Top Banking Trends 2026: The Ultimate List of Innovations

2025 has proven that innovation is nowhere near slowing down in the fintech realm. The world of payments is constantly evolving as key players, as well as newcomers, are pushing the envelope when it comes to the variety of solutions, along with their respective complexity.

At this point, payments have become the core innovation layer of fintech. Realistically, expectations are now based upon infrastructure-led innovation, not hype. Global digital payment transaction value reached ~$9.5 trillion in 2023 and is projected to exceed $16 trillion by 2028. Further reports even indicate that the annual growth rate is around 12–15% CAGR.

We’ve compiled a list of innovations we see as developers and long-time stakeholders in the market that we deem necessary for the success of any player in the banking market this year.

Summary:

- Modular infrastructures are the way forward

- Human-centric design has become the top priority

- AI and other tech trends when utilized correctly

- ESG and brand-boosting practices

- Cloud computing

1. Open Banking and BaaS: Modular Banking Infrastructure

Open Banking and Banking-As-A-Service (BaaS) have already proven to be at the core of all innovation within the banking sector. The ethos focuses on banks and credit unions sharing data and services with third-party providers through Application Programming Interfaces (APIs), fostering a more interconnected financial ecosystem. The main aim is to enhance shared effort towards combined innovation.

Key Driving Factors:

- API integration: Robust and continuously-maintained APIs are the main engine driving collaboration between banks and third-party partners.

- Customized financial products: As fintech innovation, particularly in payments, moves forward at lightning speed, a one-size-fits-all approach no longer applies. Understanding separate markets and addressing their needs dynamically is key to winning over market shares.

- Improved customer experience: The “Open” aspect in Open Banking implies transparency in operations and the handling of customer data.

Real-life examples:

Splitwise expanded its partnership with Tink (a Visa solution) to launch “Pay by Bank” across key European markets, namely France and Germany. In a major move for 2025, this integration allows users to settle shared bills instantly from their banking app without manual entry. Said move resulted in a reported 150% surge in payment initiations in the UK alone.

Our first-hand experience:

We partnered with Tarabut, the MENA region’s first regulated Open Banking platform. Tarabut reimagines online banking in the MENA region through the ecosystem of connections. Through our partnership, Tarabut enables banks and other fintechs to connect with third-party providers.

2. Mobile-First Banking Practices

Mobile-first banking is a “nice-to-have” no more. Realistically, it is now the primary arena for customer retention. The newer generations, i.e., Gen Z and Alpha, make up the majority of the current cohorts dominating the market. With that, smartphones are expected to handle complex wealth management and cross-border operations, not just balance checks. Experts are pointing towards trends that indicate that the global mobile banking market is projected to grow from roughly $1.58 billion in 2025 to over $3.66 billion by 2032, driven by the demand for “super-apps” that integrate lifestyle and finance.

Key Driving Factors:

- Super-App Ecosystems: Consolidating lifestyle services (ride-hailing, food delivery, shopping, etc) with banking functions. This not only tempts customers to engage more with apps but also enhances the potential for customer loyalty.

- Biometric Standardisation: Moving beyond FaceID to behavioral biometrics for continuous authentication.

- AI-Native Interfaces: Replacing static menus with conversational AI agents that navigate the app for the user.

- Instant Issuance: Digital-first card issuance that allows immediate spending via mobile wallets before physical delivery.

First-hand experience:

We partnered up with Dozens, one of the UK’s first mobile-only digital banks. On top of that, Dozens aims to reinvent people’s relationship with money. 9 months in, following our ethos, our partnership resulted in a platform that focuses on scalability, compliance, and a genuine drive to make money management feel simple and rewarding.

Real-life examples:

BBVA launched a major rework of its app in Spain in May 2025, launching a native AI architecture that scales personalized insights across all its operating regions. Yet another proof, digital wallet transaction values are forecast to exceed $16 trillion by 2028, which is pushing legacy institutions to race against tech giants to keep their cards “top of wallet” in Apple Pay and Google Wallet ecosystems.

3. Personalized Experience at Every Step (Hyper-Personalization)

In 2026, innovation in banking means the “Segment of One.” Clear implementation of this mentality can be translated into practices such as predicting a mortgage need before the customer even starts looking at houses. Utilizing Agentic AI, we believe, institutions such as banks increase the chance of reducing customer acquisition costs by an estimated 30–50%. Following this pivotal trend in banking is a sure-fire way for institutions aiming to deepen client relationships.

Key Driving Factors:

- Predictive Analytics: Shifting from reactive support to proactive financial wellness.

- Dynamic UX: Interfaces that change based on life stages.

- Data Autonomy: Giving users control over their personalization data.

Real-life examples:

Global markets are flaunting innovation in banking industry workflows, with Nexus Frontier Tech deploying a OneNexus AI solution that reduced SME loan processing times significantly. This is a prime example of modern banking efficiency,

4. Green Banking (ESG Integration)

At DashDevs, we understand that many companies will commit to ESG as a corporate and legal necessity. But, that doesn’t need to be the case. ESG can now be considered a core component of banking industry technology trends. Analyzing trends brought forth by the aforementioned new major market clientele, Gen Z and Gen Alpha, the reality is clear as day. ESG is a key driving force in bank innovation that wins over the hearts and minds of new potential customers.

Key Driving Factors:

- Carbon Tracking Dashboards: Enhanced transparency using apps that show the carbon footprint of spending.

- Transition Finance: Investing heavily in helping high-carbon industries to decarbonize.

- Blockchain Transparency: Showcasing the effort and impact involved in green bonds.

Real-life examples: As a trailblazing example, Societe Generale was seen showing true signs of innovative banking by issuing the first digital green bond on a public blockchain. Similarly, the Industrial Bank of Korea launched new loans dedicated to ESG, highlighting how current trends in banking are prioritizing the well-being of the planet alongside profits.

5. AI-Driven Banking Automation

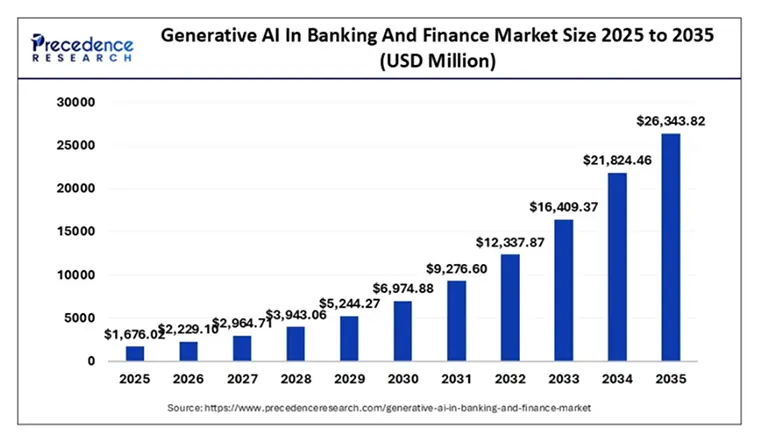

When we talk about ultimate banking trends, AI is at the forefront. The AI market in banking is projected to skyrocket from $1.67 billion in 2025 to over $21 billion by 2034. From the outside, this may be seen as weaponizing short-term solutions for long-term needs. However, innovation in banking is shifting the workforce from manual processing to strategic decision-making via “CoBots.”

Key Driving Factors:

- Automated Compliance: Efficiency is not the only metric at play. Alongside human operations, tighter real-time vetting for KYC/AML can be enabled by employing modern AI-based solutions.

- With Fintech Core, we’ve implemented AI-driven KYC systems that reduce onboarding friction while maintaining strict AML compliance standards. By combining automated document verification, biometric checks, and real-time sanctions screening, financial institutions can significantly cut processing time without compromising regulatory rigor.

- A relevant example is the Digital Identity Automation Engine, where automated compliance workflows were introduced to streamline onboarding and regulatory checks. By integrating AI-based identity verification and transaction monitoring, the bank reduced manual compliance workload while increasing review accuracy and response speed.

- Process Automation: Streamlining back-office operations and transaction processing to eliminate manual bottlenecks.

- Fraud Detection: Although we truly believe in the power of truly trained fraud detection human professionals, we also believe that empowering them with AI to identify and prevent fraudulent activities can lead to more effective results.

First-hand experience:

We’re in constant conversations with fintech developers, entrepreneurs, and market players surrounding the value of AI in fintech. While some companies do use the technology as a marketing badge, there is no denying the constant innovation in the field. We find the trick of the trade in knowing why to integrate AI in digital banking, rather than how.

Real-life examples:

OCBC Bank reported a 50% productivity lift during trials, proving that banking innovations in AI are delivering tangible ROI. J.P. Morgan also launched IndexGPT, democratizing investment advice.

6. Lending-As-A-Service (LaaS) & Embedded Finance

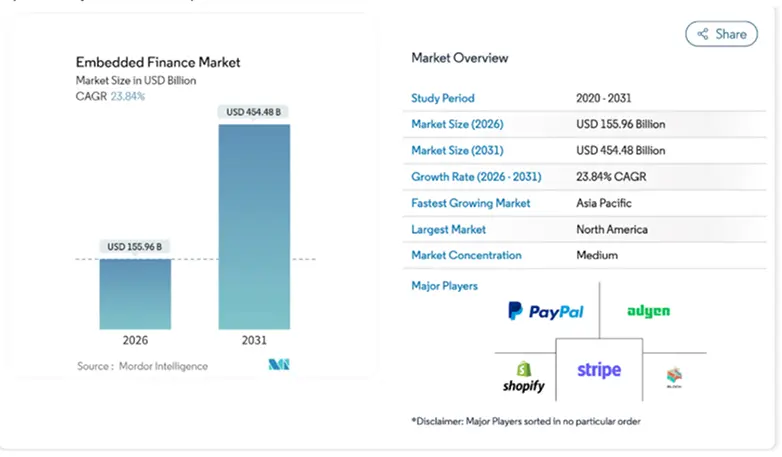

It’s fair to say that this is one of the most disruptive recent trends in the banking industry. The new and improved approach to lending organically integrates financial services into non-financial platforms. An ironclad proof of the LaaS & Embedded Finance concepts is reported by stats that report that the market is set to reach $155.96 billion in 2026.

Key Driving Factors:

- Vertical SaaS Integration: Building software from the ground up with lending at its core.

- Instant credit access: Streamlining lending decisions and disbursements.

- BNPL for Business: Split payments for B2B procurement.

- Partnership models: Collaborating with fintech and e-commerce platforms to expand reach.

Real-life examples:

Galileo will not cease to boast about being named “Best in Class” provider, enabling B2B platforms to issue virtual cards.

7. Real-Time Payments As A Global Standard

If successful models such as Wise and Revolut have proven anything, it’s that the demand for speed is shaping modern banking strategies. And, as if those two examples weren’t sufficient to prove the point, stats are pointing towards the fact that Global RTP values are forecast to grow by nearly 290% between 2023 and 2030.

Key Driving Factors:

- Instant transactions: Addressing the market’s increasing next for near-zero-delay transactions, especially at a consumer level.

- 24/7 availability: Users across different markets, time zones, and success levels demand payment services around the clock.

- Interoperability: Eliminating barriers posed by failure to assimilate across different banking institutions and geographic markets.

- Enhanced security: Implementing robust security measures sufficient for real-time transactions.

Real-life examples:

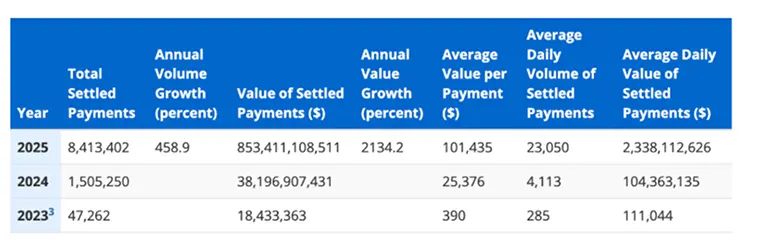

The US Federal Reserve reported that more than 1,200 institutions are now live participants on its FedNow® Service instant payments rail. Transaction volume data for the FedNow® Service for Q4 2024 shows 915,000 total settled payments and quarterly volume growth up 172%. Quarterly value growth is up double digits at 15.4%, and the average daily value of settled payments is now $219 million.

8. Strengthening Customer Lifetime Value (CLV)

Among the biggest challenges facing retail banking innovations is the fight over retention. Bain & Company released a report showing that a mere 5% in customer retention can boost profits by 25% to 95%. Consequently, fintechs opt for strategies such as “relationship pull” as opposed to “product push” as part of their innovative banking overhaul.

Key Driving Factors:

- Customer Relationship Management (CRM): Pulling all the stops, including thorough data analysis, AI prediction tools, and A/B testing of services to maintain a proactive stance towards customer needs.

- Personalized services: Customizing products to the needs of customers of varying demographics.

- Loyalty programs: Customers need to feel the benefits of loyalty just as much as the financial institutions.

- Cross-selling: Utilizing information acquired regarding customer needs and habits to develop more products, tailored to their future and/or current needs.

Real-life examples:

Take Cred in India as a prime example of how creating an exclusive “club” for high-credit-score individuals, rewarding bill payments with tangible luxury rewards, revolutionized this space. Alternatively, in Europe and North America, banks are increasingly adopting “subscription” models (often dubbed “Banking Prime”) that bundle value-added services, turning erratic transaction fees into predictable recurring revenue.

9. Responsible, Ethical, and Secure Use of Data

There’s a clear trend that is shifting customer/market preference towards zero-trust environments. A plausible argument can be made for how different generations vary in trust towards financial institutions. In response, the industry is moving toward “Phishing-Resistant” authentication and “Policy-as-Code” to ensure data handling is compliant by design.

Key Driving Factors:

- Data privacy: Strengthening data protection practices to safeguard personal information. Putting in place modern security measures, for example, blockchain data storage, evolving anti-phishing tools, and the latest technologies in threat detection

- Ethical data use: Ensuring fairness and responsibility in data usage. Enhancing the trust between customers and providers through transparency and providing full control over personal data usage.

Real-life examples:

KO Bank Polski has neared a household-name status by deploying physical security keys (like YubiKeys) for high-value retail clients, virtually eliminating phishing success for those accounts. Legacy defences are now falling prey, more often than not, to identity attacks that succeed at an alarming rate, according to the Picus Blue Report 2025.

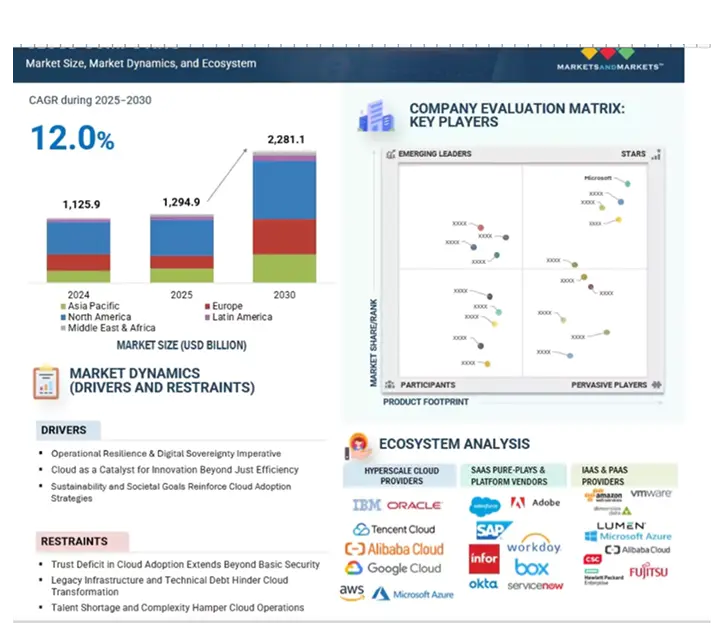

10. Cloud Computing and Sovereign Cloud

Cloud technology continues to be a pillar of banking industry technology trends. Fintechs and other tech companies alike now focus on Sovereign Cloud to ensure future banking innovations comply with local regulations.

Key Driving Factors:

- Streamlined updates: Ability to constantly update systems with the latest security and utility features.

- Cost efficiency: Enabling steady operations without the need for constant hardware improvements.

- Data accessibility: Removing geographic barriers. Enhancing access through authorized portals..

Real-life examples: The Reserve Bank of India has laid out clear guidelines for localized cloud storage, setting a precedent for trends in banking regarding data sovereignty.

11. Online Banking Gamification

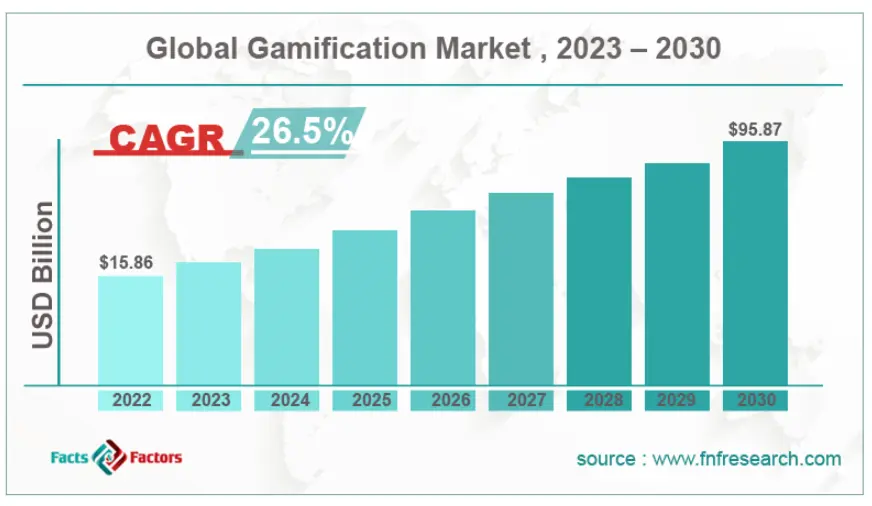

A major trend in fintech that seems to have no aim to hit the brakes is gamification, making it one of the most engaging ultimate banking trends. The market is set to reach $95 billion by 2030.

Key Driving Factors:

- Interactive engagement: Increase in customer interaction with the platform/app.

- Rewards system: Capitalizing on dopamine-based decision-making by offering incentives for desired banking behaviors.

- Financial education: Educating customers through gamified learning experiences.

- Customer loyalty: Building loyalty and engagement through fun and interactive elements.

Paytm and Cred have successfully turned innovations in banking** **into daily habits. Research confirms that Paytm’s scratch card mechanics significantly boosted user retention, while Cred’s gamified rewards model helped it capture India’s top 1% of spenders, proving that banking trends can be both fun and profitable.

What Can Banks Do to Digitalize Themselves in 2026 and Beyond?

- Build with design thinking in mind: Avoid rushing to get the product out the door. Considering the company’s mission, its upcoming journey, and its end goal is key to standing out in the market.

- Human-centric development: What separates the leader from the herd in digital banking is knowing how to translate all possible functions that can be done in physical locations to a digital platform. Working through the customer journey as developers, then removing potential barriers one-by-one is where true innovation in banking lies.

- Transparency and visibility: As aforementioned, giving customers the ability to view personal transactional data at will gives a boost to banks seeking to enhance trust.

- Eliminating redundancy: No customer wants to go through multiple KYC loops to access banking functions that do not require authentication. Banking innovation lies in the thorough consideration of creating seamless experiences.

- Flexibility in partnership integrations: World-leading banks rely on software infrastructures that allow dynamic integration of various tools and partners. Staying fluid when it comes to addressing customer needs & wants, at times preemptively.

Conclusion

Innovation in banking is not about finding the most advanced, expensive, or popular trends and tools in the market. True banking innovation lies in considerate and thoughtful design and storytelling. A modern-day digital bank is more than an online spreadsheet of balances and expenditures.

Successful digital banks such as Revolut and Wise spent the majority of their development cycles identifying what makes them stand out in the market. Knowing a bank’s genesis and end goals helps developers curate the correct list of soft and hard tools that enable truly unique and seamless experiences for customers.