Onboarding and KYC

Reduce onboarding time by 50% with robust Know Your Customer (KYC) protocols. Fintech Core solution ensures compliance with regulatory requirements while expediting the user verification process. Enrich the customer base swiftly and adhere to regulations.

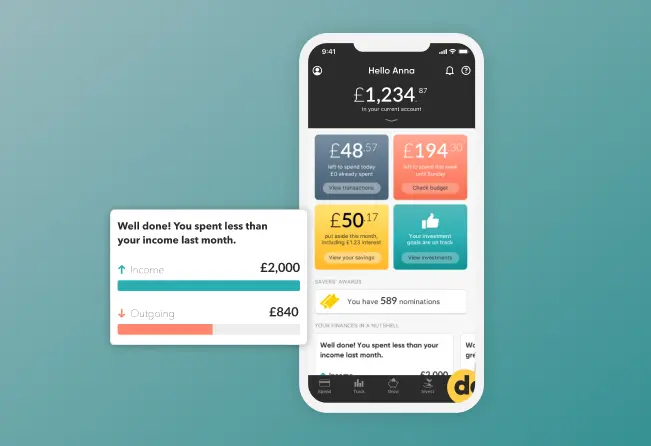

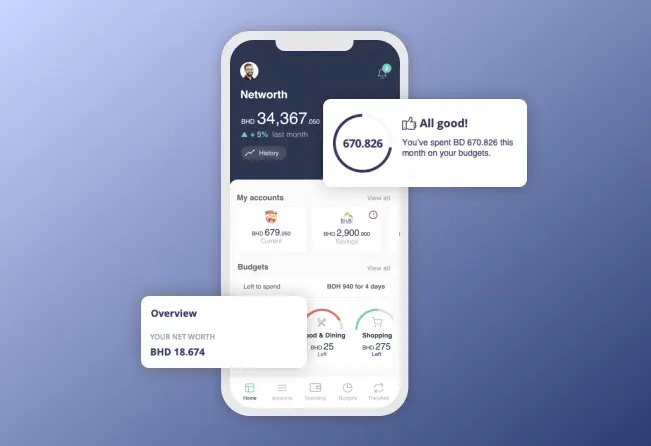

Accounts

With our account management features, you can manage accounts effortlessly. You have full access to real-time insights into transaction histories, account balances, and financial trends. Use intuitive account management tools to increase customer satisfaction by at least 30% and improve user retention and loyalty.

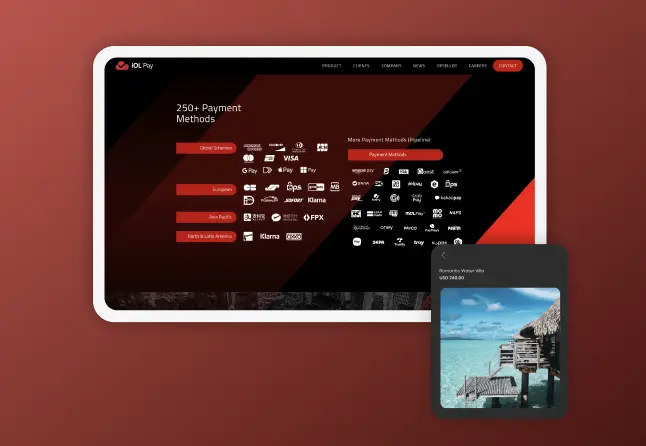

Payments

Our solution makes payments smooth and secure, speeding up transactions and making them more accessible. For example, if you own an e-commerce business, try to add our payment features and see a 25% boost in sales due to smoother payment experiences.

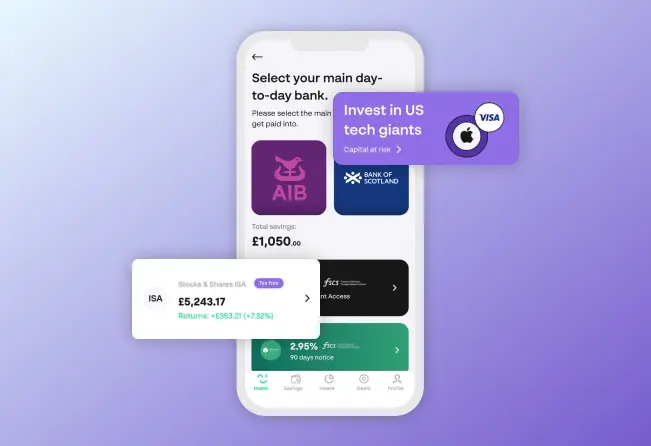

Cards

Issue branded cards to enhance brand visibility and customer engagement. Empower customers with convenient payment options while reinforcing brand recognition. Any digital wallet provider can use our card issuance capabilities, provide personalized card offerings, and expand market reach.

Currency Exchange

Expand your global reach and meet diverse customer needs with currency exchange. Users will appreciate the convenience of transacting in multiple currencies effortlessly. Running a travel booking platform? Integrate our currency exchange features for seamless transactions in various currencies and attract a wider customer base.

Acquiring (Merchant Payments)

Fintech Core provides merchants with simple payment processing tools to streamline transactions. Your clients are 100% tired of lengthy payment processing and complicated checkouts. Equip them with our seamless payment solutions to make transactions easy and improve their shopping experience with your business.

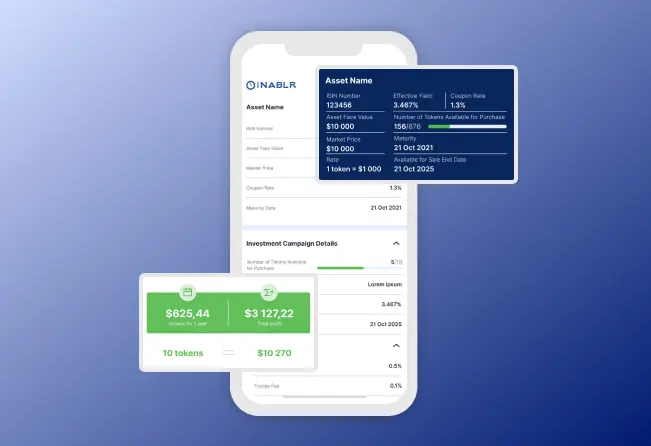

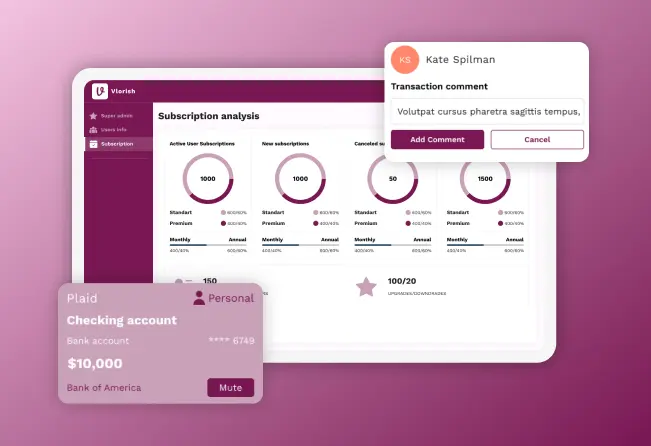

Financial accounting

Our solution gives your businesses instant insights into finances, helping to use resources better and maximize profitability. For example, any fintech startup can use our financial tools to study market trends and investor behaviour. As a result, you will make smart decisions and get extra funding.

Open banking

Own a digital bank? We provide a great chance for you to use our open banking tools, connect with different financial apps, and give your customers helpful advice on their finances. Our platform makes it easy to share data and work with other companies so you can offer better financial services and keep users interested.

Back office

Simplify office work and make your business run smoother with our back-office tools. Our platform automates tasks, reducing paperwork and giving you more time for essential jobs. For example, any bank can use our instruments and save 15% on costs while getting more done in less time.

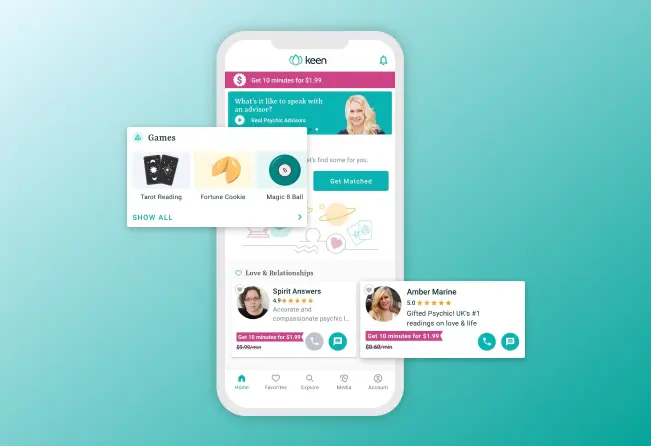

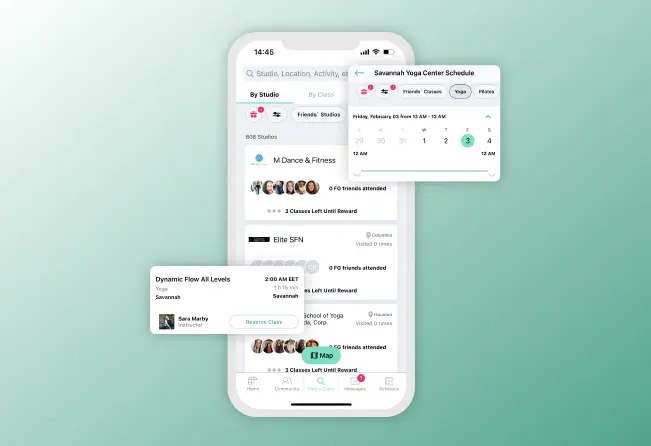

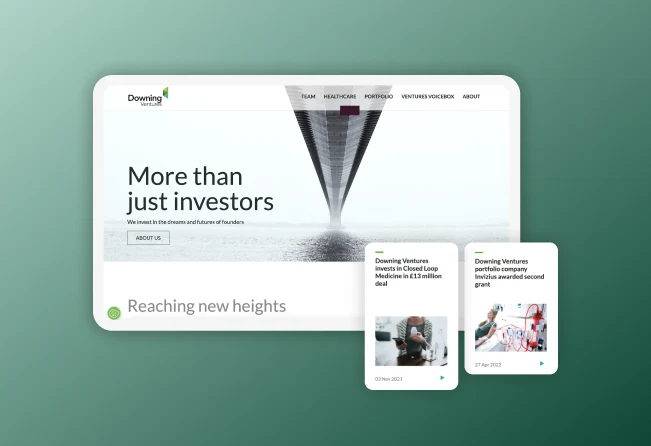

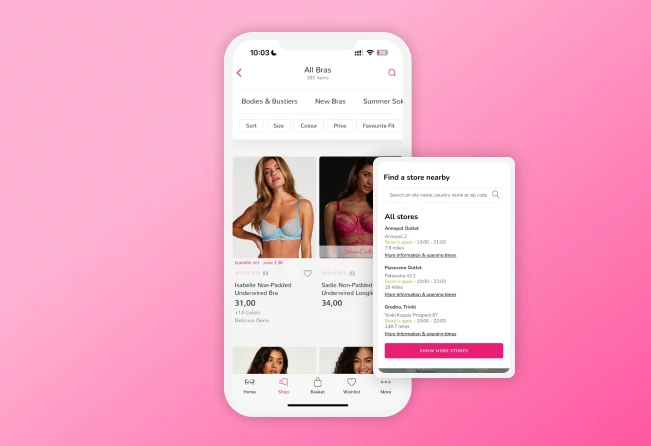

White label mobile

and web apps

With Fintech Core, you can customize your mobile and web apps to reflect your brand and enhance user experience. Our white-label solution allows businesses to modify their apps while keeping a holistic appearance across different devices.

Risk and Fraud

Keep your business and customers safe with our risk and fraud management tools. Our platform uses advanced algorithms and real-time monitoring to detect and stop fraudulent activities. We guarantee secure transactions and the best platform for building user trust.

Notifications and Alerts

Stay informed and proactive with the Fintech Core notifications and alerts system. Receive real-time updates on account activities, transactions, security alerts, and important announcements. Customize alerts based on user preferences to make the communication and engagement perfect while combined with a secure and seamless user experience.

Customer Support

Deliver exceptional customer service with our integrated customer support feature. Simplify communication channels, handle tickets effectively, and offer quick assistance to address questions and concerns. Equip your support team with insights from customer interactions to boost satisfaction and loyalty.