JANUARY 7, 2025

11 min read

Fintech is changing the way we interact with money, making financial services smarter, faster, and more accessible. Did you know the global fintech market is expected to skyrocket to $698.48 billion by 2030, with a growth rate of over 20% per year? That’s because fintech is constantly evolving, driven by new technology, changing regulations, and what people need most from their banks.

Every year brings exciting new innovations—like AI-powered tools and digital-only banks—along with improvements to ideas that are already making waves. But what does this mean for the future of banking? Let’s explore the current trends in fintech that are setting the stage for what’s next.

Why Fintech Solutions Matter

Fintech is not just a niche industry—it’s a driving force transforming the global financial ecosystem. While large banks leverage fintech to enhance their services, entrepreneurs are building innovative technologies that redefine convenience, speed, and accessibility.

Fintech has also reached a tipping point among consumers, with approximately 90% of Americans now using fintech solutions for banking, payments, or investments. This widespread adoption highlights its significant impact, providing transformative advantages for businesses, investors, and regular consumers.

Here’s why fintech matters:

- For banks: Fintech streamlines processes, reduces costs, and improves customer experiences with tools like AI-driven insights and automated services.

- For entrepreneurs: It creates opportunities to innovate, disrupt traditional systems, and scale startups globally.

- For consumers: Fintech provides faster payments, easier access to credit, and smarter tools for managing finances efficiently.

Fintech establishes connections among these stakeholders, facilitating the evolution of the financial ecosystem to meet contemporary demands and maintain its competitive edge.

10 Technologies Shaping the Future of Fintech

Technological advancement and innovation are the foundations of financial development. They will continue to drive disruptive business models in the sector. The demand for new technology in the financial services industry was spurred by the epidemic. Yet there are other factors that are going to influence the near future and affect newcomers as well.

#1 The “Buy Now, Pay Later” Financing Model

The BNPL concept is a prominent trend in the financial industry, offering consumers the flexibility to make purchases and pay in installments over time, typically without interest if paid within a specified period.

In general, BNPL providers work by partnering with retailers to offer their payment services at the checkout. Customers can select the BNPL option and provide their payment and personal information, and the BNPL provider will pay the retailer upfront for the purchase. Customers are then responsible for repaying the BNPL provider according to the agreed-upon payment schedule.

Here are some examples of how BNPL works:

- Klarna is a BNPL provider that offers a range of payment options, including splitting purchases into four equal payments or paying for purchases over a longer period with interest. Klarna also offers features like price drop notifications and the ability to pay for items up to 30 days after delivery.

- Affirm is another BNPL provider that offers payment plans for purchases ranging from $50 to $17,500. Customers can choose to pay back their purchases over three, six, or twelve months with interest, and there are no late fees or hidden charges.

Consumers are increasingly relying on this technology to pay for their items. BNPL allows customers to make payments without being required to pay for them in advance or use a credit card. Hence, it might be an appealing choice for those who don’t have a credit card or wish to avoid excessive obligations.

#2 Embedded Finance Technology

One of the most exciting and impactful innovations in fintech today is embedded finance — the integration of financial services into non-financial platforms. This technology enables businesses outside the traditional banking sector to offer financial solutions directly within their products, creating seamless customer experiences.

For example, a ride-hailing app might partner with a fintech company to embed payment solutions, allowing users to pay for rides without leaving the app. Similarly, e-commerce platforms can offer embedded lending, giving customers instant credit approval at checkout.

The benefits of embedded finance are far-reaching:

- For businesses: It drives customer engagement by offering convenience and new value-added services.

- For consumers: It simplifies transactions and makes financial services more accessible in everyday contexts.

- For fintech companies: It opens new markets by integrating with industries outside of traditional banking.

Embedded finance is redefining the boundaries of financial services, enabling companies across industries to join the fintech revolution. This trend is poised to shape the future of fintech, providing unprecedented convenience and integration for consumers and businesses alike.

#3 RegTech

RegTech is a new term for using technology to track regulatory operations. RegTech, short for Regulatory Technology, refers to innovative solutions that leverage technology to enhance the efficiency and effectiveness of regulatory compliance processes.

Here are some examples of how it helps businesses in the real world:

- RegTech companies offer solutions that use AI and machine learning to monitor transactions and identify potential risks or breaches of regulations.

- They can also help financial institutions verify customers’ identities using biometrics, facial recognition, or other technologies.

- RegTech solutions can automate regulatory reporting, allowing institutions to submit accurate and timely reports to regulators. This can reduce the risk of errors and omissions and help institutions avoid penalties.

Despite its recent emergence, the sector has seen great development, which is expected to continue. The RegTech market is predicted to increase from $8 billion in 2022 to almost $45 billion by 2030, making it a profitable business for all parties involved.

Financial technology development is required for RegTech’s growth. While it’s excellent that more things are going digital, it also means that there are more hazards. The uncontrolled digital financial sector provides a sanctuary for fraud, hacking, and other financial institution dangers.

#4 Open API

The world works toward an open financial system. Hence, open banking APIs and services are among the fintech technologies that are getting more popular. Such APIs are crucial for creating a unified user experience while safeguarding data via endpoints.

Open banking APIs have unlocked a range of innovative fintech features, including real-time expense tracking, personalized budgeting tools, seamless account aggregation, instant loan approvals, and automated savings plans. These capabilities empower users to manage their finances more efficiently while maintaining secure and transparent data sharing between banks and third-party providers.

#5 Stable and Progressive Artificial Intelligence

AI in fintech isn’t just improving efficiency—it’s reshaping the financial landscape with groundbreaking innovations:

- Hyper-personalized finance: AI anticipates life events, such as saving for a family or home, by analyzing spending, geolocation, and even health data, delivering unparalleled foresight.

- Behavioral finance insights: AI deciphers emotional cues from voice or written communication, flagging impulsive decisions and promoting smarter financial behavior.

- Dynamic fraud counterintelligence: AI creates “digital decoys” to lure and neutralize fraudsters in real-time, shifting from prevention to proactive defense.

- Quantum-powered models: Pairing AI with quantum computing enables instant portfolio optimization and global risk analysis at an unimaginable scale.

- Invisible banking: IoT-enabled AI integrates into daily life, autonomously managing payments, subscriptions, and policies—your life banks for you.

- Ethical financial inclusion: Advanced AI eliminates systemic biases, driving fair access to loans and insurance for underserved communities.

Thus, AI isn’t just smarter—it’s transforming finance into an adaptive, predictive, and near-sentient system.

#6 No-Code and Low-Code Development

No-code and low-code platforms are reshaping the way businesses approach software development, empowering non-technical users and developers alike to build applications through intuitive interfaces. This democratization of technology accelerates the creation of functional tools and solutions, often without requiring deep programming expertise.

In fintech, no-code and low-code engineering manifests in several ways:

- Customer-facing applications: Rapid development of onboarding platforms, financial calculators, or payment gateways.

- Process automation: Streamlining KYC/AML processes, generating automated audit trails, and creating workflows for compliance.

- Data visualization: Enabling stakeholders to create dashboards for real-time insights into customer transactions or fintech industry trends.

- MVPs for startups: Helping fintech startups quickly prototype and test product ideas before scaling with fully customized solutions.

Complex systems like payment gateways, AI-driven fraud detection, blockchain integrations, and high-performance trading platforms demand advanced technical expertise, robust architecture design, and rigorous security measures.

This is where our expertise at DashDevs comes into play. We specialize in delivering tailor-made fintech solutions that combine scalability, innovation, and regulatory compliance. Our developers ensure that your core systems are not just functional but also resilient, secure, and future-ready. While no-code and low-code can complement your toolkit, partnering with experienced professionals ensures your fintech vision is realized to its fullest potential.

If you are curious about other key trends in banking to follow, check out another blog post by DashDevs.

#7 Blockchain Technology

Blockchain is a transformative technology that allows individuals and organizations to securely transfer information and assets without relying on third-party providers. Banks can leverage blockchain networks like Ethereum, Hyperledger, and Ripple to monitor funds, handle transactions, and verify client identities independently of traditional intermediaries like PayPal or Mastercard.

The applications of blockchain extend far beyond banking:

- Cryptocurrency: Networks like Bitcoin and Ethereum power decentralized currencies used for payments, investments, and remittances.

- NFTs (non-fungible tokens): Platforms like Solana and Polygon support the creation and exchange of digital assets tied to art, collectibles, and more.

- Secure authentication: Blockchain is used for decentralized identity verification systems, enhancing privacy and security for user data.

- Decentralized finance (DeFi): Protocols like Uniswap and Aave allow users to borrow, lend, and trade without traditional financial institutions.

- Supply chain management: Networks like VeChain track goods across the supply chain, ensuring transparency and reducing fraud.

By integrating blockchain into fintech, businesses gain enhanced security, transparency, and efficiency, opening new avenues for innovation in financial and non-financial sectors alike.

#8 IoT Technology

The Internet of Things (IoT) refers to a network of interconnected devices embedded with sensors, software, and other technologies that enable them to collect and exchange data over the Internet.

IoT solutions are becoming increasingly popular among FinTech organizations. They allow more gadgets to interact across linked networks, from wireless and endpoint devices to centralized control administration. Furthermore, embedded systems and advanced solutions are rapidly emerging, allowing for intelligent and smooth communication across diverse nodes.

IoT is used in the fintech industry to create valuable consumer data, reduce the necessity for human intervention in financial problem-solving, detect fraud, and provide reliable data safety, among other things. Meanwhile, companies are rapidly using IoT to assess risk, improve consumer interaction, and streamline the complicated underwriting and claims processes.

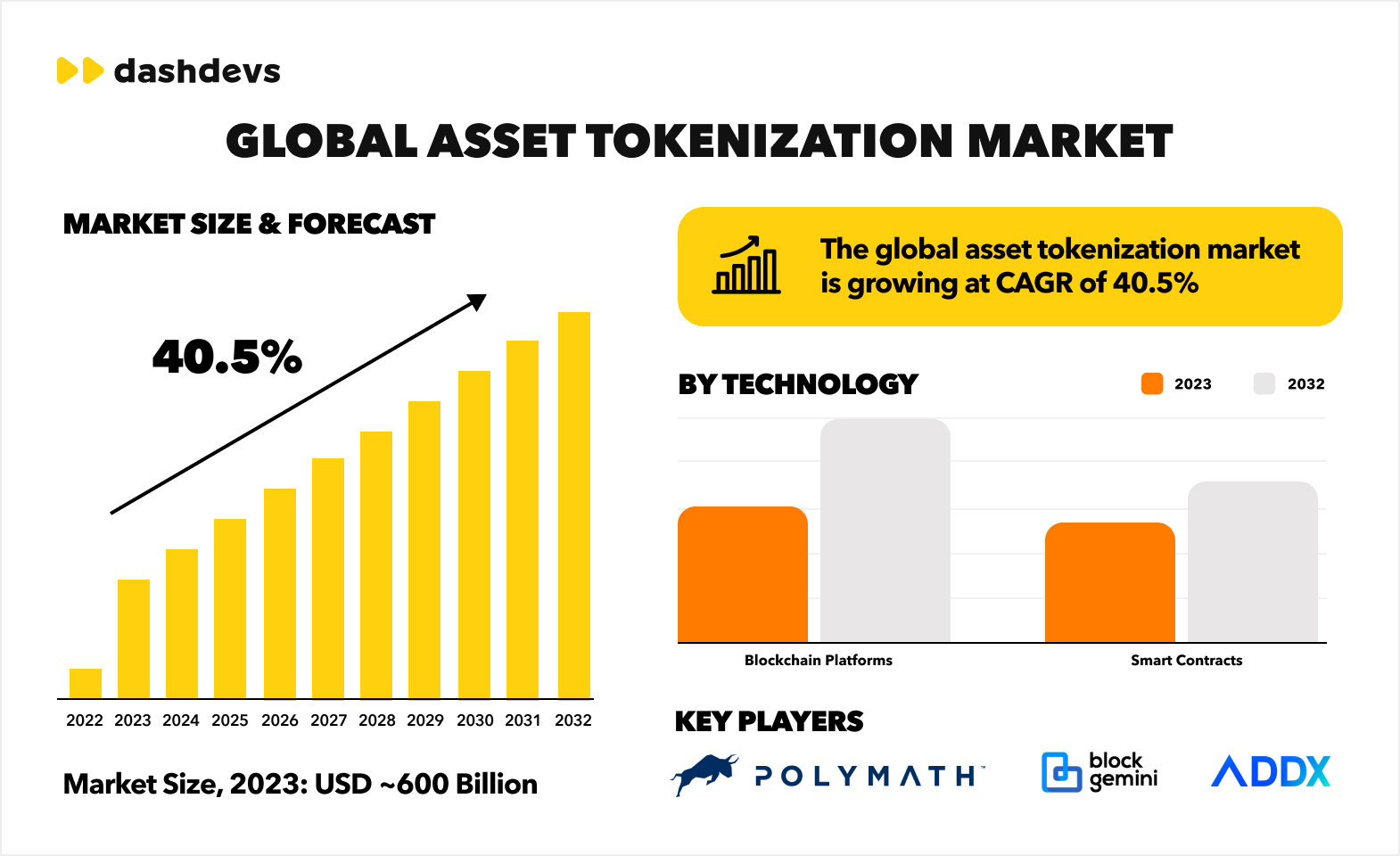

#9 Tokenized Assets and Fractional Ownership

In 2025, tokenized assets are revolutionizing the way people invest by offering fractional ownership of traditionally illiquid assets. This innovation leverages blockchain technology to tokenize assets like real estate, art, and even private equity, breaking them into smaller, tradeable units.

For example, instead of needing millions to invest in a high-value property, individuals can now purchase a fraction of it through a tokenized platform. This democratizes investment, allowing more people to access markets that were once reserved for the wealthy.

- Accessibility: Enables micro-investments, lowering the barrier to entry for diverse asset classes.

- Liquidity: Provides a marketplace where fractional shares of tokenized assets can be traded instantly.

- Transparency: Uses blockchain for secure and immutable transaction records.

Tokenized assets are reshaping wealth creation, making the investment landscape more inclusive and efficient.

#10 5G-Enabled Real-Time Payments

With the advent of 5G technology, real-time payments in fintech are set to become faster, more reliable, and more efficient. 5G’s ultra-low latency and high bandwidth will transform various payment methods, offering instant transactions that were previously impossible with 4G networks.

Key impacts of 5G on payments:

- Instant peer-to-peer payments: 5G will enable real-time money transfers, allowing users to send and receive funds almost instantly, even in busy environments. This will enhance the experience on platforms like Venmo and Zelle.

- Faster cross-border remittances: International money transfers will become as quick as domestic ones, reducing processing times and fees and making cross-border payments easier for consumers and businesses alike.

- Frictionless in-store payments: With 5G, in-store transactions will be faster and more seamless, allowing for smoother digital wallets or contactless payments, improving the customer experience.

- Enhanced security: 5G networks come with advanced encryption, making real-time payments more secure and protecting sensitive financial data.

In summary, 5G will drastically improve payment speed, reduce costs, and offer greater security, transforming how consumers and businesses engage with financial transactions.

Why Fintech Is Set to Continue Growing

The fintech sector is not just growing—it’s on the brink of a transformational shift that will redefine the global financial landscape. What we’re seeing now is just the beginning of a long, complex evolution of how we bank, invest, and manage money.

Several factors indicate that fintech’s growth will continue to accelerate:

- Consistent investment: Fintech is set to receive over $300 billion globally by the end of 2025, with investors confident in the scalability of AI, blockchain, and open banking.

- Public demand: 90% of consumers in developed markets now use fintech services, indicating a growing preference for them over traditional banking for their convenience and accessibility.

- Continuous innovation and consumer interest: Emerging technologies like AI-powered credit scoring and quantum computing are driving fintech’s evolution, enhancing efficiency, transparency, and inclusivity.

- Regulatory support: Governments and regulators are increasingly embracing fintech with supportive policies and regulations, enabling secure and stable growth.

- Mobile-first solutions: With mobile payments and wallets becoming the norm, fintech is expanding rapidly, allowing users to access financial services anytime, anywhere.

- Decentralized finance (DeFi): The rise of DeFi platforms is disrupting traditional financial systems, offering peer-to-peer transactions, lending, and staking without intermediaries.

- Blockchain adoption: More financial institutions are implementing blockchain for secure transactions, reducing fraud, and improving transparency in cross-border payments.

- AI integration: AI is being used to enhance customer experience, improve risk assessments, and automate processes like fraud detection and loan approvals.

- Consumer-centric solutions: Fintech products are increasingly tailored to meet individual needs, from personalized budgeting tools to automated investment platforms.

In conclusion, fintech is poised for explosive growth, driven by massive investments, a public eager for innovation, and a relentless push for better financial solutions. By staying on top of emerging trends and understanding fintech’s transformative potential, businesses and consumers alike can position themselves at the forefront of this revolution.

Conclusion

The future of the financial sector relies on key innovations like AI, IoT, open APIs, cloud computing, and blockchain. For businesses to stay competitive, they must embrace fintech solutions that drive efficiency, enhance customer experience, manage risks, and meet regulatory demands. Adopting these cutting-edge technologies will not only help companies thrive but also shape the next generation of financial services.

Let DashDevs, a software development consulting firm, assist you if you are seeking superior fintech app development services. With over 14 years of industry experience and a team of more than 200 experts, we have completed over 500 projects, including the launch of over 45 fintech projects tailored to the industry’s specific needs.