Tarabut

Tarabut is MENA’s first regulated Open Banking platform

This banking platform is reimagining online banking in the MENA region through the ecosystem of connections. They enable banks and other fintechs to connect with third-party providers to share information in the most secure way. Tarabut app has over 200K downloads.- Location MENA

- Industry FINTECH

- Team Size 10 people

- Duration 9 months

- Budget $ 500K

Challenges

Limited budget for the whole solution: $ 500K

Shortage of inhouse Open Banking implementation expertise

Build first open banking engine & app in MENA region, which is compliant with newly issued Legislation

Integrate all 24 commercial banks in Bahrain into the solution

Solution

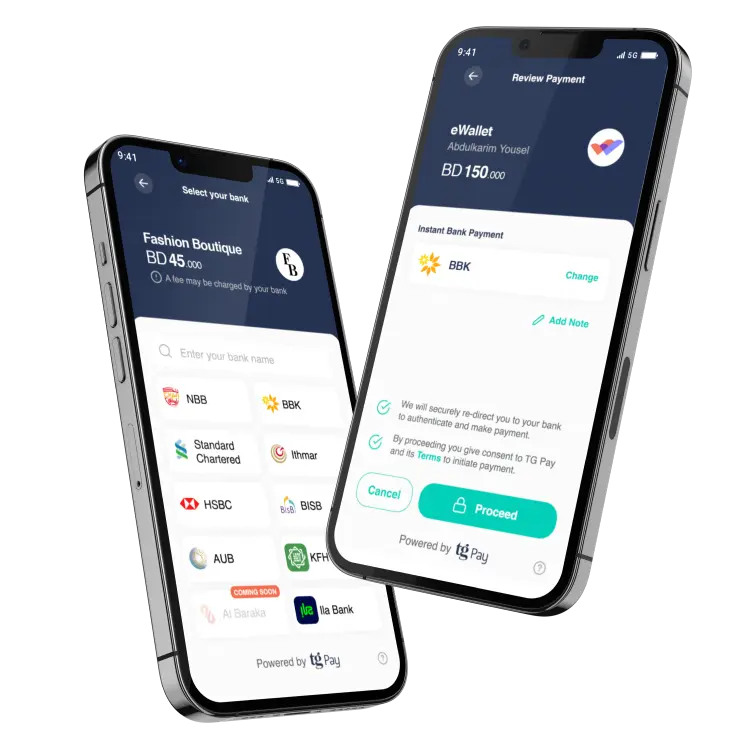

Tarabut is MENA’s first regulated Open Banking platform. It includes Web & Mobile solution B2B2C.

Personal Financial Manager system for the GCC region. The system provides users with the ability to access and manage bank accounts from all open-banking integrated commercial banks as well as make payments and transfers through the Open Banking platform 24/7 using a mobile application.

our input

UI/UX Design

Solution arcitecture

Ios development

Android development

Back-end Development

Front-end Development

Quality Assurance

Cloud & Devops

Business analysis

Project management

RESULTS

We're proud of reaching new heights with our customers, helping them achieve advanced levels of scalability and stability.

- total evaluation£25M

From £ 0 to £ 25M product evaluation based on solid development.

- user base200K+

Users of NBB banking app that was based on our white label solution. Total coverage ~4% of country population.

- banks integrated8+

8 commercial banks were connected to platform in 6 month time.

App functionality

Open banking API integration

bank accounts management

Card management

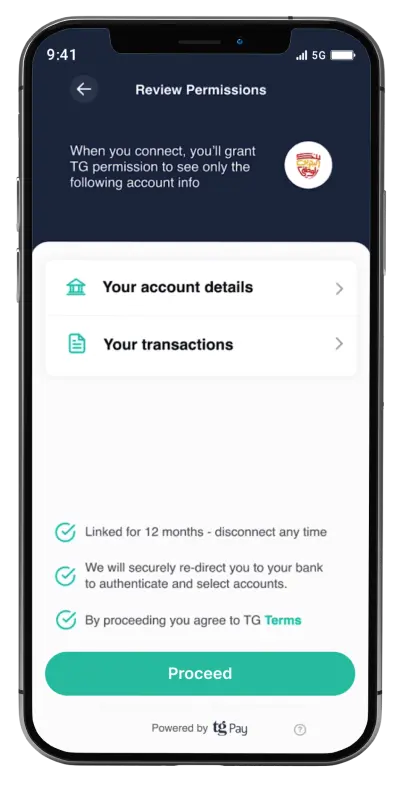

Compliance

consent management

Budgeting

native Mobile applications

regulatory reporting

financial planning

Data analytics and insights

Investment management

Multi-currency support

Peer-to-peer payment processing

Customer support

how we did it

- architecture design for domestic real-time payments through the open banking engine

domestic real-time payments

- development from scratch with on time launch9

month to launch

- core engine to its "ready-for-market" state

developed open banking

- solution has passed CBB sandbox testing process

regulation aproval

- for final product from UI/UX to Technical solution

full responsibility

- process with Regulator Bank, Commercial Bank partners & Compliance Advisors

CONSTANT INVOLVEMENT in regulatory negotiation

Technologies

we used

.Net & .Net Core

Kotlin

Swift

React

AWS

client testimonial

DashDevs delivered smoothly and on time with the app which continues to bring more value over time. Their profound fintech expertise and creative solutions added additional value.

Creation Process

Product vision

We developed a tailored vision through market research. Our team collaborated closely with the client's team to tailor the solution to the tight MENA legislation for fintech. Based on the results, we continuously refined the vision to ensure the best possible market fit.

1Product design

Once we had established a clear feature list, our team created wireframes that were specifically tailored to the chosen target audience. Our goal was to develop a concept that not only offered ease of use but would fit into the determined budget.

2architecture design

We took into consideration all the needed functionality and regulations in order to create a scalable solution. By taking into account all the benefits and drawbacks from the perspective of business, technical, compliance, and security, we suggested an adaptable solution architecture that was cost-effective and user-friendly.

3Development

Our team of 10 engineers developed a cross-platform iOS and Android app. We helped our customer secure the open banking technology, and integrate 24 banks into the solution. This was a challenge as the reliability of the application hinged on seamless compatibility with integrated services. We encountered hurdles but overall the solution ended up being non-cumbersome and highly functional.

4Maintenance & Support

Following the release, we proceeded to incorporate new features, modernize software, and work on hot-fixes based on feedback from clients.

5