Multi-Market BNPL Platform

Scalable BNPL core with risk-based onboarding, multi-limit cards, and a cost-optimized payments stack

The client approached DashDevs to support the ongoing evolution of a high-load BNPL platform where credit is delivered through card-based limits and real-time risk decisions. The product operates across multiple markets and requires continuous feature expansion without disrupting existing customer journeys.DashDevs joined as a delivery and engineering partner to extend BNPL core capabilities, adapt card products for new markets, modernize the payments stack, and strengthen observability—helping the client scale operations while keeping risk, compliance, and transaction costs under control.

- Location Czech Republic

- Industry FINTECH

- Team Size 10+ people

- Duration -

- Budget NDA

Challenges

Risk-based onboarding with multiple decision outcomes

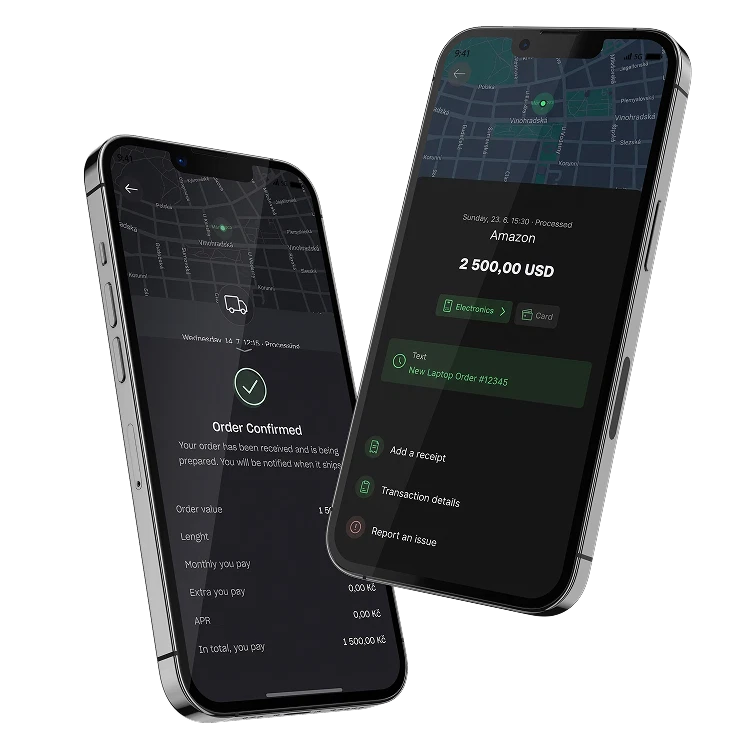

The client’’s onboarding is not a simple signup flow. Users go through a multi-step journey that includes identity verification, financial profiling, external checks, fraud/compliance screening, business rules validation, and scoring—ending in approve/reject/manual review decisions.Multi-limit credit model tied to different card behaviors

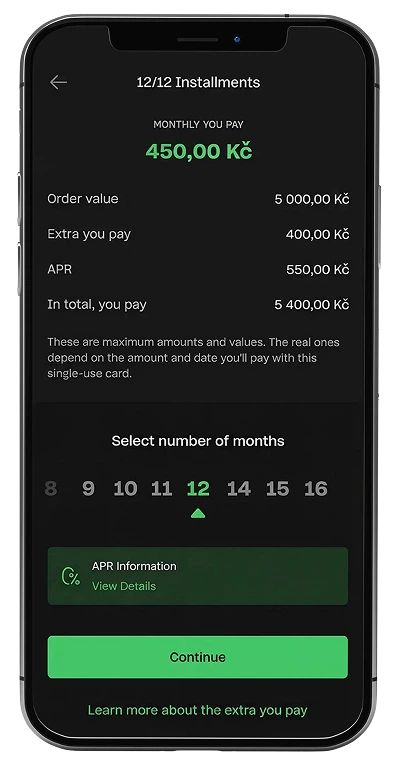

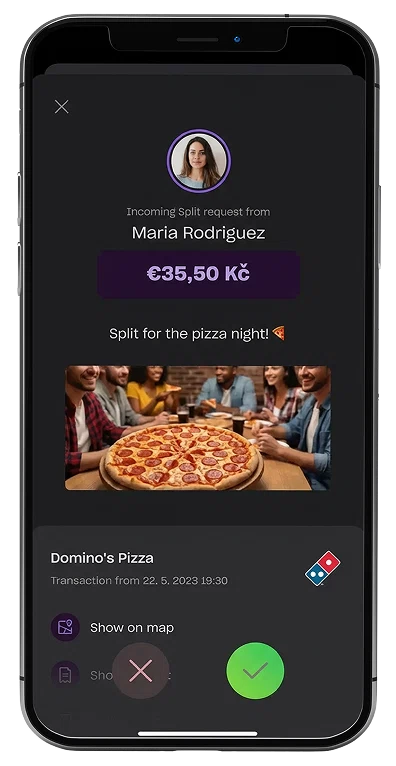

Customers access BNPL through multiple credit mechanics, including revolving limits for everyday spending, installment limits for larger purchases, and additional card types (e.g., one-time and installment-specific cards). Each must map cleanly to the right limits, policies, risk rules, and lifecycle flows—while remaining intuitive for users and scalable in operations.Market expansion without breaking existing platform logic

The platform evolves market-by-market. New functionality must be introduced for Poland while keeping parity with the Czech baseline and supporting local constraints—without introducing regressions.Payments stack transition driven by cost and control

The client operates with a mix of legacy and new payment rails. Moving toward a more efficient internal processing setup requires careful migration planning, integration work, and operational readiness—while keeping payments stable.

Solution

DashDevs contributed across BNPL core, payments infrastructure, and observability in a fast-moving, multi-team environment where the platform evolved in parallel. Our work focused on strengthening onboarding, risk and limits logic, extending card capabilities, modernizing payment processing, and improving operational visibility—while keeping the platform stable and scalable.

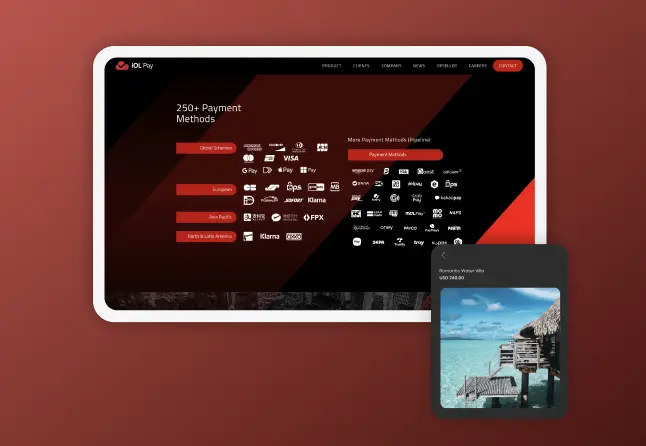

On the product and infrastructure side, we supported a full BNPL onboarding pipeline (KYC orchestration, risk and fraud checks, limit assignment, manual reviews, and premium upgrade flows), rolled out installment card functionality for Poland using proven Czech patterns, and advanced cost-driven payment modernization under the PayCore track. In parallel, we enabled wallet readiness and ecosystem integrations (Apple Pay, Google Wallet, card schemes, collections systems) and enhanced observability with Datadog and analytics dashboards, including telemetry cost optimization without sacrificing visibility.

our input

UI/UX Design

Solution architecture

IOS development

Android development

Back-end Development

Front-end Development

Quality Assurance

Cloud & Devops

Business analysis

Project management

RESULTS

With DashDevs embedded into the client’s delivery model, the platform scaled across markets while strengthening risk controls, reducing operational costs, and accelerating time-to-market for new capabilities.

- ~2× lower monitoring costs2X

Sensitive data filtering and telemetry hygiene reduced Datadog spend by approximately two times.

- Multi-market feature rollout delivered4

Installment card functionality launched for Poland, leveraging the established Czech-market foundation.

- Wallet readiness achieved100%

Supported Apple Wallet + Google Wallet certification, improving usability and enabling broader adoption.

App functionality

Multi-step onboarding (identity + financial profi

Risk scoring and decisioning

Limit assignment logic

Premium upgrade flow

Installment cards and card variants

Payments routing

Wallet enablement

Collections system integration

Analytics and dashboarding pipelines

how we did it

- Supported payments modernization with a focus on cost, control, and operational readiness

Payments Modernization

- Implemented and supported a risk-based onboarding pipeline with clear decision points and fallback paths

2-Step Decisioning

- Delivered market expansion features by reusing proven CZ patterns and adapting them for Poland

Market Expansion

- Worked inside a multi-team delivery model, extending existing systems without disrupting production flows

5+ Delivery Teams

- Strengthened monitoring and analytics while reducing cost via sensitive-data filtering and telemetry hygiene

30% Cost Reduction

- Coordinated integration work across wallet certifications, card schemes, and collections tooling

Complex Integrations

Technologies

we used

DataDog

Django

Celery

Kotlin

MVVM

Retrofit

Redis

Apollo Graphql

RabbitMQ

Creation Process

Product vision

The client’s BNPL model depends on fast, correct risk decisions and a flexible credit setup delivered through card-based limits. The roadmap required continuous evolution across markets while keeping onboarding, risk, and payments stable.

1Product Design

The user journey spans onboarding, verification, contract acceptance, and credit access. DashDevs ensured the flow remained consistent and decision outcomes were operationally supportable (including manual review and premium upgrades).

2Architecture Design

We supported modular evolution across markets and providers—helping the platform extend features (e.g., installment cards in Poland), migrate payments toward more cost-efficient rails, and improve observability for scale.

3Development

Delivery focused on strengthening onboarding and decisioning flows, rolling out the card product for Poland, modernizing payments under the PayCore track, enabling wallet certifications, and optimizing monitoring and analytics across Datadog and dashboards.

4Extended Release

Post-release, the team continued improving monitoring hygiene and cost controls, expanding integrations across collections and the wallet ecosystem, and enhancing platform scalability to support multi-market growth

5