What is Digital Banking?

Digital banking matters in 2026 because it’s no longer just about moving services online. It has become a platform-driven business model that powers how money is stored, moved, embedded, and monetized across entire digital ecosystems.

With hundreds of billions in annual revenue and net interest income projected to reach $1.61T in 2026, digital banking continues to scale fast—and it’s still early in the curve. What’s changed is scope. Digital banks are no longer limited to checking and savings; they’re expanding into AI-driven decisioning, real-time payments, embedded finance, and ecosystem partnerships that blur the line between banks, fintechs, and product companies.

In 2026, digital banking isn’t a channel. It’s the infrastructure behind modern financial experiences.

Key takeaways

- Digital banking is no longer just online access — it’s a platform-based business model powering modern financial products

- The market continues to scale, with net interest income projected at $1.61T in 2025 and growth extending through the decade

- Digital banks are moving beyond core accounts into AI, real-time payments, embedded finance, and ecosystems

- In 2026, digital banking acts as infrastructure, not a channel — enabling how financial services are built, distributed, and monetized

What does Digital Banking stand for?

It represents how banking services are designed, delivered, and governed entirely through digital channels, with full responsibility for money, risk, and compliance built into the system.

When teams explore how to build digital banking capabilities, they often start with features: onboarding, cards, transfers, savings. That’s natural — features are visible. What actually defines digital banking is what users never see.

Digital banking is responsible for:

- safeguarding customer funds

- meeting regulatory and reporting obligations

- managing risk, treasury, and operational resilience

That responsibility reshapes everything. It pushes teams beyond UX into architecture, governance, and long-term control. Digital banking isn’t just about how things look — it’s about how the system behaves under regulation, scale, and stress.

This is why early digital banking often disappointed customers. As David M. Brear, CEO 11FS, explains in Fintech Garden Episode 130 (Banking Transformation, and Human-Centered Service):

“Digital banking didn’t start because it was better for customers. It started because it removed people, paper, and buildings from the equation.”

The first wave of digital banking focused on efficiency, not service. It reduced cost, but it rarely redesigned how banking should work in a digital world.

That historical context matters because it explains the confusion we still see today between fintech apps, neobanks, and real digital banks.

In practice, modern digital banking typically includes user-facing capabilities such as:

- Online account opening with automated identity checks

- Mobile PFM (personal financial management) for spending insights, budgeting, and financial control

- Real-time payments with instant clearing and settlement visibility

- Digital identity & fraud protection embedded across onboarding and transactions

These capabilities matter — but they only work when supported by a regulated architecture designed for risk, compliance, and scale.

Key Pillars of Digital Banking

Digital banking is built on a small set of foundational pillars that determine how scalable, secure, and competitive a banking model can be. These pillars go beyond features and define how the system behaves in real production environments — under regulation, load, and constant change.

Digital-First Experience

Digital banking is designed around user behavior, not branch processes. The experience must feel seamless, instant, and personalized across every interaction.

Typical characteristics include:

- Frictionless onboarding with minimal steps

- Mobile-first design with consistent UX across channels

- Context-aware personalization based on user behavior and data

Example: A customer opens an account in minutes, receives tailored spending insights from day one, and sees relevant offers based on real usage — not generic segments.

Real-Time Technology & APIs

Digital banking operates in real time by default. Delays that were once “normal” in banking are no longer acceptable.

Core capabilities include:

- Instant balance updates and transaction visibility

- Real-time payments and settlements

- API-driven integrations with partners, fintechs, and internal systems

Why it matters: Real-time infrastructure enables faster launches, ecosystem partnerships, and embedded finance use cases — without rebuilding the core every time.

Security & Trust

Security is not a backend concern — it is a primary adoption driver. Research consistently shows that perceived security and fraud protection directly influence whether users adopt digital banking services.

Modern digital banking relies on:

- Digital identity and biometric authentication

- AI-based fraud detection and behavioral monitoring

- Real-time alerts, controls, and layered cryptographic security

Example: Suspicious behavior is detected mid-transaction, authentication is stepped up dynamically, and risk is mitigated without interrupting legitimate users.

Automation & AI

Automation is the engine of scale in digital banking. In 2026, AI is no longer limited to support chatbots — it actively participates in decision-making.

Key applications include:

- Agentic AI for credit and risk decisions

- Automated loan processing and approvals

- Personalized pricing, offers, and limits

- Continuous fraud and compliance monitoring

Result: Banking systems that adapt in real time — learning from data, reducing manual operations, and improving outcomes without constant human intervention.

Summary: How the pillars work together

| Pillar | What it enables |

| Digital-first experience | High conversion, retention, and user trust |

| Real-time technology & APIs | Speed, scalability, and ecosystem integration |

| Security & trust | Adoption, compliance, and resilience |

| Automation & AI | Operational efficiency and intelligent decisioning |

Together, these pillars turn digital banking from a set of online features into a resilient, scalable, and future-ready financial operating model.

2026 Digital Banking Trends: What’s Changing — and Why It Matters

By 2026, digital banking is no longer evolving incrementally. It is shifting structurally. Technology, regulation, and customer expectations are converging, forcing banks to rethink how money moves, how decisions are made, and how trust is built — in real time.

Below is a detailed, analytics-backed overview of the trends defining digital banking in 2026.

Agentic AI Goes Mainstream

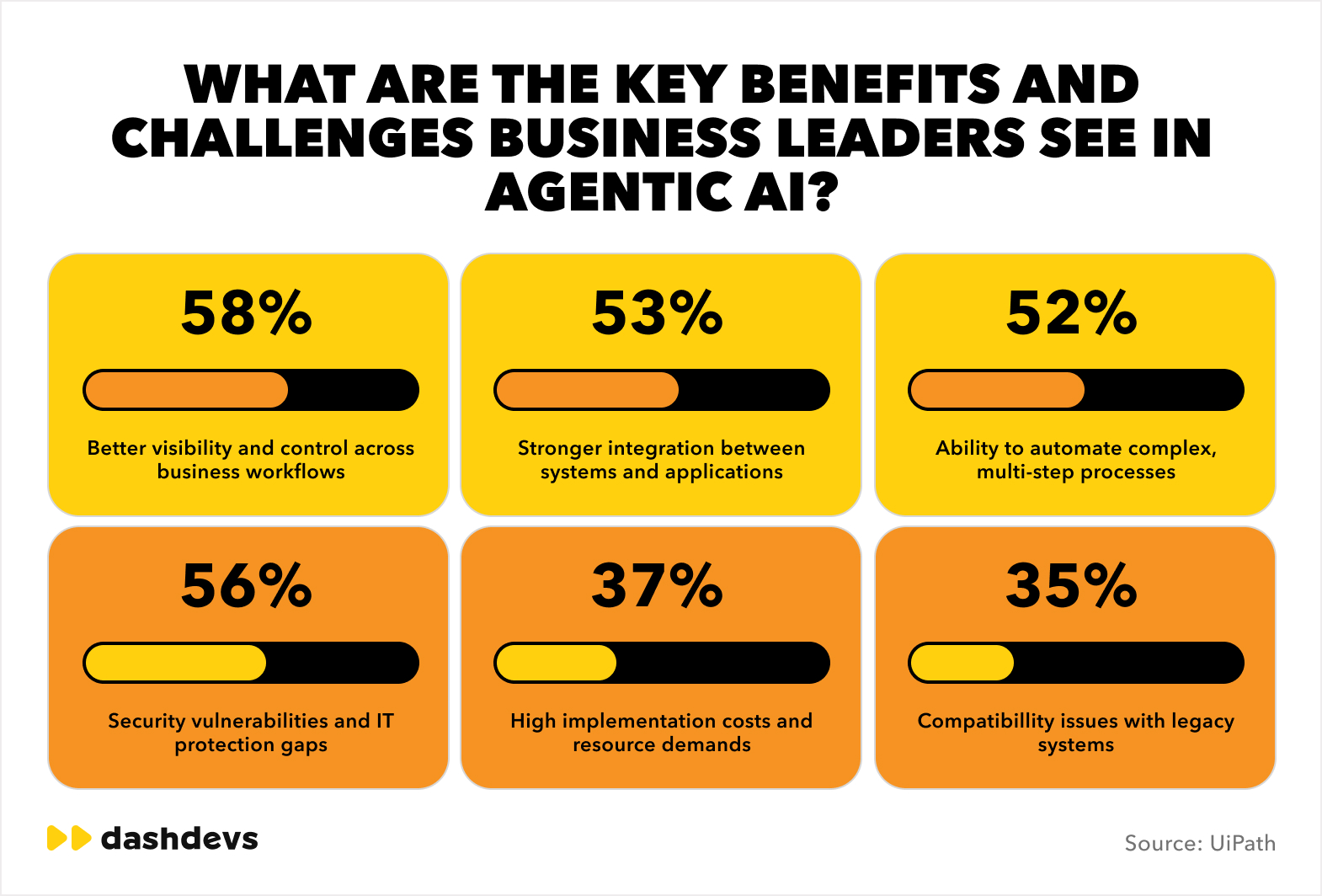

2026 marks the practical dawn of agentic AI in financial services. Unlike traditional AI models that support or recommend actions, agentic systems act autonomously within defined guardrails — reconciling accounts, making credit decisions, and detecting fraud in real time.

Major technology and analytics providers such as SAS, CGI, and Blue Prism report that banks are moving from AI experimentation to AI industrialization — embedding decision-making agents directly into core workflows.

What this changes: AI becomes a core operating layer — not an add-on. Credit, fraud, pricing, and compliance decisions increasingly happen continuously, not in batches.

To get even more insights from industry expert, watch our podcast with Dumitru Condrea where we speak about AI in financeю

Real-Time Everything Becomes the Default

Real-time processing is no longer a competitive edge — it is the baseline. Industry-wide adoption of ISO 20022, FedNow, SEPA Instant, and PIX is redefining customer expectations around speed, visibility, and control.

According to CGI’s 2026 outlook, real-time information — not just real-time payments — is becoming the industry standard.

What’s emerging:

- Instant liquidity visibility across accounts and currencies

- Real-time settlement and posting

- Real-time compliance, with AML and sanctions screening executed in milliseconds

Risk for laggards: Banks unable to support real-time liquidity, settlement, and compliance risk losing business clients to fintechs offering “instant everything” — without legacy delays.

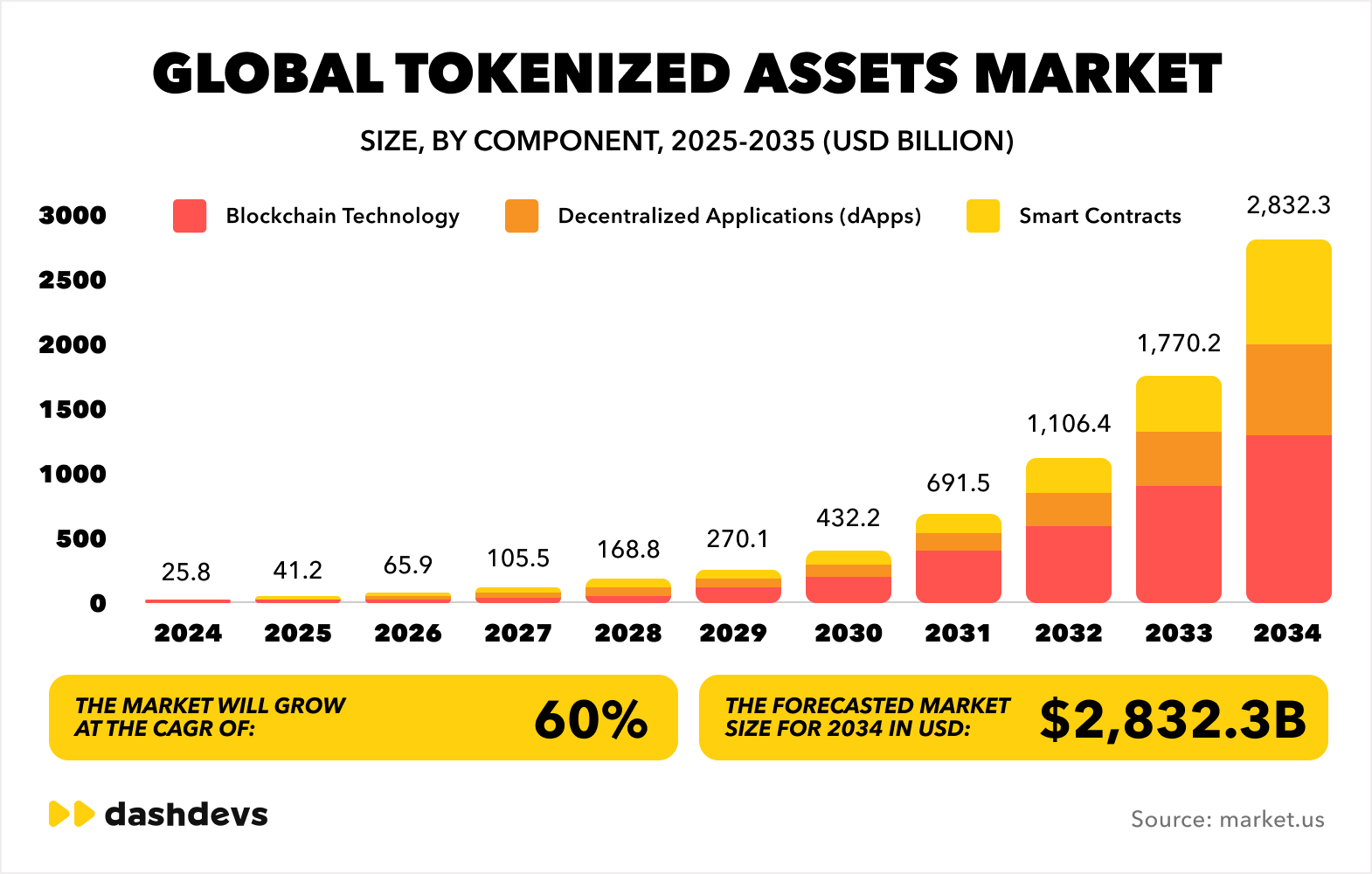

Tokenized & Programmable Money

Money itself is becoming software. Following regulatory progress such as the 2025 GENIUS Stablecoin Act in the US, stablecoin and deposit-token pilots are gaining traction across both US and EU markets.

Next evolution: The rise of programmable and agentic money — payments that execute autonomously based on rules, events, or AI agents — fundamentally changes treasury, settlements, and B2B flows.

Embedded & Ecosystem Banking

In 2026, banking is increasingly invisible. API-based embedded banking continues to unlock new non-interest revenue streams by integrating payments, accounts, and credit directly into:

- Retail platforms

- Payroll and workforce tools

- SaaS and vertical software

This shift changes customer acquisition entirely. Users no longer “choose a bank” — they encounter banking inside the products they already use.

Strategic impact: Banks that act as ecosystem enablers scale distribution without owning the interface. Those that don’t risk being relegated to commodity balance-sheet providers.

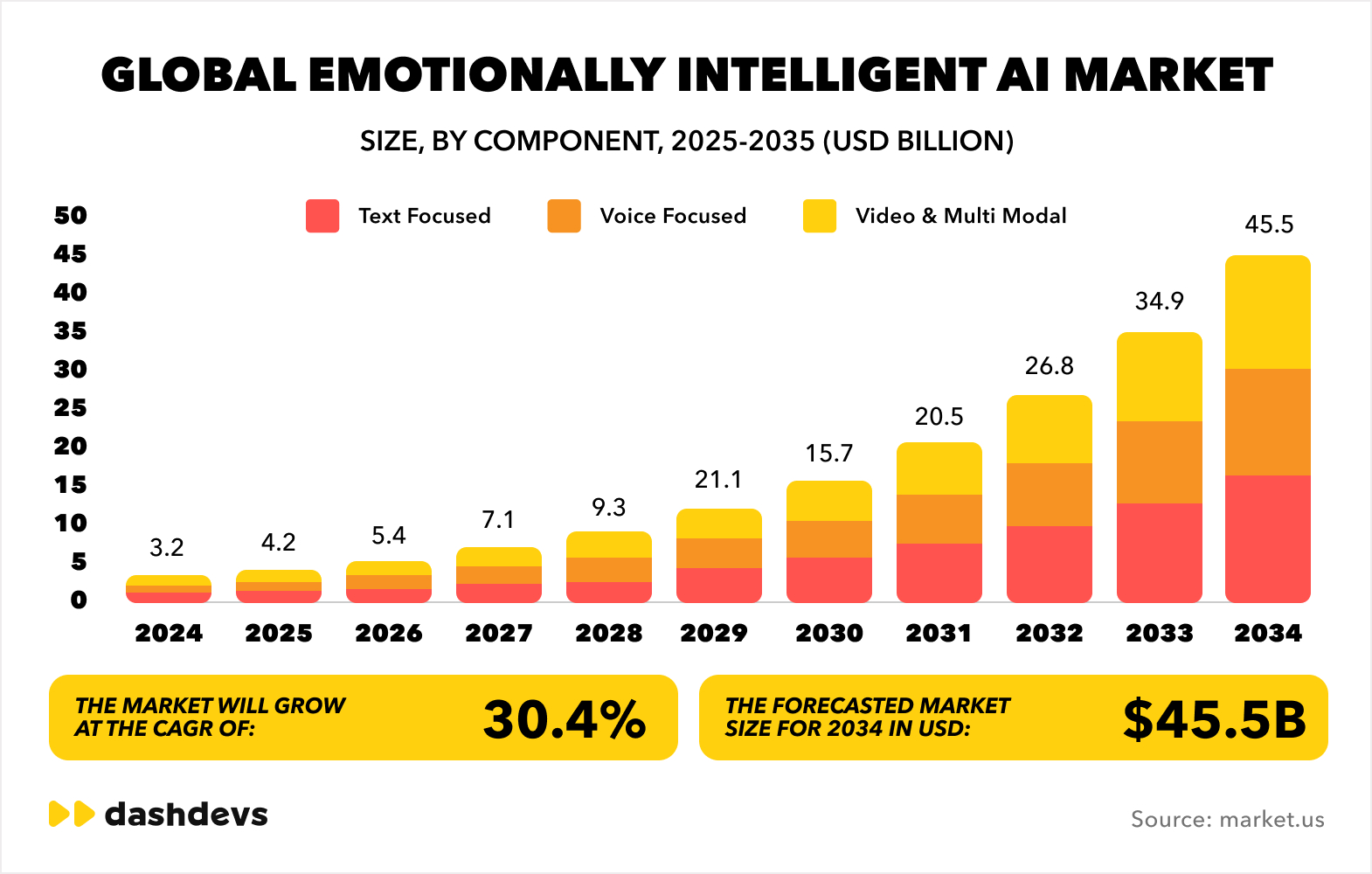

Human-Centric & Emotionally Intelligent Banking

As functional differentiation disappears, emotional trust and personalization become decisive.

This is pushing banks toward emotionally intelligent AI — systems that personalize not just offers, but tone, timing, and interaction style.

What’s changing:

- “One-size-fits-all” campaigns are being replaced by precision segment marketing

- Behavioral AI and continuous feedback loops drive adaptive experiences

- Empathy becomes a measurable competitive advantage, not a branding concept

Security, Regulation & Trust as Infrastructure

Security and compliance dominate digital banking investment priorities in 2026. The expansion of real-time payments, AI decisioning, and tokenized money introduces new AML, KYC, and fraud challenges.

Insights from Deloitte, Thunes, CGI, and SAS (2025–26) highlight several clear shifts:

- AI-driven fraud engines and biometric authentication are now baseline requirements.

- Leading institutions invest in “data purity vaults” — secured repositories isolating verified datasets from synthetic or polluted AI data.

- Zero-trust architectures and continuous compliance frameworks increasingly differentiate top-tier banks.

Bottom line: Trust is no longer a policy or a document. It is enforced continuously by system design.

Digital banking in 2026 is defined by autonomy, speed, programmability, and trust. Institutions that treat these trends as incremental upgrades will fall behind. Those that redesign their architecture, governance, and operating models around them will define the next decade of financial services.

How Digital Banking Is Changing the Customer Experience

Digital banking is reshaping customer experience at a structural level. What once focused on putting existing services online has evolved into always-on, intelligent, and globally accessible financial experiences. In 2026, customer expectations are no longer shaped by banks — they are shaped by digital products in every other industry.

This shift reflects a deeper transformation in how banking is designed and delivered. As David M. Brear, CEO 11FS explains in our Fintech Garden podcast:

“For a long time, digital was a cost-saving exercise, not an experience upgrade. Only now are we starting from first principles and asking what financial services could actually be.”

That mindset change is now clearly visible in how digital banking experiences are being rebuilt.

From Branch-Centric Banking to Digital-First

Branch-centric banking is rapidly disappearing. Across markets, physical branches are closing while customers migrate almost entirely to digital channels. The result is a fundamental change in how relationships with financial institutions are formed and maintained.

In modern digital banking, onboarding, servicing, and support are handled end-to-end online. The mobile app becomes the primary relationship layer, not a secondary interface. Banking adapts to users’ schedules and contexts, operating continuously rather than within fixed hours or locations.

This shift is a key driver behind rising digital banking adoption and explains why branch-first models struggle to meet modern expectations.

AI-Powered Personal Finance Coaching

Customer experience in digital banking is moving beyond transaction visibility toward active financial guidance. AI-driven systems now analyze behavioral data to provide personalized insights, alerts, and recommendations in real time.

Instead of static dashboards, modern digital banking platforms offer:

- Predictive cash-flow insights

- Context-aware budgeting and savings guidance

- Proactive alerts tied to real behavior, not generic rules

This evolution redefines the digital banking meaning — from managing money reactively to supporting better financial decisions continuously.

Modular and Micro-Service–Based Experiences

Digital banking apps are no longer monolithic. Increasingly, they are built on micro-services and modular architectures that allow features to evolve independently.

For customers, this enables:

- Faster updates and feature rollouts

- Experiences tailored to specific needs and life stages

- Greater stability as platforms scale

This modularity supports the long-term evolution of e-wallets, card issuing, and banking apps, allowing institutions to innovate without disrupting core services.

Global Reach and Cross-Border Capabilities

Digital banking removes geographic constraints by default. Customers now expect cross-border functionality, including multi-currency accounts, faster international payments, and transparent FX pricing.

This global reach is especially important for:

- Remote and globally mobile professionals

- International businesses and digital platforms

- Users managing income and expenses across regions

As a result, digital banks and digital financial institutions increasingly compete on global accessibility, not local presence.

The customer experience in digital banking is becoming personal, modular, and borderless. Users no longer adapt to bank processes — banking adapts to how people live, work, and move globally.

In 2026, experience quality is not a design layer added at the end. It is a direct outcome of architecture, intelligence, and operating model decisions made deep inside digital banking platforms.

Digital Banking Business Models

Digital banking revenue is often misunderstood. While the experience feels simple to users, the business model behind it is multi-layered and diversified. Most digital banks don’t rely on a single income stream — they combine several, optimized through data, scale, and technology.

Below is a simple breakdown of how digital banking actually makes money.

Interchange & Fee Income

One of the most common revenue sources comes from card usage and transactions.

- Interchange: A small percentage earned every time a customer pays with a card

- Fees: Account services, instant transfers, withdrawals, or premium support

At scale, even tiny margins per transaction compound into meaningful revenue, especially for high-frequency consumer use cases.

Lending Margins

Many digital banks generate revenue by lending out deposited funds.

- Personal loans, BNPL, overdrafts, credit lines

- Revenue comes from the spread between interest earned and funding cost

Digital underwriting and real-time data allow more precise risk pricing, improving margins compared to traditional banks.

Subscriptions & Premium Services

Instead of relying only on transactions, many digital banks introduce recurring subscription models.

Typical premium features include:

- Higher limits or cashback

- Advanced personal finance tools

- Travel, insurance, or lifestyle benefits

Subscriptions smooth revenue volatility and increase customer lifetime value.

Embedded Product Revenue

Digital banking increasingly earns money by being embedded into other products.

Examples include:

- Banking services inside marketplaces or SaaS platforms

- Revenue sharing with partners on payments, lending, or accounts

- White-label or Banking-as-a-Service (BaaS) models

Banking becomes invisible to the end user, while revenue is generated at the platform level.

FX and Treasury Income

Cross-border solutions and multi-currency capabilities unlock additional income streams.

- FX spreads on currency exchange

- Treasury optimization and liquidity management

- International payment fees

Global users and businesses generate higher-value flows, making FX and treasury a key differentiator.

| Revenue stream | What drives it |

| Interchange & fees | Transaction volume |

| Lending margins | Risk pricing and data |

| Subscriptions | Premium experience |

| Embedded revenue | Distribution scale |

| FX & treasury | Global usage |

Successful digital banking models don’t chase one revenue line. They layer multiple income streams, using technology and data to optimize margins while keeping the user experience simple.

In 2026, differentiation is less about what services you offer — and more about how efficiently, intelligently, and at what scale you monetize them.

DashDevs Case Studies — Real Experience Behind the Concept

Across many of these cases, the foundation is the same: Fintech Core, DashDevs’ modular white-label digital banking platform. It provides the regulated backbone — accounts, payments, identity, compliance, integrations — while allowing each product to express its own strategy, UX, and market positioning without vendor lock-in.

Digital Identity Automation

For this project, DashDevs focused on digital identity as a core conversion and trust driver, not a compliance afterthought.

What was delivered

- Automated onboarding and identity verification

- Improved fraud detection and compliance workflows

- Reduced manual review without increasing risk

Key lesson: Digital identity sits at the heart of digital banking. When onboarding is seamless and compliant, conversion improves without compromising trust.

Mission-Driven Digital Banking

This case demonstrates how digital banking differentiation goes beyond features. The platform is built around ESG principles and sustainable finance, aligning product behavior with customer values.

What stands out

- Sustainability embedded into the user experience

- Transparent impact reporting

- Strong emotional connection with users

Key lesson: In crowded markets, mission-driven positioning can be as powerful as technology. Digital banking brands that stand for something retain customers more effectively.

Dozens — Multi-License, Future-Ready Architecture

Dozens was built with long-term extensibility in mind, supporting multiple licenses and regulatory regimes from the outset.

What was delivered

- Architecture designed for regulatory expansion

- Ecosystem-ready integration model

- Flexibility to add new products and partners without re-platforming

Key lesson: Future-ready digital banking isn’t optimized for today’s license — it’s built for what comes next, including new markets, partners, and business models.

What These Case Studies Prove

Across different markets and strategies, the pattern is consistent:

- Modular architecture enables speed and resilience

- Digital identity directly impacts trust and conversion

- Differentiation comes from purpose as much as features

- Ecosystem readiness defines long-term scalability

Digital banking succeeds not because of a single technology choice, but because architecture, regulation, and product strategy are designed together — from day one. To learn more about top core banking solutions, read this article.

Digital Banking & the Developer Ecosystem

Modern digital banking is built as a platform, not a closed system. Behind every smooth customer experience sits a developer ecosystem that enables speed, scale, and continuous innovation. In 2026, the banks that win are the ones that treat developers, partners, and platforms as first-class users.

API Marketplaces as the New Distribution Layer

APIs are no longer just technical interfaces — they are products. Digital banking platforms expose capabilities through structured API marketplaces that allow internal teams and external partners to build, test, and deploy services faster.

This approach enables:

- Faster partner onboarding

- Reusable financial building blocks

- Controlled access to regulated capabilities

API marketplaces turn digital banking into an ecosystem that others can build on.

Third-Party Integrations by Default

No digital bank builds everything in-house. Payments, KYC, fraud, FX, lending, analytics — all are increasingly delivered through best-of-breed third-party integrations.

The differentiator is not the number of integrations, but:

- How easily they can be swapped or upgraded

- How well data flows across services

- How tightly they are governed and monitored

This is why orchestration layers matter more than individual vendors.

DevOps and Data Observability

Digital banking platforms operate continuously, and failures are visible instantly. As a result, DevOps, monitoring, and data observability are core banking capabilities, not engineering hygiene.

Leading platforms invest in:

- Real-time system health and performance monitoring

- Transaction-level tracing across services

- Data quality and anomaly detection

This visibility is what allows teams to scale safely while meeting regulatory expectations.

RegTech and Compliance Automation

Compliance is no longer handled through manual processes or periodic checks. In digital banking, regulation is increasingly encoded into systems.

RegTech tooling supports:

- Automated AML and sanctions screening

- Continuous compliance monitoring

- Audit-ready reporting and traceability

By automating compliance, digital banks reduce operational friction while increasing consistency and trust.

To Sum Up

In 2026, digital banking is not about apps or channels — it’s about building a scalable platform that drives growth. Real-time infrastructure, AI, and automation enable faster launches, lower costs, and new revenue streams across lending, payments, and embedded finance.

The biggest differentiator isn’t design. It’s architecture — how easily your platform can scale, adapt to regulation, and evolve with customer needs.

Thinking about launching or upgrading digital banking? Talk to DashDevs.