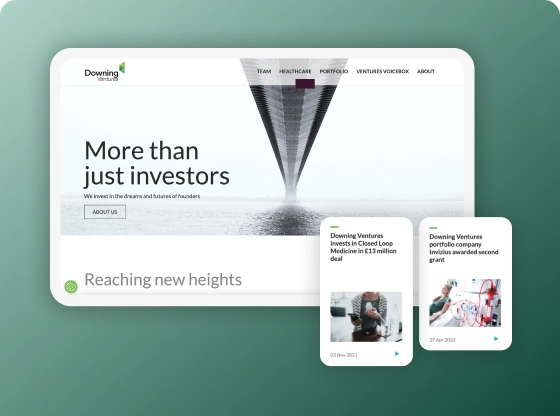

Top Countries For Software Development Outsourcing In 2024

Outsourcing development is a more investment-effective approach compared to in-house development. If you want to outsource, there are several regional-specific considerations to keep in mind.