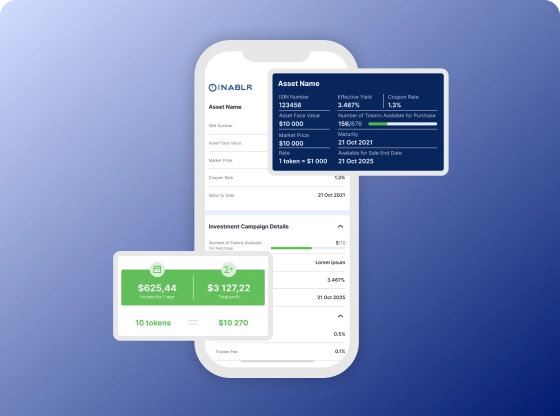

AI Customer Service Solutions as Front-End Innovations

AI in customer service can be represented as AI-powered chatbots, self-service platforms, voice assistants, video assistants, and other tools. It’s essential to know how to apply them in business right.