Dozens

Building One of the UK’s First Challenger Banks

Born in London, built with DashDevs — Dozens set out to reinvent people’s relationship with money. The idea was bold: create a financial institution that profits only when its customers grow their savings.In just nine months, our cross-functional team turned this vision into a licensed digital bank — complete with current accounts, investment features, and behavior-driven budgeting tools. Every layer of the product was designed around three pillars: scalability, compliance, and a genuine drive to make money management feel simple and rewarding

- Location UK

- Industry FINTECH

- Team Size 60+ people

- Duration 9 months

- Budget NDA

Challenges

Mapping the vision to execution. The founder had an unconventional business vision — build a bank that earns only when its customers grow their wealth. To achieve that, the bank went for a dual FCA license (eMoney + MiFID). It enabled us to launch a product that combines everyday retail banking features with intuitive investing.

Proprietary core banking platform. To ensure competitiveness, Dozen opted out of using existing BaaS cores. Instead, we built a custom Core Banking orchestration platform, designed for efficient auto-scaling, 99%+ uptime, and plug-and-play integrations.

Microservices-driven architecture. To ship a full-stack digital bank fast, we engineered a modular microservices architecture, orchestrating 20+ third-party APIs in real time — each one battle-tested for stability, security, and compliance.

Nine months to market. The goal was to launch a fully functional mobile bank — complete with current accounts, savings tools, and investment features — in under a year. That meant coordinating 60 specialists across product, design, compliance, and engineering under one synchronized roadmap.

Solution

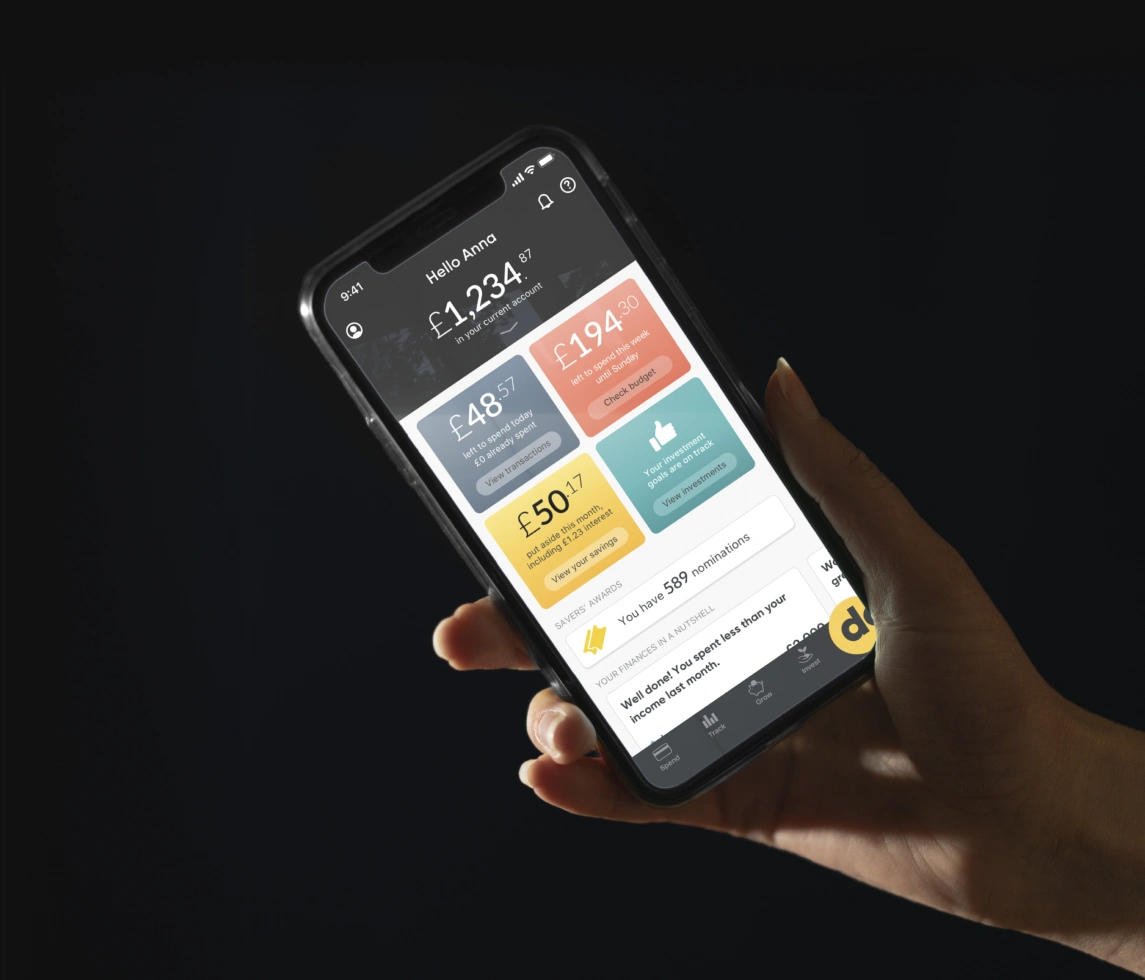

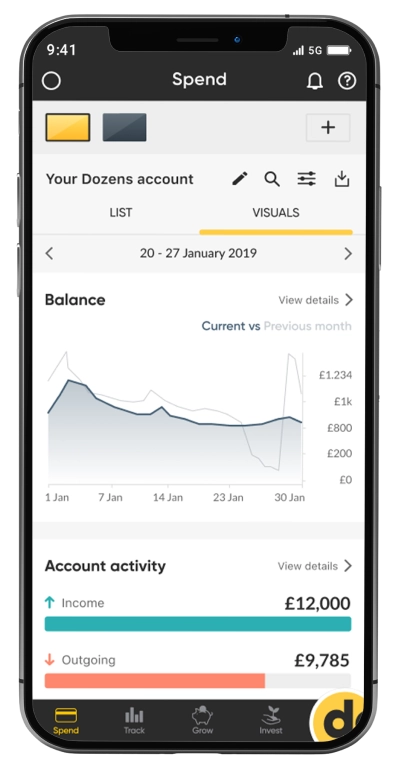

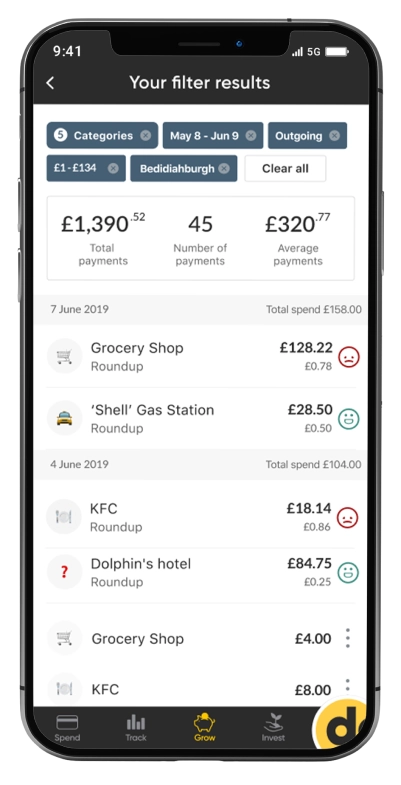

Dozens launched in 2019 with four core feature sets: spend, save, track, and invest. Apart from the no-fee current account, affordable cross-border payments, and cards, we also added personal finance management and investing products. The user flow was designed to promote behavioral change with every screen. Proprietary savings and investment products were validated through user research and regulatory stress tests, earning industry recognition from Google, Visa, and the British Bank Awards for innovation in UX design.

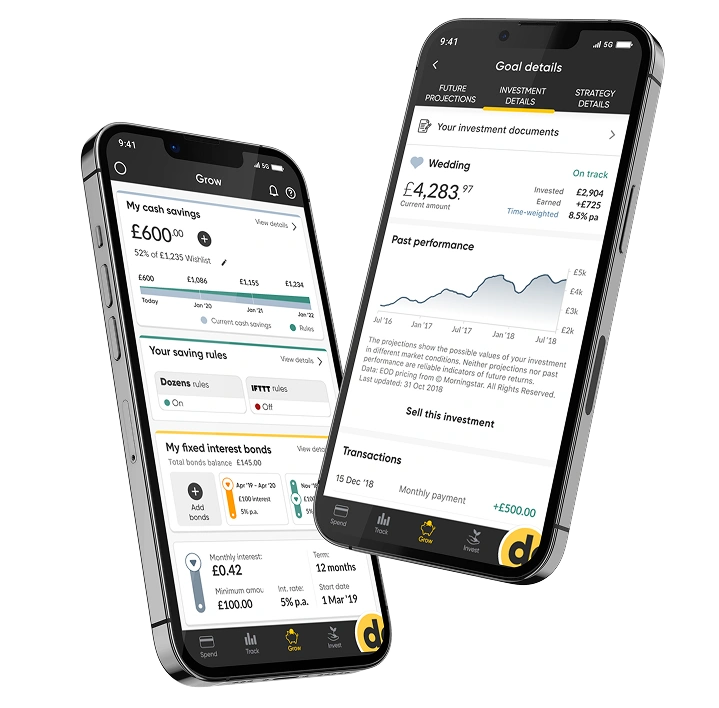

Dozens also introduced a 5% fixed-interest savings bond — a hero feature that lets users earn high, tax-free returns without exposing their capital to market risk. The funds are securely held in a trustee-controlled ISA account, with monthly payouts and the flexibility to withdraw by selling the full tranche at any time. Within the first year, Dozens acquired over 25,000 users and secured £35M in funding.

our input

UI/UX Design

Solution arcitecture

Ios development

Android development

Back-end Development

Front-end Development

Quality Assurance

Cloud & Devops

Business analysis

Project management

RESULTS

We're proud of being instrumental to our clients success and sure that stable and flexible solution will assure stable growth in the future.

- months9

From concept to launching a fully licensed, cloud-native mobile bank.

- customers60k

Acquired and retained during four years of operations.

- lower GTA costs40%

Thanks to a custom core banking platform with seamless vendor orchestration.

AWARDS

London tech 50

9th place

fintech Disruptors

23rd place

UK Startups 100

25th place

App functionality

Personal current account

Card management

KYC/AML verification

Smart spending management

AML & Fraud

Fixed-interest savings product

Stock and shares investing

Balance tracking and reconciliation

Fraud detection engine

AI-ready data layer

Trust-grade security

Customer Support

how we did it

- Scalable data infrastructure, supporting embedded analytics scenarios

AI-ready infrastructure

- Cloud-native, event-driven architecture with seamless scaling.

Custom banking core

- With ecosystem players to support onboarding, card issuing, fraud detection, and investing.20+

integrations

- Product flow co-created with users for improving financial literacy and engagement.

Behavior- driven UX

- Dual FCA licence operation with zero compliance breaches.30+

Governance excellence

- 5% trust bonds designed to convert savers through risk-free, tax-free returns.

Hero savings feature

Technologies

we used

React

.Net

Kotlin

Swift

AWS

client testimonial

From the very early days I was struck by DashDevs pragmatic approach of balancing between development and business needs. It’s really rare to find a company that not only does tech for the sake of tech, but takes grounded decisions taking into account business considerations. We built together a pretty complicated platform with 40 vendors in less than 18 month. Dashdevs is much more than a technical agency, it gives you one team feeling.

Creation Process

Product vision

The founding team’s vision was audacious: build a financial institution that profits only when its users prosper. Together, we transformed this mission into a set of actionable product requirements, defining a monetization model rooted in behavioral change, not fees. During joint scorpion sessions, we then defined clear engineering specifications, laying the foundation for a compliant, AI-ready banking platform that would scale fast without compromising trust.

1Product design

Dozens’ design sprint centered on behavioral transformation through a “Spender → Saver → Investor” user journey. Creating intuitive, habit-shaping UX required extensive prototyping and user validation. Feedback from early adopters shaped the app’s visual identity and core functionality, with the design groundwork done within six weeks. Later on, the product earned industry recognition for innovation in UX and savings product design.

2architecture design

We engineered a cloud-native, event-streaming banking core that unified payments, KYC, cards, investments, and analytics into one scalable architecture. Built for 99%+ uptime and seamless third-party orchestration, it enabled real-time balance reconciliation and latency-free trade execution. The developed modular architecture proved to be 40% more cost-competitive than existing market solutions.

3Development

Product development ran in parallel tracks — mobile, back-end, and compliance infrastructure — synchronized through continuous integration pipelines. With 20+ vendor APIs and complex orchestration logic, the team implemented fallback systems and live monitoring to eliminate single points of failure. Within nine months, Dozens launched a fully licensed, retail-ready mobile bank with current accounts, investment tools, and the flagship 5% interest rate account.

4Extended Release

The next phase focused on data intelligence and real-time banking integration. DashDevs built a data lake with automated ETL pipelines feeding live operational data into Looker dashboards. This unified analytics layer became the backbone of Dozens’ decision-making — powering insights for marketing, finance, and product teams alike.

5