Card issuing services

Book a consultationintegration of card issuing services: Must have for established businesses

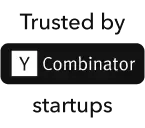

Card issuing provider integration is what allows your businesses to open bank accounts for customers and provide physical, virtual, and other cards to them. This can be utilized within any digital product, like an app or platform. Physical or digital card issuance enables us to offer customized card programs, integrate digital wallets, offer personalized business discounts, and more.

Entrust DashDevs — an experienced fintech development agency, the integration of card issuing functionality into your product.

Difficulties that card issuing provider integration solves

Having a card issuing provider integrated, can address a range of challenges for a business

They include, but not limited to:

scaling payment system

regulatory compliance and security concerns

As businesses grow, their payment systems must be able to handle increased transaction volumes and support new features. Card issuing functionality is one of the ways companies can adapt to changing needs, ensuring that businesses can efficiently process payments without disruptions.

Book a callMeeting financial regulations and ensuring the security of sensitive cardholder and payment data are critical challenges. Card issuing providers relieve the PCI DSS regulatory compliance burden on your business by implementing security measures such as encryption and fraud detection to reduce the risk of breaches.

Book a calloffering personalized customer experience

global expansion

Customers today expect tailored and seamless payment experiences. Card issuing providers enable businesses to offer customized cards, integrate with digital wallets, and provide user-friendly interfaces, enhancing the overall customer experience and fostering loyalty.

Book a callExpanding into new markets requires the ability to process payments in multiple currencies and comply with local regulations. Card issuing providers often support international transactions and provide the necessary infrastructure for businesses to operate globally, facilitating smoother entry into new markets.

Book a calloperational efficiency and cost- effectiveness

Managing payment systems can be resource-intensive. By integrating with card issuing providers, businesses can automate various aspects of card management and transaction processing, reducing manual effort and operational costs while increasing efficiency.

Book a callcard issuing features

we can integrate

Virtual Card Issuance

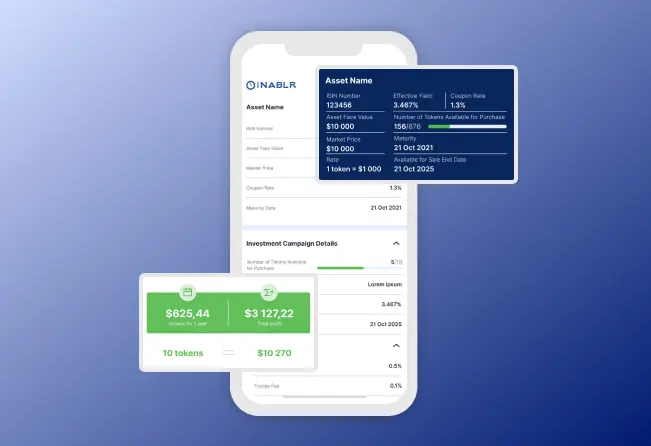

DashDevs offers a digital card service that enables the instant issuance of virtual cards for secure online transactions. Our virtual card issuing platform allows for the quick generation of virtual Visa cards, which are ideal for one-time purchases or online subscriptions.

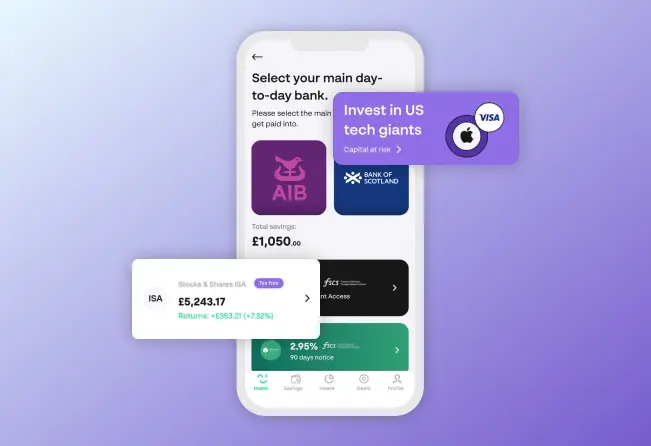

Mobile Wallet Integration

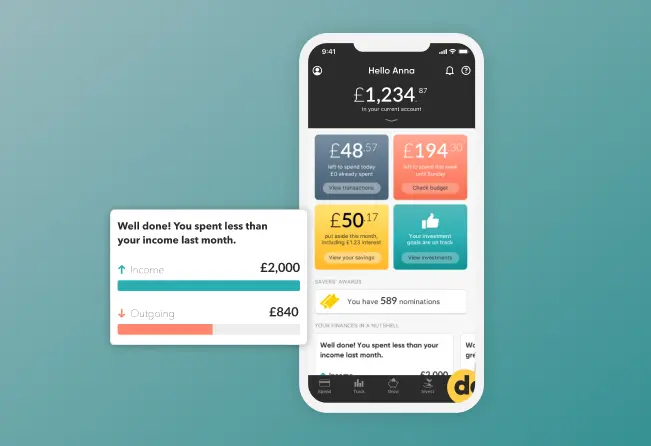

We integrate our card issuing services with popular mobile wallets like Apple Pay, Google Pay, and Samsung Pay. This digital issuance feature enables cardholders to make contactless payments using their smartphones or smartwatches, enhancing transaction convenience and speed.

Physical Card issuance

DashDevs offers to channel the card issuing system with the manufacture of physical cards, providing options for various materials, such as plastic, metal, or eco-friendly alternatives. The card issuance process incorporates security features like EMV chips, holograms, and magnetic stripes to ensure the cards are secure and durable.

Real-Time Transaction Monitoring

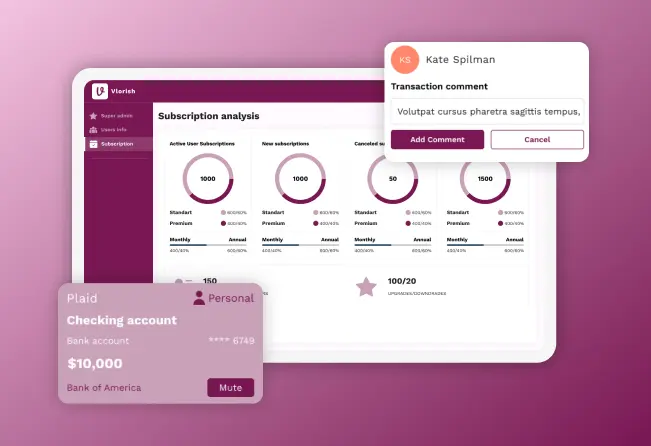

As provided by vendors of card issuing services, our digital card service includes real-time transaction monitoring to detect unusual or suspicious activity. This card acquiring feature helps prevent fraud and ensures the security of cardholders’ accounts.

Secure Authentication

For cases where user authentication is provided on your side, DashDevs implements advanced authentication methods in our card issuance process, such as biometrics (fingerprint or facial recognition), two-factor authentication, and one-time passwords (OTP), to ensure that only authorized users can access and use the cards.

Tokenization

We can utilize tokenization technology in our digital card issuance to replace sensitive card information with a unique digital token during transactions. This enhances security by ensuring that actual card details are not exposed or stored in merchant systems.

Custom Card Design

Within the scope of our card issuing services, we can include a feature that allows clients to create personalized card designs, incorporating their brand logos, colors, and unique themes. This enhances brand recognition and provides a memorable experience for cardholders.

Customizable Rewards Programs

We can include the support for rewards programs tailored to their target audience, including cashback on purchases, points redeemable for goods or services, or discounts at partner merchants.

Cardholder Support

We establish a system within your software product that enables to provide 24/7 customer support for cardholders, assisting with issues such as lost or stolen cards, transaction disputes, and general account inquiries. This ensures a positive experience and quick resolution of any problems.

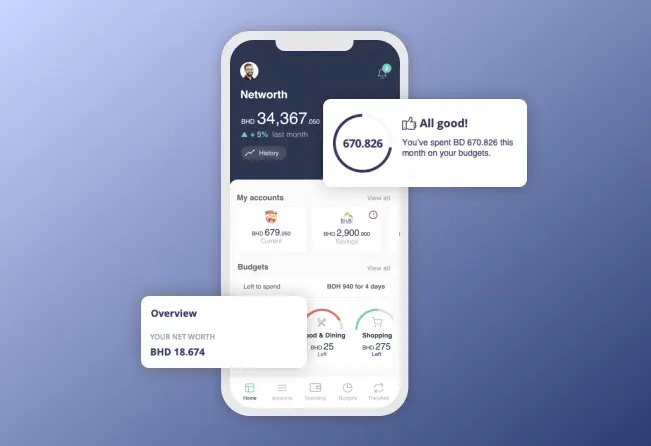

Custom Cardholder Portals

DashDevs can offer the development of personalized online portals where cardholders can manage their accounts, view transaction history, check balances, and access exclusive card benefits and offers.

Spending Controls

Our team can include tools for clients to set spending limits on their cards, restrict transactions by merchant type (e.g., gambling, alcohol), or block specific merchants. This feature helps cardholders manage their finances and avoid unwanted expenses.

International Transaction Support

DashDevs ensures that users have easy and intuitive access to international transactions if such a feature is permitted by a card issuer. This feature is particularly beneficial for clients with a global customer base or frequent travelers.

Top card issuing providers

we Can integrate

DashDevs has worked with and can help you seamlessly integratewith card issuing systems from 20+ vendors, such as:

HOW CARD ISSUING WORKS

behind the scenes, an issuing platform:

Creates a new client and account for the cardholder

Created a new card, and links it to the new account and client

Provides details to the Issuing institution

Why opt for integration of card issuing with DashDevs

delivering an integrated card issuing system end-to-end

DashDevs is a one-stop-shop for your fintech needs. We can seamlessly integrate your platform or app with the banking API of a card issuing provider and ensure secure, compliant, and error-free operation.

Most comprehensive card issuing provider integration

Here at DashDevs we can implement multiple card-issuing features from your chosen provider. From physical to virtual cards, we can deliver them all and more at request.

transparency and reporting

DashDevs, a provider of card acquiring service integration, maintains full transparency in every development project. We conduct regular progress reviews and provide detailed reports with metrics and time spent indicated.

broad Fintech expertise

Over the past 15 years, the DashDevs team has successfully delivered over 80 solutions for customers from various industries. Our solid expertise in fintech and banking APIs allows us to take on the most complex projects with consistently excellent outcomes.

Faq

What is a card issuer?

A card issuer is a financial institution, such as a licensed bank or credit union, that provides payment cards like debit or credit cards to consumers. Card issuers are responsible for underwriting, setting credit limits, and managing customer accounts.What are card issuing services?

Example of card issuing services, or features enabled by card issuers and delivered via a software product, are virtual or physical cards, wallet integration, transaction monitoring, custom card design, cardholder portals, spending controls, and more.What are card issuing services?

Example of card issuing services, or features enabled by card issuers and delivered via a software product, are:- Virtual cards

- Physical cards

- Wallet integration

- Transaction monitoring

- Custom card design

- Cardholder portals

- Spending controls

How does card issuing work?

Card issuing includes these steps:- Customer makes a request for a physical, virtual, or another card

- A financial instution sends the card issuance API request to the Visa or Master Card platform

- The card issuing platform creates an account and issues the card

- A financial institution transfers card and card account details to the customer

Who makes bank cards?

Bank cards, such as debit and credit cards, are typically manufactured by specialized card production companies under the direction of card issuers or financial institutions. These companies produce the physical cards with embedded security features like chips and magnetic stripes.What is the card issue provider?

A card issue provider is a company that offers services for issuing payment cards. These providers offer platforms and technologies that enable businesses to issue their own branded cards, manage card programs, and process transactions.What is the card issuing process?

Card issuing process involves a customer using a card issuer’s site to create a request to a bank for a card and provide their personal information required to open an account. Then, using a banking API, the bank connects with a virtual Visa or Master Card and requests to create an account and issue a card. Upon successful completion, the customer receives all necessary credit card and card account details and can start using banking services.