What is Green Fintech and How It Relates to Sustainable Development

According to recent data from Global Market Estimates, the global green fintech market is expected to increase by 22.4% annually from 2024 to 2029. A mix of technology and finance, which is called green fintech, helps the planet and promotes sustainability.

Before we explore this topic, let me introduce myself. I’m a software engineer with six years of experience. I lead the Node.js development team at DashDevs, a company known for its expertise in fintech development services and Fintech Core, a white-label product for fast developing digital banking solutions.

I have much experience in the green & sustainable finance framework behind my back, which has given me a deep understanding of this field and the knowledge to share. Additionally, I’ve hosted a webinar on green fintech which you may find beneficial for your present or future business.

So, in this article, I want to provide an opportunity for you to learn more about sustainable banking. It includes real-life examples of my team and those of other companies that can help you understand this topic better.

What is a Green Fintech?

I want to start with the basics — the definition of green fintech and why it’s gaining popularity so fast.

Green fintech is the combination of financial technology (fintech) solutions and environmental sustainability goals. The concept uses innovative financial technologies to manage environmental challenges and promote sustainable practices in the financial sector.

This includes:

- development of digital tools and platforms targeting to facilitating green investments;

- encouraging transparency in environmental reporting;

- supporting environmentally friendly financial products and services.

The first examples that come to mind are services like mobile banking in developing countries, with the goal of raising living standards. Instant payments are directly linked to green fintech’s progress because they’re faster and don’t need intermediaries, which leads to reduced CO2 emissions and a greener future.

However, green fintech mainly promotes initiatives in companies and shares innovative ideas. While there is one more term — sustainable finance — that centers on implementing these ideas and establishing companies to improve the environment rather than solely for profit.

I’ll provide more information about this concept below.

What is Sustainable Finance?

In simple terms, sustainable finance is about investing money in a way that not only makes financial sense but also considers the impact of investment decisions on the environment, society, and how a company is governed.

The goal is to invest in financially sustainable ways that help create a better world for everyone, both now and in the future.

Instead of just thinking about profits, sustainability finance also considers how companies treat their employees, how they interact with the environment, and whether they’re transparent and accountable in their actions. Basically, this approach means making investments that benefit people and the planet while still making a profit.

What is the Difference Between Green Finance and Sustainable Finance?

Let’s break down the differences between green finance and sustainability finance. While they both aim to promote sustainability, they focus on different things.

Depending on your business goals, you can choose to focus on green fintech (investing in renewable energy and eco-friendly banking) or sustainable finance (containing environmental, social, and governance concerns into financial procedures like green infrastructure or implementing transparent governance standards) for a broader strategy to sustainability in finance.

Green finance is all about:

- caring about environmental sustainability;

- investing in projects like renewable energy;

- and eco-friendly infrastructure.

Financial sustainability looks at a broader picture. It considers:

- putting sustainability as priority over revenue;

- environmental green factors;

- ensuring fair labor practices;

- social and governance aspects;

- goes beyond the finance industry.

To better understand the differences, refer to the table below:

| Aspect | Sustainable Finance | Green Finance |

|---|---|---|

| Focus | Considers environmental, social, and governance (ESG) factors | Concentrates solely on environmental sustainability |

| Objective | Aims to promote economic growth and long-term sustainable development | Targets investments towards sustainable growth and eco-friendly projects |

| Scope | Takes into account the overall impact on society and governance | Invests in projects such as renewable energy and eco-friendly infrastructure |

Think of green finance as a part of sustainable finance, focusing specifically on environmental issues. Sustainable finance, however, takes a broader view, looking at the all-around impact on society and how companies are run. Both are important for creating a better future, but they approach it from slightly different angles.

Fintech Startups Offering Green Financial Solutions

The global financial sector has significantly bolstered its response to climate change. Every year, more and more money is being invested in technologies that help us transition to a cleaner environment. In 2015, this investment was $660 billion, and now it’s over $1 trillion.

Such investments and focus on the green finance industry highlights the importance of understanding its principles in business operations. To illustrate this, I’d like to introduce you to some companies with a proven record of success over a long period.

These sustainable finance examples highlight how fintech startups can drive positive change in the green financing domain for a more wholesome sustainable future.

Let’s explore a few of them:

Tomorrow

Tomorrow is a bank with a purpose: to impact both people and the planet positively.

With Tomorrow, one of the green startups, money doesn’t just sit in an account — it actively supports projects that restore ecosystems, promote renewable energy, and create affordable housing.

- Every transaction a user makes with a Tomorrow card helps fund climate protection efforts.

- For every €10 spent, a wheelbarrow of ecosystem is restored in South Africa.

- Plus, Tomorrow offers investment opportunities that are 100% sustainable and aligned with the goals of the Paris Climate Agreement.

This company is committed to using money as a force for good as a social business. Also, it has a B Corp Certification and meets the highest social and environmental standards, providing transparency and accountability in its operations.

CarbonChain

CarbonChain helps businesses and financial organizations keep track of and reduce emissions every step of the way.

They focus on locating the most challenging emissions in big supply chains and setting a new standard for keeping track of carbon. Many companies use their advanced technology to measure their carbon footprint. It helps them pinpoint carbon risks and come up with better ways to reduce emissions.

The startup also has its big goal — to make the global supply chain carbon-free by 2050 and fully lead the private sector to a greener future.

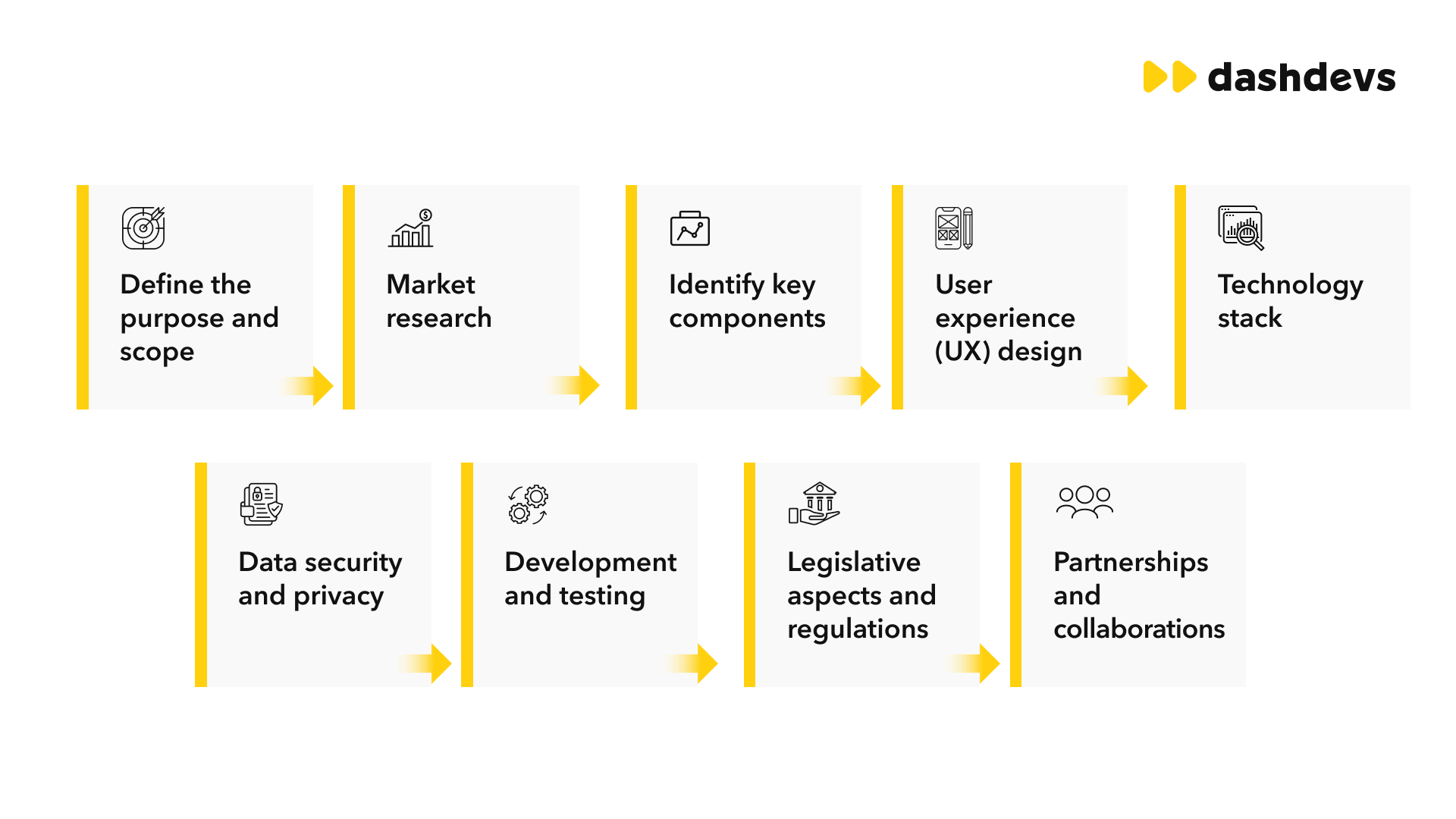

Roadmap for Developing a Green Fintech Product with a Real Case Study

If you want to get into green and sustainable finance but don’t know how you’re in the right place. I’ve created a green financing strategy that breaks down everything you need to know, step by step, with easy examples, so you can repeat the success of companies mentioned above.

Whether you’re new to finance or a pro, you’ll find helpful tips to turn your idea into reality. Let’s move on:

#1. Begin with defining what you want

Start by clearly visualizing your vision for the project. Outline what you aim to achieve in terms of sustainability and environmental impact.

Example:

- Vision — to create a platform that facilitates investment in renewable energy projects to combat climate change.

- Mission — to empower individuals and businesses to invest in eco-friendly initiatives while generating financial returns.

Example of productive ideation phase with DashDevs case study:

The idea of our client was to create a platform that transforms trees and corals into NFTs. The project started with brainstorming sessions to imagine turning trees and corals into digital assets to promote sustainability in finance. The goal was to create a platform where users could buy NFTs representing real trees and corals, supporting environmental protection.

Based on the idea, the mission was pretty straightforward, as with any other sustainable project:

- encourage people to support eco-friendly initiatives by participating in the growing NFT market and investing in renewable energy projects.

To make the NFTs, we used blockchain. Each token got a unique digital mark and was recorded on the blockchain, making it transparent, unchangeable, and trustworthy.As the final results, we developed and launched the platform, which attracted a significant number of users interested in supporting environmental causes through digital investments in renewable energy.

The project grows and we are excited about even more possibilities ahead. This includes adding more natural assets to the platform, improving features to make it more engaging for users, and teaming up with environmental groups to make a bigger impact.

The main point here is that it all began with thorough brainstorming and ideation, which, if done correctly, can bring outstanding outcomes.

If you’re considering a business idea related to sustainable finance or aiming to integrate green fintech principles into your current business, DashDevs can be your ideal partner. We have proven expertise in these areas and can assist you in achieving your goals. Together, we can work towards positively impacting the world through sustainable finance initiatives.

#2. Research the market

Research existing green finance projects and platforms to understand the market and identify potential gaps or opportunities in competitors. Analyze consumer trends, preferences, and behaviors related to sustainable investing.

Example:

- Check out platforms like Tomorrow or CarbonChain to understand their offerings and user demographics.

#3. Create a business plan

Clearly outline the main components of your project, including its objectives, target audience, revenue model, and marketing strategy.Find out what the features and functionalities you want to include into the platform or service, considering user needs and preferences.

Example:

- Create a detailed business plan outlining how your platform will attract investors, generate revenue, and promote sustainability.

- Revenue generation: subscription fees, transaction fees, or commission-based models for investment transactions.

#4. Establish partnership

First of all, if you are unsure how to do all the steps above — you need to find a partner who will help with the whole project development. As I said before, it can be a company with relevant experience in green & sustainable finance projects, like DashDevs.

After that, start collaborating with environmental organizations, financial institutions, and technology providers to use their expertise and resources for your case. Build relationships with renewable energy companies, sustainable agriculture projects, or green infrastructure initiatives for potential investment opportunities.

Example:

- Partner with a renewable energy provider to offer investment opportunities in solar or wind energy projects.

- Investor attraction: offer incentives for investors, such as tax benefits, reduced fees, or impact investing options to attract a diverse pool of investors.

#5. Turn your idea into MVP or prototype

Design and develop a user-friendly platform or service that attracts individuals and businesses to invest in green and sustainable projects of yours. You can start with MVP or prototype to test your idea and see how investors, customers and the community react to it.

Incorporate features such as transparent reporting, impact measurement tools, and educational resources to engage users and see how it works and looks.

Example:

- You can create a web-based platform that connects investors with sustainable energy projects. They may browse investment opportunities, track performance, and receive updates on project milestones there.

- Make a mobile app that allows users to round up their purchases to support environmental causes, with the option to invest in renewable energy projects directly from their smartphones.

#6. Eco-friendly Technology Integration

Integrate eco-friendly technologies into your project to help the environment and work sustainably.

Example:

- If you’re developing a mobile banking app, use servers that run on solar or wind power. This makes sure your app’s digital setup is eco-friendly.

- If you run an e-commerce website, set up green data centers to save energy and cut down on carbon emissions. For shipping, you can also use eco-friendly packaging like biodegradable materials or recyclable packaging.

#7. Ensure regulatory compliance

You should understand and follow the rules that govern green finance, as there may be specific regulations you must comply with, such as environmental standards and financial laws.

Obtain any necessary licenses or certifications to operate as a financial service provider or investment platform, such as EMI or PI.

Example:

- You might need licenses related to securities laws, anti-money laundering (AML) regulations, or environmental certifications.

Consulting legal experts can help you understand all the regulatory nuances faster and comply with all relevant laws and standards.

#8. Launch and market the project

Plan a strategic launch campaign to create awareness and attract users to your green finance project. Use any relevant digital marketing channels, social media, and partnerships with sustainability influencers to promote your platform.

Example:

- Organize a virtual launch event featuring industry experts, environmental activists, and thought leaders to generate buzz and attract media attention.

- Or begin with a test launch for a small community to evaluate their impression and gather feedback for the future “real” launch.

#9. Measure impact and iterate

Implement metrics and KPIs to track your project’s environmental impact, financial performance, and user engagement. Start with simple tools like Google Search Console to check which pages or services users search more.

Example:

- Collect feedback from users and stakeholders to identify areas for improvement and iterate on your platform or service.

- Regularly analyze data on investments made, reduced carbon emissions, and user satisfaction to assess the effectiveness of your green finance project.

Following this roadmap, you can create a green and sustainable finance project that genuinely matters and contributes to positive environmental and social change while generating financial returns.

Wrapping Up

Sustainable finance is significant and provides ample opportunities for businesses to grow in this direction. Whether you’re starting now or have been thinking about it for a while, there’s plenty of room to contribute to saving the planet while generating sustainable funds. Businesses that support sustainability are more likely to attract customers, as everyone wants to be a part of a bigger, planet-saving idea.

In this article, I showed some inspiring green finance success stories. These examples prove that not only can you make a positive impact on the world, but you can also achieve financial success.

If you’re keen on repeating their achievements, just follow the steps outlined in the roadmap and team up with trustworthy partners like DashDevs. Contact our experts to discuss your vision for the next big sustainable project.