Why Python is the Best Choice for Finance Startups

Fintech is a complex and profitable industry that demands quick decisions and modern technology. Often, many features utilized by finance startups require data analysis and pronounced data-driven workflow. Therefore, Python for finance, a programming language with a simple code structure and great data processing capabilities, becomes one of the most prominent choices here.

Over the years, the Python programming language has secured its place in the spotlight and remains there, outshining other technologies. According to the TIOBE programming index, Python’s popularity has only grown over the recent years, so the language is forecasted to be TOP-1 in 2025.

In this article, I will discuss why Python is the best choice for finance startups by explaining its capabilities and showing the use cases. Without further ado, let’s dive in!

Technologies in Finance Startups

As previously stated, finance is complex. One would call it a maze of possibilities and, equally, of opportunities. There are many options to choose from when building your tech stack, so navigating the options might be confusing.

While other technologies like Java or C++ can be an invaluable addition to the finance tech stack, Python, as a finance startup technology, tackles all the abovementioned challenges in the most efficient way.

Want to learn more about Java and compare their technologies? This comparison guide between Kotlin and Java will help you upscale your tech knowledge.

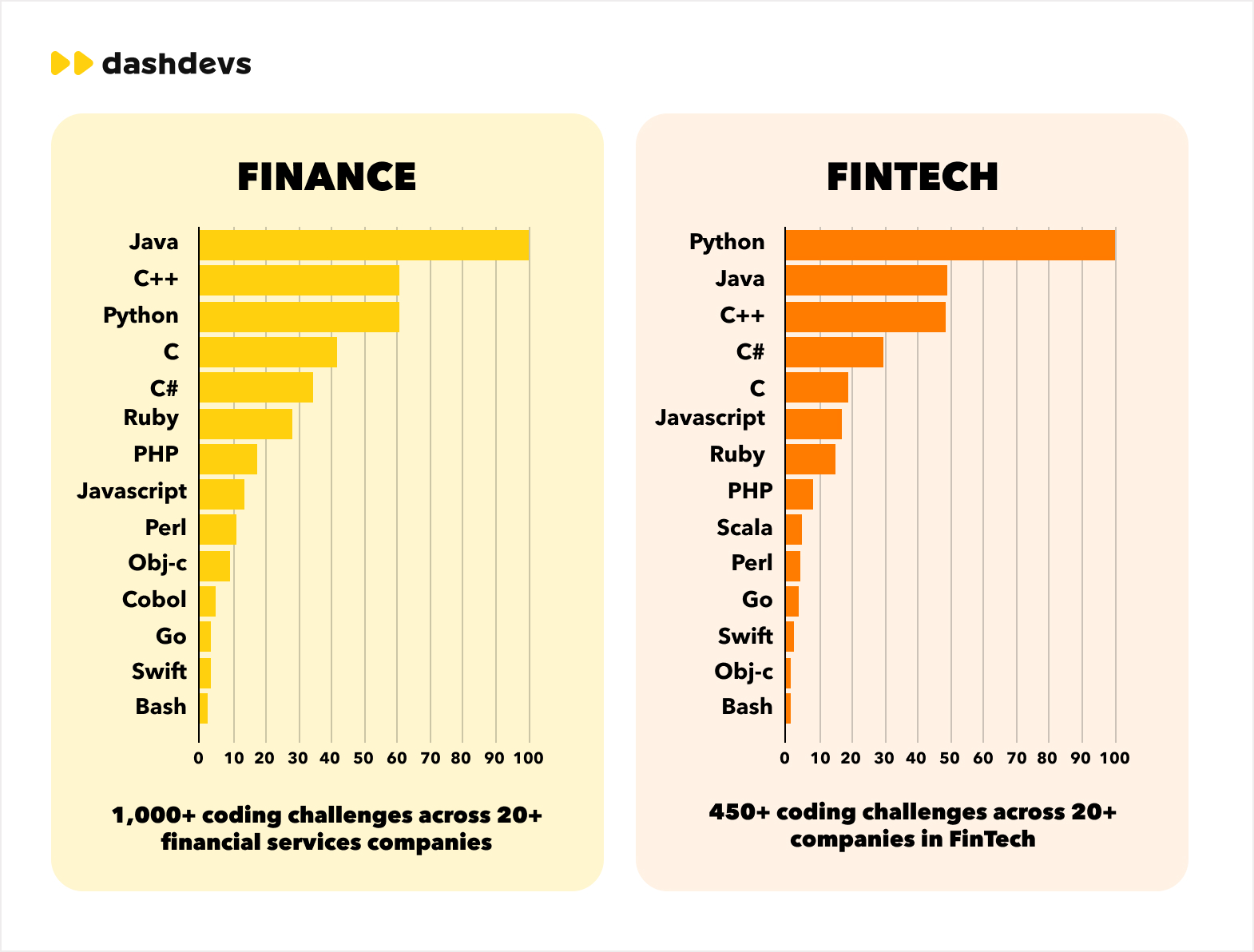

Programming specialists universally agree that Python is the most popular programming language in finance. As the graph below shows, it clearly outnumbers Java, C++, and C#, along with other technologies.

Python in finance becomes invaluable for startups because it can tackle many shortcomings in fintech development life cycles. Working with other languages, such as Java or C++, might create challenging circumstances for your business.

So, let’s take a look at what parameters make Python stand out compared to other languages.

- Development speed. While compiled languages such as Java are faster in runtime, the development process might be more lengthy, as Java code has to be written and compiled to be executed. Python, in return, is an interpreted language, which means that each line of code is executed one by one, speeding up the whole process.

- Coherent hypothesis testing. As a part of financial data science, hypothesis testing is where Python can excel compared to Java, as Python’s ecosystem is more mature. While C++ and Java can also provide libraries for such tasks, Python has more variety and offers more comfortable options for your team.

- Language compatibility. Interpreted code written in Python is what makes it portable and cross-platform. You can run the same Python code on Windows, macOS, Linux, and other systems with a Python interpreter, often without any modifications. Essentially, this allows your developers to combine Python with other languages, such as C++ or even libraries for mobile development, to create reusable code bases.

- Greater scalability. Python’s ease of use and fast development cycle allow teams to quickly build and iterate on applications. Its module structure enables it to handle increasing transaction volumes and user loads and makes it easier to manage with simple structure and syntax.

But what makes Python for finance so popular? Why can it tackle the challenges described above better than other technologies? This is what I will explain in the next section.

Python in Finance Startups

Python is a high-level programming language with enhanced code readability, which supports structured, object-oriented, and functional programming.

In simple terms, high-level programming makes Python for finance code simpler and clearer, as if one were speaking plain English but for programming.

If you want to see step-by-step Python finance development workflow, check out the Python finance development service DashDevs provides.

Let’s take a closer look at other characteristics of Python programming for finance:

- Object-oriented programming. It helps organize complex programs by grouping related data and actions together.

- Modular coding. This practice structures a program into smaller independent modules with specific functionality to enhance code structure.

- Reusable code writing. It’s the sacred behind accelerated development with Python; reusable code writing enables programmers to create code elements that can be reused within the same project.

What does it do for a finance project? First, Python’s characteristics enhance the speed of development, enabling rapid prototyping. Object-oriented programming and reusable code writing enable scalability, as they allow new items to be integrated faster.

As a technology, Python for finance can be modified and is compatible with many other technologies or Python libraries. It can also be modified with components running on faster languages like C++, as the language itself is on the slower side in terms of productivity.

Having discussed the most prominent characteristics of Python for finance, let’s dive deeper into the topic and review the benefits of Python in finance.

Benefits of Python in Finance

In this section, I will showcase the biggest advantages of Python as a programming language for finance startups.

Among them are the following:

- Accelerated prototype development. Python utilizes a simple syntax and a vast array of libraries, which shortens the initial time to market.

- Ease of use. The straightforward structure of Python makes it more understandable for coders and code reviewers.

- Vast amount of libraries. Python programming for finance startups can be used in risk management systems at a higher quality with financial data analysis libraries.

- Enhanced scalability. Python can manage increasing transaction volumes and user loads with its simple language structure and syntax.

- Language compatibility. Due to its clarity and relative simplicity, Python for finance can be integrated with other languages. I personally recommend Python and C++ integrations due to C++’s higher computing speed and Python’s higher code-writing speed.

- Ability to reuse the written code. As stated above, Python allows the code to be reused within the same project, so it ensures consistency and speed of Python finance development.

- Big community. Python’s community is big and thriving, and it makes it easier for developers to find solutions to their problems and for you – to find the developers to work with.

I understandably have a likeness to Python. Its simplicity and versatility are useful for many projects, but especially for those in the finance domain. Yet, it’s important to maintain a clear head and always remember that each great technology has its downsides. This is what the next section is about.

Shortcomings of Using Python for Finance Startups

Python has its own shortcomings, which, if left unattended, can impair the way your business works. These shortcomings are the tech limitations that might influence the outcome of the product in financial industry.

So, in this section, I will provide you with a short overview of each of them.

#1 Safety Concerns

The simplicity of Python might be a downside when it comes to security. The reused code and modular structure essentially make the software based on this language easier to break or hack into.

Yet, this downside can be fought with a number of practices.

- Language combinations. You can combine a different language for financial applications run on Python to ensure that the admin part utilizes a more secure language component. You can also enhance your software by implementing Python libraries such as TensorFlow to identify fraudulent activity faster.

- Input validation. It is entirely possible to validate input on Python in such a way that your software will simply not trust the user data and will always aim to validate it.

- Security checkups. regular financial security analysis with Python and code reviews should be conducted. This will help you identify any breaches and fix them as fast as possible. Penetration testing, in this case, can help you find soft spots in your software and improve them with integrations or encoding.

#2 Limited Productivity

Python’s productivity isn’t the sharpest on the market. Other languages can perform real-time data analysis and handling faster, despite the fact that recently adopted Python can be used for faster development. This is because Python is an interpreted language. It means it’s executed line by line by an interpreter, which adds overhead.

Compared to compiled languages, which are translated directly into machine code that the device can execute very quickly, Python lacks productivity, especially in CPU-intensive tasks.

Expert tip. Integrate with programming languages that have higher executive power. For example, C++ can be used in combination with recently adopted Python to improve real-time financial analysis and financial data processing, and it can even be integrated specifically for one software component that requires speed in execution.

Django, a high-level Python web framework, can also significantly enhance the scalability and speed of web financial applications. Its caching system stores frequently accessed data in memory, improving responsiveness by reducing the number of database queries. Among other benefits, Django can also offload time-consuming tasks to background processes, so they won’t block the main web server.

#3 Mobile Development Not Supported

Python was not made for mobile development. It can’t tackle fast-processing tasks with a heavy CPU load. Python simply wasn’t created for complex multi-leveled mobile development, as it is the language for web development and/or financial data science.

However, if you need to utilize Python for mobile development in financial industry, you can do so using specific tools. Here are some of the Python-centered software instruments I recommend considering for your project’s tech stack:

Kivy

This open-source framework can be used for cross-platform applications. It supports multiple platforms, including Android, iOS, Windows, macOS, and Linux. I would recommend Kivy for those seeking to reach cross-platform compatibility and keep the unique UI.

BeeWare

****

This framework allows your developers to write Python code once and deploy it to multiple platforms, including mobile. It’s a good option for a more native user experience on each platform. BeeWare is also a good way to enhance resource spending, as it would only require your developers to create one codebase and utilize it for many platforms with this set of tools.

The shortcomings can be fixed, and the benefits far outweigh them. This is why Python is continuously used in finance. In the next section, I will focus more on how it can be utilized in finance.

Use Cases for Python in Finance

As previously mentioned, Python can be used in finance in many different ways, improving the application’s workflow. In this section, I will review the possible use cases for Python in finance and propose some ideas on how to achieve this.

#1 AI integration

In AI integration, Python can be utilized for fraud detection by using machine learning libraries such as TensorFlow or PyTorch. These libraries can analyze transaction patterns using Python’s algorithmic nature and identify suspicious activity in real time.

Real-life example: In my personal practice, I’ve worked with a lending platform that needed to verify users’ creditworthiness. We’ve used TensorFlow to build a machine-learning model that could predict the creditworthiness of loan applicants

#2 API integration

Python can help your business connect with banking APIs to initiate transfers and retrieve account information. This would provide your end-users with a unified view of their finances, enabling them to use one application for multiple processes.

Real-life example: One of the projects I’ve helped with involved creating a Python and finance platform that aims to provide users with a holistic overview of all their banking accounts. As a result, we needed to automate bank integrations and decided to use Python on the backend level to ensure a faster and seamless connection with all APIs used for the project.

#3 Data analysis

Libraries such as Pandas and NumPy mentioned above can analyze customer data and personalize financial products accordingly. It can also help retrieve data and process it to ensure that all complex operations are handled correctly.

Real-life example: I worked on a small API for payment calculation automation some time ago. This solution utilized NumPy to calculate the invoices and helped build reports at the end of each quarter to maintain clear and structured analytics of payments made.

Also, together with my colleagues, I worked on an insurance app—Centinel—that aimed to automate essential processes such as contract creation, real-time risk assessment, and others. We used Python to ensure higher-quality financial data processing and made it over two times faster than the previous version.

#4 Risk management systems

Python can be used to build credit scoring models that assess borrowers’ creditworthiness. Its structure enables enhanced automation, so this language can automate regulatory reporting and ensure compliance with financial regulations. Python for financial modeling can also be utilized, especially in risk management systems, to ensure a portfolio’s performance in crises.

Real-life example: Remember the lending platform I mentioned earlier in AI integration? The same platform also used Pandas to clean, transform, and analyze the financial data for automated risk management.

There are many more cases of Python being used in finance development, and, who knows, maybe once you reach out to the DashDevs team – your software will become one of the cases of rapid prototyping or automated data processing.

Final Thoughts

Python is one of the best options for Python finance development, specifically fintech startups, due to its speed, scalability, simplicity, and compatibility with other languages. It could be a great starting point to assemble your tech stack.

However, to ensure that the technologies you work with are exactly what your project needs, you should connect with talented developers to help you figure it out. DashDevs’ experts have over 15 years of experience in Python and finance development and have completed 500+ projects across different domains. We can help you choose the best tech stack, and our team will ensure your project has exactly what it requires.