Who we are

We’re fast-forwarding the next chapter of FinTech

Our mission

Markets move fast. Regulators take their time. We help you excel on both timelines. Whether you’re a founder chasing your next milestone or a bank with a digital agenda, we help you crush the complexities with zero fluff and full confidence.

Start faster. Scale smarter.

Schedule a call with our teamWho we work with

Who we deliver for

Let’s engineer your unfair advantage

Explore our servicesDoing all of the above in compliance with

global best practices and standards

EU

PSD2 • GDPR • MiFID II • DORA • EBA Guidelines

UK

FCA • PSR •

Open Banking •

Data Protection ActUS

FFIEC • GLBA • SOX •

CFPB • SEC/FINRA •

State LicensesMENA

SAMA • CBB •

ADGM/DIFC •

QCB •

UAE Central Bank

Our story

How it’s going today

100+

fintech products

Brought to global markets

92%

NPS

Among customers

£100M+

Funding raised by our clients

Our recognition

Meet our people

+

Fintech natives

%

Senior specialists

%

Retention rate

We speak your language

The language of your

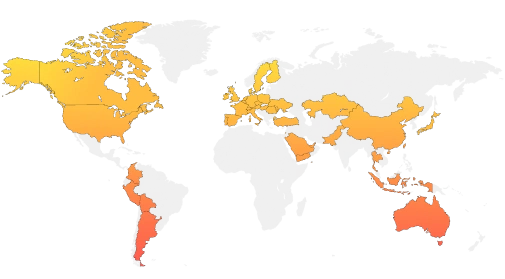

5 global hubs | 50+ markets served

UK

LONDON

1 St. Katharine's Way, E1W 1UNUSA

Wilmington

1007 North Orange Street, 4th Floor, DE 19801HUNGARY

BUDAPEST

Árbóc utca 1-3, HubHub Agora, 1133Poland

Warsaw

Krakowskie Przedmieście 13, 00-071PORTUGAL

LISBON

R. Tabaqueira A2, 1950-256

Let’s build what’s next

- 100+

Fintech products built and launched by our team

- 30%

faster time-to-market with our support

- 15+ years

Operating across global markets