FinTech Software Development in The US

Book a consultationfintech software

development in The United States by DashDevs

As a fintech software development company, we have a proven track record of over 500 products released across the globe, including the United States. We can create banking software, help you with KYC compliance, integrate your software with various APIs, and more. The expertise and experience honed our knowledge of the US’ compliance requirements, allowing us to help customers pursue their goals.

Look up our casesOur Proud Milestones

67%

clients retention rate

1000+

clients who trust us

80+

mobile apps delivered

fintech software

Development Services

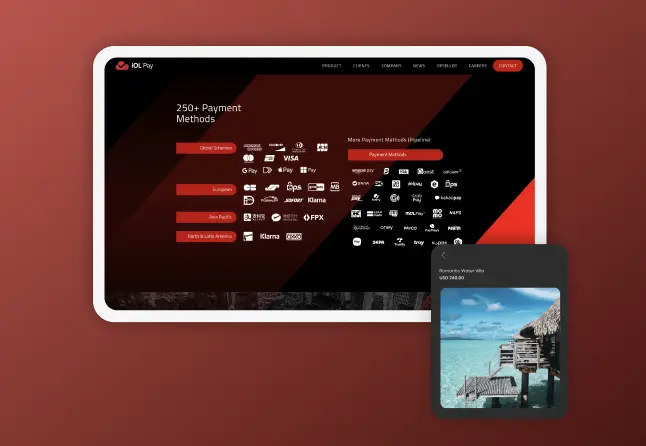

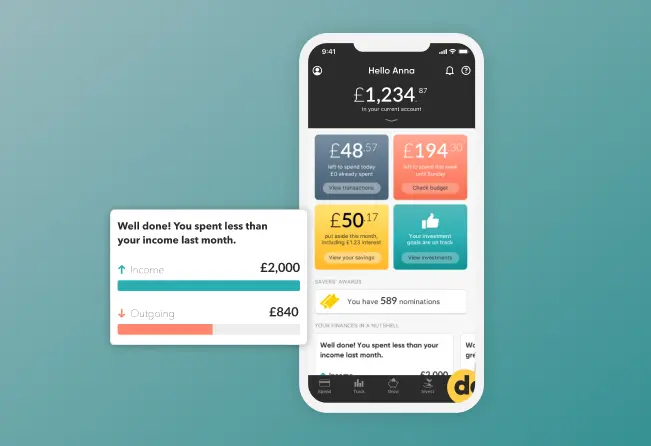

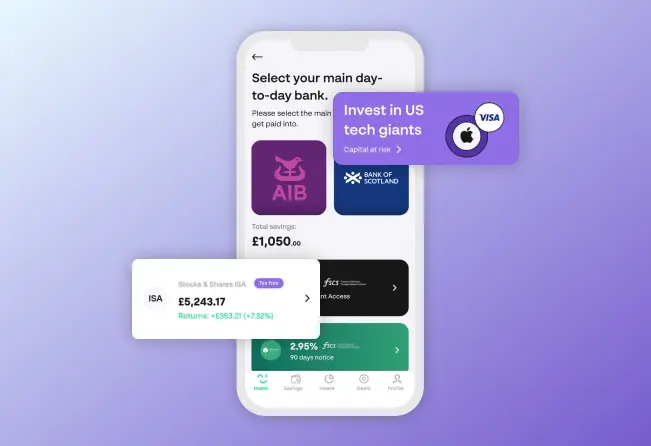

fintech mobile apps

We built over 80 mobile fintech software solutions for different industries across the globe. As one of the software companies in the US, we create software designed to elevate customer experience and ensuring seamless regulatory compliance at every step.

Open banking

Easily link with financial institutions and get instant access to real-time financial data. Our fintech software development services will give your business the power to offer valuable services to your clients. Open banking provides features like account consolidation, payment initiation, and detailed information on your customers’ financial behavior.

Banking solutions

Empower your bank’s digital transformation with fintech software. As one of the software companies in the United States, we can automate KYC/KYB process, banking rails integration, card issuing connectivity, acquiring and payment processing, AML and transactions monitoring, and provide other fintech software development services.

Integrations for banks and fintechs

Our integration service for banks and fintechs is designed to accelerate your product launch by effectively integrating various providers. This saves time and resources. We have experience integrating APIs for fintech software, and allow our customers to connect with different providers depending on their needs.

Cross border payments & FX

We offer professional assistance in setting up cross-border payment solutions to ensure effortless international money transfers across the US and other regions. Also, our financial software development company can help you integrate foreign exchange service providers, enabling international transactions. This will expand your financial services globally.

Compliance and security

Security is crucial for fintech and we make it our top priority. With 80+ mobile fintech launches, we can assist you in complying with regulations and enhancing your security measures. AML and KYC Compliance with GDPR, CCPA, etc. Information encryption and safeguarding Biometric authentication

General ledger

Our team will work closely with you to solve complex challenges associated with general ledger development, integration, and maintenance. Multi-entity accounting Realtime balances Double-entry bookkeeping system Assets management systems Reconciliation and financial reporting Integration with third-party systems

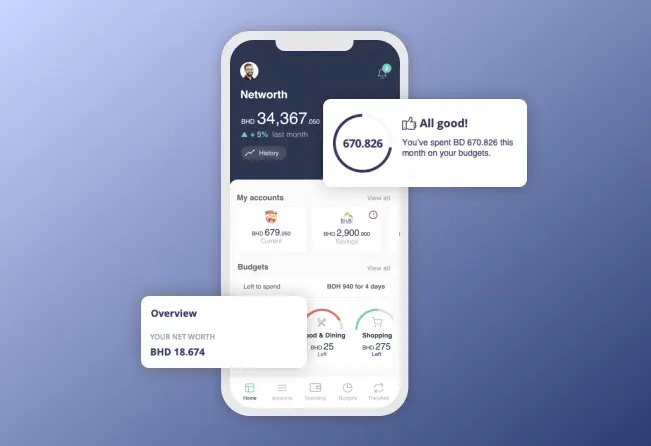

Neobanks development

We specialize in creating neobanks from scratch, complete with a comprehensive range of functionalities such as onboarding and KYC, account management, card issuing, payments, transactions history, customer support and more.

Lending

Discover our lending integration service, facilitating faster, data-informed lending decisions through advanced financial technology and APIs. As one of the the US software companies, we can help you create a lending app that would follow all legal regulations.

digital transformation for traditional banks

Modernize customer interactions with mobile banking apps, automate processes for efficiency, and ensure compliance with secure data management and seamless data migration. Embrace the agility of Microservice architecture to elevate your institution into the digital age.

card issuing

Easily issue, manage and control debit or credit cards with our Card Issuing integrations. We specialize in seamless connectivity with card issuing platforms like Marqeta, i2c, Stripe Issuing, Galileo, and Thredd to empower businesses and financial institutions to provide physical or virtual debit, credit, or prepaid cards to their customers.

Fintech consulting

We provide expert guidance on launching your own bank, including selecting the best service providers. Our strategies cover cross-border payment solutions and card issuance, as well as seamless integration of essential compliance measures like KYC and AML.

Why to choose us?

Successful proven experience

With 15 years of fintech expertise, we harness our knowledge as financial software development company to deliver end-to-end software development. Our commitment to innovative solutions ensures exceptional results.

Seamless Integrations

By cooperating with our fintech consulting team, clients can experience seamless integrations. Thanks to our vendor expertise and practical knowledge, we optimize performance and fuel your growth.

White label solution

With our white-label fintech solution, clients can easily encompass key success-driving features like account orchestration to gain a competitive edge in the market and position businesses for growth and excellence.

CUSTOMIZABLE DEVELOPMENT

Our approach ensures that your fintech solution is built precisely to match your unique requirements. As a fintech development company leave no space for one-size-fits-all solutions.

More for less

We excel at strategically prioritizing tasks throughout fintech solution development, ensuring our clients invest wisely and avoid unnecessary expenditures. Commitment to this approach is our primary value.

personal Accountability

Our commitment to customer-centric support drives our clients toward their goals. We tackle challenges head-on, crafting solutions that address individual needs and exceed customer expectations.

Security standards

PCI DSS

GDPR

PA-DSS

ePrivacy

KYC

Industry methods and workflows

Central Limit Order Book (CLOB)

IOI/RFQ/Quote (Negotiation)

EMV

Digital signature regulations and standards

SES

QES

AES

eIDAS

Financial legislation and regulations

AMLD

MiFID II

PSD2

MiFIR

Technologies We Use

mobile

Swift

Java

TypeScript

Objective-c

Kotlin

C++

Dart

back-end

.Net & .Net Core

Python

Ruby

PHP 5-7

Go

Java

Node.js

front-end

React

Angular

Vue.js

devops

Kubernetes

Docker

Fintech integrations

Innovative & uniques software solutions, that customely tailored for your business needs utions, that customely tailored for your business needs

Kyc & aml

financial account connectivity

Dashdevs continually sharpens financial services software development techniques to make your fintech product shine. We’ve finalized numerous projects in all corners of the world.

Projects:

Veriff, Feedzai, iComplyKYC, Onfido, Seon, Screener, Accuity, Jumio, LexisNexis, ML Verify, Trulioo, Sum & Subsrance, DueDil, Member Check, Refinitiv, ComplyAdvantage.

Enable your users to connect accounts and work with multiple finance apps with ease and comfort. Our team can tackle everything, from the complex development to intuitive UI.

Projects:

Plaid, Telehouse, MX Technologies Inc.

banking as a service

payment processing

Empoer your non-banking solution to offer financial services by leveraging existing banking infrastructure for faster, more accessible, and customized financial solutions.

Projects:

Solidifi, Stripe, Solid, Marqeta, GPS Global processing services, Cross River, Bankable, Treezor, Cambr, Starling Bank, Clear Bank, Thought Machine.

We can facilitate secure, efficient, and seamless transactions between buyers and sellers, driving sales and customer satisfaction.

Projects:

PayPal, Razorpay, 3Brain, Helcim, Payment Cloud, Stripe, Affirm, Square, Amazon Pay, Ingenico, National Processing, Shopify, Verifone, Stax.

Card issuing

currency exchange

Card issuing in Saudi Arabia empowers businesses to create tailored payment solutions, driving customer loyalty and financial inclusion while adhering to local regulations.

Projects:

GPS Global Processing Services, Idemia, Thales, Publicenter, Nite Crest, Allpay Cards, Tag.

Enable seamless cross-border transactions, allowing businesses and individuals to convert currencies efficiently and at competitive rates.

Projects:

Currency Cloud, Fixer, Exchangerates, Exchange Rate - API, Xignite, Currency Layer, IBAN, Open Exchange Rates, Xe.

lending as a service

online brokerage

Our team can empower you to offer credit products without the complexities of loan origination, underwriting, and risk management, expanding financial access.

Projects:

Affirm, Blend, Open Lending, Stavvy, Rightfoot, AllCloud, Open, Monevo, Plaid.

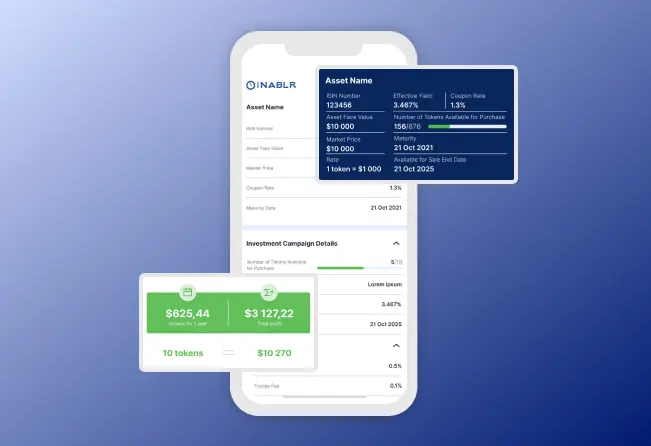

Online brokerage provides accessible, low-cost investment platforms for individuals to trade stocks, bonds, and other securities, empowering them to build wealth.

Projects:

Blackwave Trading Platform, X Open Hub, Trade Smarter, Alpaca, Interactive Brokers, Ameritrade.

Financial Product

Development Process

Assessment

We pay close attention to your needs so that we can build a financial website that meets them. It includes requirements gathering, research, and estimation of your project. We set up a meeting for you with our business analyst, who investigates the industry and your company's structure and provides a report for how much time and money will be required to launch your project.

1Discovery phase

Step one in developing custom financial software development services and solutions involves compiling a comprehensive list of features, ranking them in order of importance, and laying them out in a timeline format. We evaluate the benefits and drawbacks, and create a roadmap for development.

2Solution architecture

Our extensive experience across fintech projects and our dedication to exploring and implementing cutting-edge technology enable us to create custom financial solutions. At this step, we find the right architecture and the suitable tech stack for your product.

3Design

Through user research and testing, DashDevs fintech product development company designs how the final product will operate and look like so people gain value easily and like using it. Our designers discover user experience (UX), sketch out the program screens (UI) and examples of your brand identity.

4Development

Hire fintech dev teams at DashDevs, and our engineers build your banking software according to the UI and UX designs, utilizing the technologies and architecture that were previously described. Development includes integration with cloud services and databases, frontend and backend systems.

5Testing

When we create a financial website, our quality assurance experts conduct both automatic and manual tests to guarantee the code's integrity and the user's overall experience. We also provide a security check and penetration tests to make sure there are no leaks in your product.

6Legal compliance

Financial application development services must meet securities regulations mandated by the appropriate authority. DashDevs assures that there will be no regulative holes in your fintech product. We may consult you on proper financial license, and data storage and usage legislation.

7Deployment & maintenance

We are excited to launch your fintech product and look forward to helping it succeed. Additionally, we use CI/CD to raise the deployment capability and reassure professional software development in finance sector. We help you to launch your apps in Apple Store and Google Play and maintain your product as long as you need.

8

What is fintech software development?

Fintech development is about using technology to make money things easier.

Imagine traditional banking, but with a tech twist. Fintech creates new ways to manage your money, like using your phone to pay bills or invest. It’s about making financial services faster, cheaper, and more accessible for everyone.

Think of it as using smart tools to handle your money better.How to choose software company in the United States?

To choose a company from many software companies in the United States, you should:- Know exactly what you want your software to be capable of.

- Look for companies with specific experience in your industry or with your product.

- Check if their work ethics and ideas match your vision.

- Evaluate their developers by having a short interiview after checking the portfolio.

- Ensure that their services fit your financial plan.

- Look up the feedback from their past customers.

- Have an interview tomake a final decision.

Choosing the right software company among software companies in the US is important for your project’s success. There are many software companies in a vast country such as the US, so be careful when looking to find a perfect match.

What are the top US software companies?

Software companies are a part of a dynamic software development landscape in the IT industry of the United States. Many large companies offer broad and expensive solutions, while smaller firms specialize in custom software development, industry-focused solutions, design, or staff augmentation. The scene is rapidly growing and it’s hard to determine the top players in the niche, however, it is safe to say that the US companies often have hefty bills. Which is why many customers turn to offshore development, as the specialists from other countries might have more budget-friendly rates and same amount of practical experience.What fintech services we provide in the US?

We have a remarkable track record of successfully developing fintech applications, with numerous examples in our portfolio. Our experienced team is well-versed in the complexities of fintech, ensuring that we deliver cutting-edge solutions tailored to your specific requirements.

Our company delivers payment solutions, financial management software, lending apps, and many other services.

Whether it’s banking applications, payment solutions, investment platforms, or any other fintech software, you can trust us to bring your vision to life with precision and innovation.

How much does fintech software development cost?

The cost of fintech software development varies widely depending on several factors:- Complexity of the software: A simple payment app will be less expensive than a complex investment platform.

- Features and functionalities: The more features you include, the higher the cost.

- Platform (mobile, web, or both): Developing for multiple platforms increases costs.

- Design and user experience: A high-quality design and user experience can add to the budget.

- Development team location: Costs vary significantly based on the location of the development team.

Generally, you can expect to pay anywhere from $30,000 to $300,000 or more for a fintech software project.