Digital Identity Automation Engine

- Location SAUDI ARABIA

- Industry Banking

- Team Size N/A

- Duration Ongoing

- Budget NDA

Challenges

High onboarding drop-off due to manual data entry, slow verification, and inconsistent identity information.

Fragmented and outdated customer records caused operational inefficiencies without direct Nafath connectivity.

Incomplete or inconsistent data reduced the accuracy of AML/KYC checks and overall risk assessments.

No automated two-way sync with Nafath, combined with limited internal engineering capacity, slowed integration and increased reliance on manual processes.

Solution

DashDevs designed and deployed an automated digital identity pipeline centered on secure communication with Nafath.

The integration retrieves encrypted customer information, validates it against internal systems, and continuously synchronizes updates—creating a dynamic, accurate, and regulator-aligned onboarding experience.

This setup significantly reduced manual inputs, improved data integrity, and strengthened compliance, forming the basis for future NAFAT-based authentication, which allows users to securely log in to fintech and banking apps through their verified digital identity.

our input

UI/UX Design

Solution arcitecture

Ios development

Android development

Back-end Development

Front-end Development

Quality Assurance

Cloud & Devops

Business analysis

Project management

RESULTS

With the trust of our partners, we have created a solution that not only meets the needs of users but also aligns with their values and contributes to a more sustainable future.

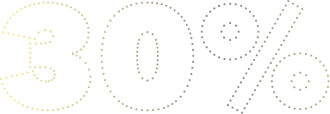

- REDUCTION IN ONBOARDING ABANDONMENT30%

A cleaner data flow, automated ID retrieval, and fewer manual inputs significantly decreased drop-off during account creation.

- FASTER ONBOARDING TIME (5 → 4 MINUTES)20%

Streamlined identity checks, fewer user actions, and real-time data validation shortened the full onboarding journey by roughly one minute.

- IMPROVEMENT IN RISK-SCORING ACCURACY20%

Consistent identity data, improved verification logic, and automated updates increased the precision of KYC, AML, and overall risk assessment.

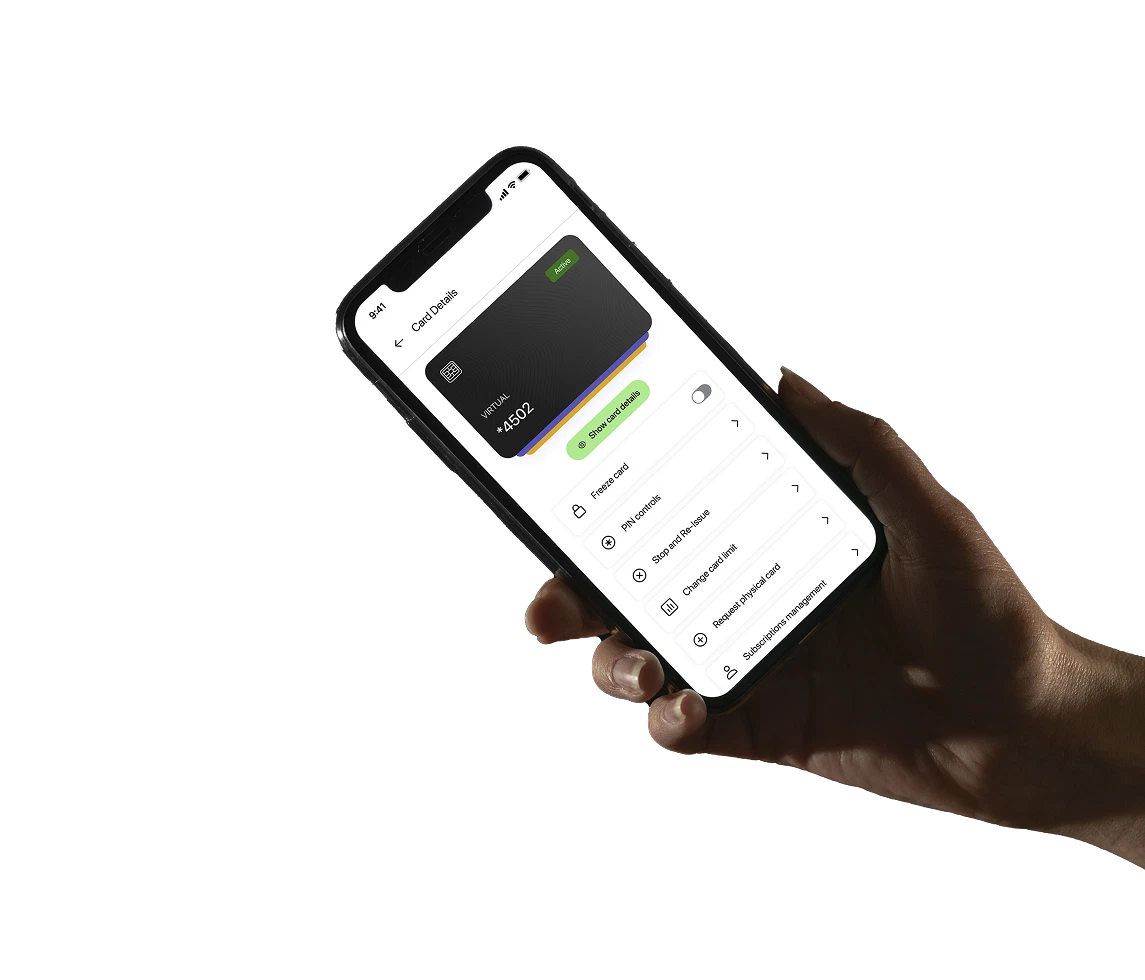

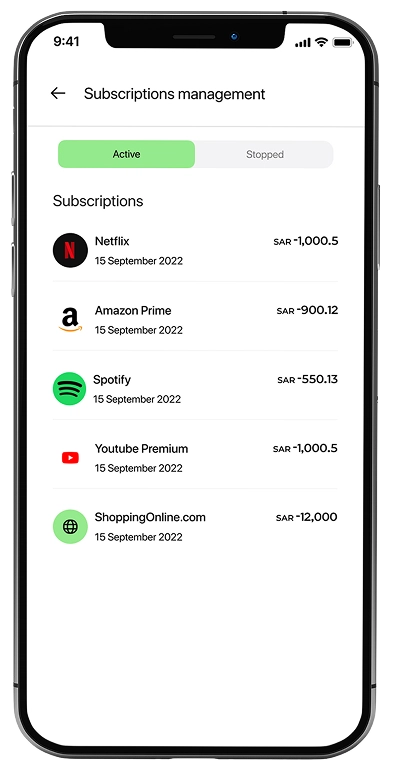

Platform Features

Automated identity retrieval from NAFAT

Automated onboarding and KYC data updates

Enforced secure ID-card verification

Decryption and validation of customer identity attributes

Enhanced AML and risk-scoring accuracy

Improved data consistency across CRM, onboarding, and risk systems

Continuous synchronization of customer profiles

Reduced operational workload through process automation

how we did it

- Encrypted, standards-aligned connectivity ensuring compliant identity retrieval across all touchpoints

SECURE NAFATH-READY API INTEGRATION

- Automated patching workflows keep identity records accurate without human intervention.90%

REDUCTION IN MANUAL PROFILE FIXES

- Scalable technical blueprints and architecture diagrams streamline cross-team communication and future development.40%

FASTER INTERNAL ALIGNMENT

- Encrypted, standards-aligned connectivity ensuring compliant identity retrieval across all touchpoints300

ms REAL-TIME IDENTITY PIPELINE

- Centralized flow feeding verified identity data into onboarding, customer systems, and risk engines.

UNIFIED ONBOARDING + CRM + RISK ARCHITECTURE

- Robust monitoring, traceability, and reliable fallback handling for regulator-ready oversight.

FAIL-SAFE ERROR & AUDIT CONTROLS

- Structured measurement model tracking onboarding speed, abandonment rates, and identity data quality.

KPI-DRIVEN PERFORMANCE FRAMEWORK

Technologies

we used

.Net & .Net Core

Kotlin

Swift

React

AWS

The Product Development Process

Product vision

The goal was to create a faster, compliant onboarding flow powered by a national digital identity source. DashDevs helped define a roadmap that placed Nafath at the center while aligning with Saudi Arabia’s three compliance pillars: AML controls, fraud prevention, and SAMA Tanfeeth as the automation layer for communication with the Central Bank.

1Architecture Design

DashDevs built a secure identity pipeline around Nafath—covering encrypted requests, retrieval, decryption, validation, and real-time patching. The design strengthened AML and fraud processes through clean data, while Tanfeeth was approached as a regulatory-communication framework that accelerates decisions, ensures immediate information access, and supports national financial safety.

2System Development

The team implemented secure API integration, identity dataset processing, synchronization workflows, and risk-enrichment logic. AML, fraud, and Tanfeeth each received dedicated capabilities—from improved scoring accuracy to compatible fraud signals to audit-ready reporting flows—brought together through a unified orchestration layer.

3Cross-Team Collaboration

DashDevs worked closely with product, engineering, and compliance teams to refine flows, documentation, and KPIs. Technical diagrams clarified how AML, fraud, and Tanfeeth fit into one coordinated architecture, ensuring smooth implementation and future scalability.

4Future Opportunities

The system now provides a foundation for deeper SAMA-aligned automation, including upcoming Nafath-based authentication and faster Central Bank communication—pushing the institution toward a fully orchestrated financial-safety and compliance ecosystem.

5