Fintech Trends 2026: Key Shifts in the Future of Financial Technology

Fintech is entering a decisive phase in 2026. What once felt experimental has now become infrastructure. What used to differentiate products is quickly becoming table stakes.

Artificial intelligence is moving from decision support to autonomous execution. Payments are expected to be instant. Financial services are embedded directly into products users already rely on. Compliance, identity, and resilience are no longer separate layers but part of core system design.

According to statistics, the global fintech market is projected to exceed $1.3 trillion by the early 2030s, growing at close to 20% CAGR. But growth alone is no longer the story. The real question for fintech leaders in 2026 is how systems are built, governed, and scaled under real-world pressure.

This article explores the fintech trends that will define 2026, what they mean for businesses, and how to prepare for what comes next.

Fintech Market Outlook 2026: From Growth to Infrastructure

The fintech market continues to expand rapidly, but the character of that growth has fundamentally changed. Early fintech growth was driven by consumer-facing innovation and feature differentiation. In 2026, growth is driven by infrastructure maturity, regulatory readiness, and operational resilience.

Investors are increasingly prioritizing fintech companies that demonstrate predictable execution, clear compliance ownership, and scalable system design. At the same time, regulators expect fintech platforms to meet the same operational standards as traditional financial institutions.

| Indicator | Market Signal |

| Global market size | $1.3T+ by early 2030s |

| Primary growth driver | Infrastructure & automation |

| Investor focus | Regulation-ready platforms |

For fintech businesses, this means that architectural decisions made today will directly determine market access, licensing feasibility, and long-term valuation.

Trend 1: AI Agents and Autonomous Finance

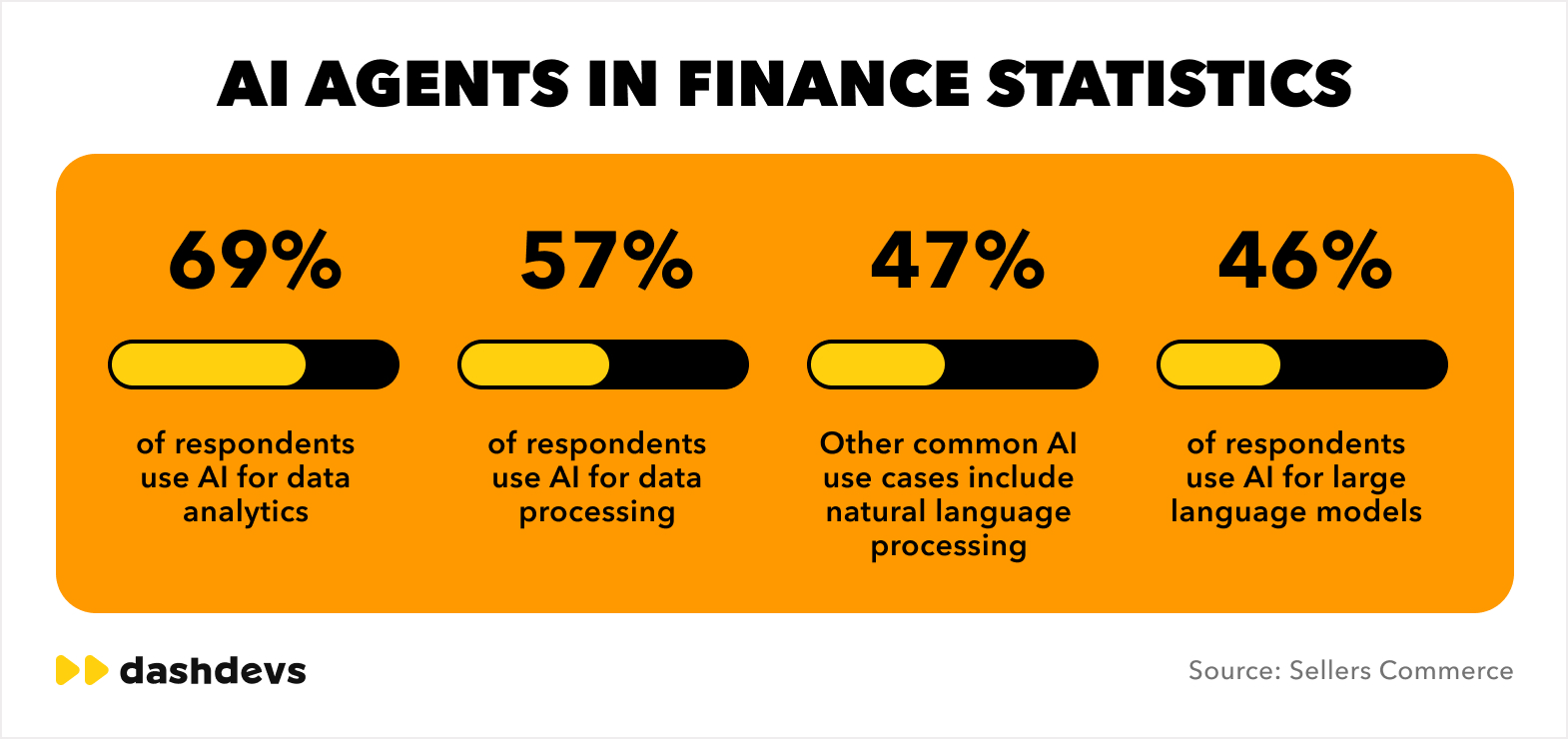

AI in fintech has moved far beyond dashboards, analytics, and conversational interfaces. In 2026, fintech platforms are actively deploying autonomous financial agents capable of executing end-to-end workflows without constant human supervision.

These agents ingest data from multiple systems, apply decision logic, trigger downstream actions, and generate audit-ready logs in real time. Common production use cases include KYC and onboarding triage, transaction reconciliation, fraud pattern detection, compliance monitoring, contract analysis, and operational reporting.

| Metric | Value |

| AI in fintech market | $52.19B by 2029 |

| CAGR | ~20% |

| Core adoption area | Back-office & compliance |

From DashDevs’ delivery experience, the critical insight is that autonomous AI only succeeds when systems are designed for traceability, explainability, and controlled escalation. Under frameworks such as the EU AI Act and DORA, fintechs must prove why a decision was made, how it can be overridden, and where responsibility ultimately sits.

The move toward autonomous financial agents is already visible in consumer finance products where AI directly influences user outcomes. DashDevs’ work on Chip, an AI-driven savings and personal finance platform, illustrates how AI can be embedded into real operational workflows rather than isolated experiments.

In this platform, AI is responsible for analyzing user behavior, optimizing savings decisions, and continuously adapting recommendations based on real financial activity. These systems operate at scale, handling sensitive financial data while maintaining user trust through transparent logic and predictable outcomes.

In 2026, AI architecture is no longer separate from compliance architecture. They are one and the same.

Trend 2: Embedded Finance Evolves into Ecosystems

Embedded finance has evolved from a tactical integration into a strategic operating model. In 2026, financial services are no longer added to products; they are designed into the core user journey.

Beyond payments, platforms are embedding lending, insurance, savings, payroll, and investment services directly into marketplaces, SaaS tools, and consumer applications. The embedded finance market is expected to exceed $7 trillion by 2030, driven by demand for contextual, frictionless financial experiences.

| Indicator | Data |

| Embedded finance market | $7T+ by 2030 |

| Fastest-growing verticals | Lending, payroll, insurance |

| Regulatory scrutiny | High and increasing |

In practice, DashDevs’ work on platforms like MuchBetter shows that embedded finance shifts accountability to the platform owner. Compliance, fund flows, and risk logic cannot be outsourced entirely to providers. If a banking or KYC partner fails regulatory checks, the embedded product bears the consequences.

By 2026, embedded finance is no longer about speed to launch. It is about control, observability, and resilience across the entire financial stack.

We have explored the embedded finance topic recently in this blog post.

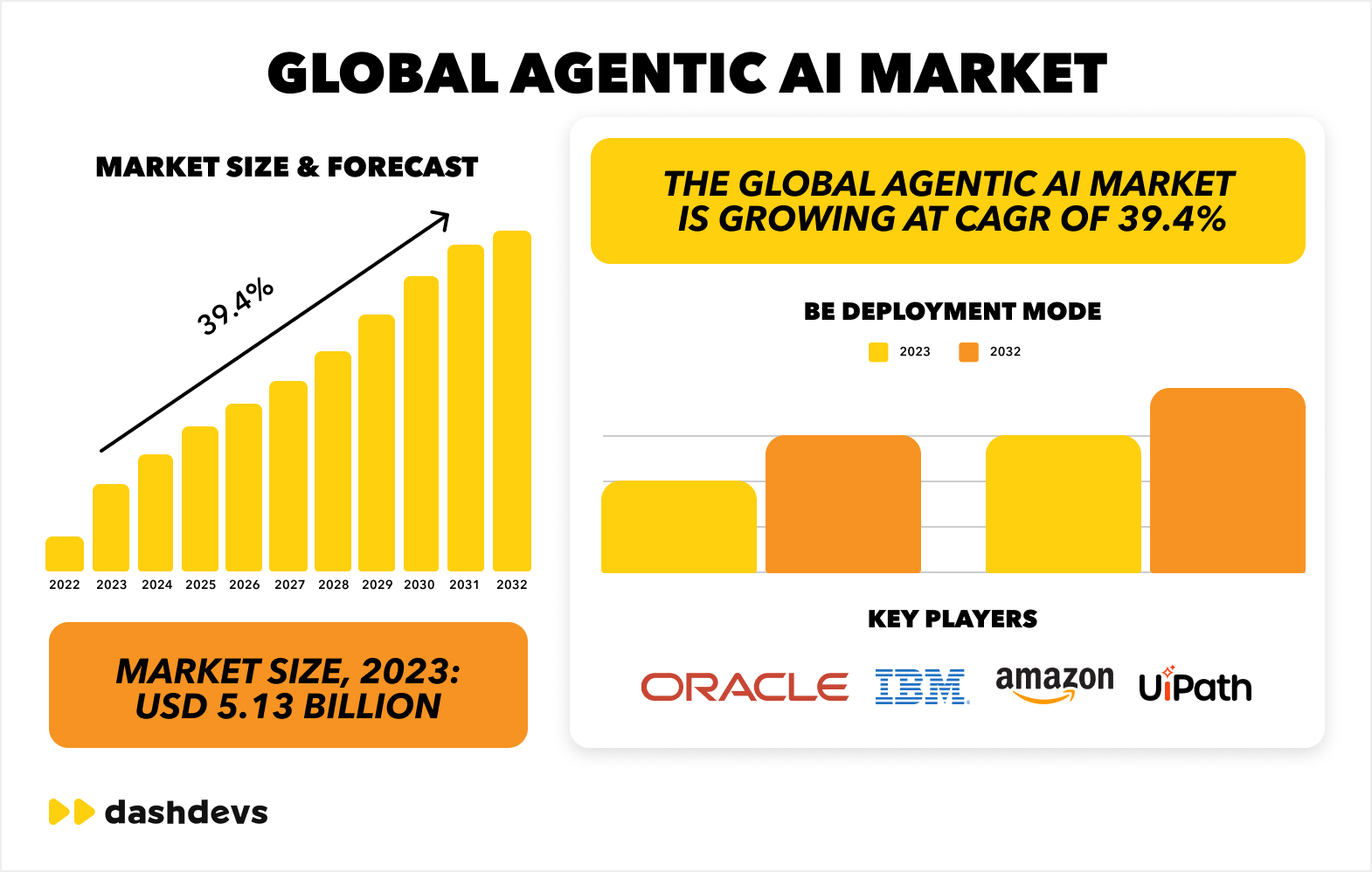

Trend 3: Agentic Commerce Enters the Mainstream

Agentic commerce represents a visible shift in how transactions are initiated and completed. AI agents are now capable of browsing digital storefronts, comparing offers, negotiating terms, and executing payments autonomously.

| Indicator | Data |

| AI-driven retail traffic | +4,700% YoY |

| Payment networks | Agent verification frameworks |

| Adoption stage | Production pilots |

Visa, Mastercard, and major PSPs are developing protocols that allow merchants to authenticate AI agents, validate consent, and authorize machine-initiated payments. This fundamentally changes fraud models, identity verification, and checkout design.

For fintechs, agentic commerce introduces new challenges: distinguishing trusted agents from malicious automation, enabling programmable consent, and maintaining compliance without blocking legitimate machine activity.

Trend 4: Open Finance Moves from Accounts to Context

Open banking focused on access. Open finance focuses on understanding.

In 2026, fintech platforms increasingly incorporate data beyond bank accounts, including payroll, utilities, pensions, tax records, insurance policies, and crypto assets. This shift enables a full, real-time view of a user’s financial behavior and obligations.

| Data source | Product use case |

| Payroll | Dynamic affordability models |

| Utilities | Behavioral risk scoring |

| Pensions | Long-term wealth planning |

| Crypto | Net worth aggregation |

This shift from access to context is already visible in large-scale open finance infrastructure. DashDevs’ work on Tarabut, one of the leading open banking and open finance platforms in the MENA region, illustrates how open finance operates in practice when real banks, regulators, and fintechs are involved.

Rather than focusing on raw API connectivity, the platform was built around secure data orchestration, consent management, normalization layers, and enterprise-grade governance. These components allow financial data to be accessed, controlled, and reused reliably across multiple institutions in real time—while meeting strict regulatory and uptime requirements.

If you’re interested in building an open banking platform like Tarabut, you’re welcome to read this guide from our experts.

By 2026, open finance success depends on data quality, consent management, and real-time control rather than the number of APIs integrated.

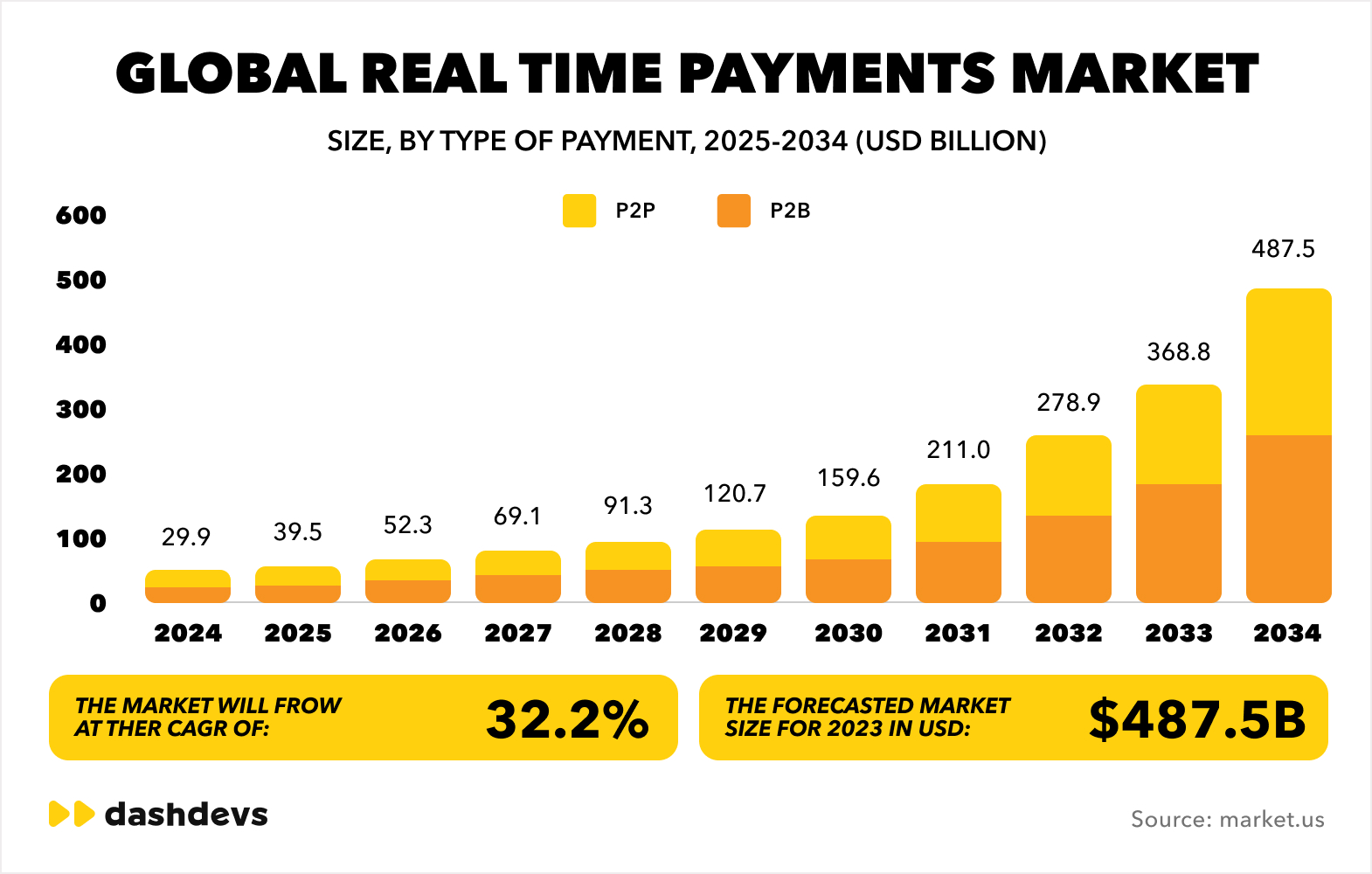

Trend 5: Real-Time Payments Become a Strategic Layer

Real-time payments have moved from a competitive advantage to a baseline expectation. Their strategic value now lies in the secondary effects they enable across products and operations.

| Capability unlocked | Business impact |

| Instant refunds | Higher customer trust |

| Embedded payouts | Marketplace scalability |

| Real-time liquidity | Treasury automation |

| Event-driven lending | New revenue models |

Systems such as FedNow, SEPA Instant, UPI, and PIX have normalized instant settlement. At the same time, ISO 20022 messaging enables richer data exchange, supporting smarter fraud detection and compliance automation.

From an execution perspective, batch-based risk controls no longer work. In 2026, real-time payments require event-driven architecture, continuous monitoring, and automated decisioning.

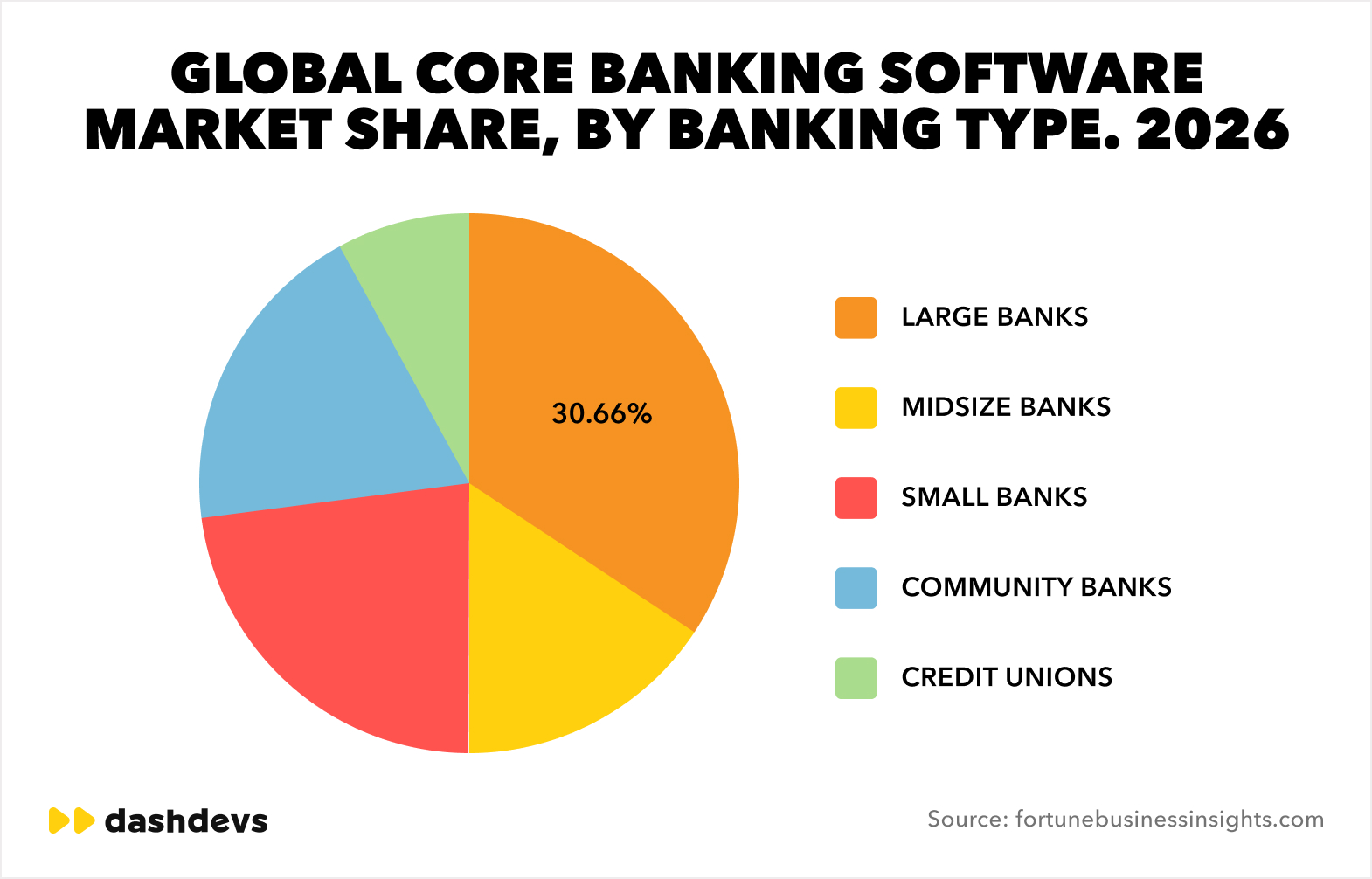

Trend 6: Core Banking Modernization Gets Practical

Core banking modernization has shifted from ambition to necessity. Legacy systems struggle to support real-time payments, embedded finance, and AI-driven decisioning.

| Legacy cores | Modern cores |

| Monolithic | Modular |

| Batch-based | Event-driven |

| Hard to audit | Audit-ready |

Rather than full system replacement, most fintechs pursue progressive modernization. Our delivery experience shows that decoupling critical functions such as onboarding, payments, and lending delivers faster ROI while reducing operational risk.

This shift toward progressive core modernization is especially visible in investment and asset management platforms, where legacy systems often limit real-time operations and product evolution. In one such project, DashDevs modernized a long-running investment management platform Downing into a modular, scalable architecture that now supports real-time portfolio operations and sustained growth—without a disruptive full-system rewrite.

The result was a core capable of evolving incrementally, integrating new capabilities faster, and meeting modern audit and operational requirements while keeping the platform stable in production.

In 2026, core systems are evaluated not by feature lists but by their ability to integrate, scale, and withstand regulatory scrutiny.

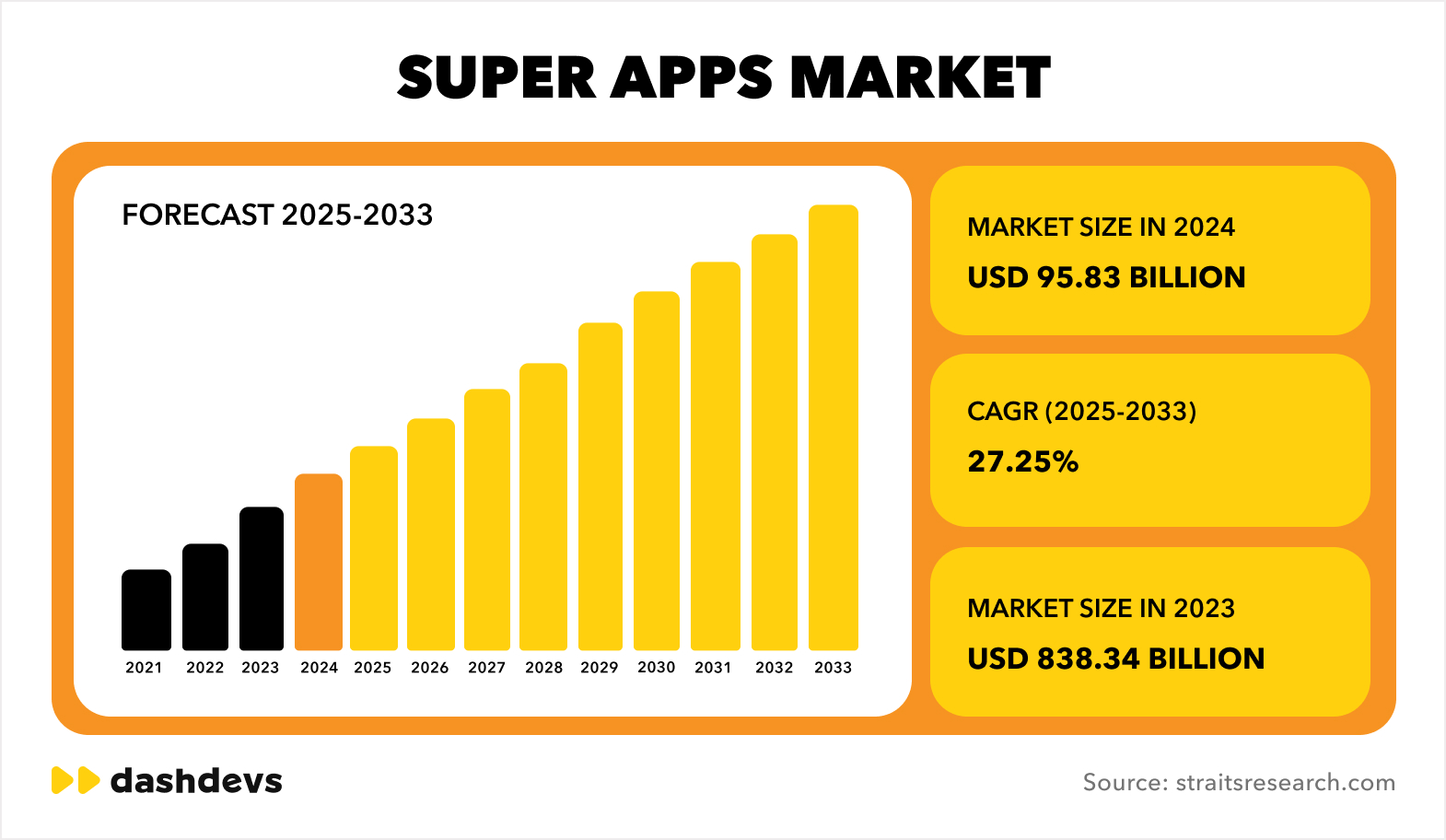

Trend 7: Super-Apps Mature into Financial Operating Systems

The super-app model continues to evolve, but its Western implementation differs significantly from Asian precedents.

In 2026, super-apps function as modular financial operating systems that integrate services through APIs and partnerships rather than centralized ownership.

| Model | Characteristics |

| Consumer OS | Payments, banking, insurance |

| B2B OS | Invoicing, treasury, lending |

Regulation limits aggressive bundling, encouraging federated models where interoperability, shared identity, and data governance define success.

Trend 8: RegTech Becomes Core Infrastructure

In 2026, compliance is no longer something fintech teams prepare for. It is something systems execute continuously.

Traditional compliance models were built around periodic reporting, manual reviews, and post-factum controls. That model no longer works in an environment defined by real-time payments, autonomous AI decisioning, embedded finance, and cross-border data flows. As fintech platforms accelerate, regulators are responding by shifting expectations from documentation to continuous operational proof.

This is why RegTech is no longer a supporting function. In 2026, it becomes a core infrastructure layer.

What regulators now expect in practice

| Requirement | 2026 expectation |

| Monitoring | Continuous, real-time |

| AI decisions | Explainable and traceable |

| Vendor risk | Continuously assessed |

| Incident response | Automated and auditable |

| Data access | Consent-driven and revocable |

Frameworks such as DORA, PSD3, and the EU AI Act explicitly require fintech companies to demonstrate not only that controls exist but that they are active, measurable, and enforceable at runtime.

Read also about PSD3 vs. PSD2 and what they mean for the payment sector.

Why this matters now

Regulatory scrutiny is no longer limited to banks. Fintechs embedding payments, lending, or AI decisioning are increasingly treated as systemically important technology providers. This is particularly visible in areas such as:

- AI-driven credit scoring and fraud detection

- sponsor-bank and BaaS relationships

- third-party dependency chains

- outsourced cloud and data infrastructure

Under DORA, for example, fintechs must prove operational resilience across their entire vendor ecosystem. If a KYC provider, cloud service, or data aggregator fails, regulators expect fintechs to show how risks were identified, mitigated, and contained.

The rapid growth of the RegTech market reflects this structural shift. Solutions focused on audit logging, model explainability, policy-as-code, and continuous controls are moving from “nice to have” into mandatory platform components.

From DashDevs’ experience building compliance-heavy fintech platforms, the key insight is that retrofit compliance fails at scale. Systems designed without built-in auditability, explainability, and resilience require constant manual workarounds and become brittle under regulatory pressure.

In contrast, platforms that treat compliance as infrastructure gain:

- faster regulatory approvals

- lower operational risk

- easier market expansion

- higher partner and investor confidence

What this means for fintech leaders

In 2026, RegTech is not about avoiding fines. It is about earning the right to scale.

Fintechs that embed compliance, explainability, and resilience directly into their architecture will move faster, enter more markets, and operate with far less friction. Those that treat compliance as an afterthought will find growth increasingly constrained—not by technology, but by regulation.

Trend 9: Digital Currencies and Tokenization Reshape Financial Infrastructure

In 2026, digital currencies and tokenization are no longer experimental initiatives run by innovation labs. They are becoming foundational infrastructure for how value is issued, transferred, settled, and governed.

Central Bank Digital Currencies (CBDCs) are moving steadily from research and pilots into controlled production environments. At the same time, tokenization of real-world assets is shifting from niche blockchain use cases to mainstream financial operations.

Market and regulatory signals

| Signal | Data |

| Countries exploring CBDCs | 130+ |

| Tokenized assets market | $10.9T by 2030 |

| Primary adoption drivers | Settlement efficiency, transparency, programmability |

CBDCs are being positioned as programmable, API-accessible money rather than simple digital cash. Wholesale CBDCs are already being tested for interbank settlement, liquidity management, and cross-border payments. Retail CBDCs are increasingly framed as complements to existing payment rails rather than replacements.

At the same time, major financial institutions are issuing tokenized versions of funds, bonds, and other assets, embedding compliance rules directly into the asset lifecycle.

Why this matters for fintech platforms

Tokenization introduces capabilities that traditional systems struggle to provide:

- atomic settlement without reconciliation layers

- embedded compliance logic (transfer restrictions, investor eligibility)

- real-time ownership visibility

- automated corporate actions such as dividends or vesting

For fintech platforms, this creates new infrastructure requirements. Systems must support compliant custody, identity-aware transactions, smart-contract governance, and interoperability across multiple networks and standards.

By 2026, tokenization is no longer judged by novelty. It is judged by:

- legal clarity

- integration with existing financial systems

- operational resilience

- regulatory acceptance

Fintechs that treat tokenization as an isolated feature risk building systems that cannot scale or pass regulatory scrutiny. Those that design token-ready architecture gain flexibility across payments, investments, and cross-border financial products.

Trend 10: Decentralized Banking Enters the Regulated Mainstream

Decentralized finance is undergoing a structural transformation. In 2026, it is converging with regulation to form regulated decentralized banking models, often referred to as deobanks.

Early DeFi emphasized permissionless access and experimentation. The next phase emphasizes compliance, transparency, and operational reliability, without abandoning the benefits of decentralization.

Signals of convergence

| Signal | 2026 reality |

| Settlement speed | Near real-time |

| Intermediaries | Reduced by 30–50% |

| Auditability | On-chain, continuous |

| Compliance | Embedded into protocols |

Rather than operating outside the financial system, deobanks integrate KYC, AML, transaction monitoring, and policy controls directly into smart-contract logic. This allows regulators, auditors, and partners to verify activity in real time, rather than through delayed reporting.

What makes this different from early DeFi

The defining shift is governance by design.

Regulated decentralized banking platforms introduce:

- tiered access and identity verification

- programmable compliance rules

- transparent, immutable audit trails

- automated liquidity and settlement logic

This enables global-scale financial infrastructure that reduces reliance on intermediaries while remaining compliant with regulatory frameworks.

The same infrastructure highlights how regulated DeFi and deobank models are emerging in practice. In building digital asset trading platforms like this, DashDevs implemented custody, compliance workflows, and trading logic that operate across both traditional regulatory frameworks and blockchain rails.

This approach enables near real-time settlement, reduced reliance on intermediaries, and continuous auditability—without sacrificing KYC, AML, or regulatory control. Smart contracts and blockchain settlement are treated as execution layers, while governance, risk, and compliance remain first-class system components.

Liquidity Union demonstrates how decentralized finance evolves into regulated decentralized banking: not by abandoning financial controls, but by embedding them directly into the infrastructure that powers digital asset markets.

Why fintechs are paying attention

For fintech companies, deobanks represent more than an alternative technology stack. They offer a fundamentally different cost and scalability model.

Reduced intermediaries lower operational overhead. On-chain transparency reduces reconciliation and audit complexity. Smart-contract execution enables faster product iteration without rewriting core logic.

In 2026, decentralized banking is no longer positioned as a threat to traditional finance. It is increasingly viewed as a new operating model for building global, resilient financial platforms.

Taken together, these trends make one thing clear: in 2026, fintech leaders will be defined not by how boldly they innovate, but by how reliably they execute at scale under real regulatory, operational, and market pressure.

How a Fintech Development Provider Can Help You Keep Up With Fintech Trends in 2026

Navigating the fast-evolving fintech landscape in 2026 can be challenging. A fintech development provider offers expertise and resources to keep your business competitive while addressing technical, regulatory, and security requirements.

- Access specialized expertise: Gain access to fintech professionals with deep knowledge of the latest technologies and trends. Get tailored advice on strategies, tech stacks, and market insights to achieve your business goals.

- Accelerate time to market: Speed up your product launch with ready-made frameworks like FintechCore. Maintain your software’s uniqueness while benefiting from faster, efficient development processes.

- Ensure compliance and security: Stay aligned with regulations like GDPR and PSD3. Implement cutting-edge anti-fraud measures and security protocols to safeguard your product and user data.

- Flexible development control: Choose your level of involvement—from hands-on collaboration to full project delegation. Benefit from real-time updates and transparency throughout the development process.

DashDevs brings a proven track record in fintech development. Our portfolio spans digital banking, payment apps, trading platforms, and more. Some of the recent fintech projects we developed are:

- MuchBetter, an award-winning e-wallet preferred by global gaming sites

- Downing, a sustainable investment management platform focused on renewable energy

- Chip, an AI-based app that helps customers manage their savings and investments

- Tarabut, an open-banking app that connects banks and fintech in MENA region

- Digital assets trading platform

With access to industry expertise, faster time-to-market solutions, and robust compliance measures, you can focus on scaling your operations and delivering innovative financial products that resonate with your audience.

Summing Up

The fintech landscape in 2026 presents both opportunities and challenges. Staying competitive means leveraging advanced technologies, adhering to complex regulations, and ensuring secure, innovative solutions.

Partnering with a fintech development provider can help businesses navigate this complex landscape, ensuring faster time-to-market, adherence to compliance, and access to cutting-edge technologies. By doing so, companies can unlock new opportunities, meet customer expectations, and secure a leading position in the fintech space.