Compliance-first Digital Banking Platform

- Location Saudi Arabia

- Industry Banking

- Team Size 10 people

- Duration 2 years

- Budget NDA

Challenges

Build a unified compliance ecosystem with automated AML/fraud monitoring, real-time behavioral scoring, and seamless SAMA Tanfeeth data exchange.

Replace fragmented, manual tools with a single audit-ready platform that supports fast investigations and strict regulatory traceability.

Ensure secure, isolated handling of high-risk (PEP/blacklist) cases while maintaining integration with national reporting standards.

Migrate from slow legacy case-management systems to modern, scalable infrastructure capable of meeting SAMA’s certification requirements.

Solution

DashDevs delivered a full compliance transformation—covering AML screening, fraud monitoring, case management, and SAMA Tanfeeth integration—acting as an extension of the client’s compliance engineering team. Together with the bank’s specialists and Onftek, we built a multi-layered architecture supporting real-time decisioning, automated reporting, and regulator-grade auditability, including isolated SSU environments for handling high-risk cases with complete data segregation.

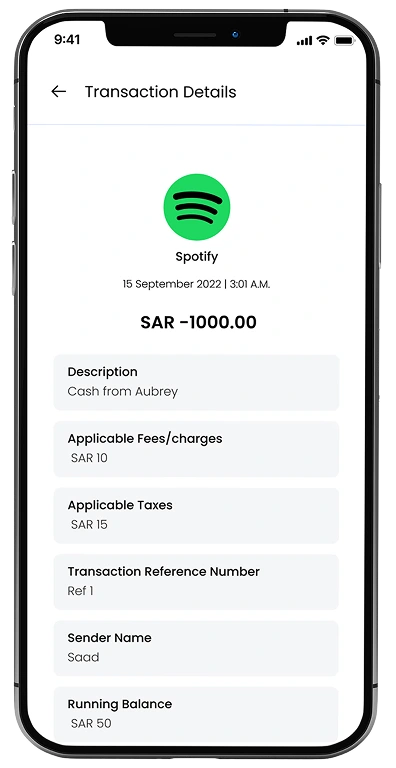

The platform unifies continuous customer screening, automated transaction evaluation, and modern case management with 24/7 operational support. Every transaction is scored in real time: low-risk actions pass automatically, medium-risk events trigger temporary holds, and high-risk patterns are blocked instantly—enabling fast, risk-based decisions while maintaining full compliance readiness.

our input

UI/UX Design

Solution arcitecture

Ios development

Android development

Quality Assurance

Java development

Data engineering

Biometric authentication development

Cloud & Devops

Business analysis

Our Phased

Approach to

AML & RegTech

Enablement

Phase 1

Compliance & Data Foundation

Building the base: AML setup, onboarding screening, data readiness, and integration preparation

Phase 2

Fraud & Behavioral Analytics

Advanced profiling, risk scoring, automated hold/reject logic, and integration with Mambu

Phase 3

Government & Regulatory Integrations

Connecting to SAMA Tanfeeth, Onftek, and achieving Summit & Feed certifications.

Phase 4

Isolation & SSU Environments

Dedicated flows for high-risk personas: PEPs, blacklists, and enhanced review queues.

Phase 5

Migration & Real-Time Screening

Transition from Oracle CX to Focal and activation of real-time AML rules and triggers.

RESULTS

With the trust of our partners, we have created a solution that not only meets the needs of users but also aligns with their values and contributes to a more sustainable future.

- SAMA TANFEETH CERTIFICATION PASSED100%

All steps were completed successfully, ensuring full alignment with regulatory onboarding, reporting, and transaction-level requirements.

- REDUCTION IN FALSE POSITIVES50%

Optimized AML rules, enhanced data quality, and smarter risk modelling cut noise in alerts by half—boosting accuracy and operational efficiency.

- FASTER CASE INVESTIGATIONS2x

Investigation time was reduced from 48 to 24 hours through streamlined workflows, automated enrichment, and isolated SSU review environments

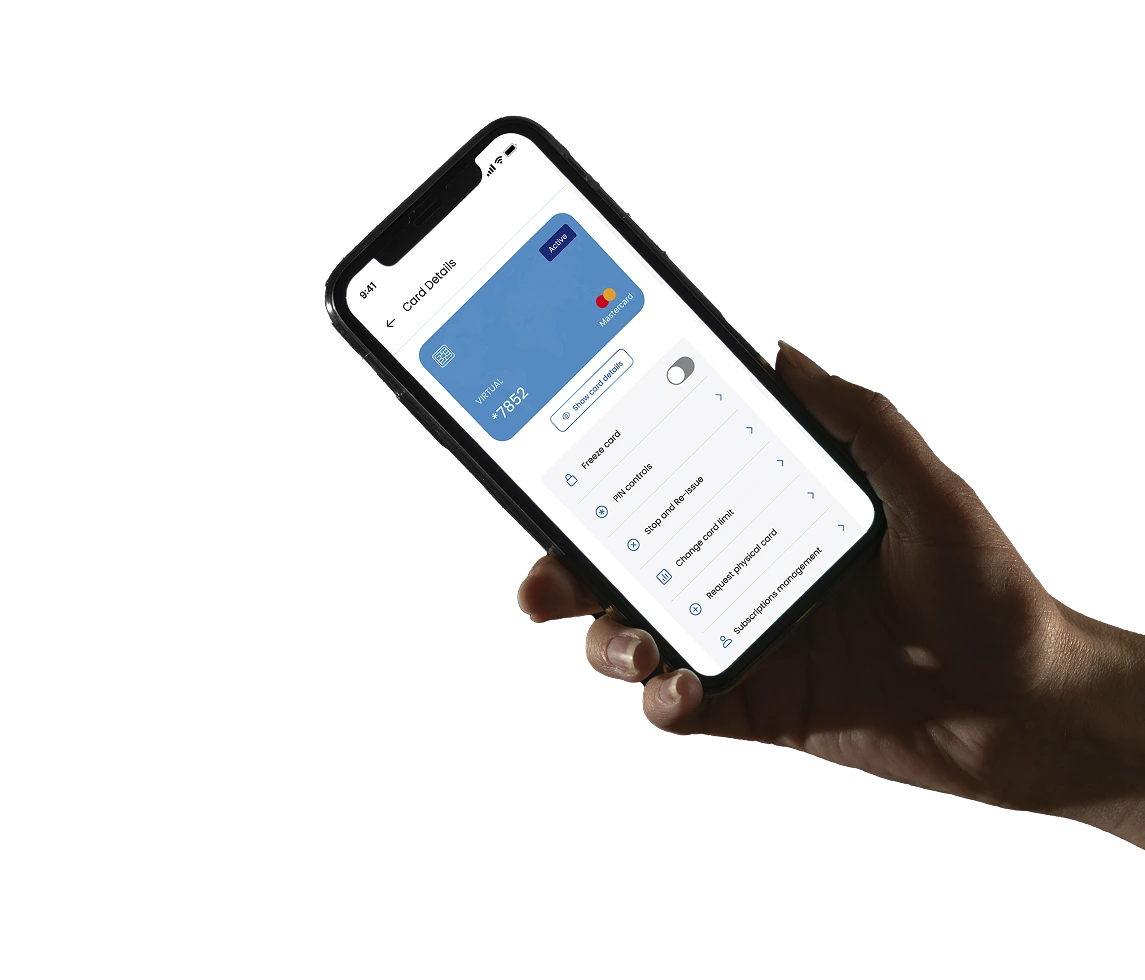

Platform Features

End-to-end AML lifecycle

Government reporting via SAMA Tanfeeth

Isolated SSU environment

Automated onboarding screening

Unified case management

Full audit trail and decision traceability

Continuous rescreening

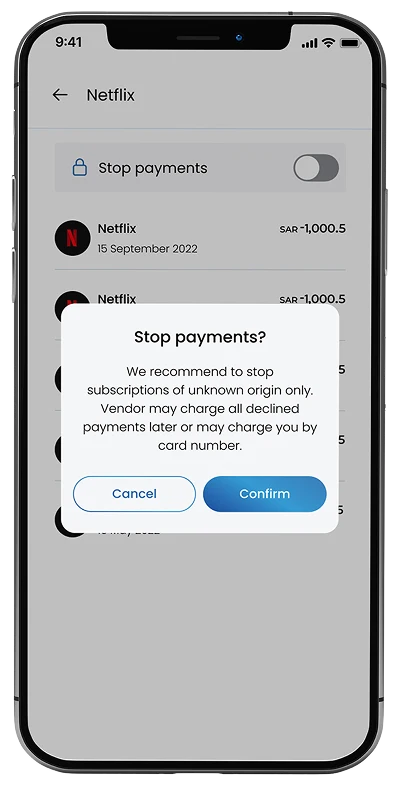

“Accept/Reject/Hold” decision engine

Real-time dashboards and alerting

Automated fund freezing for high-risk cases

Adaptive fraud monitoring

Encrypted, regulator- approved data exchange

Behavioral scoring for real-time alerts

how we did it

- Regulator-grade control framework built directly on the bank’s core systems to ensure full auditability and real-time supervision.

Multi-layer compliance architecture

- Screening pipeline connected to international sanctions lists, regional watchlists, and dynamic rule sets for instant risk detection.

GLOBAL + LOCAL AML SCREENING

- Context-aware decisioning that evaluates device signals, behavioral patterns, transaction history, and anomaly indicators.

Adaptive fraud engine

- End-to-end orchestration enabling onboarding, reporting, transaction checks, and certification-ready compliance flows.

FULL SAMA TANFEETH INTEGRATION

- Secure, fully segregated investigation zone for handling PEPs, escalations, and high-risk customer cases.

ISOLATED SSU ENVIRONMENT

- Round-the-clock monitoring, incident response, and production stability for uninterrupted regulatory operations."

24/7 COMPLIANCE OPERATIONS SUPPORT

Technologies

we used

.Net & .Net Core

Kotlin

Swift

React

AWS

Creation Process

Product vision

The client set out to build a fully digital banking experience with embedded regulatory intelligence. DashDevs translated this vision into a structured compliance roadmap — one capable of automating the AML lifecycle, supporting behavioral fraud detection, and meeting SAMA’s strict certification standards.

1Architecture Design

We designed a cloud-based compliance ecosystem with real-time decisioning at its core. Every customer and transaction triggers automated workflows: screening, risk scoring, event logging, and alert escalation. Structured communication channels ensure reliable, encrypted data exchange with SAMA Tanfeeth.

2System Development

DashDevs built the AML automation pipeline, the behavioral fraud engine, the unified case management environment, the API communication modules for SAMA, and the isolated SSU instance. Each component integrates through the bank’s core platform—ensuring consistent decisions, auditable logic, and instant regulatory actions.

3Migration & Integration

Within months, the legacy Oracle CX was replaced with a unified case management environment. DashDevs coordinated with Onftek to pass all SAMA Tanfeeth certification waves, testing encryption, message formats, and regulatory workflows.

4Extended Release & 24/7 Operations

DashDevs established Level 1 operational support to maintain continuous uptime. Our team monitors compliance pipelines round-the-clock, handles incidents in real time, and ensures the bank stays aligned with evolving regulations.

5