Chip

Transforming Saving and Investment with Cutting-Edge CHIP Technology

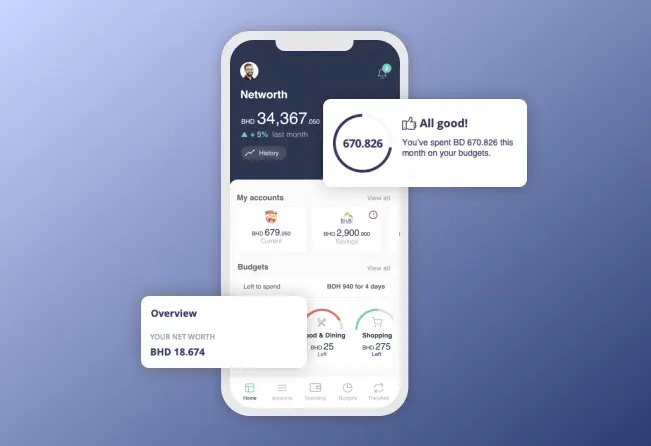

Chip is a mobile app that revolutionizes saving and investment by using AI to analyze spending habits and income. Users can easily set savings goals and track progress, with investment options and partnerships with leading banks. Chip is committed to high security standards, making saving and investing simple and secure.- Location UK

- Industry FINTECH

- Team Size 5 people

- Duration 3 months

- Budget NDA

Challenges

Meet numerous industry specific security standards & prepare product to be PCI/DSS compliant-compatible system.

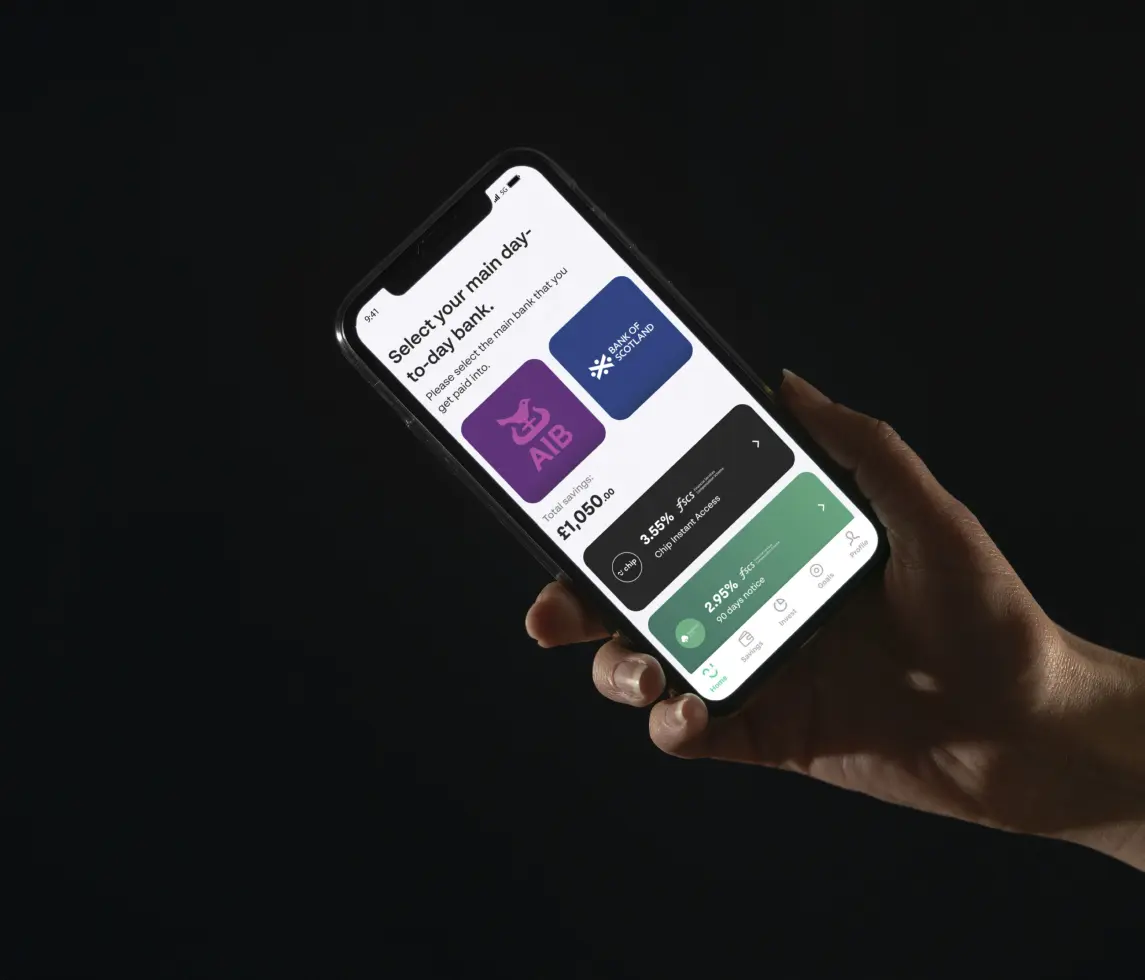

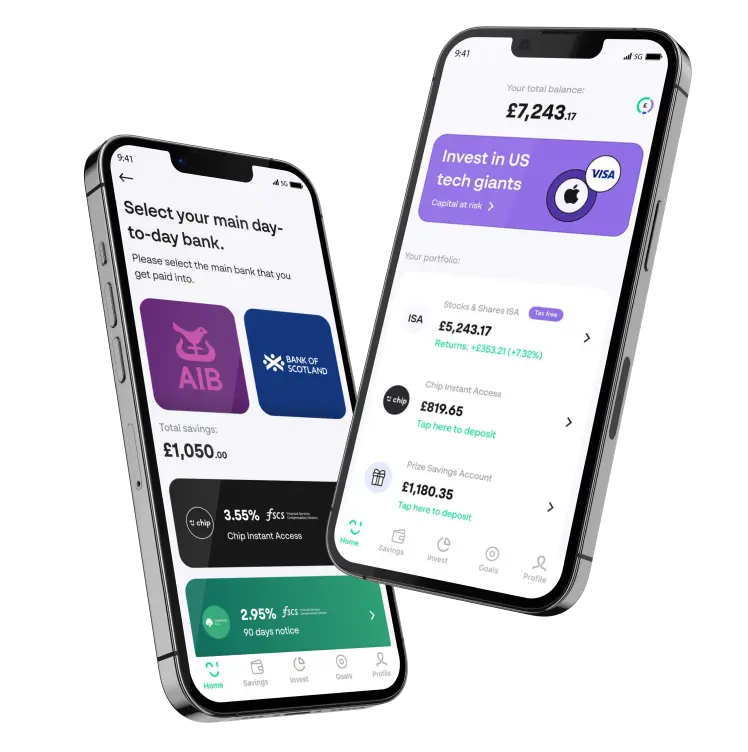

Developing API for easy integration of clients accounts from different banking institutions.

Need to meet high security standards applicable to financial industry.

Solution

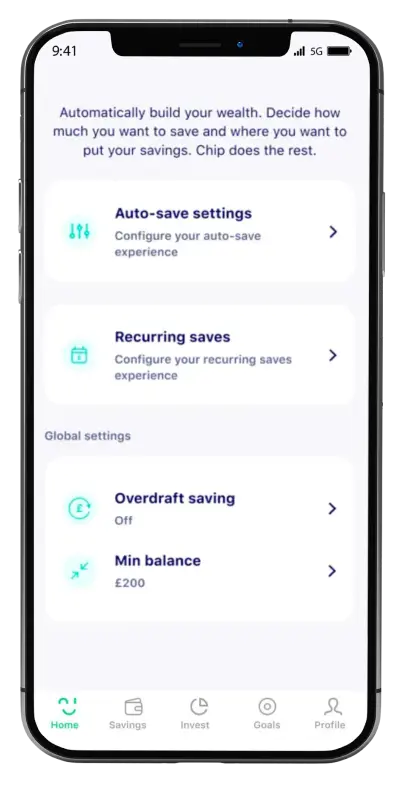

Chip is a mobile app that offers an automatic savings account for users. It analyzes the user’s spending habits and income to calculate how much money they can afford to save each week, and then transfers that amount to a savings account held with Chip’s partner bank.

Chip allows to set savings goals, track their progress. It also offers investment options for users who want to put their savings to work in the stock market.

our input

Solution architecture

Ios development

Android development

Back-end Development

Quality Assurance

Project management

RESULTS

Our collaborative efforts have given rise to an exceptional mobile app that has surpassed user expectations, achieved remarkable success in the market, and brought immense value to our clients.

- funds raised£45M

Raise additional capital due to solid development.

- active users500K

Working with iOS and Android applications.

- saved by users£250

User friendly app helped users to save £250 since the app's launch.

App functionality

Round-ups

unified API Interface

Savings account

Investment options

balance tracking

Bank account connection

One-click withdrawals

Secure authentication

Automatic saving transfers

notifications

Saving rate adjustment

Smart balance management

Cloud storage and backup

how we did it

- that provided efficient data structure to support growing business needs and allow business to scale and smoothly add new features

cutting edge microservices architecture

- development from scratch with on time launch3

month to launch

- developed ocre engine to its "ready-for-market" state

open banking

- Optimal value for money development costs

Reduced costs

- delivery of new features, maintenance & support3+

years total partnership

- for three iOS and Android apps that meets all data & functionality requirements

full responsibility

Technologies

we used

.Net & .Net Core

React

AWS

Creation Process

Discovery & Conceptualization

During this stage, we conducted a market analysis to identify the target audience and define the product vision. We then worked closely with the client's team to shape hypotheses and test them with independent focus groups. The feedback we received helped us shape and reshape the product vision to fit the market niche.

1Design & Prototyping

After clarifying the feature list, our team created wireframes that aligned with the target audience's preferences. We worked on a concept that was easy to use and could be scaled or changed to meet the client's future needs. We then created high-fidelity designs and prototypes that helped us refine the user experience.

2Solution Architecture

During this stage, we created a list of all the required vendors for product creation and performed in-depth research on their differences in terms of price, quality, scalability, and compatibility with each other. After weighing all the pros and cons from a business, technical, compliance, and security perspective, we proposed a flexible and scalable solution architecture based on optimally priced vendors.

3Development & Testing

Our team of engineers worked on developing the iOS, Android, and Web back-office portals simultaneously. We integrated with different service providers, which presented numerous challenges. We had to overcome outdated API documentation, sub-partner dependencies that affected timelines and created codependencies. We also performed rigorous testing to ensure the application's reliability, functionality, and security.

4Maintenance & Support

After releasing the MVP, we continued implementing new features and fixing bugs based on client feedback. Our frequent releases every two weeks helped us improve the product and keep pace with the market. We also provided post-launch support to ensure the application's stability and address any issues that arose.

5