KYC services

Book a consultationKnow-your-customer (KYC): Non-Negotiable for Fintech Industry Security

Security practices in the financial industry play a predominant role. As such, KYC technology in account authentication, transaction processing, etc., heavily minimizes the risks of fraud and financial losses. It’s often that effective KYC in place is one of a few mechanisms that distinguish a high-security product from a vulnerable one, ensuring the brand’s trust and a high customer experience.

Entrust the integration of KYC into your product to DashDevs — a vendor of compliant and successful KYC solutions.

kyc integration benefits

Having strong KYC practices in place, as a fintech company, grants you both value-adding and reputational benefits. They include but not limited to:

identity thief prevention

money laundering prevention

Solid KYC processes in place ensure thorough identity verification, effectively minimizing the risk of identity theft and securing users’ personal and financial information. This proactive approach protects both the customers and the institutions from fraudulent activities.

Book a callBy rigorously verifying customer identities, KYC helps in detecting and preventing money laundering activities, safeguarding the financial system from illicit transactions. This contributes to a more transparent and secure financial environment.

Book a callensuring standards compliance

enhanced risk management

Implementing KYC procedures ensures that financial institutions comply with regulatory standards, maintaining legal and ethical integrity in their operations. This adherence to compliance not only mitigates legal risks but also enhances operational efficiency.

Book a callKYC enables better risk assessment by providing a clear understanding of customer profiles, allowing institutions to manage and mitigate potential risks effectively. This informed approach leads to more strategic decision-making and a safer financial landscape.

Book a callbetter brand image and user trust

Adopting stringent KYC measures enhances the brand image and builds user trust by demonstrating a commitment to security and regulatory compliance. This fosters a sense of reliability and confidence among customers, leading to stronger relationships and loyalty.

Book a callwhat businesses can benefit from kyc solutions in place

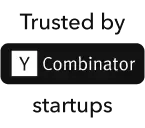

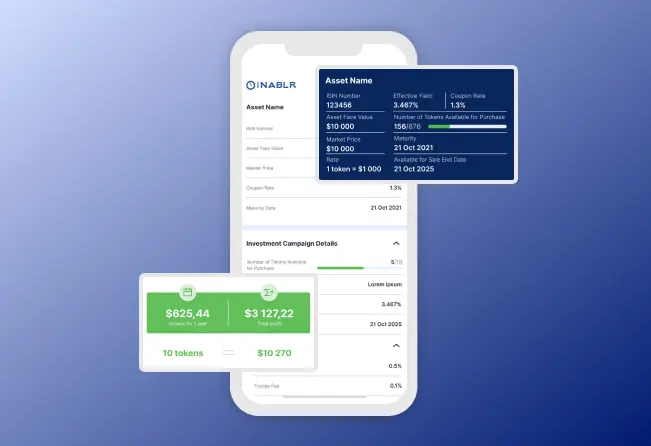

Fintech companies

Financial technology firms use KYC for secure customer onboarding, fraud prevention, and regulatory compliance in digital financial services.

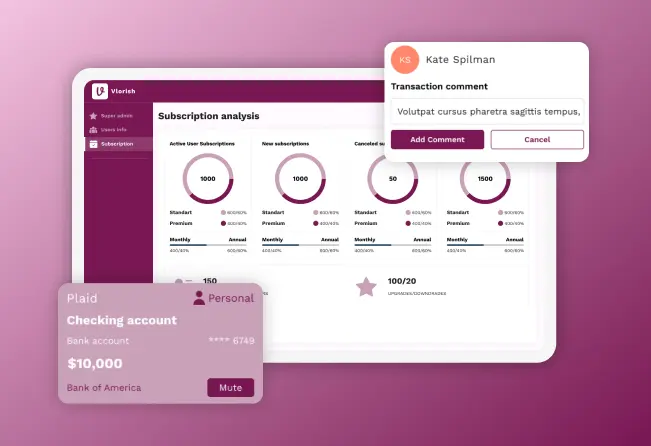

banking Institutions

Banks and financial service providers use KYC to verify customer identities, prevent fraud, and comply with anti-money laundering regulations.

Cryptocurrency Exchanges

For them, KYC is essential for verifying user identities, preventing money laundering, and adhering to regulatory standards in the crypto industry.

Insurance Companies

Here, KYC helps in verifying customer identities, assessing risk profiles, and ensuring compliance with insurance regulations.

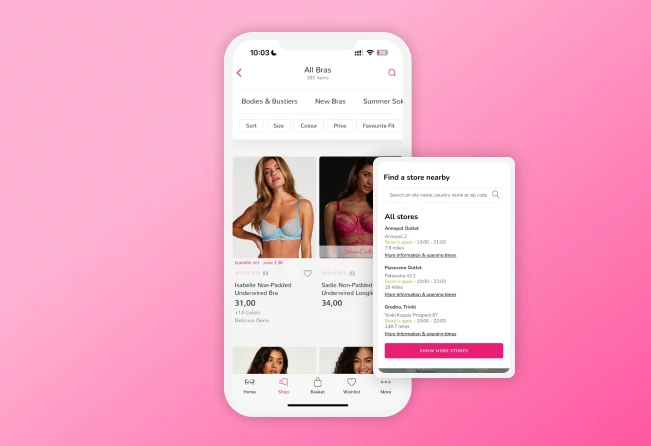

E-commerce

In e-commerce, KYC is used to verify seller identities, prevent fraudulent transactions, and build trust in online marketplaces.

Real Estate Agencies

Real estate businesses use KYC to verify the identities of buyers and sellers, prevent money laundering, and comply with real estate regulations.

Telecom Companies

Telecommunication providers use KYC to verify customer identities during SIM card registration and ensure compliance with telecom regulations.

Healthcare Providers

Healthcare institutions use KYC in their digital solutions for patient identity verification, ensuring privacy and compliance with healthcare regulations.

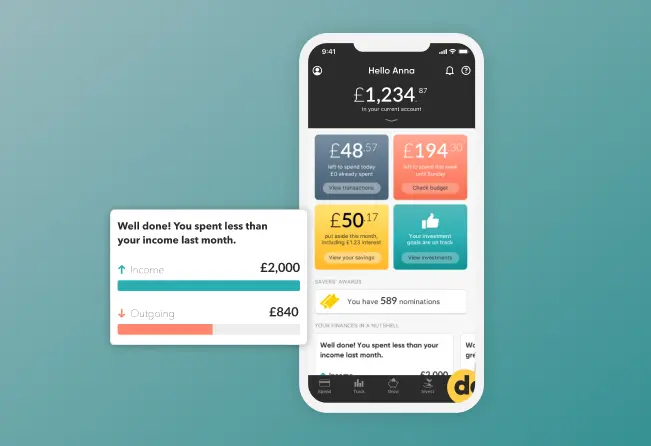

Payment Service Providers

Businesses offering payment services use KYC for patient identity verification, ensuring privacy and compliance with healthcare regulations.

Top KYC providers we Can integrate

DashDevs has worked with and can help you seamlessly integrateKYC solutions from 20+ vendors, such as:

Why opt for integration of kyc solutions with DashDevs

End-to-end Integration approach

DashDevs is a one-stop-shop for your fintech development needs. We not only can help you integrate KYC system, but also create scalable infrastructure and connect vendors of other solutions

experience creating a provider’s kyc solution from scratch

Here at DashDevs we had cases of creating fully-fledged KYC systems for beginning providers of KYC solutions. We can run a development from the ground up, as well as help integrate with third-party providers.

transparency and reporting

DashDevs, a provider of KYC integration services, maintains full transparency in every development project. We conduct regular progress reviews and provide detailed reports with metrics and time spending indicated.

broad Fintech expertise

Over the past 15 years, the DashDevs team has integrated different KYC solutions for 30+ customers from various industries. Our solid expertise in fintech and KYC allows us to take on the most complex projects with consistently excellent outcomes.

KYC Legal regulations in different regions

KYC processes are regulated by a set of laws valid for various regions. Compliance with particular regulations is obligatory for businesses with customers from these regions.

united kingdom

The UK adheres to the Money Laundering Regulations (MLR) and the Financial Conduct Authority (FCA) guidelines, which require businesses to conduct KYC checks to prevent money laundering and terrorist financing.

united states of america

In the USA, the Bank Secrecy Act (BSA) and the USA PATRIOT Act mandate KYC compliance for financial institutions, requiring them to verify customer identities and maintain records of their transactions.

Middle East and North Africa

KYC regulations in the MENA region vary by country but generally align with the Financial Action Task Force (FATF) recommendations. Countries like the UAE have their own Anti-Money Laundering (AML) laws that require KYC checks for financial transactions.

european union

The European Union has the Anti-Money Laundering Directives (AMLD), with the latest being the 6th AMLD (AMLD6), which sets out KYC requirements for member states to prevent money laundering and terrorist financing.

KYC Solution integration

Process

Define Your KYC Requirements

The DashDevs team collaborates with you to pinpoint the specific KYC features needed for your application. This could involve identity verification, anti-money laundering checks, or enhanced due diligence processes.

1Choose a KYC vendor

We assist you in evaluating and selecting a KYC solution provider that offers a comprehensive and secure platform. With our substantial experience with different KYC providers, we can ensure that the vendor meets your application's needs for quality, pricing, technology, location coverage, regulatory compliance, user experience, etc.

2Integrate KYC Solution into an App

In the main process stage, the DashDevs team of expert fintech engineers conducts the technical integration of the chosen KYC solution into your application, platform, or other software solution. This includes establishing a secure and efficient connection with the vendor’s services, and ensuring that identity verification, compliance, and other checks work as intended.

3conduct testing of the integration

DashDevs rigorously tests the KYC integration within your app to ensure security, accuracy, and functionality. We verify that the solution complies with relevant federal and local regulations, offers a stable and secure verification processes, and provides a seamless user experience to customers utilizing the authentication or payment interface.

4use KYC integration to provide services

With the KYC integration in place, you can now leverage it to offer secure and compliant identity verification services to your users, enhancing trust and safety in your application.

5monitor and maintain integration

Upon your request, DashDevs continues to monitor the integration for performance and security. We provide ongoing maintenance and updates to keep the KYC solution in line with evolving standards, technological advancements, and user needs.

6

What digital kyc dashdevs

can help integrate

The DashDevs team work with most of nowadays digital KYC

solution, helping to integrate them. These include:

1

1biometric verification

Biometric verification involves using the second authentication factor, which is, in this case, unique biological traits like fingerprints or facial recognition.

1

1

2

2ID document verification

ID document verification in KYC entails checking the authenticity of government-issued identification, such as passports or driver's licenses.

2

2

3

3electronic signature verification

Electronic signature verification in KYC ensures the legitimacy of digital signatures on documents, confirming the identity of the signer.

3

3

4

4Online database checks

Online database checks involve cross-referencing customer information against various databases, such as credit bureaus or public records.

4

4

5

5OTP verification

In KYC practices, OTP verification uses a one-time password sent to a customer's mobile device or email to authenticate their identity, providing an extra layer of security.

5

5

Faq

What is KYC verification?

KYC (Know Your Customer) verification is a process used by businesses to verify the identity of their clients to prevent fraud and comply with regulatory requirements. KYC verification involves collecting and verifying personal information to ensure the authenticity of the client’s identity.What is an example of a KYC?

An example of KYC is verification of customer’s identity during account authentication via biometric, OTP, or other forms of authentication. KYC as a service helps the bank ensure that the customer is who they claim to be and meets regulatory compliance requirements.What is the best KYC provider?

The best KYC service provider vary from business to business as KYC vendors in general offer different services and technologies for verifying customer identities. So businesses should choose based on their specific requirements. The popular options of KYC finance companies include:- Jumio

- Onfido

- Trulioo

- Veriff

Can I outsource KYC?

Yes, you can outsource fintech KYC to specialized service providers who handle the verification process on behalf of your business. Outsourcing KYC can help businesses save time and resources while ensuring compliance with regulatory requirements.How much does KYC cost?

The cost of KYC services can vary widely depending on the provider and the level of service required, but it typically ranges from a few cents to several dollars per verification. Businesses should consider their budget and the level of verification needed when determining the cost.How do I choose a KYC provider?

When choosing a KYC provider, consider factors such as:- Reputation

- Region coverage

- Customer support

- Pricing

- Technology capabilities

- Customization and settings available