Top 10 Core Banking Software Providers Powering Digital Finance

A key target for the majority of companies nowadays is efficient and effective scaling through the utilization of the best-fitting digital solutions. In the finance sector, core banking software plays a crucial role when delivering improved revenue streams and user experiences.

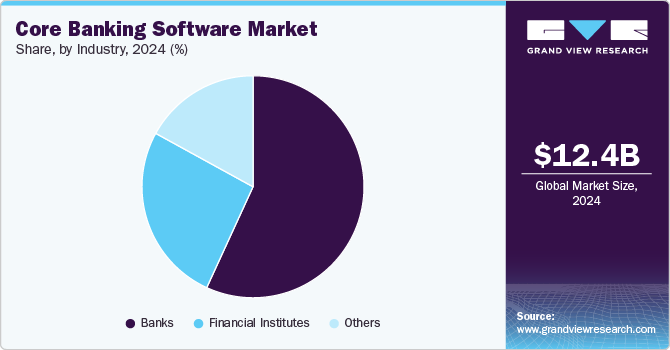

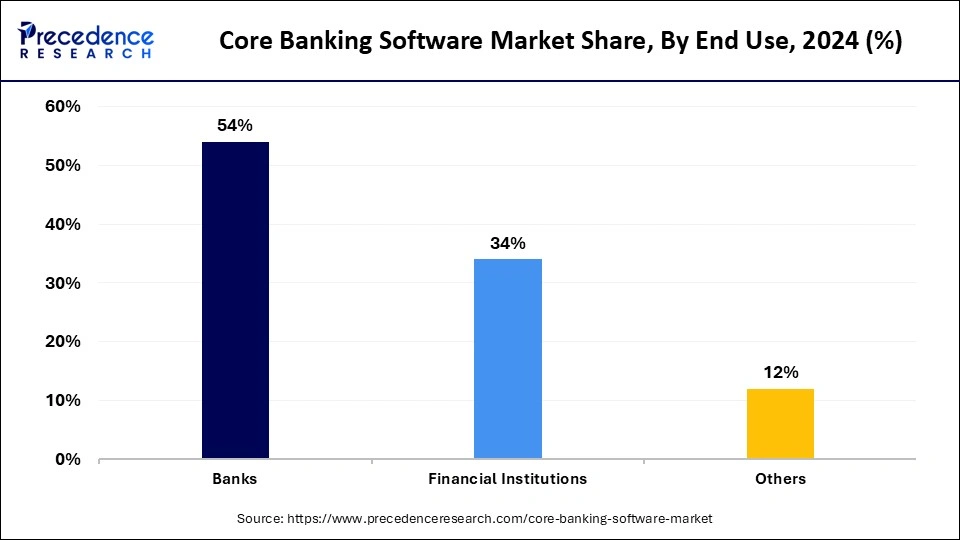

Driven by the demand for scalable, quick, customer-centric banking solutions, the global core banking software market was estimated at approximately USD 12.5 billion in 2024, projected to reach USD 13.8 billion in 2025, with a forecasted growth to around USD 33.1 billion by 2034 at a 10.2% CAGR. Other research estimates the 2024 market at USD 12.37 billion, growing to USD 21.6 billion by 2030 at a similar 10.2% CAGR.

Article Summary:

- What is core banking software?

- Top 10 core banking products

- How to choose the right banking product for your company

- Non-finance business that can benefit from core banking products

Core Banking Software: Explained

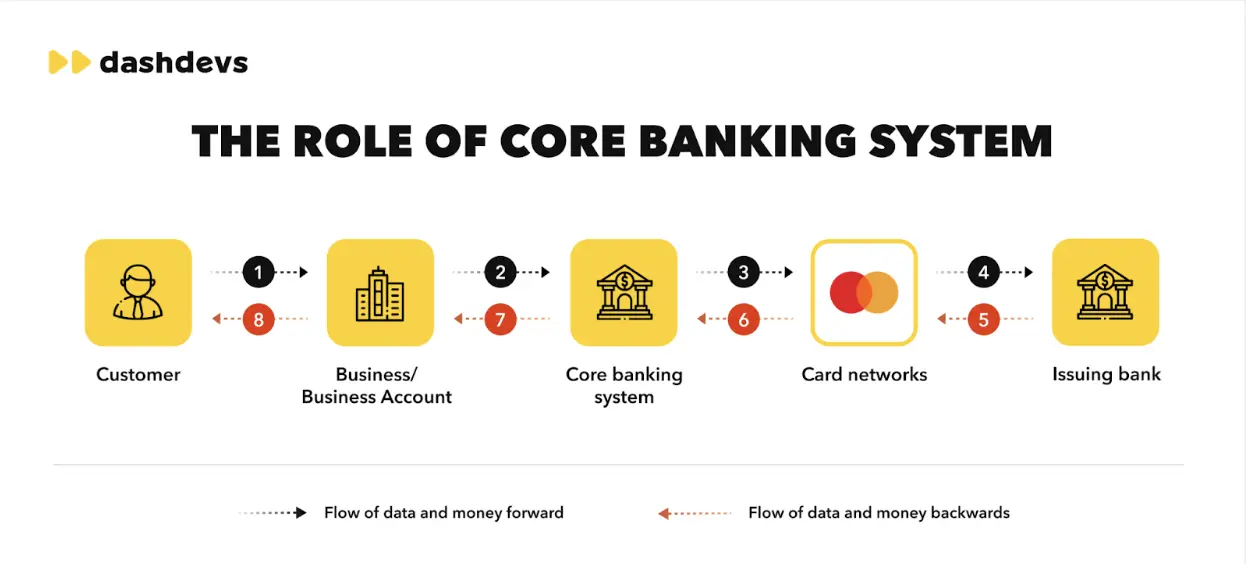

Core banking software is an integrated technology platform that manages and automates essential banking operations.

Think of core banking software as a ready-made digital structure, provided B2B, that integrates seamlessly with an external application, handling the back-end of banking services provided to end customers. With core banking, it’s possible to include most of the banking functionalities in virtually any app or platform.

Top 10 core banking products

This exhaustive list of recommended core banking software solutions is based on the breadth of functionality provided, reliability metrics, and ease of integration within existing applications and those in development.

Important note: The exact composition of core banking software may vary, depending on the provider. For example, advanced analytics and cross-border transactions may not be included by default. Besides, it’s worth mentioning that payment processors and payment gateways, two essential components of transaction processing, may be integrated into core banking solutions as third-party or custom native modules.

You may explore extensive details about payment processors and payment gateways from another blog post by DashDevs.

| Vendor | Main Headquarters location | Foundation Date | Size (Employees) | Pricing model | Key Strength |

| DashDevs | London, UK | 2011 | 100+ | Subscription-based (SaaS) | Fast time-to-market and unlimited customization opportunities |

| Mambu | Berlin, Germany | 2011 | 200+ | Subscription-based (SaaS) | Rapid adoption and flexibility for digital banking |

| Finastra | London, UK | 2017 (merger) | 10,000+ | Open-source | A broad set of financial software solutions |

| Finacle | Bangalore, India | 1999 | 2,800 | Subscription-based (SaaS) | Accelerates innovation-led growth |

| FIS | Jacksonville, FL, US | 1968 | 62,000 | Subscription-based (SaaS) or one-time purchase | Comprehensive range of financial products and services |

| Temenos | Geneva, Switzerland | 1993 | 4,600 | Modular-based one-time-purchase | Rich functionality and cutting-edge technology |

| Thought Machine | London, United Kingdom | 2014 | 500+ | Subscription-based (SaaS) | Smart contract capabilities for product configurability and automation |

| Fiserv | Brookfield, WI, US | 1984 | 44,000 | Subscription-based (SaaS) or one-time purchase | Leading technology for core banking and payments |

| Oracle FLEXCUBE | Mumbai, India | 1997 | 9,000 | Modular-based one-time-purchase | Advanced automation and comprehensive modular solutions |

| TCS BaNCS | Mumbai, India | 2004 | 40,000+ | Subscription-based (SaaS) | Real-time processing and a comprehensive suite for core banking |

1. Fintech Core

Fintech Core is a modular, pre-connected fintech infrastructure designed for companies building early-stage digital wallets, super-apps, and crypto exchanges. It acts as the foundation needed to launch and scale financial products quickly, without the long integration cycles typical of traditional fintech builds.

Fintech Core works for companies that have already validated their idea and now need to move fast with a structured, scalable architecture.

With Fintech Core, you can:

- Launch a combined crypto + fiat financial product with ready integrations

- Build a digital wallet or exchange with prebuilt modules

- Extend an existing product using modular components for payments, wallets, and crypto

- Reduce time-to-market by using a system that is already connected to multiple providers

Fintech Core is a product, not a custom build. The architecture, integrations, and modules already exist and can be configured for your use case.

Fintech Core’s modular offering includes:

- Real-time multi-currency transaction processing

- Connected fiat and crypto modules

- Pre-integrated partner ecosystem

- Scalable, cloud-based architecture

- Customizable UI and workflow layers

- Digital wallet capabilities

- Risk, compliance, and KYC integrations

- Modular expansion for cards, liquidity, and other optional features

How to Choose the Right Banking Product for Your Company:

When it comes to shortlisting potential core banking software providers, assess them based on the following key considerations:

- Functionality and features: Evaluate the functionality of a provider’s core banking platform and ensure that it meets your banking needs and objectives.

- Cost of integration and pricing: Access the cost of core banking software integration. Besides, check processing fees and ensure that they are feasible for your end customers.

- API maturity and integration capabilities: A nimble and dynamic API will enable you to integrate all necessary tools, helping you utilize all means to launch and scale.

- Niche-specific suitability: Confirm that the provider’s solutions are tailored to your specific banking niche or market segment.

- Location coverage: Verify that the provider has adequate coverage and support in your operational regions and is compliant with legal regulations.

- Provider’s reputation and trustworthiness: Research the provider’s market reputation and reliability through reviews and ratings.

- Scalability and flexibility: Assess if the provider can scale its core banking software throughput with your growth and adapt to changing requirements.

- Customer support: Check the quality and availability of the provider’s customer support services. It’s essential for both you, as a recipient of B2B core banking services, and your end customers, who will have to contact the provider directly or via your support service in case of any issues.

“There is no one-size-fits-all solution. What works for a fintech or a de novo bank may not work for a traditional institution.” - Eduardo Camargo, Chief Strategy Officer and Head of CIS LATAM, GFT

Who Needs Core Banking Software?

Companies that should adopt core banking systems can be divided into 2 categories: Fintech businesses and non-fintech businesses. However, both categories can benefit from the following features:

- Customer onboarding

- AML/KYC

- Account management

- Transaction processing

- Currency exchange

- Card issuing

- Financial accounting and general ledger

- Reporting

- Integration hub

Fintech Businesses:

Typical fintech companies or startups have main offerings that may not be directly related to banking, such as personal finance management or lending platforms. Yet, they can consider reinforcing their service lines with core banking.

A prime example of such businesses is Mint, who offer payment processing and point-of-sale systems for small businesses.

Integrated core banking offering: Square Banking offers business bank accounts, savings accounts, and loan products, this way having traditional banking services integrated into its ecosystem.

Additionally, integrated core banking allows them to receive payments directly rather than via a third-party processor, which provides cost-efficiency and flexibility.

Non-fintech Businesses

Non-fintech companies can also leverage services from core banking providers. To these, the power of core banking lies in making key services and products more financially accessible, hence driving more sales. However, they can also add banking services to their main offering.

One example is Shopify, a company best known for providing sales capabilities to small businesses, which introduced Shopify Balance to give merchants faster access to their funds, simplified money management, and business spending tools. The service is powered through a banking-as-a-service (BaaS) partnership that enables Shopify to embed financial features without building a full banking stack internally.

Another example is Uber, which launched Uber Money to provide drivers and couriers with real-time earnings access, digital wallets, and debit card products. By embedding financial functionality inside its ecosystem, Uber strengthened engagement and reduced reliance on external payout partners.

In Southeast Asia, Grab Financial Group has expanded from ride-hailing into a broad portfolio of financial products, including payments, loans, insurance, and merchant services. This expansion is supported through regional BaaS and fintech partnerships that allow Grab to scale financial offerings across multiple markets.

Fintech and non-fintech businesses alike share similar reasons for adopting core banking, which include the following:

- Additional revenue streams

- Better customer experience

- Compounding competitive edge

- Faster time to market for product offerings

- Additional scalability and market expansion capabilities

- Extra data for target customers and their consumer behavior patterns

To get a full picture of how core banking software helps companies overcome key scaling hurdles, click here.

2. Mambu

Mambu is a cloud-native core banking platform founded in 2011, known for its composable banking approach. It enables financial institutions to innovate rapidly by offering a flexible and scalable banking infrastructure. Mambu’s modern architecture allows businesses to easily assemble and deploy customized financial solutions.

Core banking offering:

- Configurable loan and deposit management.

- Integrated payments and transaction processing.

- Modular customer onboarding workflows.

- API-driven, composable architecture for flexibility.

- Cloud-native scalability for rapid growth.

- Fast time-to-market for new financial products.

3. Finastra

Finastra was formed in 2017 from the merger of Misys and D+H, becoming a global leader in financial software. The company provides a wide range of solutions for retail, corporate, and universal banking, with a strong focus on open banking and digital transformation for financial institutions.

Core banking offering:

- Real-time, multi-currency transaction processing.

- Advanced risk management and compliance integration.

- Open API ecosystem for fintech collaboration.

- Comprehensive retail, corporate, and universal banking support.

- Seamless digital transformation tools for legacy systems.

- Scalable architecture for global financial institutions.

4. Finacle

Finacle is a core banking solution developed by EdgeVerve, a subsidiary of Infosys. Core banking system providers like Finacle serve customers globally, providing robust support for retail, corporate, and universal banking. The platform is designed to facilitate digital transformation, enhance customer engagement, and drive operational efficiency for financial institutions.

Core banking offering:

- Omnichannel customer experience management.

- Advanced analytics and AI-driven insights.

- Scalable architecture supporting global operations.

- Comprehensive support for digital and traditional banking.

- Extensive API integration for seamless third-party collaboration.

- Real-time transaction processing with multi-currency support.

5. FIS

Fidelity National Information Services (FIS) is a global leader in financial technology solutions, providing a diverse range of core banking services targeted to banks and financial institutions of all sizes. With an emphasis on innovation, FIS offers a comprehensive, scalable platform that covers everything from retail banking to wealth management, allowing institutions to remain competitive in a continuously changing market.

Core banking offering:

- Cloud-enabled, scalable core platform.

- Real-time processing across retail, commercial, and digital banking technology.

- Integrated risk management and compliance tools.

- Extensive API ecosystem for fintech integration.

- Advanced data analytics and AI capabilities.

- Support for omnichannel banking technology and seamless customer experiences.

6. Temenos

Temenos is a well-known provider of core banking software, servicing over 3,000 financial institutions worldwide. Temenos’ flexible and scalable architecture enables banks to create innovative products and services while retaining operational efficiency. The platform serves a wide variety of banking operations, from retail to corporate, and is intended to expedite digital transformation.

Core banking offering:

- Real-time, end-to-end processing across all banking verticals.

- Cloud-native and cloud-agnostic deployment options.

- Advanced analytics and AI-driven personalization.

- Comprehensive support for digital and traditional banking.

- Extensive API framework for third-party integrations.

- Modular architecture for easy customization and scalability.

7. Thought Machine

Thought Machine is a next-generation core banking technology provider best known for its flagship product, Vault Core. Designed with a cloud-native, API-first approach, Thought Machine enables banks to break free from legacy systems and build highly configurable, scalable, and future-proof banking services. It serves some of the world’s leading banks and has a strong reputation for innovation and flexibility.

Core banking offering:

- Cloud-native, real-time core banking engine.

- Smart contract-based product configuration.

- High resilience and scalability for enterprise-level deployments.

- Seamless support for multi-currency and global operations.

- Open API framework for easy integrations.

- Continuous delivery model for fast product iteration.

8. Fiserv

Fiserv is a highly trusted banking software provider. It offers a wide range of core banking solutions designed to enhance operational efficiency and customer experiences. Its platform enables seamless integration of core banking applications and provides advanced tools for compliance, innovation, and customer engagement across various banking sectors.

Core banking offering:

- Integrated digital banking solutions for seamless customer engagement.

- Scalable cloud-based and on-premises deployment options.

- Advanced risk management and compliance tools.

- Real-time payments and transaction processing.

- Comprehensive data analytics and reporting capabilities.

- Extensive API and fintech integration support.

9. Oracle FLEXCUBE

Oracle FLEXCUBE is a comprehensive core banking platform from one of the leading banking software vendors, Oracle. As a digital banking software provider, Oracle FLEXCUBE is designed to meet the needs of global financial institutions, offering one of the best core banking software solutions in the industry. The payment platform is built to enhance customer experiences while enabling banks to innovate, scale, and maintain regulatory compliance.

Core banking offering:

- Omnichannel banking support with seamless integration.

- Scalable architecture for global and regional banks.

- Real-time processing engine

- Advanced compliance and risk management features.

- Integrated digital banking and mobile capabilities.

- Extensive API support for third-party integrations.

10. TCS BaNCS

TCS BaNCS is another modern core banking system offered by Tata Consultancy Services (TCS), a prominent player among banking software providers. Their platform supports a wide range of banking operations, from retail to corporate banking, and is known for its flexibility, scalability, and ability to support cloud-based core banking system solutions. TCS BaNCS empowers banks to drive digital transformation, enhance customer experiences, and maintain regulatory compliance.

Core banking offering:

- End-to-end support for retail, corporate, and universal banking.

- Real-time, multi-channel transaction processing.

- Cloud-ready architecture for scalable deployment.

- Advanced risk management and compliance integration.

- Comprehensive digital banking and mobile banking capabilities.

- API-driven architecture for seamless third-party integration.

Note: The mentioned providers are not listed in any particular order, meaning that provider #1 is not necessarily the best and provider #10 the worst. They are all top-tier core banking services providers on the global market.

Looking for a trusted provider of software development services? Reach out to DashDevs, and let’s discuss.

Top Core Banking Solutions Vendors Comparison

Now, let’s compare the listed above core banking solution vendors by other key criteria:

| Vendor | Main Headquarters location | Foundation Date | Size (Employees) | Pricing model | Key Strength |

| 1. DashDevs | London, UK | 2011 | 100+ | Subscription-based (SaaS) | Fast time-to-market and unlimited customization opportunities |

| 2. Mambu | Berlin, Germany | 2011 | 200+ | Subscription-based (SaaS) | Rapid adoption and flexibility for digital banking |

| 3. Finastra | London, UK | 2017 (merger) | 10,000+ | Open-source | A broad set of financial software solutions |

| 4. Finacle | Bangalore, India | 1999 | 2,800 | Subscription-based (SaaS) | Accelerates innovation-led growth |

| 5. FIS | Jacksonville, FL, US | 1968 | 62,000 | Subscription-based (SaaS) or one-time purchase | Comprehensive range of financial products and services |

| 6. Temenos | Geneva, Switzerland | 1993 | 4,600 | Modular-based one-time-purchase | Rich functionality and cutting-edge technology |

| 7. Thought Machine | London, United Kingdom | 2014 | 500+ | Subscription-based (SaaS) | Smart contract capabilities for product configurability and automation |

| 8. Fiserv | Brookfield, WI, US | 1984 | 44,000 | Subscription-based (SaaS) or one-time purchase | Leading technology for core banking and payments |

| 9. Oracle FLEXCUBE | Mumbai, India | 1997 | 9,000 | Modular-based one-time-purchase | Advanced automation and comprehensive modular solutions |

| 10. TCS BaNCS | Mumbai, India | 2004 | 40,000+ | Subscription-based (SaaS) | Real-time processing and a comprehensive suite for core banking |

How to Choose a Core Banking Provider?

When it comes to shortlisting potential core banking software providers, assess them based on the following key considerations:

- Functionality and features: Evaluate the functionality of a provider’s core banking platform and ensure that it meets your banking needs and objectives.

- Cost of integration and pricing: Access the cost of core banking software integration. Besides, check processing fees and ensure that they are feasible for your end customers.

- Niche-specific suitability: Confirm that the provider’s solutions are tailored to your specific banking niche or market segment.

- Location coverage: Verify that the provider has adequate coverage and support in your operational regions and is compliant with legal regulations.

- Provider’s reputation and trustworthiness: Research the provider’s market reputation and reliability through reviews and ratings.

- Scalability and flexibility: Assess if the provider can scale its core banking software throughput with your growth and adapt to changing requirements.

- Customer support: Check the quality and availability of the provider’s customer support services. It’s essential for both you, as a recipient of B2B core banking services, and your end customers, who will have to contact the provider directly or via your support service in case of any issues.

Choosing a perfect-fit core banking provider is an important strategic decision. Should you need assistance, don’t hesitate to reach out to DashDevs. We are both a development team and a digital banking software provider. With more than 13 years in the market and over 500 projects under our belt, we can advise you on core banking providers as well as help integrate them into your applications or platforms.

Final Take

As of 2025, core banking software remains a crucial digitalization opportunity for businesses, offering improved revenue and user experiences. The market is driven by a near-universal adoption among financial institutions. Both fintech and non-fintech businesses can leverage core banking provided by DashDevs, Mambu, Finastra, and other top providers.

Should you need to integrate core banking in your app or platform, consider DashDevs as your trusted dev partner. With more than 15 years on the market and over 500 projects under our belt, we can deliver seamless integration with any customization you like, channeling you to global banking.