI-driven fraud systems go far beyond rule-based scoring. They combine behavioural analytics, device fingerprinting, and transaction graphing to spot anomalies that humans or legacy systems would miss.

For example, Visa’s AI models have identified up to 54% of fraudulent transactions that passed undetected through banks’ existing systems in the UK. When analysing card transactions and instant payments together, Visa’s network achieved a 30% uplift in detection accuracy, proving how connected data ecosystems can anticipate fraud patterns that look legitimate in isolation.

Effectively, the next generation of fraud detection relies on hybrid architectures, blending rule logic with adaptive AI models. Such solutions parse historical patterns, behavioural baselines, and external data sources in milliseconds. When a transaction deviates from the normal rhythm of a customer’s activity — a new device, unexpected timing, or uncharacteristic location — it’s flagged for instant risk scoring and, if necessary, paused pending secondary verification.

To enable real-time fraud detection, we recommend the following:

- Deploy fraud analytics engines as dedicated microservices, running parallel to payment execution rather than inside the critical path.

- Stream live transaction data into a real-time decisioning layer, based on low-latency technologies such as Redis, Kafka, or in-memory graph databases.

- Continuously retrain machine learning models on fresh transaction data, feeding back confirmed fraud cases to improve predictive precision.

- Use a feedback loop between VoP and fraud systems, enriching risk models with confirmed identity mismatches and historical payment anomalies.

Ultimately, real-time fraud monitoring is the key element to production adoption. Every accurately blocked fraud attempt reinforces the reliability of instant payments, proving to consumers and regulators alike that speed and security can coexist.

Real-Time Liquidity Forecasting

Under the new framework, banks and PSPs must ensure that euro liquidity is always available to settle transactions within seconds, regardless of the time or day. That means moving away from static end-of-day positions and adopting real-time liquidity forecasting that mirrors the nonstop rhythm of instant payments.

The challenge is straightforward: faster speeds and higher transaction caps mean less predictable outflows. To stay compliant and operational, you’ll need to prefund settlement accounts or maintain credit lines with central or partner banks.

Although your real goal should be to gain more visibility into when to deploy the available cash.

To enable real-time liquidity forecasting, you’ll need:

- Continuous cash flow visibility. Every transaction — incoming, outgoing, queued, or rejected — should feed directly into your liquidity dashboard. With a TIPS or national clearing system integration, Treasury teams can then track balances and outflows down to the second.

- Predictive modeling and stress scenarios. AI-based forecasting models can learn the typical flow patterns of customers, currencies, and time zones. Use them to simulate liquidity stress events such as large outbound bursts, settlement delays, or partner bank downtime, to test different rebalancing scenarios.

- Automated liquidity orchestration. Configure adaptive treasury rules to trigger intraday transfers between accounts, top up prefunding buffers, or automatically draw on approved credit lines, based on certain conditions. These automations reduce manual intervention and ensure compliance with settlement obligations even during off-peak hours.

For PSPs outside of the eurozone payments space, liquidity management becomes even more complex. Euro liquidity must be sourced through partner banks or cross-currency pools. Although regulators allow applying transaction caps (minimum €25,000) during off-hours when funding access is limited. Implementing an automated liquidity control engine ensures these caps are enforced dynamically, maintaining smooth operations without breaching regulatory boundaries.

Building the Backbone of Instant Finance

The EU’s instant payment mandate is rewiring how money moves across Europe. Real-time settlement, continuous availability, and AI-powered fraud prevention are setting a new standard for what “seamless” really means. And joining this bandwagon is the right move for anyone operating in this space.

At DashDevs, we help banks, PSPs, and fintechs integrate instant payments without breaking compliance or uptime — from upgrading legacy SEPA cores to embedding Verification of Payee and real-time fraud monitoring into your stack.

Whether you’re preparing for the 2027/28 deadlines or looking to build new payment products on top of instant rails, we’ll help you do it fast, safely, and with full regulatory confidence. Talk to our fintech engineering team.