SME Account Payable Tool

For a major retail and commercial bank in the UK

Small and midsize businesses don’t have sprawling finance departments. They have AP teams buried under hundreds of invoices — paper slips, email PDFs, photos from the warehouse floor — all of which still need to be typed in, checked, matched to a PO, and scanned for fraud. And the cost of processing paper invoices alone can exceed $170K per year.Trying to strong-arm suppliers into changing their habits isn’t realistic. What companies need instead is a tool that automates the messy reality of AP work. And we’ve built one for one of the UK’s biggest banks.

- Location UK

- Industry Banking

- Team Size 10 people

- Duration 12 months

- Budget NDA

Challenges

Fragmented systems with no automation. Most SMEs juggle emails, spreadsheets, and multiple accounting tools that don’t talk to each other. We needed to build a multi-channel experience that would allow easy data capture and secure sharing with popular financial software.

Stringent compliance requirements. All AP tools must align with UK tax rules (VAT categories, Making Tax Digital), supplier verification standards, and secure payment processing.

Wide variability in invoice formats. Training OCR/ML models to handle the diversity in invoice formats — while maintaining accuracy across edge cases — was a technical and UX challenge.

Handling multi-currency realities. UK SMEs juggle GBP, EUR, and other currencies. That means FX swings, cross-border VAT rules, and reconciliation logic that doesn’t blink when an invoice hops currencies. The product had to make multi-currency feel native, not like bolted-on plumbing.

Solution

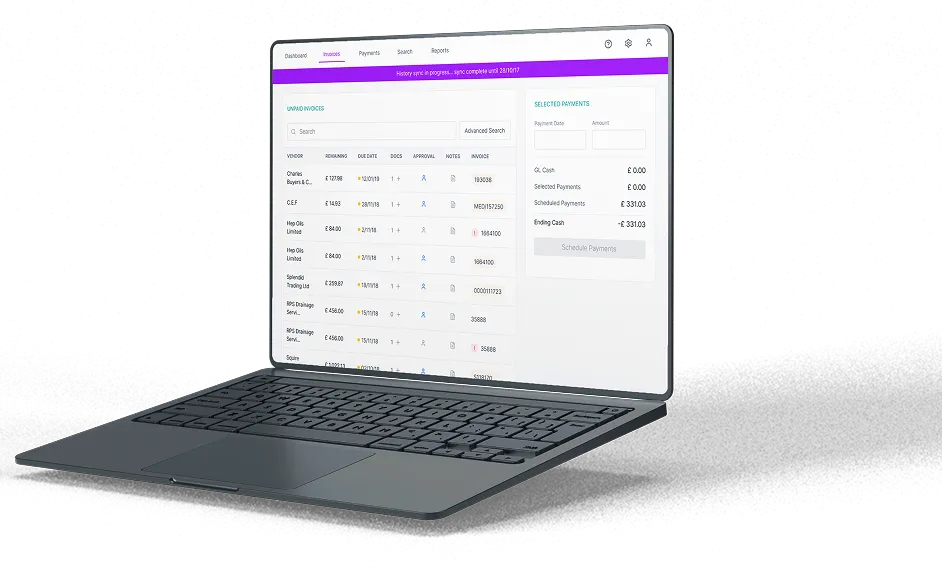

We’ve developed a fully automated accounts payable platform that takes the chaos out of invoice processing. The system captures invoices from email, mobile, or upload, then uses optical character recognition (OCR) to accurately extract every data point — no more retyping, no more second-guessing supplier submissions.

Each invoice is automatically validated, checked against purchase orders, and routed through a configurable approval workflow. VAT rules, supplier details, totals, and currency conversions are applied in the background, giving finance teams clean, consistent data.

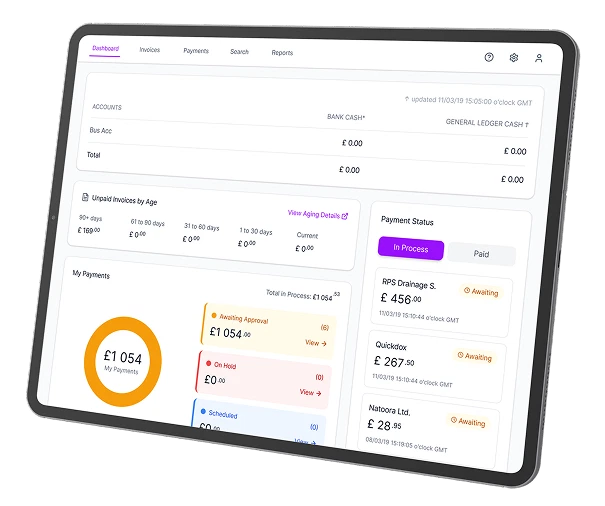

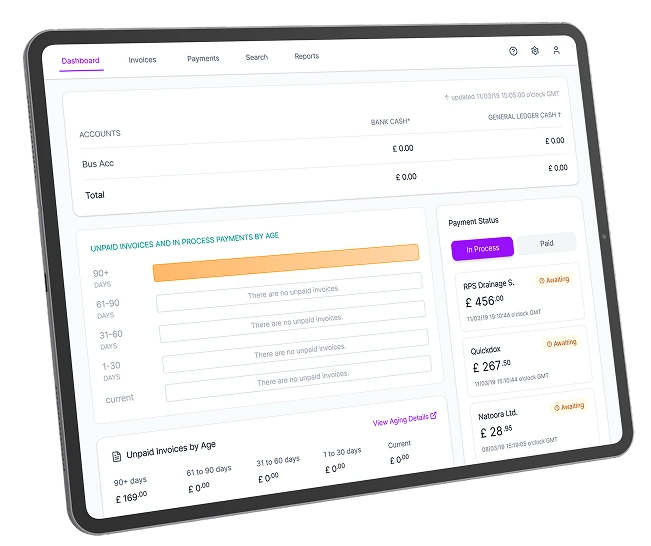

On the payments side, we integrated directly with the bank’s financial services layer to support secure direct debit, multi-currency logic, and payment scheduling, all wrapped in a clean, intuitive UX. Every payable sits in one unified dashboard where teams can review, approve, and execute payments with full audit trails.

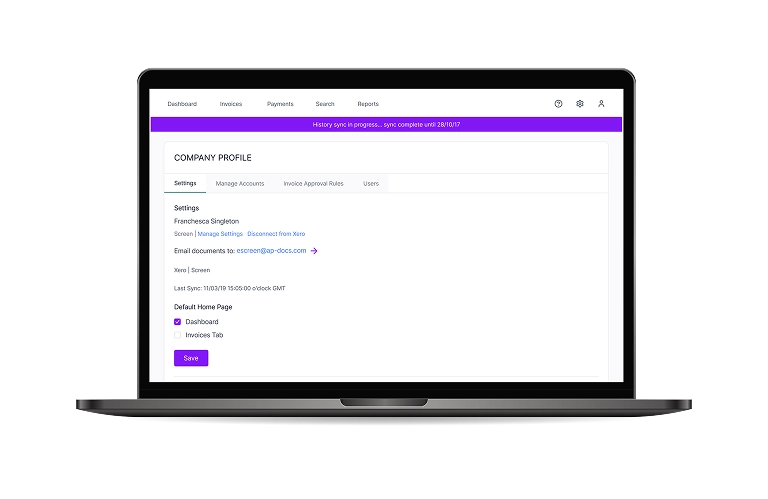

Accounting integrations with Sage and Xero keep books in sync, while the supplier portal reduces back-and-forth by letting vendors upload documents, track statuses, and correct issues before they hit the finance desk.

Architecture

User Interface

- Saas platform

API

Business Layer

- Authentication & Authorization

- Invoices

- POs

- CRs

- Admin/Internal Tools

Data Interface

- Payments

- Discounts

- Analytics

- Subscription mgmt.

- Communications

- AI/Machine Learning

- Business Intelligence

- Connectors

- Facade to external APIs

- Third party eco-systems

- EvolutionAI

- Stripe

our input

UI/UX Design

Solution arcitecture

Ios development

Android development

Back-end Development

Front-end Development

Quality Assurance

Cloud & Devops

Business analysis

Project management

RESULTS

With the trust of our partners, we have created a solution that not only meets the needs of users but also aligns with their values and contributes to a more sustainable future.

- faster workflow execution50%

with a unified AP processing engine

- reduction in data-entry errors90%

Thanks to ML-driven data extraction and validation

- APs per month supported at scale500+

For larger businesses, seeking efficiencies

App functionality

Customer onboarding

Authentication and e-Signatures

Tiered service pricing

Streamlined payment processing

Invoice capture with OCR

Accounting software integrations

Purchase order (PO) matching

Financial management tools

Multi-currency support

Supplier portal

Custom VAT rules

Report generation

Invoice and payment approvals

Email and app notifications

how we did it

- Collects and scans invoices from any channel with OCR

Invoice capture pipeline

- Thanks to automated validation & PO matching3X

faster approvals

- That enables direct debit, payment scheduling, and multi-currency payouts

Bank-ready payment module

- Synced AP data instantly with the UK’s most widely used accounting platforms

Sage & Xero integrations

- With rule-based checks baked into every step

Stronger fraud safeguards

- All data logged and traced to support financial controls.

Compliance-grade audit trails

Technologies

we used

Node.js

React

Gatsby

Stripe

Evolution AI

Salesforce

The Product Development Process

Product vision

User interviews made the core problem unmistakable: the majority of SME customers still processed primarily paper-based invoices, burning hours on data entry and fighting errors that stall payments. With tight cash flow and suppliers expecting punctual payouts, small finance teams are constantly under pressure. We set out to build an AP platform that eases these qualms.

1Product Design

Our team mapped real-world AP workflows across three user personas, handling accounting, business finances, and payment authorisation. The goal was to design a UX that simplifies capture, approvals, and payments. All prototypes were tested with real users to validate edge cases, minimise clicks, and surface the right data at the right moment and then implemented with Gatsby and React.js frameworks.

2Architecture Design

We engineered a modular, event-driven architecture that ties together OCR, data validation logic, PO matching, payments, and accounting integrations. Built for reliability and compliance, each module handles high-variance invoice formats while maintaining a clean audit trail. Then designed a backend payment processing module, integrating with UK banking rails and Stripe for card payment processing.

3Delivery

Front-end, back-end, and OCR/ML pipelines were developed in parallel using CI/CD and automated QA. We integrated directly with the bank’s financial services layer, onboarded Sage and Xero connectors, and built a fault-tolerant ingestion flow capable of processing invoices from multiple channels.

4Extended Release

After delivering and validating the MVP, we’ve mapped several extra features for improving CX, delivered with the new release — a chatbot that provided users with contextual support, a cash flow projection dashboard to support financial decisions, and greater support of international payout methods. The platform evolved into a stable, automation-first AP system ready for scale across UK SMEs.

5