White Label Banking Platform By DashDevs: Is This Revolut Alternative Better?

Revolut has now surpassed 30 million retail customers worldwide and now makes more than 400 million domestic and international transactions combined every month. While seemingly large this number is, the global neobanking market is expected to grow at a compound annual growth rate (CAGR) of 54.8% from 2025 to 2030. It proves that the neobanking market is far from being saturated, while more and more businessmen realize the potential opportunity in neobank development and intend to develop their customer solutions within the next 6 years.

Specialized, innovative, narrow-niche, local, and other neobanks have a solid chance to succeed. In that regard, you may wonder what resources and instruments you need to create a neobank and become a technology provider like Revolut yourself?

This post will help you understand the Revolut business models and neobanking in general. It will also show that there is a better solution than Revolut for the creation and easy launch of neobanks.

Neobank Explained: Based on the Example Of Revolut

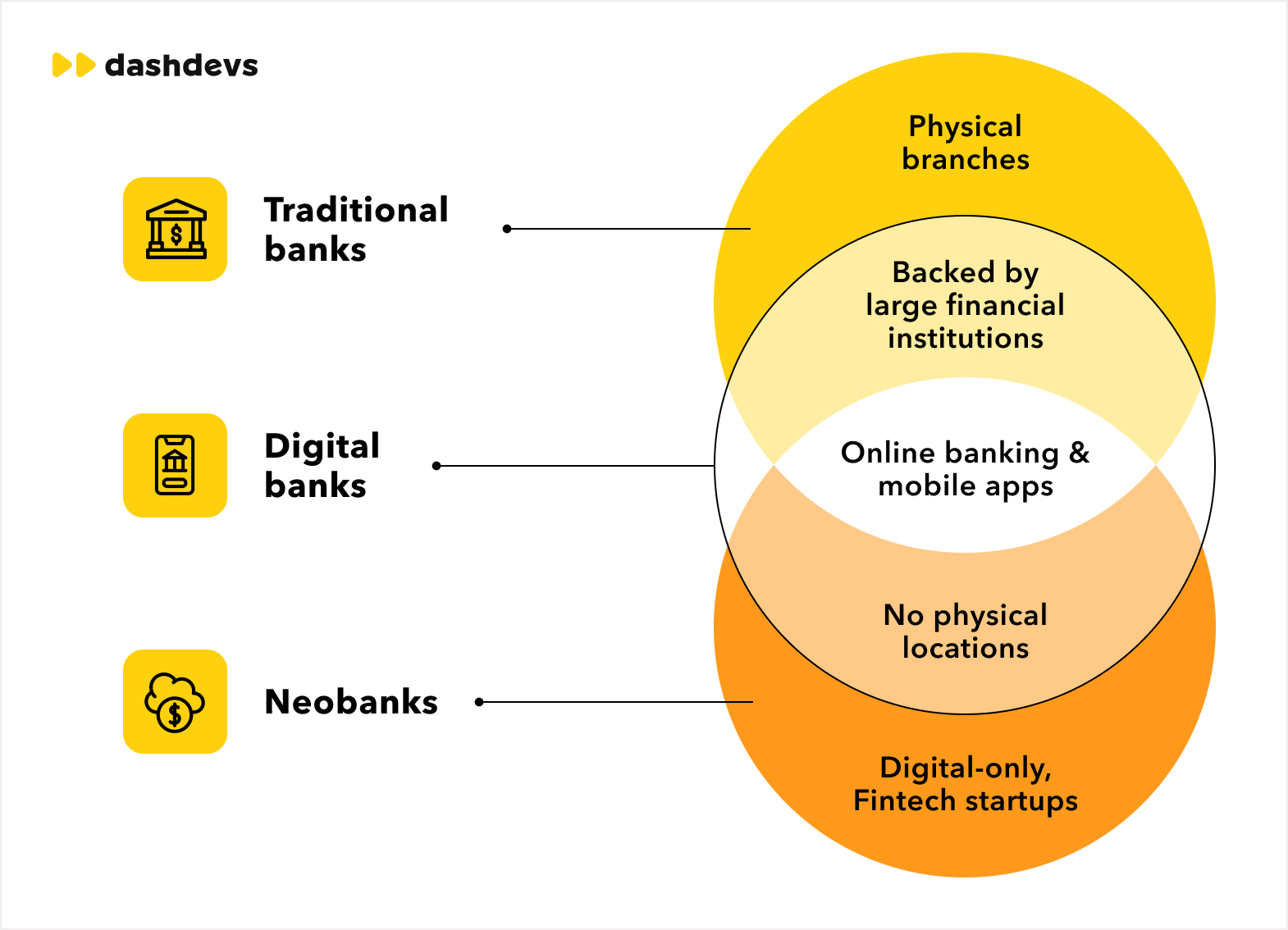

Neobank is a type of digital bank that operates exclusively online without traditional physical branch networks.

It’s necessary to understand that digital banks are still able to provide all the banking services, including payment processing, lending, card issuing, and more. They operate through mobile apps and web platforms, often offering lower fees and a more innovative banking experience due to the absence of costly banking branches.

A neobank should not necessarily be a licensed financial institution.

They usually present the customer-facing side of banking, while a licensed banking partner conducts all the back-end operations for their customers.

The technology through which neobanks are enabled to provide banking services is banking API. You can discover more about banking APIs and their integration as well as types of banking APIs from other blog posts by DashDevs.

Let’s take Revolut as an example and get an insight into the neobanking sphere and neobanking solutions based on it:

Revolut is a global neobank and financial technology company operating since 2015.

It’s easier to understand what is Revolut bank and how Revolut works by delving deeper into two business models it features:

Business-to-Consumer (B2C) business model of Revolut: As a neobank, Revolut provides individuals with banking services through the Revolut banking app. The key offerings include checking and savings accounts, payment and money transfer services, budgeting tools, and various other financial products. Fees and interchange revenue is how Revolut makes money as a neobank.

Business-to-Business (B2B) business model of Revolut: As a technology platform, Revolut offers their banking API, allowing businesses to create a neobank or integrate banking services directly into their own applications or platforms. This empowers non-bank businesses to offer financial functionalities without being a bank themselves. Leveraging API enables integration of card issuing, account management, payments, and other core banking features into non-banking apps, essentially creating a neobank-like experience.

Compared to other neobanking solutions, Revolut wasn’t the first or the largest of the neobanking platform. Yet, it stands out as a comprehensive option, covering most needs of both individuals and business partners. It also features international expansion. So, no wonder it quickly gained an edge and rapid popularity.

It’s worth understanding that Revolut, being a comprehensive neobanking solution and a provider of banking integration for business, is one of the vivid examples in the niche. Yet, it’s not an excellent choice when it comes to the creation of other neobanks or neobanking platforms. There are other technology platforms that can provide banking API integration.

One such solution is a white-label modular platform for fast neobank creation and launch by DashDevs. Compared to Revolut, it can be a better choice for small to medium-sized companies looking for technology leadership:

Fintech Core by DashDevs: Building a Revolut-Like Banking App

Fintech Core by DashDevs is a white-label modular fintech solution for the creation and fast launch of digital banking and payment products for mobile or web platforms.

Fintech Core, as more than just a Revolut alternative, offers all the functionalities and features that Revolut does. But what truly matters is that Fintech Core has several advantageous points compared to Revolut:

- Fintech Core is a white-label product. When using Revolut, you create a product under their brand. This means that your product’s interface will contain the logo and other attributes of the Revolut brand. However, with FinechCore, we can modify your solution at every technology level and in every detail while presenting lower prices and offering faster time-to-market compared to custom development

- DashDevs has integrations with many third-party vendors. Due to our pre-integrated modules, it’s easier to set up banking processes with providers that cover required regions and offer competitive rates. Besides, with Fintech Core, you don’t face the number of API requests per minute and other limitations imposed specifically by Revolut. It’s also worth mentioning that although there are a number of pre-integrated vendors, there is no vendor lock and we can still add any additional ones upon your request.

- Fintech Core-based development doesn’t have technical limitations. It means that we can integrate not only core banking functionalities but also all the modern-day features, including gamification, AI-based features, and more.

Using the FintechCore by DashDevs you can:

- Develop a fully-fledged neobank (B2C solution).

- Integrate the banking functionality in a non-bank mobile app or web platform (B2C solution).

- Develop a technology platform for providing banking API and banking services (B2B solution).

- Develop a platform that’s both a neobank and a provider of banking API and banking services for other businesses (B2C + B2B solution).

Basically, Revolut offers you just to create a neobank, operating as per Revolut pricing options, branded largely as Revolut, and restricted by Revolut region coverage, citizenship, number of API requests per minute, and other limitations. At the same time, Fintech Core offers to create your custom product, providing only the features you need and having design, coverage, and pricing of your choosing.

One of the solutions created with our Fintech Core is Pi-1 — an award-winning cloud-based BaaS banking platform. It is created from scratch in 9 months only. Explore this success story from the DashDevs’ case study page.

Core Features of Revolut and Fintech Core-Based Neobank

Revolut can help build solutions with the most comprehensive suite of functionalities included. However, the Fintech Core was designed to match and outperform Revolut’s capabilities. That’s why, using Fintech Core, you can create a neobank similar to Revolut with the following features:

| Features | Details |

|---|---|

| Money transfer | Enables the transfer of money domestically and internationally |

| Joint accounts | Allows multiple users to share a single account, suitable for couples or families |

| Savings | Users can select an interest rate and add or withdraw money when they need to |

| Virtual cards | Offers virtual debit cards that can be used for online purchases |

| Credit services | Personal loans and overdraft facilities providing access to additional funds |

| Card issuing | Allows users to provide their team with virtual and physical business debit cards |

| International payments | Allows users to make cross-border payments in multiple currencies |

| Multi-currency accounts | Allows users to hold, exchange, and transfer multiple currencies within their accounts |

| Currency exchange | Users can exchange money in 25+ currencies, set limit and stop orders, and get instant price alerts |

| Forward currency contracts | Users can fix their exchange rates and set dates to carry out currency contracts |

| Crypto trading | Enables users to buy, sell, and hold cryptocurrencies within their accounts |

| Accept payments | Enables users can accept, settle and track payments |

| Payment gateway | Users can accept payments directly from their websites. The widget can be customized |

| Recurring billing | Setting automated expense billing with the opportunity to add a photo of the receipt |

| Invoices | Users can utilize invoicing software to send invoices from their accounts |

| Spend management | Users can control team spending, manage expenses, and track staff spending |

| Budgeting tools | Tools and features to help users budget expenses, including categorizing transactions, setting spending limits, and receiving overspending notifications |

| Wealth management | Users can receive financial services and investment advice on optimizing their investment portfolios |

| Analytics | Users can access detailed analytics and insights into their spending habits and financial trends |

| Risk and fraud management | Sanctions, PEPS and fraud checks to protect user’s assets and maintain identity safety |

| Education | Users can access educational resources and content within the platform to help improve their financial literacy |

| Notifications and alerts | Instant notifications about the user’s financial transactions, and account activities and important updates |

| Support chat | Enables users to reach out to support center representative or a chatbot for help |

Gaps and Issues in Revolut Offering

Revolut is a popular service provider. Yet, it is not completely a universal solution to the needs of most businesses looking to enter the niche of neobanking. If you create a neobank based on Revolut, you risk encountering the following problems:

- Deposit protection is limited. Although savings in a Revolut account are protected up to EUR 100,000, they are not covered by government-backed deposit insurance programs, which is a concern to those looking for increased deposit security.

- Automated suspension of accounts. Revolut reserves its right to terminate user accounts. Besides, Revolut compliance measures, while necessary for regulatory adherence, periodically result in user accounts being temporarily frozen.

- Confusing fee structure. The fee structure for Revolut also differs by country, so transparency can be slightly complex. This can be confusing for any business sending currency transfers to exotic locations.

- Complicated subscription options. While Revolut offers a free basic account, meaning you can create accounts for your customer for free, additional services and perks are only available through monthly subscription options. Premium bonuses such as travel insurance, priority customer service, and greater ATM withdrawal limits should be weighed against the membership expenses.

- Inadequate fraud and Anti Money Laundering (AML) practices in place. Revolut has experienced many unsuccessful AML checks that affected its reputation in a very bad way. Besides, back in 2021, Revolut had a major $20 million theft, which has raised concerns about the system’s security measures.

- Inadequate customer service. Despite Revolut offering customer service via chat inbox and email, as well as virtual assistant care via its app, its customers, both individuals and partnering businesses, experience many cases of poor customer service. The lack of traditional customer care channels might be inconvenient, which can have a detrimental effect on your business should you partner with Revolut.

- Inflexible asset management. The assets acquired in the application cannot be transferred to another broker, but they should be sold/converted back into cash, which can then be withdrawn.

- Inflexible cryptocurrency management. Crypto cannot be deposited or spent, only converted back to fiat inside Revolut.

- Service disruptions and scalability issues. There have been instances of service disruptions and outages, leading to inconvenience for users. Besides, with rapid user growth, Revolut has faced scalability challenges, leading to occasional service disruptions.

As can be observed, users of Revolut bank can face specific challenges. At the same time, businesses that integrate the Revolut API face similar challenges since they are naturally inherited. It is worth mentioning that any neobank built with the help of Revolut cannot perform better than Revolut neobank since it inherits both Revolut capabilities and limitations.

On the contrary, Fintech Core by DashDevs, as a modular solution, doesn’t have inherited issues. By choosing a perfect, for a particular customer, provider, we can ensure that the end neobank won’t have gaps and errors that are critical for their business.

Fintech Core-Based Neobank Advantages

Fintech Core was designed as a capable solution, having unique advantages over custom neobank development due to being white-label and modular. So here are the core beneficial specificities of the Fintech Core, and, respectively, any neobank built upon it:

#1 Fintech Core focuses on customization and flexibility

We don’t limit our customers to basic options. Instead, on top of boardless branding opportunities, we provide customization and flexibility the Revolut offerings lack:

- Computing platform. Fintech Core customers can select, for example, whether they want to build an iOS/Android native white label mobile banking app, or they want to stick to the web or hybrid customer application.

- Branding and design. With Fintech Core customers can integrate the desired UI/UX design into the neobanking application with the help of DashDevs professionals.

- Product features. Enabling or disabling features, tailoring your solution exactly to your needs. You can choose providers and modules that solve specific pain points of your business. For example, you can choose to include card issuing, currency exchange, open banking, financial accounting, merchant payment, and other features.

- Workflows and processes. Fintech Core offers to customize transaction flows, approval processes, and KYC/KYB processes.

#2 Fintech Core targets a specific group of customers

The DashDevs team has created over 70 fintech products for businesses from across different industries and with diverse target markets. We used our vast experience and considered the specificities of different target customers.

Due to that, instead of offering a generic solution and adding upon it, Fintech Core aims to a specific target group. With Fintech Core, DashDevs can create the tailored neobank for general users, looking for casual banking services, proficient customers in need of advanced spending control and analytics features, traders looking for crypto and stock exchanging functionalities, and basically anyone else.

#3 Fintech Core offers the latest security measures and set-up KYC/KYB processes

The DashDevs team recognizes the importance of standard complaints as well as risk and fraud management and solid KYC and KYB processes in place. Therefore, with our Fintech Core solution, we provide a set of comprehensive tools to recognize and prevent fraud, data breaches, and data handling violations. Here are the checks we have implemented:

- Sanctions checks: Screening customers, transactions, or counterparties against lists of sanctioned individuals, entities, or countries. Ensuring compliance with international sanctions regulations and preventing engagement in any prohibited or restricted activities.

- PEPS checks: Screening customers, individuals, or entities against Politically Exposed Persons (PEPs) lists.

- Fraud checks: Detecting and preventing fraudulent activities, identifying suspicious patterns, behaviors, or transactions that may be fraudulent.

#4 Fintech Core offers extended customer support options

Fintech Core clients can have access to First, Second, and Third-tier customer support. We can provide any customer support options your business needs, from live support provided via multiple communication channels to virtual assistant and chatbot support.

#5 Fintech Core offers extended banking functionalities

With Fintech Core, the DashDevs team can build the Backoffice functionality so that the client can monitor and support its operations, a feature Revolut doesn’t support.

Additionally, Fintech Core allows for a General Ledger, which is a record of all past company transactions organized by accounts. This module is also not supported by Revolut.

#6 Fintech Core addresses the limitations of Revolut

Fintech Core focuses on addressing the main technical and business model problems exposed in solutions by Revolut as detailed previously. We cover the needs of the regions where the influence and capabilities of Revolut are lower compared to others. What’s most important is that the number of third-party integrations we have, including Veriff, Onfido, Jumio, etc., allows us to create neobank solutions that don’t have the technical, security, and other weaknesses of Revolut.

You can find out how to build a digital bank, based on DashDevs experience, from another our blog post.

Step-by-Step Flow for Creating Neobank Based on Fintech Core with DashDevs

The DashDevs team knows it’s crucial to understand how to develop a neobank or similar solutions using Fintech Core. Here’s how we approach such a project end-to-end, with the results you get and approximate timelines indicated:

#1 Customer request

The process begins upon your request for DashDevs’ assistance, where you outline your vision for the neobank or another software solution with banking functionalities integrated, target audience, specific requirements, objectives to achieve, etc. This initial communication helps us to set the project’s direction.

- What assets and results you get: Project objectives outline, a preliminary plan, and our understanding of your expectations.

- How much time it takes: Up to 1 week

#2 Discovery phase

In this phase, the DashDevs conduct market research, identify key features and agree with you on the modules, i.e. interface options and banking functionalities to include. Besides, we conduct product feasibility testing, technology assessment, and more. We also discuss customization requirements and assemble the necessary team for the project.

You can discover more information on how the DashDevs team approaches the product discovery phase from our service page.

- What assets and results you get: A detailed project roadmap, competitor and target audience analysis with user persona developed, a feature list, a defined project scope, and a dedicated team with all specialists required for the project.

- How much time it takes: 2 to 4 weeks.

#3 MVP development (Optional)

In many cases, we recommend starting with the development of a Minimum Viable Product (MVP) to test the core functionalities of the intended neobank solution to be created upon our white label banking platform. This stage helps in validating the particular neobank product idea and gathering early feedback from stakeholders and a limited group of users.

- What assets and results you get: A functional MVP that can be presented to a group of potential users or investors.

- How much time it takes: 2 weeks to 2 months.

#4 Development phase

Using the Fintech Core fintech white label solution, our specialists conduct the development phase that involves building the full-scale neobank or another application with the banking functionality with all planned features and integrations.

- What assets and results you get: A fully developed neobank application, ready for validation and QA testing.

- How much time it takes: 1 month to 1 year, depending on the complexity

You can discover more about how the DashDevs team provides development services from our service page.

#5 Testing phase

The application undergoes thorough testing to ensure its reliability, security, and performance. This includes using manual and automated testing methods, e.g., functional testing, integration testing, user acceptance testing, etc.

- What assets and results you get: A fully tested, debugged, and validated neobank application, ready for launch.

- How much time it takes: 1 week to 2 months.

#6 Launch phase

In the launch phase, the neobank application created with white label financial services is officially released to the public via the market and other web places you want it to. This involves deploying the application to production environments, conducting final checks, and initiating marketing and promotional activities to attract users. We can help you align the launch with your marketing activities.

- What assets and results you get: A live neobank application available to users, initial user base, and market presence.

- How much time it takes: We tailor the launch day to the specific point in time requested. The preparations take from several days to 2 weeks.

Approximate total project development time: 3 months to 1 year and 6 months, depending on the complexity.

#7 Post-launch support

After the launch, we provide ongoing support to monitor the application’s performance, address any issues, gather user feedback, and implement necessary updates and improvements swiftly.

- What assets and results you get: Continuous improvement of the neobank application through timely updates.

- How much time it takes: Ongoing, as needed.

Final Take

The development of a neobank or a technology platform, as well as integrating banking functionalities in non-bank apps, is a promising opportunity. Revolut, being a neobank and banking API provider, can cover such a need. Yet, it comes with technical and business model limitations. It’s also doesn’t offer many branding options, and the development of a product with its banking API may be pricey.

On the contrary, the Fintech Core white-label business finance system by DashDevs can provide the same high-level functionality. At the same time, it allows you to make a neobank more flexible, fully customized and branded as your own private label business finance system.

DashDevs, a provider of fintech development services, has over 13 years of experience and has delivered more than 500 projects successfully. We can offer you a quick launch of a custom neobank. With Fintech Core, you will get a high-performing and cost-effective solution, providing you with the most value per dollar invested.