FinTech Software

Development services

Book a consultationDashDevs — A Trusted fintech software development company

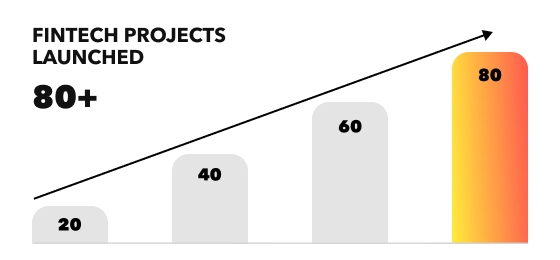

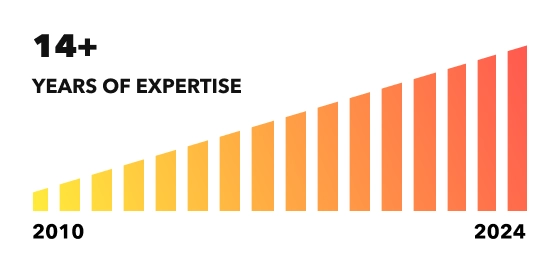

The DashDevs team specializes in crafting financial products — from banking applications and B2B payment solutions to wallets, investment platforms, and beyond. With a proven portfolio of over 80 impactful fintech solutions and experience with customers from around the globe, we are fully empowered to bring your vision to life.

Why to Start with a FIntech software product

It’s easy to claim that the fintech niche is booming. Right now, the popularity of payment, banking, trading, crowdfunding, lending, and other software options that target both businesses and individuals is on the rise. Despite the high competition level, entering the niche for new players, both startups and non-fintech businesses with non-financial main offerings, is possible. But remember that having the right tech partner is half the battle.

$313

billion

is the size of the global fintech market

85%

CAGR of

is the predicted global fintech market annual growth rate

$16

trillion

from $9 trillion in 2023 to $16 trillion by 2028 is the predicted increase in global digital wallet transaction volume

2.5%

1.5%-3.5% is the average fee per online transaction

26K

startups

are belonging the global fintech ecosystem, which is a notable rise from 12,000 in 2019

$1.5

trillion

$245 billion in 2022 to $1.5 trillion by 2030 is the predicted rise in fintech revenue globally Sources: Technavio, Statista, CFC, Forbes

Our custom Fintech software development services

Dashdevs offers a range of development services tailored to businesses of all sizes, from startups to enterprise-level businesses across diverse industries. Below is an overview of our main service lines.

Core Banking & Infrastructure

Banking solutions

We empower banks to digitally transform with our specialized fintech software development. This includes KYC automation, banking rails integration, card issuing, and acquiring/payment processing. We also support regulatory reporting, mobile banking apps, and customer portal development.

Payment gateway development

Within our financial software development services we greate customer-fasing environments that ensure a secure transmission of customer data to acquirers. We support in-store, online, and in-app payments with an emphasis on compliance.

General ledger

DashDevs provides custom fintech software development for general ledger needs. Our solutions cover multi-entity accounting, real-time balances, double-entry bookkeeping, and reconciliation. We also offer seamless integration with third-party systems.

Open banking

Our fintech software development company connects financial institutions to real-time data. We enable features like account consolidation, payment initiation, and customer financial insights. This solution is secure, efficient, and designed for modern banking.

Banking solutions

We empower banks to digitally transform with our specialized fintech software development. This includes KYC automation, banking rails integration, card issuing, and acquiring/payment processing. We also support regulatory reporting, mobile banking apps, and customer portal development.

Payment gateway development

Within our financial software development services we greate customer-fasing environments that ensure a secure transmission of customer data to acquirers. We support in-store, online, and in-app payments with an emphasis on compliance.

General ledger

DashDevs provides custom fintech software development for general ledger needs. Our solutions cover multi-entity accounting, real-time balances, double-entry bookkeeping, and reconciliation. We also offer seamless integration with third-party systems.

Open banking

Our fintech software development company connects financial institutions to real-time data. We enable features like account consolidation, payment initiation, and customer financial insights. This solution is secure, efficient, and designed for modern banking.

Payments & Transaction Solutions

Domestic payments solutions

DashDevs tailors fintech development services to meet local payment needs. We support P2P, direct debit, mobile payments, credit/debit card payments, SEPA, Faster Payments, and ACH. Our services are custom-built for specific local requirements.

Acquiring & payment processing solutions

Our fintech app development services streamline payment processing by connecting to top acquirers. We support secure transactions for in-store, online, and in-app payments. Our focus is on compliance and transaction efficiency.

Cross-border payments & FX

We create fintech custom software development solutions for international transactions. This includes cross-border payment systems and currency conversion via FX provider integration. It enables effortless global money transfers for clients.

Point of sale solutions

We offer financial software development company expertise in omnichannel PoS systems. These solutions include tap-to-pay functionality for convenient retail payments. We help retailers meet modern customer payment expectations.

Domestic payments solutions

DashDevs tailors fintech development services to meet local payment needs. We support P2P, direct debit, mobile payments, credit/debit card payments, SEPA, Faster Payments, and ACH. Our services are custom-built for specific local requirements.

Acquiring & payment processing solutions

Our fintech app development services streamline payment processing by connecting to top acquirers. We support secure transactions for in-store, online, and in-app payments. Our focus is on compliance and transaction efficiency.

Cross-border payments & FX

We create fintech custom software development solutions for international transactions. This includes cross-border payment systems and currency conversion via FX provider integration. It enables effortless global money transfers for clients.

Point of sale solutions

We offer financial software development company expertise in omnichannel PoS systems. These solutions include tap-to-pay functionality for convenient retail payments. We help retailers meet modern customer payment expectations.

Card & integration Services

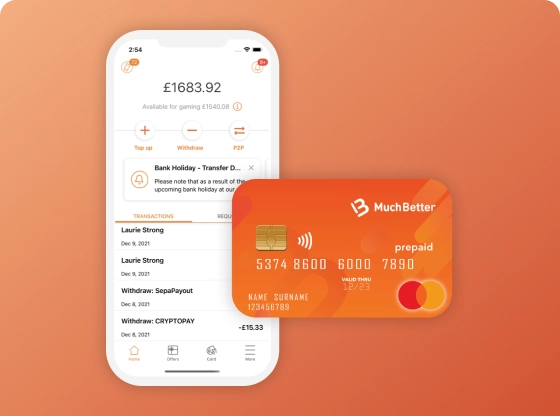

Card issuing

DashDevs simplifies card issuing with our fintech development services. We integrate with platforms like Marqeta, i2c, Stripe, and Galileo. This allows clients to issue physical or virtual debit and credit cards seamlessly.

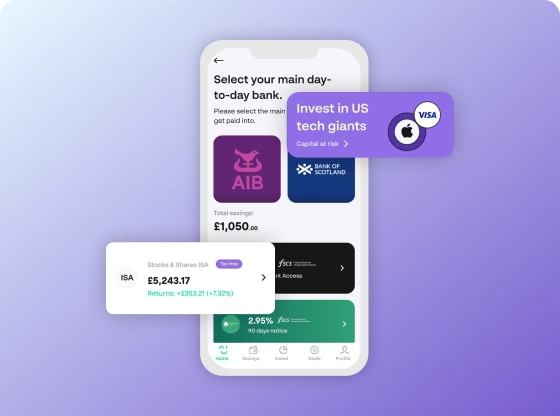

Personal finance & wealth management

We develop fintech software development services for personal finance needs. These solutions include budgeting, robo-advisory, trading platforms, P2P lending, and credit monitoring. They help users manage finances and investments digitally.

Lending

Our custom fintech software development supports a variety of lending solutions. We build P2P lending systems, core lending software, loan management tools, and mortgage automation. Our solutions enable fast, data-driven lending decisions. Personal finance and wealth management

integrations for banks & fintechs

As a fintech development company, we offer integration services. We accelerate product launches by integrating essential providers. This service saves time and resources and ensures successful vendor selection for clients.

Card issuing

DashDevs simplifies card issuing with our fintech development services. We integrate with platforms like Marqeta, i2c, Stripe, and Galileo. This allows clients to issue physical or virtual debit and credit cards seamlessly.

Personal finance & wealth management

We develop fintech software development services for personal finance needs. These solutions include budgeting, robo-advisory, trading platforms, P2P lending, and credit monitoring. They help users manage finances and investments digitally.

Lending

Our custom fintech software development supports a variety of lending solutions. We build P2P lending systems, core lending software, loan management tools, and mortgage automation. Our solutions enable fast, data-driven lending decisions. Personal finance and wealth management

integrations for banks & fintechs

As a fintech development company, we offer integration services. We accelerate product launches by integrating essential providers. This service saves time and resources and ensures successful vendor selection for clients.

Insurance & Real Estate Tech

Insuretech

DashDevs delivers fintech software development to improve the insurance industry. We support underwriting, claims processing, and customer experience optimization. Our solutions are built to drive digital transformation in insurance.

Marketplaces development

Our fintech software development company offers marketplace development. We provide custom CMS, B2B, B2C, and multi-vendor support with secure cloud integration. Our solutions ensure fast, secure transactions for marketplace operators.

Real estate technology (PropTech)

We apply financial software development services to real estate technology. Our solutions enhance property transactions, optimize management, and deliver market insights. We support clients in investment, rental, and property management.

Insuretech

DashDevs delivers fintech software development to improve the insurance industry. We support underwriting, claims processing, and customer experience optimization. Our solutions are built to drive digital transformation in insurance.

Marketplaces development

Our fintech software development company offers marketplace development. We provide custom CMS, B2B, B2C, and multi-vendor support with secure cloud integration. Our solutions ensure fast, secure transactions for marketplace operators.

Real estate technology (PropTech)

We apply financial software development services to real estate technology. Our solutions enhance property transactions, optimize management, and deliver market insights. We support clients in investment, rental, and property management.

Digitalization & Apps

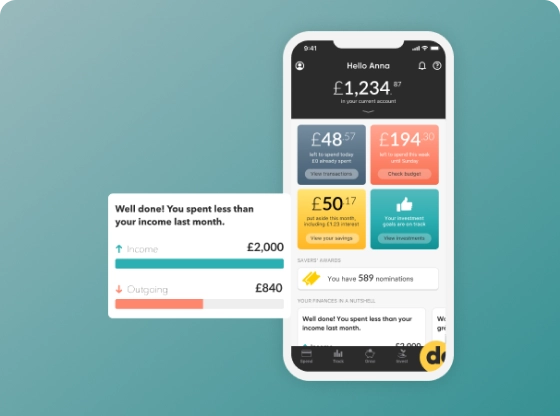

Fintech mobile apps

DashDevs has built over 80 custom fintech app development services. These include mobile apps for banking, payments, insurance, and more. Our apps are user-friendly and compliant, enhancing customer experience.

Digital transformation for traditional banks

Our financial software development company helps traditional banks modernize. We focus on mobile banking, process automation, and data security. Our services use microservices to streamline operations and improve service delivery.

Neobanks development

Our fintech software developers specialize in building neobanks. We provide onboarding, account management, card issuing, transaction history, and customer support features. Our services deliver fully functional digital banking platforms.

Fintech mobile apps

DashDevs has built over 80 custom fintech app development services. These include mobile apps for banking, payments, insurance, and more. Our apps are user-friendly and compliant, enhancing customer experience.

Digital transformation for traditional banks

Our financial software development company helps traditional banks modernize. We focus on mobile banking, process automation, and data security. Our services use microservices to streamline operations and improve service delivery.

Neobanks development

Our fintech software developers specialize in building neobanks. We provide onboarding, account management, card issuing, transaction history, and customer support features. Our services deliver fully functional digital banking platforms.

Consulting & Compliance

Fintech consulting

DashDevs provides expert consulting services for navigating the fintech software development landscape. We advise on cross-border payments, KYC/AML, and strategic planning. Our team supports clients through complex fintech decisions.

Compliance and security

With over 50 fintech launches, we prioritize security and compliance. Our financial software development services cover AML, KYC, GDPR, CCPA, encryption, and biometric security. We ensure robust compliance for peace of mind.

Fintech consulting

DashDevs provides expert consulting services for navigating the fintech software development landscape. We advise on cross-border payments, KYC/AML, and strategic planning. Our team supports clients through complex fintech decisions.

Compliance and security

With over 50 fintech launches, we prioritize security and compliance. Our financial software development services cover AML, KYC, GDPR, CCPA, encryption, and biometric security. We ensure robust compliance for peace of mind.

FinTech Standards and Regulations We Follow

Security standards

PCI DSS

GDPR

PA-DSS

ePrivacy

KYC

Industry methods and workflows

Central Limit Order Book (CLOB)

IOI/RFQ/Quote (Negotiation)

EMV

Digital signature regulations and standards

SES

QES

AES

eIDAS

Financial legislation and regulations

AMLD

MiFID II

PSD2

MiFIR

Technologies We Use

mobile

Swift

Java

TypeScript

Objective-c

Kotlin

C++

Dart

back-end

.Net & .Net Core

Python

Ruby

PHP 5-7

Go

Java

Node.js

front-end

React

Angular

Vue.js

devops

Kubernetes

Docker

Third-party integrations we provide

DashDevs has in our partnership network 100+ third-party vendors, which we can integrate to enable one or another product functionality.

Financial Account Connectivity

Currency Exchange

Banking-As- A-Service

Lending-As- A-Service

Card Payment Processing

KYC & AML

Online Brokerage

Card Issuing

Our standard fintech product development process

Planning Phase

Requirements: Gathering and analyzing user needs.

Software architecture: Сreating a detailed blueprint of the system.

Design: Architecting the system and interfaces.

Execution Phase

Development: Coding and converting design into software.

Testing: Verifying software functionality and performance.

Deployment: Releasing the software to users.

Stabilization / Post-production support

Maintenance: Ongoing support and enhancements.

Phases of Our Fintech Product development process in detail

Requirements Gathering

In this stage, we work closely with stakeholders to clarify project goals, define user needs, and understand constraints. We document these requirements through functional specifications, use cases, and user stories to create a clear project scope, ensuring alignment between business objectives and technical feasibility. This foundation ensures all team members have a shared understanding of the end goals.

1Software Architecture

Here, we develop a detailed blueprint that outlines system components, modules, data flow, and technology stack choices. This architecture provides standards, best practices, and technical guidelines for the development team, promoting cohesive development and ensuring alignment with project requirements.

2UX/UI Design

In this phase, we focus on creating user-centered interfaces. We use wireframes, prototypes, and visual mockups to iteratively test and refine design elements. By incorporating user feedback and performing usability testing, we enhance both aesthetics and functionality, ensuring the final product meets user expectations and delivers a seamless experience across devices.

3Development

Then, we proceed with translating the design into functional software, working in sprints using Scrum methodologies. Each sprint delivers incremental features, allowing for continuous adaptation and improvement based on feedback. Sprint reviews and retrospectives help ensure that development aligns with project goals, addresses potential issues early, and builds on previous iterations effectively.

4Testing

Here, we thoroughly verify the software’s functionality, usability, and performance. We employ both automated testing and manual validation to identify and resolve issues early. Using defect tracking and continuous integration tools, we document test cases, scenarios, and execution reports, ensuring the product meets high standards for reliability and is ready for deployment.

5Deployment

Next, we release the software to the production environment through CI/CD pipelines. We use DevOps practices, automated deployment scripts, and monitoring tools to ensure stability, seamless deployment, and accessibility for end-users. Post-deployment checks confirm that all configurations are accurate, and monitoring enables quick responses to any issues that arise.

6maintenance

Finally, we provide continuous support, implementing updates, bug fixes, and performance monitoring. We gather client feedback and use operational insights to ensure the product remains stable, responsive, and aligned with evolving user needs. This approach enables continuous improvements, value retention, and the sustained performance of the product over its lifecycle.

7

FAQ

What is FinTech software development?

FinTech software development is creating digital solutions for financial services, streamlining tasks like banking, payments, and investments. Through fintech software development services, companies address security, compliance, and scalability challenges in finance, enabling user-friendly experiences with secure, data-driven features. This development field combines financial expertise and cutting-edge tech to meet evolving consumer needs in areas like digital banking, blockchain, and mobile payments.What software is used in FinTech?

Common software tools in FinTech include:- Digital banking platforms

- Blockchain technology

- Payment gateways

- Data analytics tools

- Machine learning frameworks

- Cybersecurity software

- Cloud solutions for scalability and security

These tools enable seamless, secure, and efficient transactions, aligning with the financial software development services provided by fintech companies. However, it’s worth noting that the fitnech niche is not limited to payment-centered solutions only. So the scope of tools in fintech, both business and development ones, is much broader.

What does a FinTech software developer do?

A fintech software developer builds, maintains, and improves digital applications tailored to financial needs. This role involves working on custom fintech software development, from payment systems to secure mobile banking apps. Developers focus on security, compliance, and user experience, ensuring robust solutions that meet industry standards. They are essential for fintech app development services that address financial tech demands in today’s market.What is the average cost of custom software development?

The cost of custom software development varies widely, depending on project scope, complexity, and developer rates. For fintech custom software development, expect prices ranging from $50,000 to over $500,000. Choosing the right fintech development company with expertise in financial software development services can optimize costs, ensuring that the final product meets specific financial requirements effectively.What fintech services does Dashdevs provide?

DashDevs provides comprehensive fintech development service lines, including:- Core banking and infrastructure

- Payments and transactions

- Card and lending

- Insurance and real estate tech

- Cryptocurrency and blockchain

- Digitalization and apps

- Consultation and compliance

We have multiple service options within each service category. Besides, we can tailor our services to your particular request and need.

How do I find the right fintech software development company?

Finding the right fintech software development company involves evaluating experience, technical skills, and client feedback. Look for firms that specialize in custom fintech software development with a portfolio of relevant projects. Key criteria include expertise in security, scalability, and familiarity with fintech app development services. A reliable financial software development company should demonstrate a strong track record in delivering robust, compliant, and user-friendly fintech solutions.