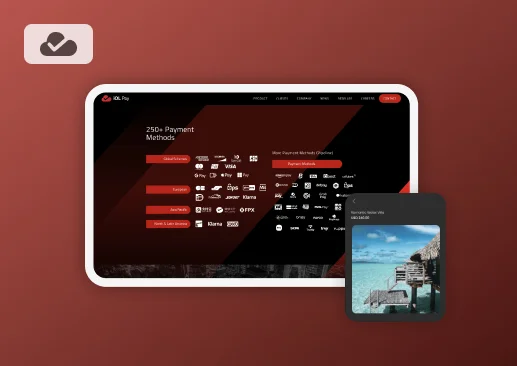

Over 250 payment methods in innovative iOL pay by DashDevs

iOL Pay is a versatile software development kit (SDK) that supports 250 payment methods for B2B2C businesses. For people in the hospitality industry speed is crucial, so iOL Pay seamlessly integrates payment options for your customers. With iOL Pay, customers gain access to global card networks like Apple Pay, American Express, Google Pay, and VISA, as well as local networks such as Alipay, Bancontact, Girropay, Klarna, and more.