NDA

Client Servicing Platform for Alternative Asset Managers

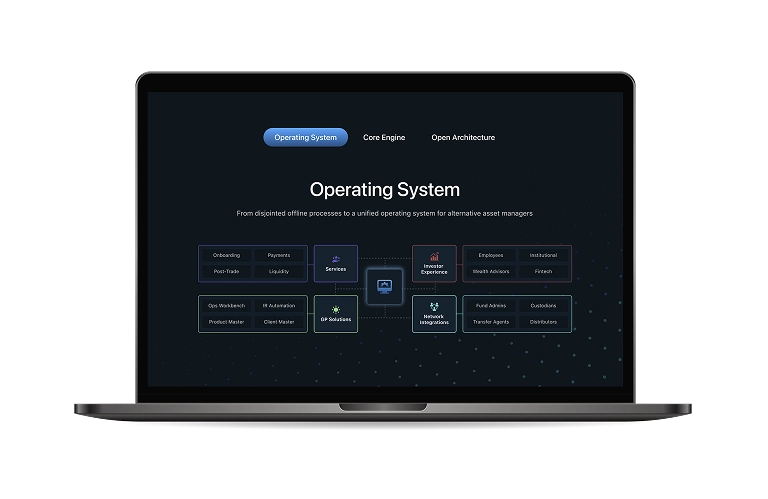

This platform streamlines client servicing for alternative asset managers, integrating pre-trade, execution, and post-trade processes into one seamless system. With an API-driven, scalable approach, it simplifies operations, enhances efficiency, and enables effortless product distribution. Backed by Apollo and Motive Partners, this platform is transforming how asset managers scale and serve clients in private markets.- Location JAPAN

- Industry FINANCE

- Team Size 4 PEOPLE

- Duration ONGOING

- Budget NDA

Challenges

Delivering a complex finance platform within an 18-month timeframe required efficient planning and execution.

Managing collaboration across multiple teams, including developers, financial experts, and compliance specialists.

Integrating AltOS into existing banking and investment infrastructures while ensuring seamless API connectivity.

Navigating strict KYC requirements and establishing a detailed process for core banking compliance and security.

Solution

Our team was responsible for developing and refining the platform, ensuring seamless integration with core banking and regulatory systems. We built a robust banking infrastructure to support secure transactions, compliance, and investment management.

We developed and implemented API connectivity, allowing the platform to integrate effortlessly with external financial platforms. Additionally, we enhanced security by incorporating AI-powered transaction monitoring, fraud screening, and automated KYC verification using Onfido.

DashDevs team also designed and built a scalable, intuitive user interface to optimize the experience for asset managers. By ensuring efficiency, compliance, and seamless workflows, we helped the project redefine client servicing in alternative asset management.

our input

WEB development

Front-end Development

Back-end Development

Solution Architecture

App functionality

CORE BANKING SYSTEM

KYC & COMPLIANCE

INVESTMENT DOCUMENT MANAGEMENT

FUND TRANSFERS & PAYMENTS

DOCUSIGN INTEGRATION

BANK ACCOUNT SUPPORT

HAWK MONITORING

how we did it

- The project spanned 18 months, requiring deep fintech expertise and precise execution to integrate core banking, KYC, and automated risk management into a seamless, scalable solution.18+

MONTHS OF INNOVATION

- From transaction monitoring to fraud detection, we ensured top-tier security and compliance with industry regulations, leveraging AI-driven analytics and cutting-edge Hawk monitoring to safeguard financial operations.

security & compliance

- Our team developed a robust API-driven infrastructure, ensuring seamless integration with financial institutions. We also built the frontend to support smooth and efficient user interactions.

FULL-SCALE SYSTEM

- We built a custom core banking API that ensures smooth fund transfers, payments, and investment document handling, enabling effortless financial operations and compliance with industry standards.

core banking integration

- Designed for growth, the platform supports API connectivity, AWS-powered workflows, and a fully modular structure, allowing seamless expansion and adaptation to new financial services.

FUTURE-READY ARCHITECTURE

- By integrating Onfido KYC verification and AI-powered fraud detection, we enhanced security, ensuring that all user transactions meet regulatory requirements while reducing onboarding time.

AUTOMATED KYC & FRAUD PREVENTION

Technologies

we used

Node.js

React

The platform development process

RESEARCH & PLANNING

We began with an in-depth market and technical analysis, identifying key requirements for core banking integration, KYC compliance, and risk assessment. This phase included defining the system architecture, security protocols, and API structure to ensure seamless financial operations.

1MVP DEVELOPMENT

Next, we built a minimum viable product (MVP) focusing on core functionalities such as core banking API, fraud detection, KYC verification, and investment risk analysis. This included integrating Onfido for identity verification, AI-powered transaction monitoring, and real-time portfolio risk assessment..

2FINAL RELEASE & SCALABILITY

The platform was launched with a scalable, modular architecture that allows seamless expansion. The system was optimized for security, regulatory compliance, and real-time financial processing, ensuring long-term reliability for alternative asset managers.

3