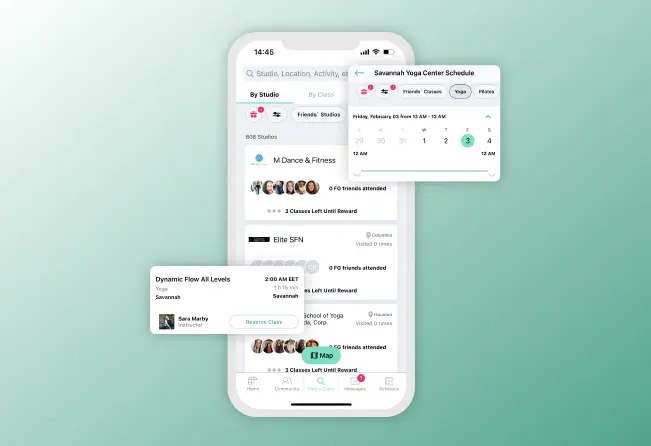

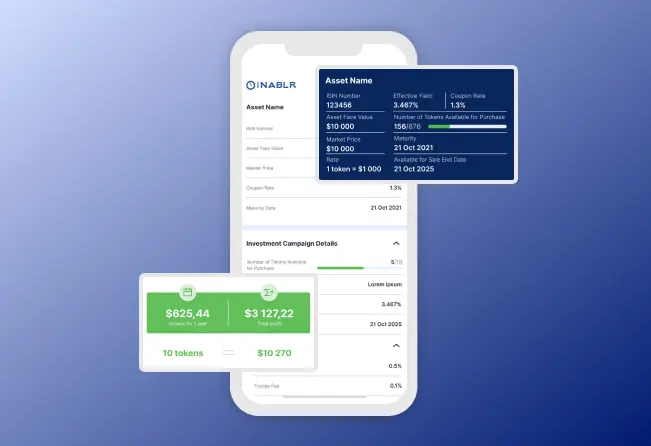

open banking solutions

Book a consultationYour integration project, Our Tech Expertise: joining open banking revolution together

Open banking API is a trending technology, integration of which connects startups to third-party vendors, and enables them to provide open banking services via nearly any digital product. Cross-selling, network opportunities, and better operational capabilities can now be acquired! Entrust your open banking development to DashDevs — a fintech provider with the open bank API expertise and experience needed to deliver standard-compliant, high-performing, and timely open banking solutions.

open banking api

integration benefits

Being one of the first fintech companies offering open banking services is more than a status. It offers:

Enhanced customer experience

competitive advantage

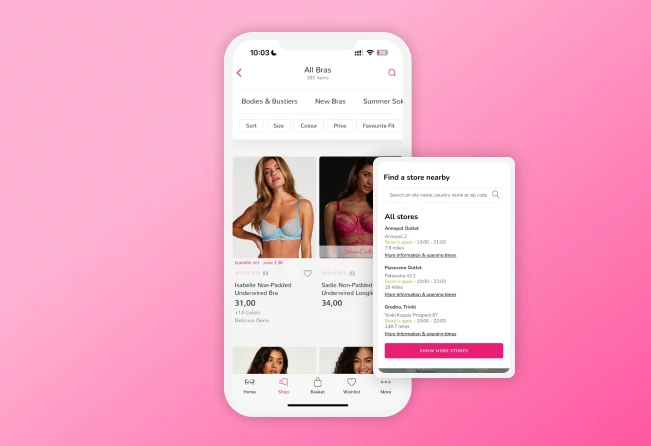

Customers now give preference to fully-fledged solutions that cover all their needs without any additional software app required. Open banking allows your digital product to become one-stop shop, resulting in a better customer experience.

Book a callOpen banking API enables businesses to stand out by offering innovative financial services that may not be available elsewhere. This innovation can position the company as a forward-thinking leader in its industry.

Book a callexpanded market reach

access to industry- latest innovations

By leveraging open banking APIs, companies can access a broader customer base. This integration facilitates the offering of financial services across different markets and regions, removing traditional barriers to entry.

Book a callOpen banking APIs provide businesses with direct access to the latest technological advancements in the financial sector. This access enables companies to quickly adopt new features and capabilities, keeping their services at the forefront of innovation.

Book a callHow open banking works

- 1

digital app receives a customer’s request

The customer requests a particular open banking service via an API’s user interface integrated into a digital app. The request can be to read bank account, create statistics based on transactions types, etc.

- 2

request is verified by checking the API key

Then, API open banking security mechanisms verify the correctness and security of the request by checking the API key. It enables to block potentially fraudulent or just wrong requests.

- 3

API and service provider exchange data

After that, the open banking fintech API communicates with the open banking platform. The API share the customer’s request, and the service provider shares the particular information requested.

- 4

digital app displays response sent by API

Finally, open bank API integration transfers the response indicating the success or failure of fulfilling the request back to the digital app, and displays the answer. This way, the user will be able to access the requested information.

Open banking integration

Process

define your open banking need

The DashDevs team helps identify the specific functionalities you aim to enhance or provide in your application. These may include facilitating open banking payments or offering financial insights by accessing users' banking and transaction data.

1Choose open banking vendor

Then, DashDevs guides your evaluation and choosing of a vendor that offers a robust open banking platform. We ensure that it aligns with your app's requirements for secure data access, comprehensive API coverage, regulatory compliance, etc.

2integrate open banking api in app

After that, we conduct the integration of the selected open banking APIs into your application. The DashDevs team establishes secure connections to banks and financial institutions for data sharing and payment services. If necessary, we design and develop the interface for users to access the open banking integration from.

3conduct testing of the integration

DashDevs thoroughly test the open banking API integration within your app to verify security, data accuracy, functionality, and user experience. We ensure full compliance with financial regulations, both federal and local.

4use open banking api to provide services

Once the open banking API integration is deployed, you can utilize it to offer your users enhanced services such as financial management tools, payment initiation, and personalized banking insights.

5monitor and maintain integration

By your request, DashDevs continuously monitors the API integration for performance and security. We maintain and update the integration to adhere to evolving open banking standards, technological advancements, and user feedback.

6

What are the risks of open banking?

Creating product requires careful consideration of a lot of factors.

choosing an open banking provider

There is a vast range of open banking service providers on the market. They are all suited to businesses with different specificities, objectives, and budget limitations, and choosing a perfect-fit vendor can present additional difficulty.

Technical complexity

Open banking, as a rather innovative and rapidly evolving technology, requires vast expert knowledge and fintech expertise. Ensuring that the integration works seamlessly in your digital product can be challenging.

regulatory constraints

Failure to meet federal and local regulations for open banking (PSD3) and data security standards (HIPAA and GDPR) can result in significant reputational and financial damage, including delays, fines, or the revocation of licenses.

user acceptance challenges

Adding a new functionality to your digital product always carries user acceptance risks. Considering the constraints that external open banking API interfaces may have, ensuring a seamless user experience may require substantial effort.

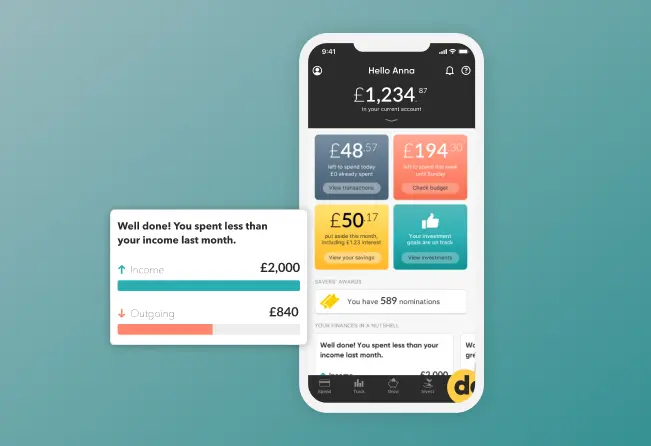

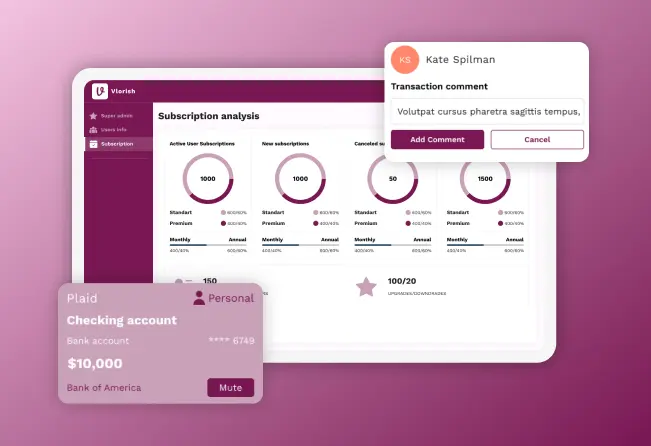

open banking providers we work with

DashDevs has experience working with and integrating openbanking APIs from 20+ providers

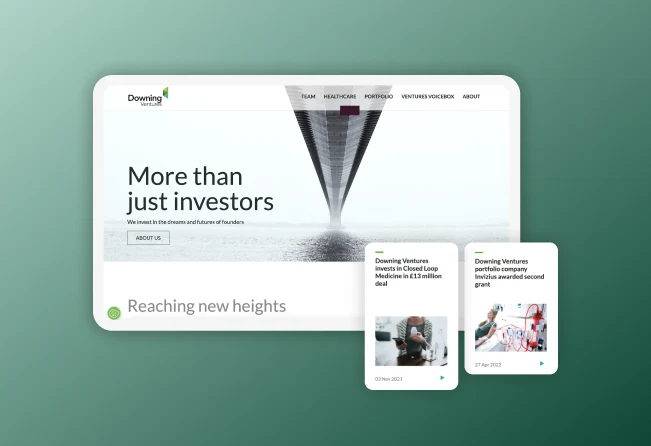

Why You should integrate open banking with DashDevs

End-to-end API Integration

We provide comprehensive open banking services, from research to provider selection, implementation, and maintenance. DashDevs is your one-stop-shop for bank api integration projects.

experience with many open banking providers

Throughout our many projects, the DashDevs team has worked with numerous providers of open banking API on the market. This ensures the optimal outcomes of integrating a particular provider of your choosing.

transparency and reporting

DashDevs, an open banking API integration company, maintains full transparency in every development project. We conduct regular meetings to review the progress and provide detailed reports with metrics and time spending indicated.

proven Fintech expertise

Over the past 15 years and upon the successful delivery of 500+ projects, 80 of which were fintech, DashDevs has gained excellent expertise in open banking and experience with the latest banking and finance technologies.

Faq

What is open banking?

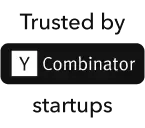

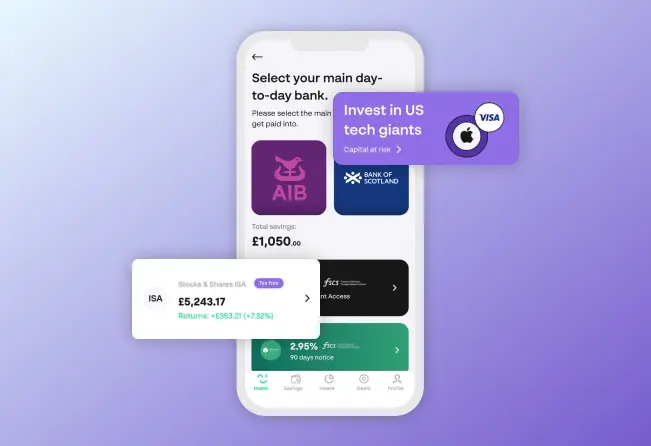

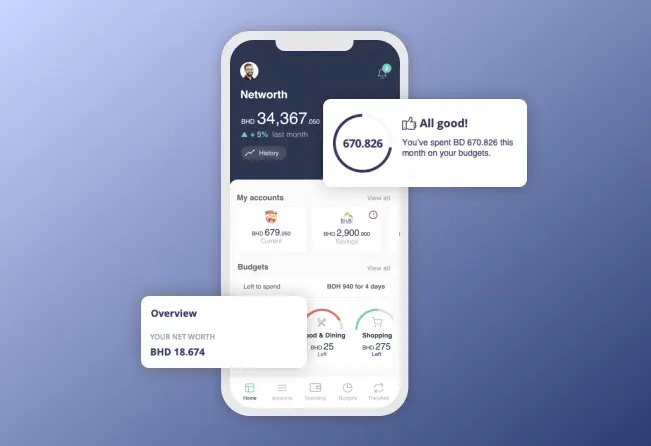

Open banking is a financial services system where banks provide third-party developers access to financial data through the use of application programming interfaces (APIs). This enables the development of new apps and services for customers, fostering innovation and competition in financial services.What is an example of open banking?

An example of open banking is a personal finance app that consolidates your financial information from different bank accounts into one place, offering insights into spending patterns, savings opportunities, and investment advice, all through accessing your financial data with your permission.What are the risks of open banking?

The risks of open banking include:- Data breaches and cybersecurity threats

- Privacy concerns with sensitive financial information

- Unauthorized access and fraudulent transactions

- Regulatory and compliance risks

- Dependence on a third-party provider’s security measures

Why do people use open banking?

People use open banking for its convenience, personalized financial services, and the ability to manage multiple accounts and financial products in one place. It offers users greater control over their financial data and the opportunity to benefit from tailored financial advice and products.What is an open banking provider?

An open banking provider is a third-party company or financial technology firm that offers services or applications using data accessed through open banking APIs. These providers can offer a range of financial services, including budgeting tools, payment services, and financial planning.