The Next Global Payment Rail: Stablecoins

Discover market-ready stablecoin use cases

For decades, global payments relied on the same rusty rails—SWIFT transfers moving across borders. Each transaction passed through a maze of intermediaries: acquiring banks, issuing banks, local banks, correspondent banks, FX providers, and card networks. Every handoff added more fees, more delays, and more opacity.

The first wave of fintech challengers aimed to rein in the ‘greedy middlemen.’ They stitched together faster country-specific rails, cutting the fees often in half.

But the new system still has a weakness: currency volatility.

As one ex-Wise treasury lead recalls, a sudden currency swing in Ghana forced him to shut down transfers overnight, cutting off thousands of users. Pre-funding models, where fintechs park large sums of money in local accounts to enable “instant” payouts, usually work for small remittances. But they don’t suit multimillion-dollar B2B flows or high payment volumes.

And that’s the tipping point: since existing solutions no longer scale, the industry starts looking for the next rail: stablecoin payments.

Why are stablecoins becoming the next-gen payment rail?

Stablecoins are crypto tokens designed to behave like fiat money without the volatility. Issued on distributed ledgers, they maintain a peg to a traditional asset—most often the US dollar—by offering one-to-one convertibility on demand. Unlike Bitcoin or Ether, stablecoins are not speculative plays but a bridge between digital assets and traditional finance: liquid, globally transferable, and perceived as a solid store of value.

And the global markets like the sound of that.

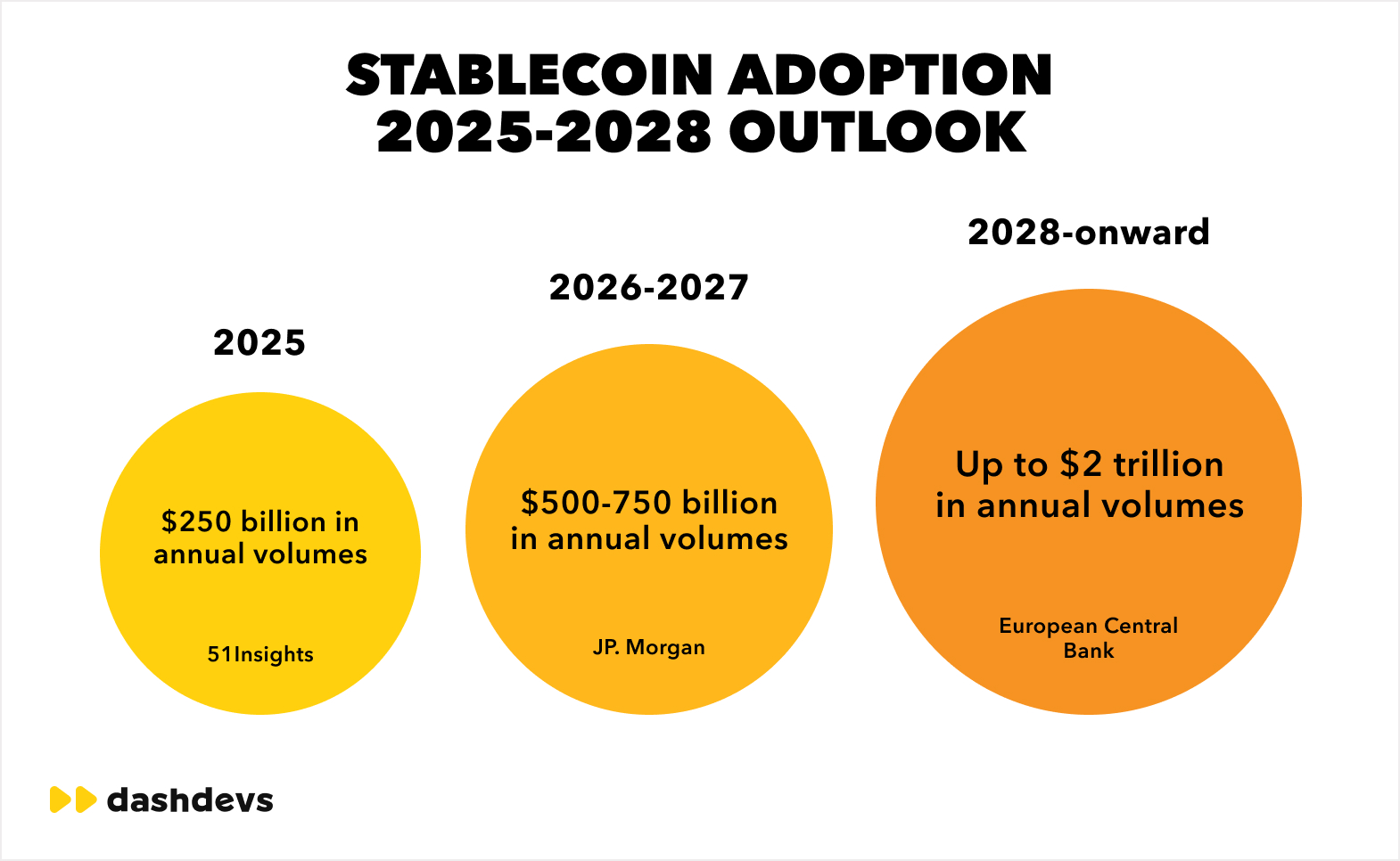

As of mid-2025, over $250 billion in stablecoins circulate globally, facilitating more than $2.3 trillion in monthly volume. Analysts are bullish: J.P. Morgan projects a market in the $500-750 billion range within a few years. The European Central Bank goes further, suggesting we could see $2 trillion in supply by 2028.

Stablecoin adoption 2025-2028 outlook

The three main reasons behind growing stablecoin payment volumes are lower fees, growing consumer acceptance, and greater regulatory clarity.

1. Unmatched affordability

Although stablecoin circulation has doubled over the past 18 months, it still represents less than 1% of global money flows. Meanwhile, banks process the majority of corporate cross-border payments, cashing in on high fees.

That leaves a massive, underserved market—from SMEs priced out by high correspondent banking fees to families sending remittances across borders. Stablecoins open the door to faster, cheaper transfers where legacy systems can’t compete.

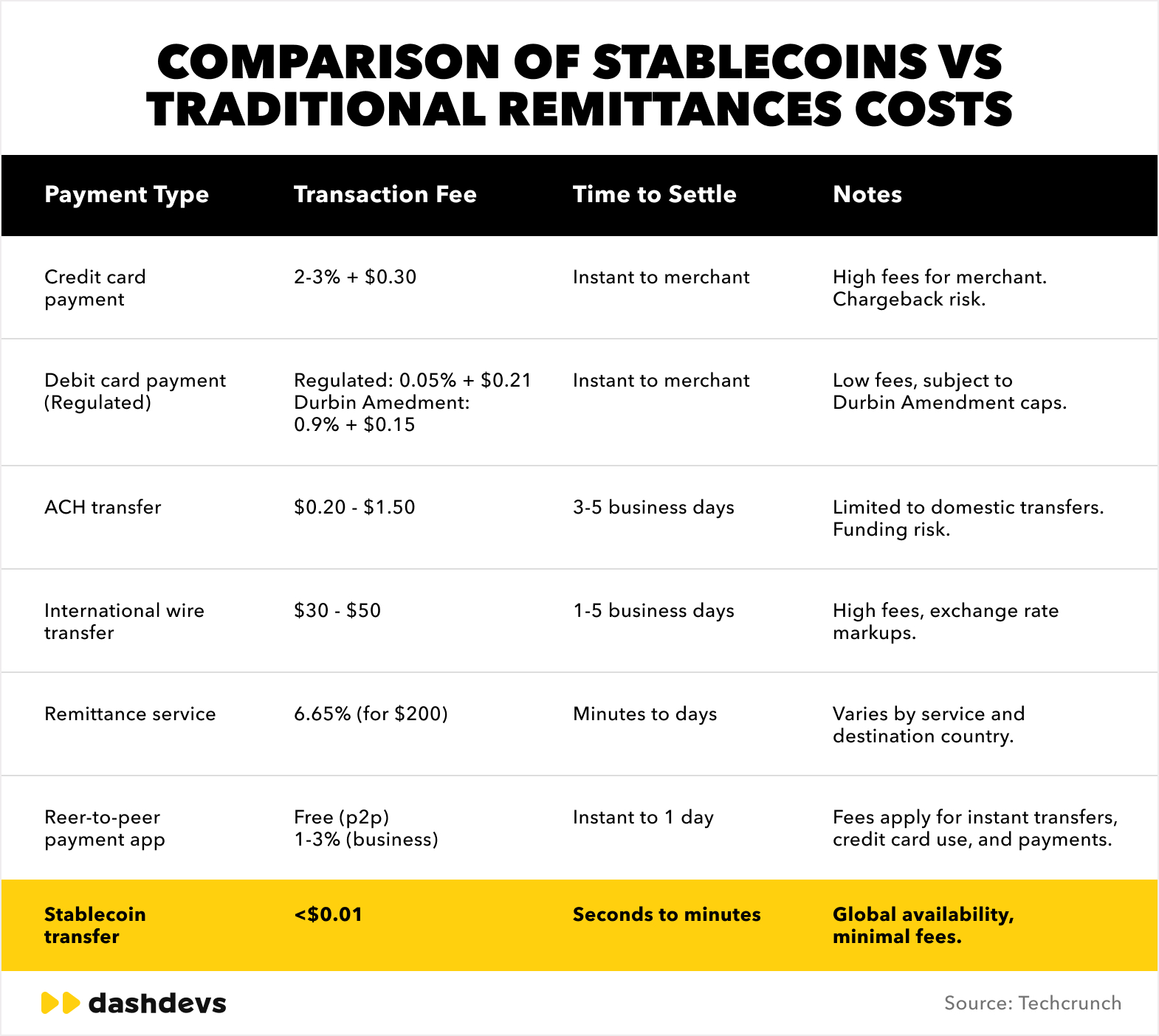

Sending $200 from the UAE to the Philippines via traditional rails will cost $6.08 on average. Using stablecoins is $1 or less, depending on the provider.

Comparison of stablecoins vs traditional remittances costs

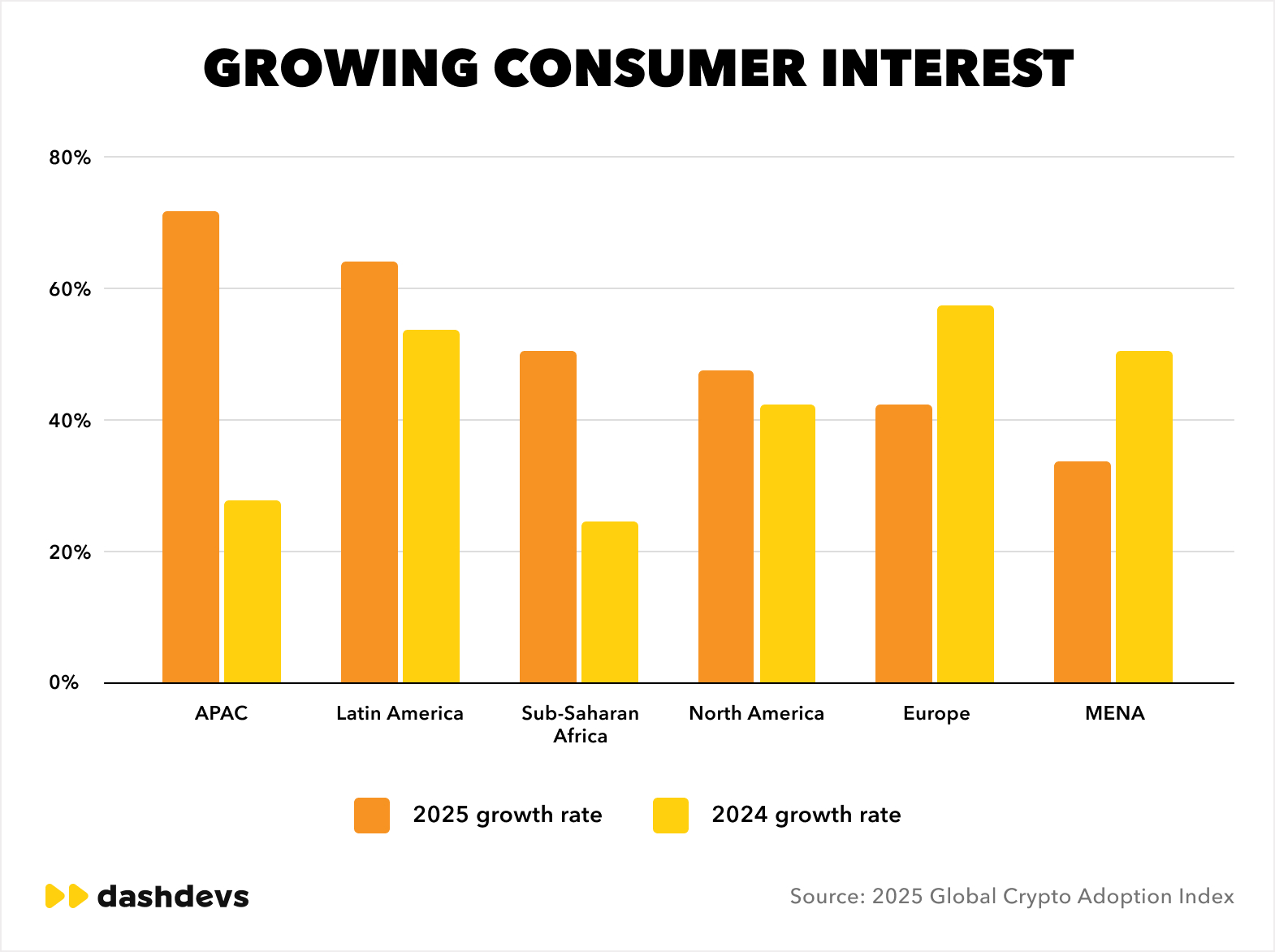

2. Growing consumer interest

Crypto isn’t a niche club anymore. Adoption rates have grown at double-digit rates annually over the last two years in most regions, as regular folks swap curiosity for adoption:

The same enthusiasm spills over to stablecoins. Active stablecoin wallets jumped from 19.6 million to over 30 million in just one year, a 53% growth, with their primary use being payments.

A February 2025 survey found that 26% of US adults used stablecoin for remittance abroad

in the past year. In other words, stablecoins are quietly becoming the preferred way to move money globally, especially to and from underserved markets.

3. Higher regulatory maturity

The regulatory fog is clearing for stablecoin payments:

- The US has passed the GENIUS Act, its first federal law regulating payment in stablecoins. A wider cryptocurrency market structure bill has already been presented to Congress and is undergoing active discussions.

- Europe has already harmonized rules across the bloc through MiCA (Markets in Crypto-Assets Regulation). Multiple add-on guidelines and recommendations have since been issued to ensure trade fairness and security.

- Switzerland is ahead of the curve, being the first country in the world to enact legal regulations for blockchain technology in August 2021. Since then, the country has already built a robust framework for digital asset service providers.

- The UK is actively working towards its own stablecoin regime, with two FCA consultation papers released in 2025: CP25/14 (on stablecoin issuance and crypto custody) and CP25/15 (on prudential requirements for crypto firms).

This wave of favorable stablecoin regulations gives institutions the clarity they need to move from pilots to full-scale stablecoin adoption.

Stablecoins step in where banks fall short

Stablecoins fill in the gaps long overlooked by global banking systems: middlemen who used to manage local partnerships, fraud, and operations. They were necessary in the early days, but have become increasingly cumbersome (and to an extent unnecessary) in the digital finance age.

Stablecoin payments flow over blockchains, which are credibly neutral, auditable, composable, and designed to scale globally. Meaning you can keep full audit trails and add custom controls to prevent fraud or KYC—all while benefiting from an already existing and widely adopted technology, linking people everywhere, just like an email.

For individuals, it means accessible, instant, and transparent money movement. For businesses, that translates into better cash flow predictability, smoother working capital management, and far fewer reconciliation headaches.

And this opens up a new pane of use cases.

Market-ready stablecoin use cases

P2P remittances

The global remittances stood at $904 billion last year, with one billion people using some money transfer service. But the experience is far from great. Fees are high, and transfers take a long time to get routed.

Stablecoins eliminate the chain of correspondent banks by moving value directly on-chain, enabling transfers in seconds at a fraction of the cost of traditional remittance services.

Several stablecoin-based remittance platforms are already proving this at scale. Remitly, which serves users in 170+ countries, has integrated USDC payments into its treasury and payout operations to boost reliability and access in markets with limited infrastructure. Aspora, a fintech company serving the Indian diaspora, has turned stablecoin rails into a growth engine: its remittance volumes jumped sixfold in one year, from $400 million to $2 billion, while delivering transfers that are 10x faster and cheaper.

B2B cross-border payments

Similarly, moving large sums between businesses is notoriously inefficient. Stacked-on fees eat into already thin margins. Stablecoins change that equation by offering near-instant settlement, 24/7 availability, and significantly lower costs—even for high-value transactions. For CFOs, this means tighter cash flow control, fewer reconciliation delays, and reduced dependency on intermediaries.

Adoption is already underway. PayPal launched its PYUSD stablecoin to process B2B cross-border flows, slashing fees by up to 90%. Stripe has rolled out embedded USDC payments across 50+ countries, giving businesses the ability to pay international suppliers instantly.

Conduit, in turn, is building better infrastructure in LATAM and African markets by connecting domestic payment rails to on-chain stablecoin settlement. The company broke $10 billion in annualized volume in 2024, moving 14 currencies across nine countries. Cedar Money and Caliza are also working on stablecoin-backed solutions for global import-export businesses.

Interbank settlement

Even at the institutional level, money doesn’t move as smoothly as most think. Large banks still rely on outdated rails that batch and clear transactions in limited windows, often introducing delays, costs, and operational risk.

Stablecoins enable banks to settle in real time, 24/7, with reduced risks and better liquidity.

Instead of waiting for end-of-day netting, banks can rebalance instantly across regions and put idle capital to work, rather than leaving it stranded in nostro accounts.

Some of the world’s biggest players are already experimenting with this use case. J.P. Morgan launched Kinexys Digital Payments, enabling cross-border stablecoin transactions for institutional clients, and in June 2025, introduced JPMD, a deposit token representing commercial bank money with 24/7 settlement and even the ability to pay interest.

Other major U.S. banks—including Bank of America, Morgan Stanley, and Citigroup—are expected to roll out stablecoin payment initiatives of their own. These moves mark a shift from proofs-of-concept to production-ready tools that could soon underpin global wholesale settlement.

Emerging stablecoin use cases

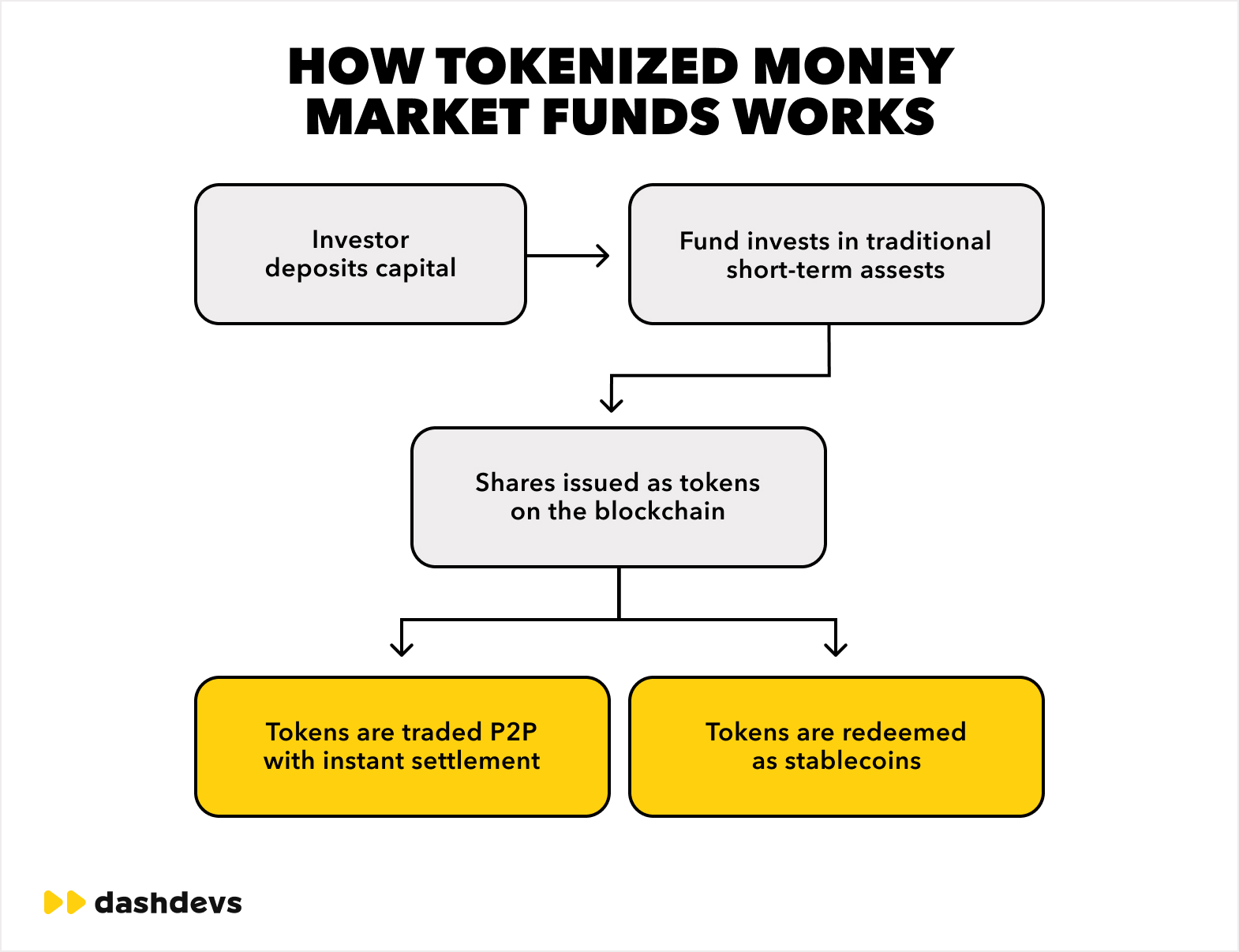

Tokenized money market funds

Liquidity management keeps finance running, turning idle capital into returns. Money market funds have long handled the job, but they’re bound by old rules: limited trading windows, daily record updates, monthly yields, high minimums, and redemptions that take days (or weeks). In a world where digital assets settle in seconds, that model looks outdated.

Tokenized money market funds can change the playbook. By issuing fund shares on distributed ledgers, providers give investors digital assets that represent claims on yield-bearing instruments, backed by the same underlying securities but with all the benefits of blockchain rails. These tokenized shares can be traded peer-to-peer, transferred instantly, and even swapped directly for stablecoins.

That transforms MMFs from passive “store of value” assets into dynamic tools that can double as collateral, liquidity buffers, or even a medium of exchange inside the digital economy.

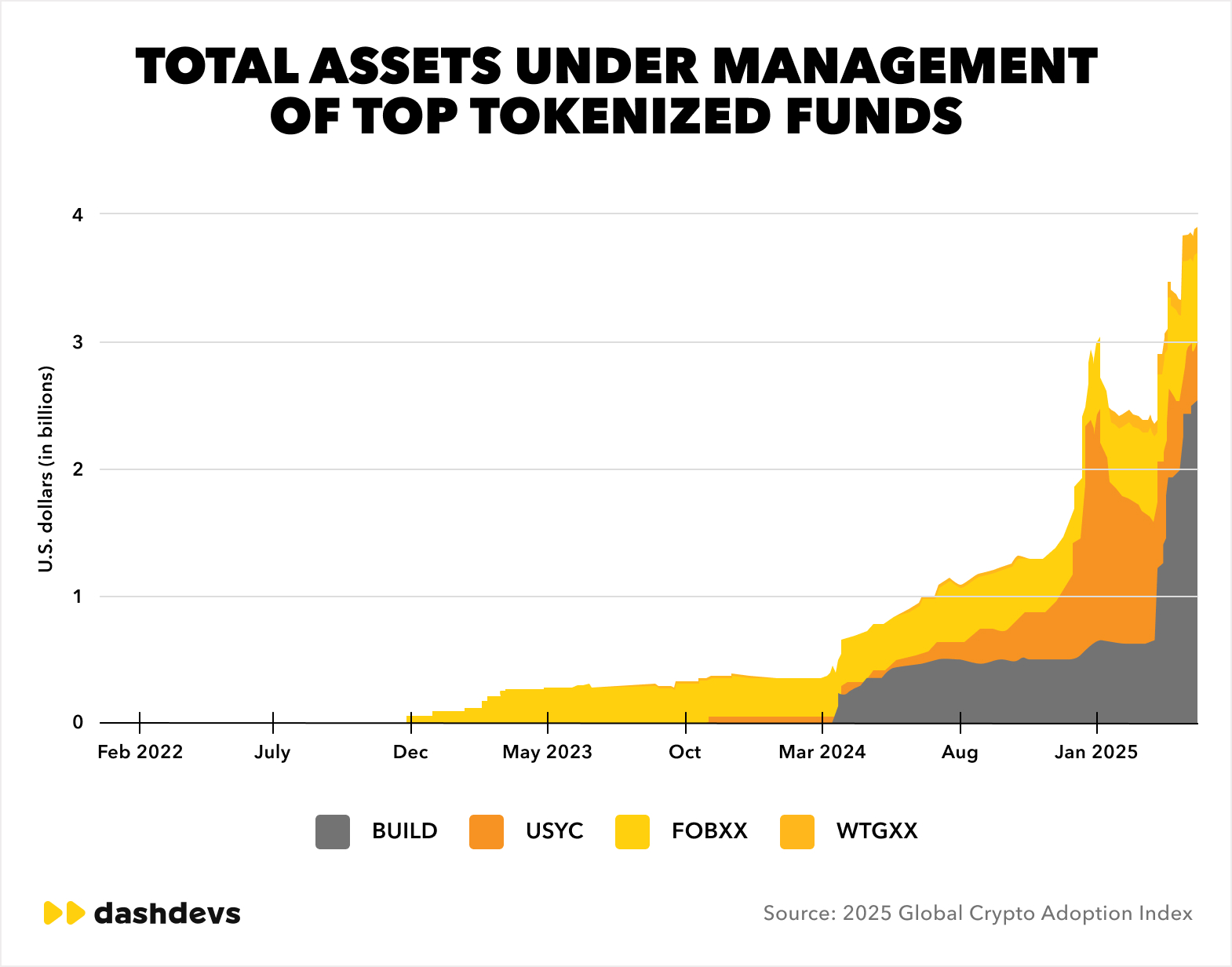

Several heavyweight players have already entered the space. Franklin Templeton’s FOBXX manages over $700 million in tokenized assets. Circle/Hashnote’s USYC has reached nearly half a billion in AUM, while WisdomTree’s WTGXX holds more than $10 billion. The standout is BlackRock’s BUIDL, with $2.5 billion under management, making it the largest tokenized private fund to date.

Total assets under management of top tokenized funds

Investors can instantly swap their holdings for USDC, unlocking liquidity that would otherwise take days to access. Prime brokers now accept tokenized MMFs as collateral for derivatives trades, and some custodians are preparing to follow. Even in traditional finance, JPMorgan has piloted a transaction where tokenized BlackRock MMF shares were pledged as collateral with Barclays, blurring the line between conventional and digital markets.

For treasurers, asset managers, and hedge funds alike, tokenized MMFs solve a long-standing pain: how to keep money both safe and usable. They preserve the conservative risk profile of traditional MMFs but add a layer of flexibility, speed, and interoperability that legacy rails could never deliver.

Stablecoin-based payroll

Payroll has quietly become one of the most challenging problems in the era of distributed work. A company in Berlin might employ a designer in Lagos, a developer in Buenos Aires, and a marketing consultant in Manila. All of them would love to get paid without watching 5-10% of their paycheck evaporate in fees.

Stablecoin payments can be used to disburse salaries instantly across borders, settle in stable value, and avoid the dependency on a patchwork of banks and intermediaries.

- Contractors get paid faster, in local currencies, without any ‘hidden fees.’

- Employers gain more predictable payroll cycles, streamlined reconciliation, and the flexibility to scale hiring globally without overhauling their treasury setup.

Hong Kong-based AllScale is already working in this domain. Their stablecoin product suite spans invoicing, payroll, and even social commerce capabilities. Through integrations with messaging platforms like Telegram, Line, and WhatsApp, businesses can manage contracts, issue invoices, and pay out wages in stablecoins—all from the same interface.

Rise, a hybrid payroll platform, has recently partnered with Circle to allow companies to issue both fiat and stablecoin payouts in parallel, so employees can choose the form of compensation that works best for them. For many contractors, that means cutting the time between work delivered and money in hand from weeks to minutes.

On-chain analytics

Many argue that stablecoin payments raise the stakes for compliance. But regulators mostly treat them the same as any other financial instrument—aka you need to run KYC and meet applicable AML/CFT requirements.

The advantage? Stablecoin payments are public by design. Every transfer, wallet address, and contract interaction is hard-coded on the blockchain. What companies need are new tools to run risk scoring and fraud recognition against these records.

Several vendors are already working on this: Chainalysis, TRM Labs, and Fireblocks. Each provides anti-fraud analytics and compliance tools for transition monitoring, anomaly detection, and in-depth investigations.

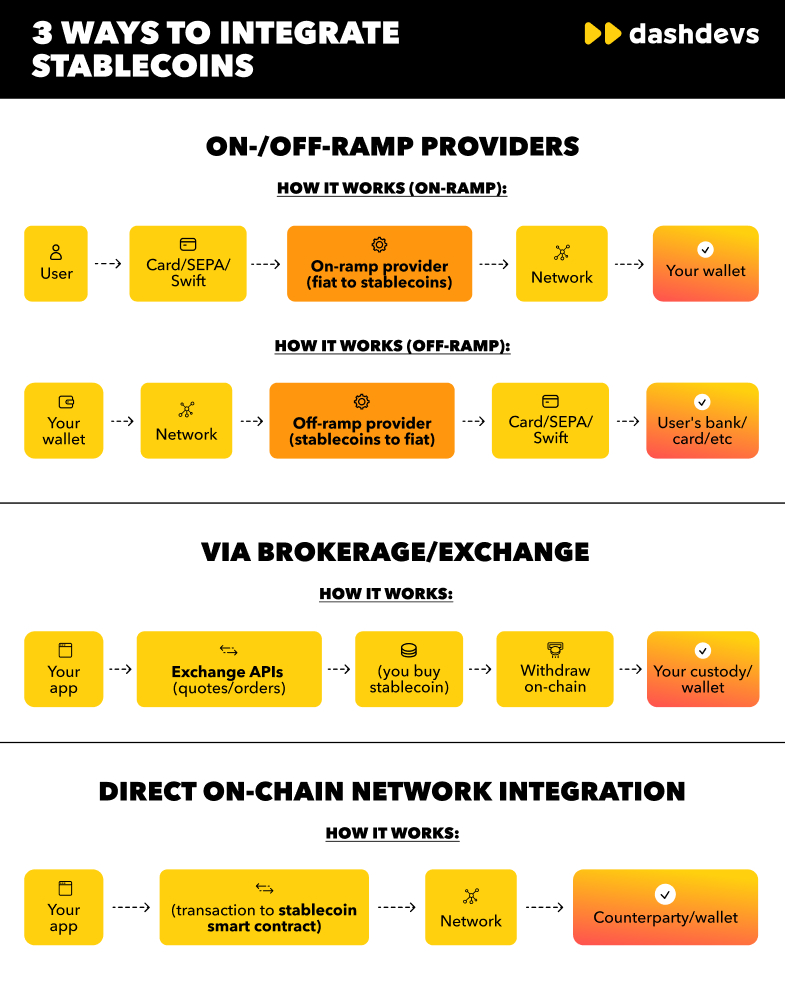

How to integrate stablecoins into financial products

Stablecoins conjure an image of the new digital finance: more open, instant, affordable, and borderless.

If you want to be part of it, there are three ways to integrate stablecoins into your product(s).

On-ramp/off-ramp integration

Stablecoins can be integrated into financial products the fastest by leveraging existing on- and off-ramp providers. These services act as the bridge between traditional money and digital assets, linking bank accounts, cards, and wallets to crypto platforms.

A number of providers operate in this space: MoonPay, Ramp Network, Mercuryo, and Keyrails, among others. Their value lies in prebuilt API integrations, fraud prevention systems, and regulatory compliance frameworks that would take years for most fintechs to replicate.

For instance, our team has recently used the Hedera network to build a UAE-Philippines stablecoin remittance product. Hedera’s stablecoin rails (USDX → PHPX) offered better processing costs than Circle and Tether’s alternatives, plus Hedera’s well-defined SDK and API architecture accelerated integration. The local compliance piece still required licensing in the Philippines, but the technical lift was light enough to validate the MVP.

With on-ramp/off-ramp providers, you don’t have to run any blockchain nodes or manage private keys if you’re using stablecoin for remittance payments. The provider handles on-chain interactions (minting or transferring the stablecoin to the specified address) and ensures the stablecoin is fully reserved and redeemable (e.g., USDC is 100% fiat-backed). What’s left for you is to integrate the API calls, provide a user interface for inputting transaction details, and possibly store the user’s wallet addresses or generate deposit addresses if needed.

This makes on/off-ramp integration one of the most practical entry points: middle-of-the-road in complexity, relatively quick to deploy, but still reliant on vendor pricing and compliance guardrails.

| Pros | Cons |

|

|

Brokerage-based integration

Another route is to integrate with a crypto brokerage. Instead of building your own rails, you let users buy and use stablecoins through players like Coinbase, Binance, or Kraken.

All three provide well-documented APIs for trading, account management, and withdrawals. Integration typically requires setting up API keys with proper permissions and following the exchange’s authentication scheme (often HMAC signatures, API secrets, etc., or OAuth for user-specific access).

In this case, many companies opt for custodial integration, where the fintech might have a master account with the exchange and either use sub-accounts for each user or tag stablecoin transactions with an internal reference to map them to user accounts. The exchange then holds the actual stablecoins in custody. For example, Paxos’s brokerage service custodies all crypto assets on behalf of the fintech’s users and provides an API to perform transactions.

In this case, you don’t have to handle private keys or blockchain transactions directly. Everything stays within the exchange until a withdrawal is requested. And you only need to ensure synchronization between its internal ledger and the exchange: After a trade, it might query the exchange for the new balance or rely on the API response to update the user’s displayed balance.

For instance, Shopify has recently partnered with Coinbase to enable merchants to accept USDC payments on Base. The integration plugs directly into merchants’ order and fulfillment flows, supporting delayed capture, tax finalization, and refunds. Built as an open-source, on-chain commerce protocol, it shows how exchanges can act as turnkey providers for embedding stablecoin payments into everyday financial and retail platforms.

But ease comes with trade-offs. Brokerages set the pricing, fees, and stablecoin settlement mechanics, which means you surrender some control over the unit economics and user experience. For young fintechs or startups, however, the upside often outweighs the downside—speed to market, minimal engineering overhead, and a chance to validate demand before investing in heavier infrastructure.

| Pros | Cons |

|

|

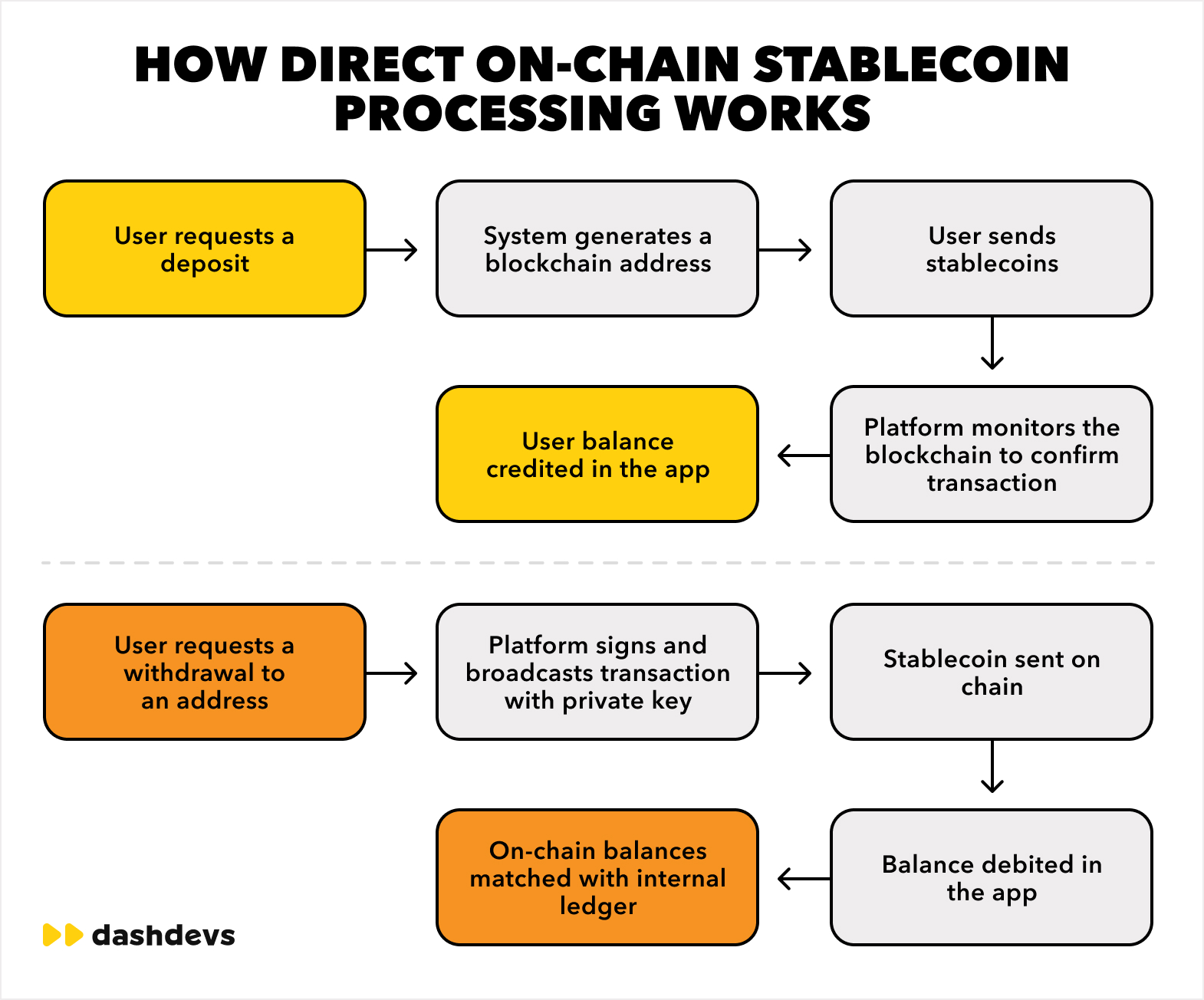

Direct on-chain integration

At the far end of the spectrum lies direct on-chain integration. In this case, you connect straight to blockchain network(s) in bypass of intermediaries.

Effectively, you build your own wallet infrastructure and plug into the network. From the user’s perspective, it looks just like depositing or withdrawing fiat. But behind the scenes, the platform is orchestrating on-chain transfers in real time.

Because this is a direct connection, you’ll have to handle custody—hot wallets for day-to-day flows and cold storage for reserves. Our team has recently helped a digital asset trading platform implement an effective treasury management mechanism for maintaining appropriate liquidity levels of stablecoin and cryptocurrencies traded on the platform. It allows them to on/off-ramp crypto, enforce security, and automate transfer policies between different wallets.

Compliance also sits squarely on your side. Every inbound and outbound transfer should be screened against sanctions lists and blockchain analytics tools to prevent illicit flows. One way to do this is via smart contracts.

Most centralized stablecoins have embedded logic for on-chain checks. You can program automatic sender/receiver blacklist checks or a command to add or remove addresses from the blacklist based on the off-chain screening you do (e.g., as part of your general KYC/KYB process). Some stablecoins—USDT, USDC, and BUSD—also give functionality to destroy or seize tokens from blacklisted addresses.

Technically, this model requires operating blockchain nodes (or using API providers like Infura or Alchemy) to detect deposits, assemble ERC-20 transfers, sign them securely, and reconcile on-chain balances with the platform’s internal ledger. Every movement on-chain must have a matching record in the system’s database—similar to how banks reconcile accounts—to maintain trust and accuracy. We’ve previously built such solutions with open-source technologies for a new remittance company. The process is often intricate, but it’s critical for compliance and future market scalability.

If fiat conversion is also part of the flow, you’ll also need to find a partner to mint or redeem stablecoins. Likewise, you’ll need to integrate with the banking rails in the target markets for fiat currency ramp-on (user top-ups) and ramp-off (user payouts).

The upside of running your own on-chain processing is obvious: minimal vendor fees, complete control over settlement logic, and the ability to design stablecoin flows exactly as your product demands.

The trade-off? High engineering complexity, regulatory exposure, and operational risk. You’ll have to:

- Protect private keys

- Create multi-signature approvals

- Manage whitelisted addresses

- And control rate limits

And because blockchain transactions are irreversible, mistakes can be costly.

Direct on-chain integration is therefore the choice of mature fintechs and digital banks with the resources to invest in secure infrastructure. It can give a strategic edge but requires high upfront costs and full commitment.

| Pros | Cons |

|

|

Looking into the future of payments: Dual-rail infrastructure

Unlike many other changes in fintech, stablecoins aren’t a zero-sum game. Blockchain will never fully replace fiat rates (or vice versa). A more likely scenario is a dual-rail system, where both systems run side-by-side, and the best route for each transaction is chosen dynamically.

Picture this: a transfer from London to Singapore clears on-chain in near real time, while a transfer to New York moves faster and cheaper via existing fiat rails like ACH or SWIFT. The orchestration layer calculates the optimal path in the moment, balancing cost, speed, and reliability.

In effect, payments stop being tied to a single network—they become network-agnostic and fully programmable. And for fintechs, it’s the ultimate competitive advantage: being able to move money anywhere, anytime, across whatever rails deliver the best outcome.

Want to become part of this evolution? With FinTech Core, our stackable white-label platform for building financial products, you can plug stablecoins into your stack without adding years of dev time or exorbitant regulatory risk. Built for speed, designed for scale, and already trusted by fintechs and banks across markets, our architecture lets you launch fast and grow confidently.

Discover FinTech Core or contact us for a free demo!