Digital Assets Trading Platform

- Location APAC

- Industry FINTECH

- Team Size 12 experts

- Duration 6 months

- Budget NDA

Challenges

Fragmented liquidity systems. The client needed one secure, automated environment to manage fiat and crypto liquidity.

Performance at trading scale. Peak loads reached 30,000 transactions per second, requiring millisecond-level execution without compromising fairness or stability.

Regulatory pressure on every transaction. The client’s EMI and VASP licenses required airtight KYC/KYB/KYT and Travel Rule compliance, plus full audit visibility to satisfy regulators.

Security that scales, without counterparty risk. Key management, signing, and risk controls had to stay in-house — within an architecture ready to expand across new assets, liquidity partners, and jurisdictions.

Solution

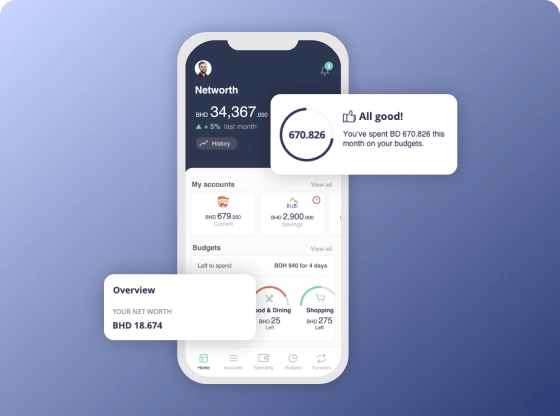

It features a full-stack trading and liquidity infrastructure with compliance at its core. Retail and institutional investors can securely place market, limit, and stop loss orders for fiat and cryptocurrencies. The liquidity is ensured by client reserves and designated market makers, connected via APIs.

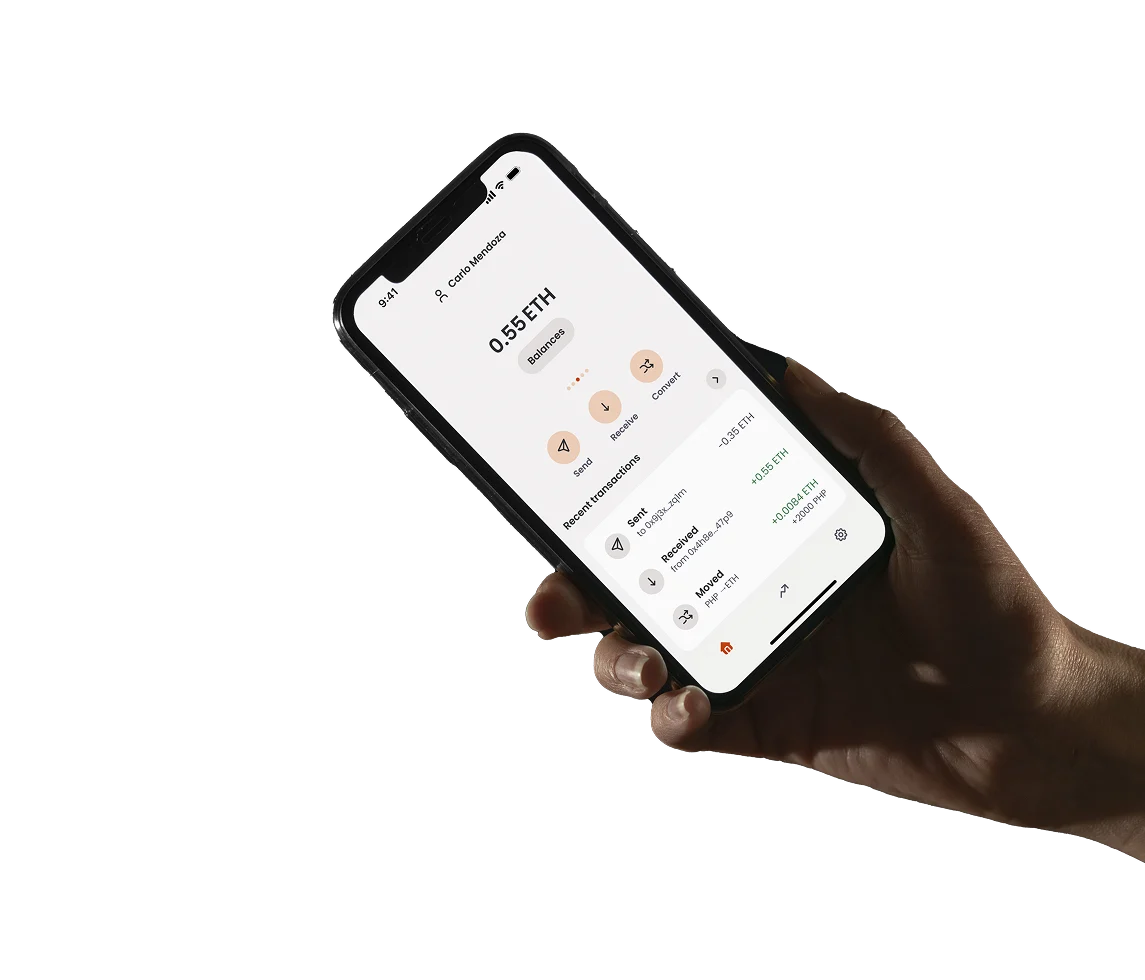

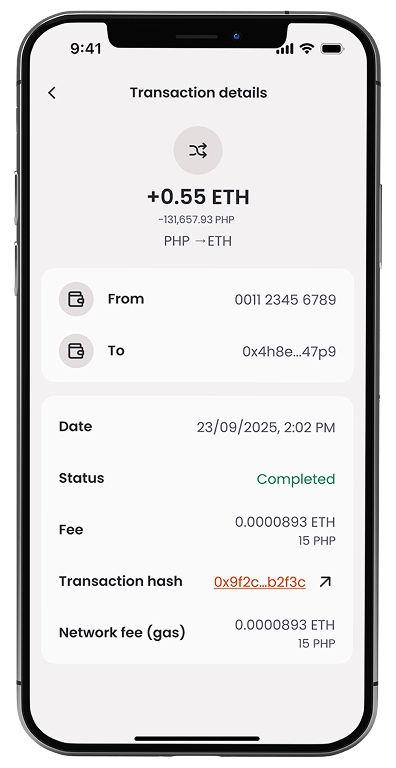

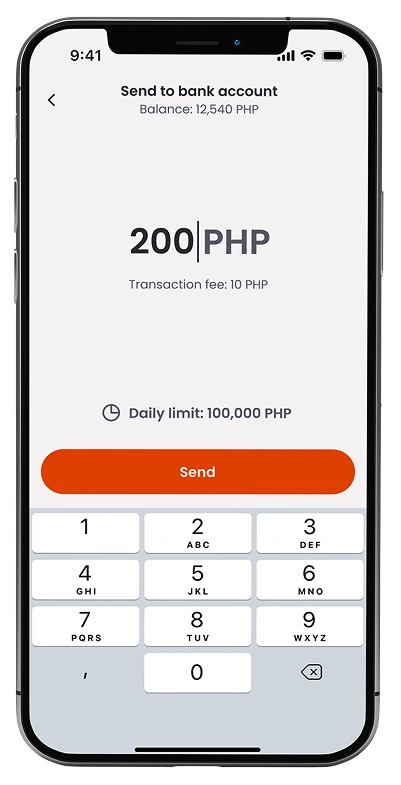

By using FinTech core components, each user can also create a multi-currency bank account, as well as hold 20 different tokens in their cryptowallet. They can store and spend the held assets from the app or securely withdraw them to another bank account. All transactions – fiat or crypto — are monitored against custom anti-fraud and business rules and checked against AML compliance rules.

RESULTS

With the trust of our partners, we have created a solution that not only meets the needs of users but also aligns with their values and contributes to a more sustainable future.

- Transactions per second30K+

The matching engine delivers institutional-grade execution for retail and corporate users with <40 ms latency, thanks to scalable architecture with in-memory order books and event-driven processing.

- Faster New customer onboarding60%

With optimized KYC, KYB, KYT, and Travel Rule flows, we’ve sped up the average customer verification and onboarding time by 2.5X. All while keeping the platform fully aligned with EMI and VASP standards.

- liquidity ratio achieved95:5

The client maintains always-on liquidity, thanks to automated rebalancing between hot and cold wallets, powered threshold-based monitoring, scheduled sweep logic, and KMS-secured key signing.

App functionality

KYC / KYB / KYT compliance

viUser authentication

Crypto & fiat wallets

Bank account

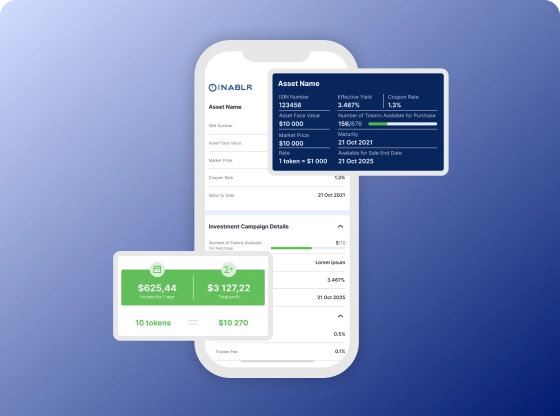

Matching engine & trading module

Liquidity management

Fiat on/off ramps

Risk scoring & tiered limits

In-house key management

Market maker & partner APIs

Audit logs & reporting

Customer support

how we did it

- Built for 24/7 uptime, elastic scaling, and sub-40 ms processing latency

Robust order matching engine

- Bridging fiat and crypto in one architecture

Unified ledger

- Thanks to automated audit trails and policy mapping

EMI & VASP compliant

- Zero third-party key dependency, offering better security

Full in-house custody

- Supported with a modular integration layer for EVM & non-EVM chains20+

crypto assets

- For seamless top-up and withdrawals to local banks

Fiat on/off ramp

- On/off ramp stablecoin processing for cross-account payments

Stablecoin support

- Convenient back-office console for users, limits & liquidity management

Command center

- Dynamic user limits based on verification levels

Tiered risk management

- Prioritized roadmap to go from an MVP to a full-feature product

Consultative approach

Creation Process

Product vision

The client’s goal was clear: launch a unified liquidity platform where crypto and fiat could coexist under a single regulatory and technical framework. Together, we scoped the key requirements for a platform capable of institutional-grade trading across multiple asset classes with full EMI/VASP compliance, using Fintech Core as the starting point.

1Product Design

Our design sprint focused on simplifying complexity. User journeys were optimized for simplicity without compromising on compliance. Each prototype went through regulatory stress tests to guarantee a seamless experience backed by audit-proof integrity.

2architecture design

We engineered a modular architecture centered on a unified ledger and ExchangeCore-based matching engine. The stack combines in-memory processing, asynchronous event queues, and KMS-secured key management to deliver sub-40 ms latency and zero downtime. We also isolated compliance modules, wallet management, and liquidity logic into independent services to streamline future integrations.

3Delivery

The delivery phase ran in parallel tracks — front-end, back-office, and crypto infrastructure — synchronized through continuous integration pipelines. Each module was deployed and tested in a sandbox mirroring EMI-level operational conditions. Early testnets proved the engine could sustain 30,000 TPS while automated rebalancing kept liquidity ratios steady at 95/5.

4Extended Release

The extended release focused on broadening market reach. We expanded token support to 20+ assets, introduced APIs for external market makers, and added corporate multi-user roles with permission management. The system evolved from MVP to a fully compliant, multi-asset platform ready to onboard new jurisdictions and institutional partners without rewriting a single core module.

5