Payment Orchestration Platform

- Location EUROPE

- Industry FINTECH

- Team Size 10-12 experts

- Duration 6 months

- Budget NDA

Challenges

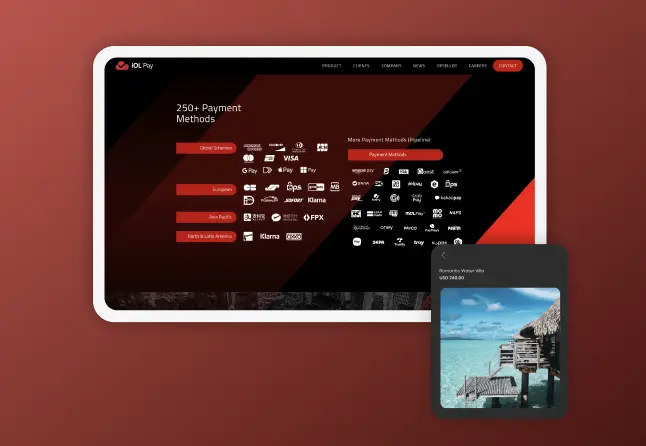

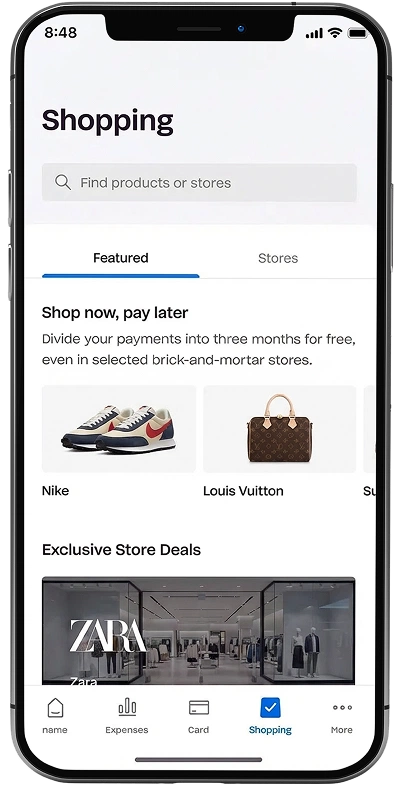

Addressing a fragmented payment collection infrastructure. Adopting a unified, structured methodology to collect repayments across cards, wallets, and local payment methods, without the need for a third-party orchestration was key to approaching the BNPL model.

Maintaining existing APIs, frontend flows and customer experience while replacing and extending payment providers.

Ensuring reliability during peak times. Consistency and integrity were key while ensuring stable payment collection under extreme traffic spikes during seasonal commercial campaigns, such as Black Friday, all while maintaining full operational visibility and control.

Solution

Dashdev’s approach delivers a white-label payment orchestration layer built to handle BNPL repayments at scale while maintaining uninterrupted operations. Maintaining existing APIs and customer experience, the infrastructure enables secure repayment collection across cards, mobile wallets, and local payment methods. Routing, token management, and execution are consolidated into a single orchestration layer, giving the client control over when and how repayments are collected across markets.

Utilizing key components of Fintech Core, the modernized solution allows the client to operate a unified payment control layer without dependence on transaction-based SaaS providers. Support added for Apple Pay and Google Pay tokenization, direct A2A payments via BLIK, direct gateway integrations, and configuration-led payment activation. Scalability prioritized when addressing all repayments, ensuring audit-ready architecture with full operational visibility, supporting cost-efficient growth and resilience during peak volumes.

our input

Solution arcitecture

Back-end Development

Front-end Development

Quality Assurance

Cloud & Devops

Business analysis

Project management

RESULTS

Built on Fintech Core, the platform enabled the client to internalize critical payment infrastructure, orchestrate multiple payment rails, and scale BNPL repayment processing without dependency on transaction-based SaaS providers.

- PAYMENT REQUESTS PER SECOND10K+

The payment orchestration layer built on Fintech Core was designed to reliably handle peak repayment traffic of up to 10,000 concurrent requests per second — ensuring stable BNPL payment collection during high-load periods such as Black Friday and seasonal campaigns.

- PAYMENT RAILS ORCHESTRATED4

Users of NBB banking app that was based on our white label solution. Total coverage ~4% of country population.

- PAYMENT LOGIC UNDER CLIENT CONTROL100%

By licensing Fintech Core instead of relying on transaction-based SaaS providers, the client gained full ownership over repayment routing, timing, and cost structure — removing percentage-based intermediaries from critical payment flows.

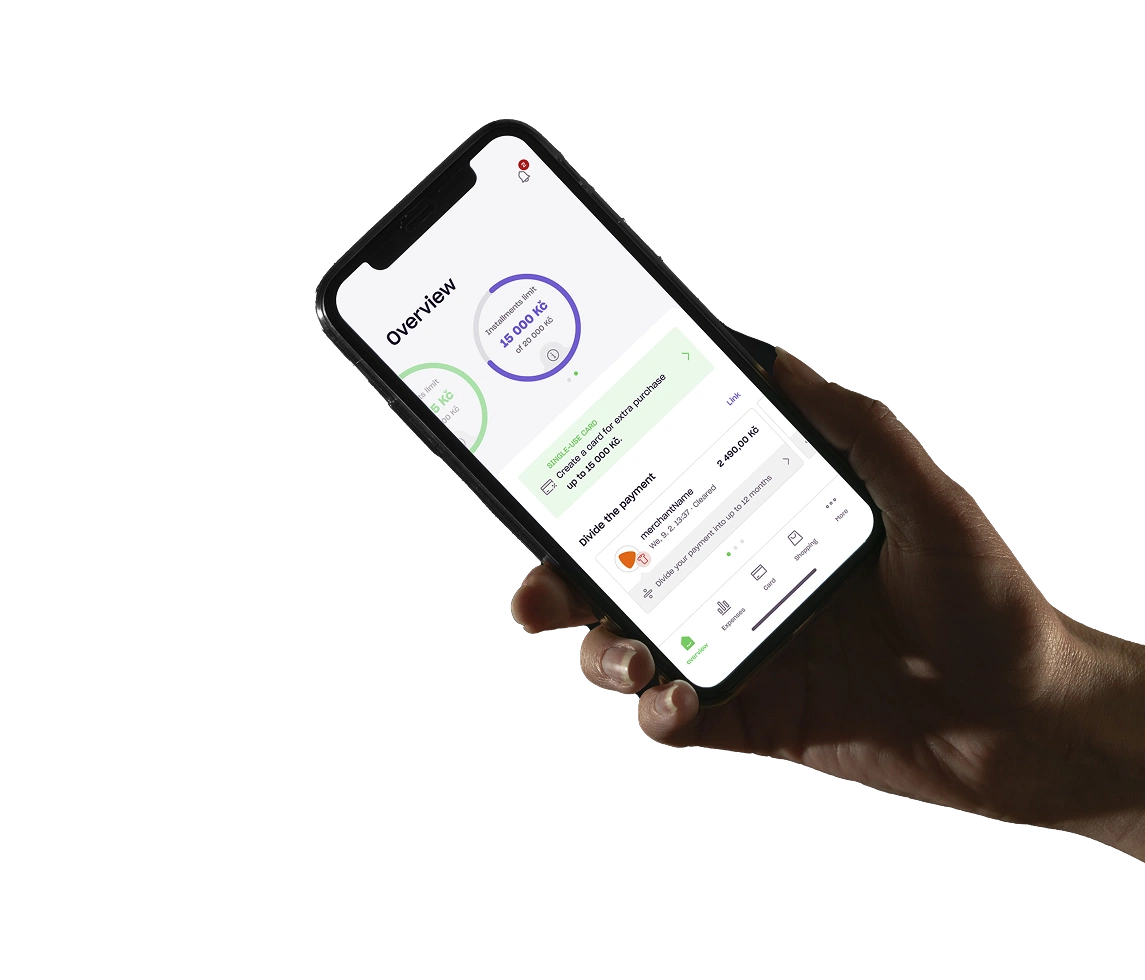

App functionality

Secure user authentication

Centralized general ledger

Transaction processing and reporting

Multi-currency merchant accounts

Card and wallet payments

Apple Pay integration

Google Pay integration

BLIK payment support

PayCore token processing

Real-time APIs and webhooks

Back-office transaction management

User and access management

how we did it

- A Fintech Core–based orchestration layer abstracted payment routing, token handling, and execution from underlying gateways, enabling controlled BNPL repayment collection across markets.

PAYMENT ORCHESTRATION ENGINE

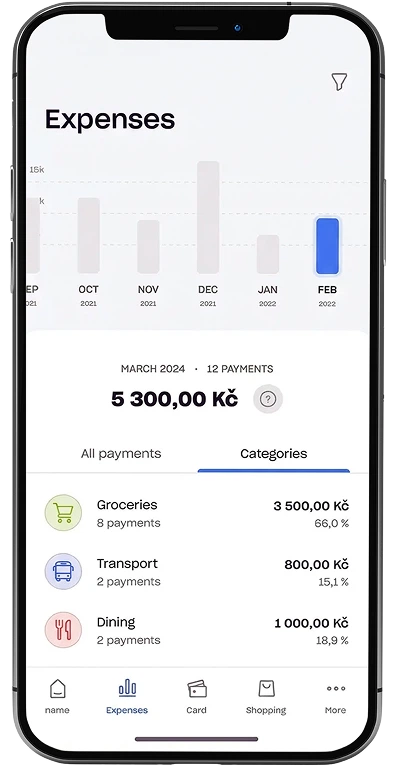

- A centralized general ledger tracks repayment flows and transaction states across CZK, RON, and PLN, supporting accurate reconciliation and real-time operational reporting.

UNIFIED LEDGER

- The new infrastructure was introduced without changing existing APIs or frontend flows, allowing the client to switch and extend payment providers transparently.

ZERO- DISRUPTION INTEGRATION

- Apple Pay and Google Pay tokenization were implemented within the orchestration layer, despite limited native support from underlying gateways.

WALLET & TOKENIZATION SUPPORT

- for final product from UI/UX to Technical solution

LOWER-COST A2A PAYMENTS

- Payment methods can be activated, routed, or disabled via configuration, enabling rapid market-level optimization without redeploying core systems.

CONFIGURATION-DRIVEN PAYMENTS

- The orchestration layer was designed to sustain peak loads of up to 10,000 payment requests per second, ensuring reliability during Black Friday and seasonal campaigns.

SCALABLE CLOUD ARCHITECTURE

- An internal operations interface provides visibility into transactions, users, and repayment actions such as capture, refund, and void.

BACK-OFFICE & OPERATIONS CONTROL

- By licensing Fintech Core instead of using transaction-based SaaS, the client retained full control over payment logic and avoided percentage-based processing fees.

LICENSED TECHNOLOGY MODEL

- Repayment timing and routing were designed to support BNPL-specific behavior — collecting efficiently without negatively impacting customer experience.

BNPL-FIRST PAYMENT LOGIC

Technologies

we used

React

RTK Query

CSS

TypeScript

HTML5

Tailwind

Radix UI

Creation Process

Phase 1:

Middleware & API

compatibilityA Fintech Core–based middleware layer was introduced between the client and PayCore. This layer mirrored existing PayU APIs, ensuring that the client’s core system and frontend required no changes when switching payment providers.

1Phase 2:

Wallets &

tokenizationBecause PayCore did not natively support Apple Pay and Google Pay tokenization, DashDevs implemented token decoding and wallet payment flows within Fintech Core, enabling frictionless mobile payments across supported markets.

2Phase 3:

Operational control

& visibilityA back-office system built on Fintech Core models provided the client teams with real-time visibility into BNPL repayment flows, transaction states, and user actions, while supporting role-based access and operational controls.

3Phase 4:

Scalability & peak

readinessThe orchestrator was designed to handle up peak load, ensuring stable performance during peak traffic events such as Black Friday and major seasonal campaigns.

4