Sustainable Finance Solution

- Location USA

- Industry FINTECH

- Team Size 4 experts

- Duration 6 month

- Budget $ 200K+

Challenges

Design a secure verification process with features like Touch ID & Face ID, 256-bit encryption, and two-factor verification to protect user information.

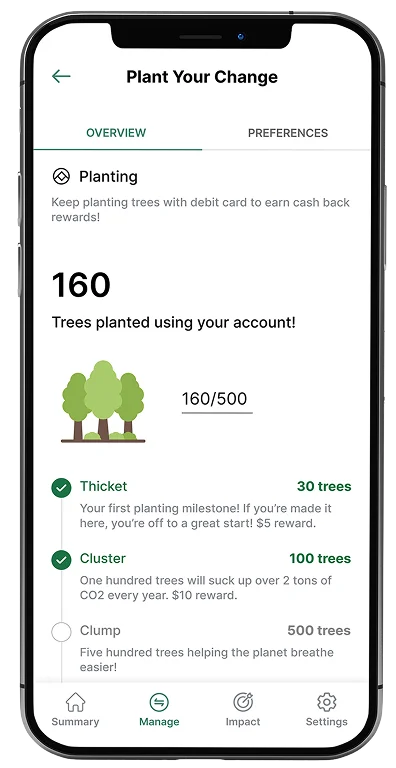

Implement a comprehensive loyalty program that includes cashback and rewards systems.

Integrate a wide range of analytical tools to gather and analyze user data, enabling continuous improvement and personalized recommendations.

Provide users from different countries with the opportunity to connect with specialists via Voice over IP (VoIP) telephony, ensuring seamless communication and support.

Solution

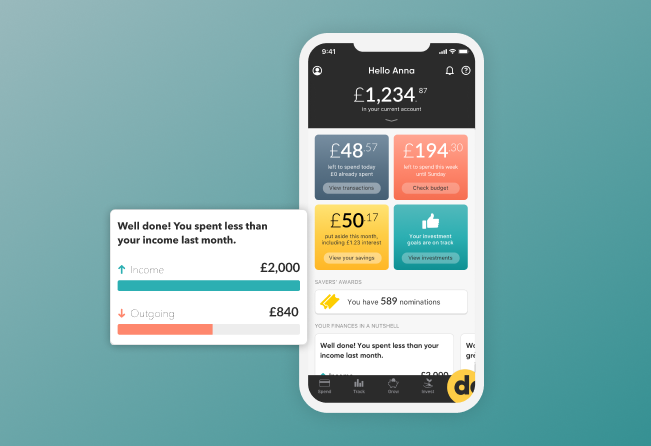

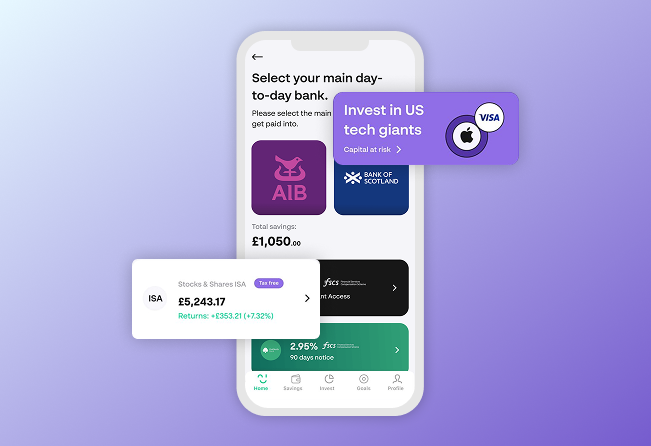

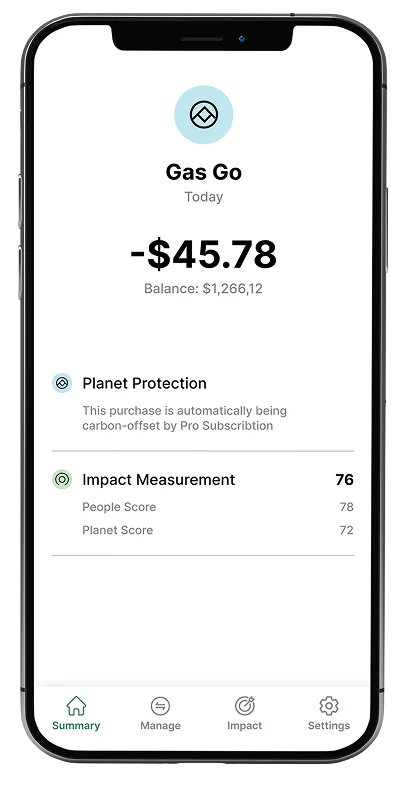

This app is a comprehensive financial platform that is designed to help users manage their money in a way that aligns with their values and supports a more sustainable future. It allows users to manage their money in an ethical and sustainable way. Application offers a cash management account that provides a high-interest rate, investment accounts, retirement accounts, and more. It also allows users to track their carbon footprint and offers a program called “Planet Protection” that lets users offset their carbon emissions by planting trees.

our input

Solution architecture

Ios development

Android development

Back-end Development

Quality Assurance

Project management

RESULTS

With the trust of our partners, we have created a solution that not only meets the needs of users but also aligns with their values and contributes to a more sustainable future.

- rating on each platform4.5+

The app has garnered an impressive rating on both the App Store and Google Play Market, which reflects public satisfaction and trust.

- users worlwide5M+

With a user base of over 5M active users has emerged as a trusted choice for individuals seeking sustainable financial solutions.

- INDUSTRY LEADER AWARD2021

For its outstanding user experience, the app was honored with the prestigious Webby Award for Best User Experience in Finance.

App functionality

KYC

virtual Ledger

Payments Processing

Account top-up

Money Withdrawal

investment Options

Personalised Match Tool

Spending tracking & Categorization

Savings management

Reporting & Personalised insights

financial Advisors

Real-Time Reviews and ratings

Search filter

Arranged callbacks

user support

how we did it

- successfully integrated a new vendor, aligning their services with the project's specific business requirements within a short timeframe

Accelerated KYC Integration

- of first release solution that met all technical requirements6

month to launch

- agile functionality adjustments without code deployment

Feature Flag Implemented

- seamlessly incorporated reactive programming principles

RxSwift Integration

- total partnership length after first product release1

Years of partnership

- bolstered the project's quality through comprehensive unit and UI testing and improved critical code components

Enhanced Testing Coverage

Technologies

we used

Swift

RxSwift

iOS

GoogleAPIs

Creation Process

Product vision

We began our collaboration with research to understand their specific requirements and long-term goals for the app. This involved conducting thorough market research, competitor analysis, and defining key features and functionalities that would set the app apart in the fintech industry.

1Consulting

DashDevs' legal advisors provided in-depth consulting services to the client, offering insights and recommendations on technical feasibility, scalability, and compliance with industry regulations. We helped streamline the app's functionalities, ensuring that it adhered to best practices in user experience, security, and performance.

2architecture design

During the architecture design phase, DashDevs team designed a scalable and reliable system specifically for the app. This included selecting appropriate technologies and frameworks to meet all the requirements and ensuring seamless integration with external APIs for banking services, payment systems, and real-time data updates.

3Product design

We took care to invite the best UI/UX designers with great expertise to create an intuitive and visually appealing interface for the app. Experts conducted user research to understand the TA's preferences and designed user-friendly workflows, visually engaging screens, and intuitive navigation to enhance the overall UX.

4Development

We integrated essential features into the app, such as effortless integration with bank accounts and cards. Real-time data updates were also integrated into the app's architecture, enabling users to stay up-to-date with their financial information in real-time. By leveraging advanced data analytics and machine learning techniques, the app provided users with personalized recommendations and actionable insights, enhancing their overall financial management experience.

5Maintenance & Support

After the app's successful launch, DashDevs team continued to provide ongoing maintenance and support services to ensure the product's smooth operation. This involved monitoring performance, addressing any issues or bugs promptly, implementing updates, and enhancing the app based on user feedback and emerging industry trends.

6